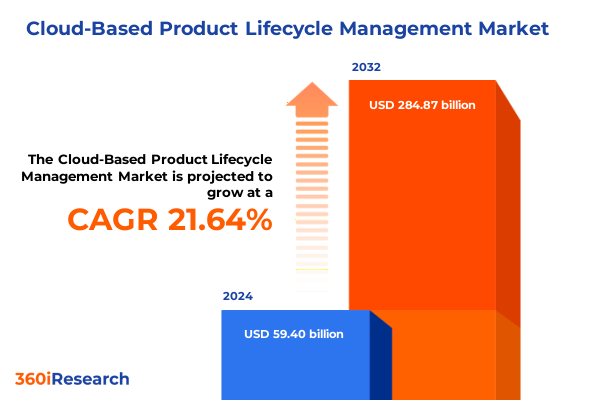

The Cloud-Based Product Lifecycle Management Market size was estimated at USD 71.87 billion in 2025 and expected to reach USD 86.97 billion in 2026, at a CAGR of 21.74% to reach USD 284.87 billion by 2032.

Unveiling the Future of Product Lifecycle Management: How Cloud-Based Solutions Are Redefining Innovation Speed Operational Efficiency and Collaborative Excellence

The rapid evolution of product lifecycle management from on-premises systems to cloud-native platforms has set the stage for an unprecedented transformation in how organizations conceive, develop, and deliver products. Cloud-based PLM solutions now serve as the backbone for digital innovation, enabling real-time collaboration across global teams, streamlining engineering workflows, and integrating product data seamlessly with enterprise applications.

In this context, stakeholders are experiencing a paradigm shift where silos dissolve and multidisciplinary teams converge on unified platforms. The result is accelerated decision-making, reduced time to market, and enhanced product quality. As companies grapple with volatile supply chains, shifting regulatory requirements, and intensifying competitive pressures, the agility afforded by cloud-based PLM is no longer a luxury but a critical business imperative.

This introduction lays the groundwork for understanding the forces driving the adoption of cloud PLM, highlights the strategic benefits that differentiate cloud models from traditional deployments, and sets the stage for a deeper analysis of the market dynamics, segmentation nuances, and regional variations that follow.

Emerging Technological Paradigms in Cloud PLM That Are Driving a Paradigm Shift in Product Innovation Sustainability and Cross-Functional Collaboration

Emerging technologies are reshaping the foundational capabilities of cloud-based PLM, ushering in a new era of intelligent product development. Digital twin frameworks now allow virtual replicas of physical assets to run parallel simulations, providing engineers with predictive analytics on performance and maintenance needs. Concurrently, advances in artificial intelligence and machine learning are embedded in data management modules to automate error detection, optimize design iterations, and forecast component lifecycles.

Simultaneously, the proliferation of connected devices and the Internet of Things has extended PLM beyond the engineering suite into field operations. Real-time telemetry feeds inform continuous improvement loops, enabling product teams to close the gap between design intent and operational reality. This connective tissue fosters a closed-loop ecosystem where feedback from the shop floor directly influences upstream planning, reducing defects and driving sustainability goals.

Looking ahead, the convergence of low-code interfaces, immersive augmented reality collaboration spaces, and blockchain-based data integrity checks is poised to redefine stakeholder engagement. As these transformative shifts accelerate, organizations must adapt their PLM strategies to harness emerging capabilities, ensuring that they remain at the forefront of innovation, efficiency, and cross-functional alignment.

Analyzing the Cumulative Effects of 2025 United States Import Tariffs on Cloud-Based Product Lifecycle Management Infrastructure and Service Delivery

The introduction of sweeping tariffs on imported technology components in 2025 has led to multifaceted pressures across cloud-based PLM infrastructure and service delivery. Providers reliant on hardware imports from countries subject to 25 to 30 percent duties have faced immediate cost escalations for servers, networking equipment, and storage arrays. These elevated procurement expenses are now factored into capital expenditure budgets, compelling service leaders to reevaluate pricing strategies and project roadmaps for digital transformation initiatives.

Supply chain fragility has been exacerbated by the new levy, with extended lead times for critical data center hardware impacting deployment schedules. On average, infrastructure rollout timelines have lengthened by up to 30 percent, prompting some PLM vendors to diversify sourcing to Vietnam, Taiwan, and Mexico, albeit with additional qualification overheads and certification cycles.

Despite these headwinds, major cloud operators with scale advantages have absorbed portions of the increased costs to maintain market competitiveness, while smaller and mid-tier PLM specialists have begun passing price adjustments to end customers. Early reports suggest that additional operational expenses are gradually filtering through service contracts, although end users have not yet experienced full tariff-driven price inflation-indicating an absorption period that may shift consumer pricing in upcoming fiscal cycles.

This cumulative tariff impact has also fueled a strategic pivot toward enhanced software capabilities and managed services, as enterprises seek to mitigate hardware volatility. By emphasizing lightweight deployment models and subscription-based collaboration tools, PLM stakeholders are adapting to an environment defined by higher component costs and supply chain unpredictability.

Decoding Market Segmentation Dynamics to Uncover Component Industry Deployment and Organizational Dimensions Shaping Cloud PLM Adoption Patterns

Understanding market segmentation reveals nuanced adoption patterns that mirror organizational needs, technological priorities, and industry-specific requirements. Considering the component perspective, the services layer breaks down into managed services offerings that handle end-to-end PLM administration, alongside professional services that cater to custom integrations and bespoke implementation roadmaps. Within the software domain, collaboration tools focus on cross-disciplinary design reviews, data management tools ensure secure version control and traceability, and process management tools orchestrate workflow automation across the product lifecycle.

When viewed through an industry vertical lens, the aerospace and defense sphere demands rigorous change management protocols for aeronautics and space projects, while the automotive sector balances regulatory compliance for commercial and passenger vehicles. Consumer goods companies navigate between durable goods lifecycles and fast-moving consumer products, each with distinct speed-to-market imperatives. Electronics and semiconductor firms allocate resources between consumer electronics innovation cycles and chip fabrication tracing. Healthcare and medical devices segments oscillate between medical device validation processes and pharmaceutical R&D closures, whereas industrial machinery players integrate heavy equipment durability tests alongside light machinery maintenance routines.

Deployment models further stratify cloud PLM markets, with hybrid architectures blending on-premises systems for sensitive IP alongside burstable public cloud environments for elastic compute loads, private clouds catering to data residency requirements, and public cloud platforms enabling global collaboration without significant capital investments.

Finally, organizational scale influences PLM strategy, as large enterprises differentiate between tier 1 companies with enterprise-grade governance frameworks and tier 2 firms that prioritize streamlined deployments. Meanwhile, small and medium enterprises range from medium-scale operations seeking rapid time to value to lean small enterprises favoring low-overhead, subscription-based PLM modules. This segmentation landscape underscores the importance of tailored solution design to match each cohort’s unique combination of component, industry, deployment, and size-specific demands.

This comprehensive research report categorizes the Cloud-Based Product Lifecycle Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Industry Vertical

- Deployment

Comparative Regional Perspectives Revealing How Cloud PLM Adoption Trends Vary Across the Americas Europe Middle East Africa and Asia Pacific Markets

Examining regional dynamics highlights distinct trajectories for cloud-based PLM uptake across global markets. In the Americas, widespread digitization drives early adoption among automotive manufacturers and aerospace contractors, supported by mature public cloud infrastructures and an ecosystem of experienced managed service providers. The United States leads with high levels of cloud maturity and integration of AI-driven analytics into PLM workflows, while Latin American operations are gradually aligning with global engineering standards and embracing collaborative software modules.

Europe, the Middle East, and Africa exhibit a diverse set of drivers. Western European manufacturers face stringent regulatory and sustainability mandates, prompting investments in data management tools that enforce compliance and trace carbon footprints. Eastern European heavy machinery firms are leveraging hybrid cloud deployments to modernize legacy systems, and Middle Eastern aerospace entities are forming public-private partnerships to co-develop process management solutions. Across Africa, emerging industrial clusters are partnering with global SaaS vendors to leapfrog infrastructure constraints through subscription-based PLM offerings.

Asia-Pacific markets reflect varied maturity levels and strategic focus areas. Japan’s precision-driven electronics sector champions advanced digital twin integrations, while South Korean semiconductor firms leverage secure private clouds to optimize chip design cycles. China is rapidly scaling private and public cloud PLM solutions to support national industrial agendas, and India’s small and medium enterprises adopt low-code collaboration tools to accelerate product iterations. Australia and Southeast Asian nations are blending managed services with on-premises environments to balance data sovereignty with cross-border collaboration requirements.

This comprehensive research report examines key regions that drive the evolution of the Cloud-Based Product Lifecycle Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud PLM Providers and Their Strategic Innovations Partnerships Funding and Market Positioning in a Competitive Ecosystem

A clear view of competitive dynamics emerges when profiling leading cloud PLM providers. Legacy incumbents are rapidly evolving their on-premises architectures into cloud-native platforms, leveraging decades of domain expertise in CAD integration, version control, and compliance management. Meanwhile, pure-play SaaS entrants are disrupting the market with modular solutions that emphasize rapid deployment, subscription-based pricing, and low-code configurability.

Strategic partnerships are reshaping vendor capabilities, as cloud hyperscalers team up with established PLM suites to deliver bundled infrastructure and application offerings. This synergy accelerates global rollouts and unlocks advanced analytics services for product performance monitoring. In parallel, venture-backed startups are carving niches in AI-powered design validation and collaborative VR-enabled review spaces, attracting significant funding rounds aimed at embedding intelligent automation across the product lifecycle.

Mergers and acquisitions continue to consolidate the landscape, with large enterprise software integrators acquiring specialized PLM modules to plug functional gaps and enhance end-to-end traceability. Ecosystem development is a key differentiator, as top providers cultivate networks of third-party developers, consulting partners, and technology alliances to extend platform capabilities and drive customer success.

Ultimately, organizational decision-makers evaluate providers not only on feature sets and total cost of ownership but also on long-term roadmaps, security certifications, and the robustness of global support infrastructures. This complex interplay of innovation, scale, and service depth defines the competitive contours of the cloud PLM market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud-Based Product Lifecycle Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aras Corporation

- Arena Solutions, Inc.

- Autodesk, Inc.

- Centric Software, Inc.

- Dassault Systèmes SE

- HP Inc.

- International Business Machines Corporation

- Lectra S.A.

- Oracle Corporation

- Propel, Inc.

- PTC Inc.

- SAP SE

- Siemens Industry Software Inc.

Strategic Imperatives for Industry Leaders to Capitalize on Cloud PLM Innovations Drive Digital Transformation and Mitigate Emerging Trade and Operational Risks

Industry leaders must prioritize a balanced approach that aligns strategic vision with operational pragmatism. First, investing in digital twin and AI-infused process modules can deliver rapid ROI by reducing design rework and minimizing quality escapes. Concurrently, establishing cross-functional governance frameworks ensures that every stakeholder-from engineering and manufacturing to supply chain-adheres to unified data standards and change management protocols.

To mitigate geopolitical and trade-related uncertainties, decision-makers should cultivate diversified supplier networks and consider hybrid or multi-cloud architectures that enable workloads to shift seamlessly across regions. This flexibility minimizes the risk of hardware bottlenecks or sudden cost escalations. Moreover, embedding security-by-design principles into PLM deployments will strengthen resilience against data breaches and intellectual property exposures.

On the organizational level, developing center-of-excellence teams for cloud PLM adoption can accelerate best practice sharing, skills transfer, and continuous improvement. These teams can drive pilot programs to validate new digital workflows before scaling broadly, ensuring that process automation and integration efforts align with core business objectives.

Finally, forging collaborative innovation partnerships with technology vendors, academic institutions, and industry consortia will position leaders at the forefront of emerging standards, sustainability methodologies, and advanced manufacturing paradigms. This ecosystem-driven mindset is essential for sustained competitive advantage in a dynamic market landscape.

Transparent Research Methodology Detailing Data Collection Analysis Triangulation and Validation Protocols Ensuring Rigorous Insights Into Cloud-Based PLM Dynamics

This research is grounded in a rigorous methodology combining primary and secondary data sources to ensure validity, reliability, and actionable insights. Primary research included structured interviews with senior executives from leading BPM vendors, engineering directors at multinational manufacturers, and head analysts at cloud service providers. These interviews provided qualitative depth, uncovering strategic priorities, procurement criteria, and perceptions of emerging PLM capabilities.

Secondary research comprised a comprehensive review of public disclosures, white papers, academic studies, and industry publications to capture market dynamics, technology trends, and regulatory developments. Government databases and trade association reports supplemented this analysis, offering granular information on regional deployment patterns and tariff structures.

Data triangulation techniques were employed to reconcile discrepancies between sources, ensuring that quantitative findings align with qualitative perspectives. Each data point was validated through cross-reference checks, expert reviews, and, where applicable, feedback loops with participants. To enforce transparency, all assumptions and definitions are documented, and methodology appendices detail sampling frames, questionnaire designs, and analytical models.

This multi-layered approach guarantees that insights into cloud-based PLM dynamics are not only comprehensive but also grounded in real-world evidence, equipping decision-makers with a robust foundation for strategic planning and investment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud-Based Product Lifecycle Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud-Based Product Lifecycle Management Market, by Component

- Cloud-Based Product Lifecycle Management Market, by Industry Vertical

- Cloud-Based Product Lifecycle Management Market, by Deployment

- Cloud-Based Product Lifecycle Management Market, by Region

- Cloud-Based Product Lifecycle Management Market, by Group

- Cloud-Based Product Lifecycle Management Market, by Country

- United States Cloud-Based Product Lifecycle Management Market

- China Cloud-Based Product Lifecycle Management Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Synthesizing Insights on Cloud-Based Product Lifecycle Management Trends Strategic Imperatives and Future Outlook for Continuous Innovation and Operational Resilience

This executive summary has outlined how cloud-based product lifecycle management is transforming the way organizations collaborate, innovate, and deliver value. From the advent of digital twin simulations and AI-driven workflows to the nuanced impact of 2025 tariffs on hardware costs and supply chain resilience, the cloud PLM landscape is defined by both opportunity and complexity.

Segmentation analysis has demonstrated that success hinges on aligning component strategies, industry-specific requirements, deployment preferences, and organizational scale. Regional perspectives further underscore that no single model fits all markets, with adoption patterns shaped by regulatory environments, infrastructure maturity, and local innovation ecosystems.

Leading vendors and disruptors alike are extending their capabilities through strategic partnerships, targeted acquisitions, and robust platform roadmaps. Meanwhile, actionable recommendations emphasize the importance of governance, multi-cloud flexibility, security integration, and center-of-excellence approaches to drive maximum return on investment.

As the competitive environment accelerates, stakeholders who embrace adaptive PLM strategies, foster collaborative ecosystems, and leverage rigorous market intelligence will be best positioned to sustain premium product performance, optimize operational efficiencies, and navigate emerging trade and technological risks into the next decade.

Engage with Ketan Rohom to Secure Your Comprehensive Cloud PLM Market Research Report and Unlock Actionable Insights for Strategic Decision-Making

Engaging with the Associate Director of Sales & Marketing offers the most direct path to acquiring comprehensive insights tailored for strategic cloud-based PLM initiatives. Ketan Rohom’s expertise bridges detailed market intelligence and practical implementation guidance, ensuring that executive stakeholders receive both high-level overviews and granular recommendations. By reaching out to him, organizations can secure a customized research package that aligns with specific project goals, industry contexts, and technological challenges.

This call to action invites decision-makers to leverage Ketan Rohom’s deep understanding of cloud PLM dynamics, pricing models, and vendor landscapes. His role as Associate Director ensures that every engagement benefits from a collaborative approach, where client priorities shape the final deliverable. Whether your team is evaluating new software modules, optimizing cross-functional workflows, or assessing vendor partnerships, this direct consultation will deliver actionable frameworks designed to accelerate time to value.

Contacting Ketan Rohom marks the first step toward empowering your organization with a robust market research foundation. By initiating dialogue today, you position your leadership to capitalize on emerging trends, navigate potential trade headwinds, and implement adaptive PLM strategies. Embrace this opportunity to transform your product lifecycle management practices into a sustained competitive advantage by partnering with a proven expert in sales, marketing, and cloud-based PLM research

- How big is the Cloud-Based Product Lifecycle Management Market?

- What is the Cloud-Based Product Lifecycle Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?