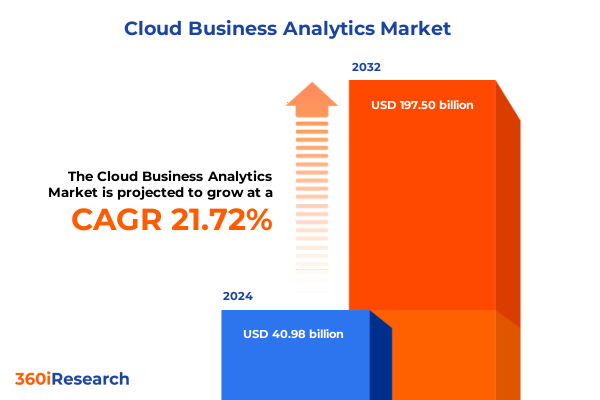

The Cloud Business Analytics Market size was estimated at USD 49.90 billion in 2025 and expected to reach USD 60.08 billion in 2026, at a CAGR of 21.71% to reach USD 197.50 billion by 2032.

Exploring the Critical Role of Cloud Business Analytics in Driving Strategic Decision Making and Operational Excellence Across Sectors

As organizations navigate an era defined by rapid digital transformation, cloud business analytics has emerged as a strategic linchpin for translating vast and varied data into actionable insight. The proliferation of cloud platforms, combined with the exponential growth in data volumes, is challenging traditional analytical approaches and inspiring a reevaluation of how enterprises harness information to optimize performance. Consequently, today’s leaders are compelled to adopt cloud-native architectures that support scalable processing power, real-time data streams, and elastic storage capabilities.

In addition, the convergence of operational and analytical workloads within a unified cloud environment has blurred the lines between insight generation and execution, fostering a culture where decisions are increasingly automated and augmented by machine learning algorithms. This shift extends beyond technology, demanding new skill sets, organizational structures, and governance models to ensure that insights translate into meaningful outcomes. With agility and adaptability at a premium, cloud business analytics is reshaping the competitive landscape by enabling faster time to insight and more intelligent resource allocation.

Moreover, the growing interdependence of cloud ecosystems has prompted vendors and customers alike to reconsider traditional vendor lock-in concerns, prioritizing interoperability, open standards, and hybrid deployment flexibility. As a result, analytics strategies are no longer confined to on-premises or siloed cloud environments but instead span multiple deployment models to meet evolving business needs. This introduction lays the groundwork for understanding how these forces are coalescing to create unprecedented opportunities for innovation and value creation in the cloud analytics domain.

Unveiling the Most Impactful Technological and Organizational Shifts Reshaping the Cloud Business Analytics Landscape in the Digital Era

The cloud business analytics landscape is undergoing a profound transformation driven by advancements in artificial intelligence, edge computing, and data fabric architectures. Modern analytics platforms leverage embedded machine learning to automate pattern recognition, predictive modeling, and anomaly detection, enabling organizations to shift from retrospective reporting to forward-looking insights. This evolution not only accelerates decision cycles but also democratizes analytics capabilities, empowering business users without deep technical expertise to explore data and uncover hidden opportunities.

Concurrently, the rise of edge analytics is redefining data processing paradigms, as organizations capture and analyze information closer to its source. By decentralizing compute resources and reducing latency, edge-enabled analytics support time-sensitive applications such as real-time monitoring, IoT management, and autonomous systems. As a result, enterprises can capitalize on previously untapped data streams and respond to emerging events with unprecedented speed.

In parallel, data fabric strategies have gained momentum, providing a cohesive layer for data integration, governance, and orchestration across distributed environments. This holistic approach simplifies data access and ensures consistency, enabling seamless movement between hybrid, private, and public cloud deployments. Ultimately, these transformative shifts are converging to reshape how organizations design, implement, and derive value from cloud business analytics solutions.

Assessing the Aggregate Consequences of US 2025 Tariff Measures on Cloud Business Analytics Supply Chains and Cost Structures

The United States’ tariff measures implemented in early 2025 have introduced material complexities into cloud analytics supply chains and cost structures. By increasing duties on imported servers, networking gear, and storage components, these tariffs have elevated procurement costs and prompted many providers to reevaluate their hardware sourcing strategies. Consequently, some vendors are diversifying manufacturing partnerships, while others are accelerating investments in local assembly and domestic supply networks to mitigate exposure to fluctuating trade policies.

Moreover, the elevated cost of key infrastructure components has trickled down to subscription pricing and service fees, pressuring vendors to enhance value propositions through feature differentiation, managed service bundles, and outcome-based pricing models. In response, cloud analytics providers are innovating around consumption-based billing and serverless architectures to offset the impact of higher capital costs. These shifts have also spurred renewed emphasis on containerization and microservices, allowing customers to optimize resource utilization and reduce idle capacity.

In addition, the geopolitical backdrop underscores the importance of supply chain resilience and risk management in long-term IT planning. Organizations are now scrutinizing vendor roadmaps for assurances around component availability, while forging collaborative relationships with multiple suppliers to maintain continuity. Ultimately, the cumulative effect of the 2025 tariff landscape is driving both providers and consumers toward more agile, cost-efficient, and diversified strategies for delivering and adopting cloud business analytics capabilities.

Delving into Segmentation Nuances That Illuminate the Varied Demand Patterns Within Cloud Business Analytics Markets Across Key Dimensions

Segmentation insight begins with deployment models, where hybrid cloud configurations have gained traction as enterprises seek to strike a balance between scalability and control. By integrating on-premises workloads with private and public cloud resources, organizations can tailor their analytics infrastructure to meet security requirements and performance SLAs. Private cloud environments remain the choice for highly regulated sectors demanding stringent compliance, while public cloud offerings continue to appeal for their elasticity and accelerated time to market.

From the component perspective, the interplay between solutions and services defines the value chain. While robust analytics platforms provide foundational tools for data ingestion, transformation, and visualization, managed services and professional services are instrumental in ensuring successful implementation and ongoing optimization. Managed services deliver operational efficiencies through proactive monitoring and maintenance, whereas professional services drive strategic alignment by tailoring solutions to specific use cases and business objectives.

Organization size further influences adoption paths. Large enterprises leverage extensive IT budgets and centralized governance to undertake enterprise-wide analytics transformations, often integrating global data estates under unified platforms. Conversely, small and medium enterprises favor modular, turnkey offerings that can be deployed rapidly with minimal upfront investment, focusing on targeted use cases that deliver quick ROI and support incremental expansion.

Across end users, banking, financial services, and insurance institutions prioritize risk, fraud, and customer analytics to safeguard assets and deepen client relationships. Healthcare and life sciences entities leverage operational and patient analytics to improve outcomes and streamline research initiatives, while IT and telecom firms harness network performance and customer usage data to enhance service quality. Manufacturing organizations optimize supply chain and production analytics to boost operational throughput, and retail ecommerce players rely on sales and customer analytics to drive personalized marketing and inventory management.

Finally, application segmentation underscores the diverse value propositions of cloud analytics. Customer analytics solutions unlock insights into behavior and sentiment, fraud analytics safeguard transactional integrity, operations analytics enhance process efficiencies, risk analytics fortify decision-making frameworks, and sales analytics power revenue growth strategies. Together, these dimensions illustrate the multifaceted nature of demand and the imperative for platforms that can adapt to varied requirements.

This comprehensive research report categorizes the Cloud Business Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- End Users

- Application

- Deployment Model

- Organization Size

Exploring Regional Variations in Cloud Business Analytics Adoption and Growth Dynamics Across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping cloud analytics adoption trends. In the Americas, robust digital infrastructure and mature cloud ecosystems have fostered widespread uptake, with organizations across financial services and technology leading the charge. This region’s emphasis on innovation and rapid deployment cycles has catalyzed a competitive environment where vendors continuously refine analytics capabilities to meet evolving customer expectations.

Meanwhile, Europe, the Middle East, and Africa exhibit a rich tapestry of opportunities tempered by regulatory complexity. GDPR and sector-specific privacy regulations drive demand for analytics platforms with integrated compliance and data protection features. Countries within this region vary in maturity, with Western European markets focusing on advanced use cases such as predictive maintenance and digital twin implementations, while emerging economies in the Middle East and Africa are prioritizing foundational analytics deployments to accelerate digital transformation.

Across Asia-Pacific, dynamic economic growth and government-led digital initiatives have accelerated cloud analytics investment. Organizations in this region are keen to leverage analytics for smart city projects, e-commerce optimization, and manufacturing automation. The appetite for localized cloud services has also grown, as businesses seek control over data residency and compliance in jurisdictions with nascent regulatory frameworks. Collectively, these regional insights underscore the importance of tailored strategies that account for local market conditions, regulatory landscapes, and sectoral priorities.

This comprehensive research report examines key regions that drive the evolution of the Cloud Business Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positioning and Innovation Strategies of Leading Cloud Business Analytics Providers in a Rapidly Evolving Market Environment

Leading providers in the cloud business analytics arena are leveraging strategic partnerships, acquisitions, and open source integrations to fortify their market positions. Major hyperscale operators have augmented their native analytics offerings with specialized tools for data cataloging, automated ML pipelines, and real-time event processing. At the same time, traditional software vendors have pivoted to cloud-centric models, embedding analytics capabilities directly into enterprise resource planning and customer relationship management suites.

In addition, vendor innovation is increasingly characterized by a modular approach, enabling customers to assemble bespoke analytics stacks from a combination of core platform services, third-party extensions, and domain-specific accelerators. This composable architecture paradigm allows organizations to align their analytics deployments closely with business imperatives and to adjust rapidly as requirements evolve.

Moreover, ecosystem plays are taking center stage, with providers forging alliances with system integrators, telecom operators, and industry consortia to extend their reach and deliver end-to-end solutions. These alliances often encompass joint development initiatives, co-marketing programs, and shared go-to-market strategies, designed to accelerate adoption and unlock new vertical opportunities. Through these strategic positioning efforts, leading vendors are not only expanding the breadth of their portfolios but also deepening customer relationships by offering integrated, outcome-focused solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Business Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Cloud Computing Ltd.

- Alteryx, Inc.

- Amazon Web Services, Inc.

- Domo, Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- Pyramid Analytics B.V.

- QlikTech International AB

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Sisense Ltd.

- Tableau Software, LLC

- Teradata Corporation

- ThoughtSpot, Inc.

- TIBCO Software Inc.

- Zoho Corporation Pvt. Ltd.

Proposing Actionable Strategic Initiatives for Industry Leaders to Accelerate Cloud Analytics Adoption While Navigating Regulatory and Market Challenges

To navigate the complexities of today’s cloud analytics market, industry leaders should prioritize the development of unified data platforms that bridge silos and enable seamless end-to-end workflows. By establishing centralized governance frameworks and implementing data quality controls, organizations can build trust in analytics outputs and ensure alignment with strategic objectives. Furthermore, investing in upskilling initiatives will empower cross-functional teams to harness advanced analytics tools, thereby democratizing insight generation and fostering a data-driven culture.

Concurrently, decision makers must explore flexible consumption models, such as serverless deployments and outcome-based contracts, to optimize costs and mitigate the impact of external economic pressures. Engaging in collaborative partnerships with managed service providers and system integrators can accelerate time to value by infusing specialized expertise and resources into initiatives. Additionally, proactively assessing supply chain risks and diversifying hardware and software sourcing will bolster resilience against regulatory and geopolitical shifts.

Ultimately, the most successful organizations will embrace a continuous improvement mindset, iterating on analytics use cases and integrating feedback loops to refine algorithms and processes. By adopting agile methodologies and leveraging modular architecture principles, they can adapt rapidly to emerging opportunities and maintain a competitive edge in a landscape defined by perpetual change.

Outlining Rigorous and Transparent Research Methodology Employed to Ensure Data Reliability and Insight Credibility in Cloud Analytics Market Study

This research draws on a blend of primary and secondary methodologies to ensure comprehensive and unbiased insights. Secondary research entailed a thorough review of industry publications, technical whitepapers, regulatory filings, and vendor documentation to establish a foundational understanding of trends, technologies, and market dynamics. This desk research provided context for identifying key thematic areas and emerging growth vectors.

Building on this groundwork, primary research involved structured interviews with senior executives, solution architects, and technology strategists across end-user organizations and vendor communities. These in-depth discussions yielded qualitative insights into decision-making criteria, deployment challenges, and success factors. Simultaneously, quantitative surveys gathered data on adoption rates, technology preferences, and investment priorities, enabling a robust triangulation of findings.

To validate the accuracy of insights, a multi-stage review process was implemented, encompassing cross-validation with industry experts and iterative refinements based on feedback loops. Quality assurance measures included consistency checks, data integrity audits, and scenario stress testing to ensure that the research outputs are both reliable and actionable. Through this rigorous methodology, the study achieves a high level of credibility and relevance for stakeholders seeking clarity in the cloud analytics domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Business Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Business Analytics Market, by Component

- Cloud Business Analytics Market, by End Users

- Cloud Business Analytics Market, by Application

- Cloud Business Analytics Market, by Deployment Model

- Cloud Business Analytics Market, by Organization Size

- Cloud Business Analytics Market, by Region

- Cloud Business Analytics Market, by Group

- Cloud Business Analytics Market, by Country

- United States Cloud Business Analytics Market

- China Cloud Business Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Industry Insights and Strategic Imperatives to Reinforce Competitive Advantage Through Cloud Business Analytics Innovations

In conclusion, cloud business analytics stands at the forefront of organizational transformation, enabling enterprises to derive strategic advantage from data-driven decision making. The convergence of AI-driven automation, edge processing, and data fabric architectures is redefining how insights are generated, operationalized, and scaled across diverse environments. As businesses grapple with the ramifications of new trade policies, segmentation nuances, and regional dynamics, flexibility and resilience have emerged as essential characteristics of successful analytics programs.

Segmentation insights reveal that deployment models, component choices, organization size, end-user requirements, and application priorities collectively shape adoption paths and value levers. Regional analysis underscores the need for customized market approaches that address local regulatory regimes, infrastructure maturity, and sector-specific imperatives. Meanwhile, leading vendors are differentiating through integrated platforms, ecosystem partnerships, and modular architectures designed to deliver outcome-focused solutions.

Moving forward, organizations that invest in unified data governance, agile delivery frameworks, and collaborative partnerships will be best positioned to harness the full power of cloud analytics. By adopting proactive strategies to manage supply chain risks and optimize consumption models, industry leaders can maintain cost discipline while accelerating innovation. Ultimately, this study provides a roadmap for stakeholders to navigate a continually evolving landscape and capitalize on the transformative potential of cloud business analytics.

Inviting Decision Makers to Engage Directly with Associate Director for Exclusive Access to the Full Cloud Business Analytics Market Research Report

To unlock the full strategic potential of cloud business analytics and stay ahead of emerging trends, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can provide exclusive access to comprehensive insights, detailed analysis, and tailored recommendations that will empower your organization to make data-driven decisions with confidence. Engage directly to explore customized packages, gain clarity on how this research applies to your unique challenges, and secure the in-depth guidance necessary to drive transformational outcomes in your cloud analytics initiatives.

- How big is the Cloud Business Analytics Market?

- What is the Cloud Business Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?