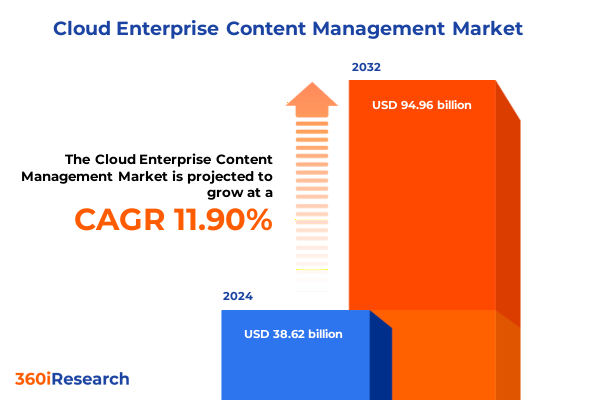

The Cloud Enterprise Content Management Market size was estimated at USD 43.27 billion in 2025 and expected to reach USD 48.49 billion in 2026, at a CAGR of 12.21% to reach USD 96.96 billion by 2032.

Establishing the Strategic Imperative of Cloud-Based Enterprise Content Management to Accelerate Digital Transformation and Operational Agility

The advent of cloud content management is revolutionizing enterprise operations due to digital transformation demands. Organizations are facing exponential content growth, remote workforce collaboration needs, and the pressure to deliver seamless customer experiences. Cloud-based platforms provide the agility and scalability to store, manage, and distribute content efficiently, enabling departments to collaborate across geographies while ensuring data integrity and accessibility. As businesses increasingly rely on digital processes to maintain competitiveness, the strategic significance of cloud enterprise content management becomes undeniable.

Furthermore, advanced capabilities such as integrated content analytics, robust digital asset management, and intelligent workflow automation are driving deeper insights and process optimization. The convergence of AI-driven metadata extraction, sentiment analysis, and text analytics empowers decision-makers with actionable intelligence drawn from unstructured information. Meanwhile, comprehensive digital asset management capabilities spanning audio, video, and design file handling ensure that creative and technical teams can interact with multimedia assets without legacy constraints, paving the way for streamlined innovation cycles.

Moreover, security and compliance frameworks are being reinforced through cloud-native governance controls, encryption mechanisms, and audit trails that adapt to evolving regulatory requirements. This report delves into how enterprises can harness these transformative capabilities to achieve operational resilience, enhance governance, and fortify competitive positioning. By examining key trends, shifts, and stakeholder imperatives, the following sections outline a comprehensive view of the cloud enterprise content management landscape and actionable guidance to navigate its complexities.

Uncovering the Transformative Technological, Regulatory, and Market Shifts Reshaping the Enterprise Content Management Landscape in the Cloud Era

Technological innovation stands at the forefront of change within the enterprise content domain, with cloud-native architectures enabling microservices, containerization, and API-driven integrations. Organizations are replacing monolithic on-premise systems with modular platforms that scale elastically, lowering operational overhead and accelerating time to value. In addition, the integration of intelligent automation-ranging from metadata extraction to sentiment analysis and advanced OCR-enhances content discoverability and unlocks latent business insights that were previously siloed.

Concurrently, regulatory evolutions such as data privacy directives, cross-border data transfer regulations, and industry-specific compliance mandates are compelling enterprises to adopt content governance frameworks that extend across hybrid cloud and on-premise environments. Companies must dynamically enforce retention policies, maintain comprehensive audit logs, and implement robust access controls to mitigate legal and reputational risks. Consequently, cloud providers are investing in regionally discrete data centers and sovereign cloud solutions to address jurisdictional compliance challenges.

Moreover, market dynamics have shifted under the influence of distributed workforces and customer-centric business models, driving demand for seamless content collaboration, real-time co-authoring, and mobile-friendly interfaces. The consumerization of enterprise software has elevated user experience expectations, prompting vendors to deliver intuitive dashboards, low-code customization, and self-service portals. As a result, the convergence of technological prowess, stringent compliance requirements, and evolving workplace paradigms is redefining the rules of engagement in the enterprise content management sector.

Assessing the Cumulative Repercussions of 2025 United States Tariffs on Cloud Enterprise Content Management Operations and Supply Chains

In 2025, the introduction of elevated United States tariffs on imported hardware components, networking equipment, and semiconductors has reverberated across the cloud content management ecosystem. Organizations relying on on-premise data storage arrays, edge devices, and specialized servers have encountered increased capital expenditures, compelling procurement teams to reevaluate vendor contracts and consider domestic manufacturing alternatives. These cost pressures have rippled through infrastructure budgets, influencing the strategic calculus between maintaining hybrid deployments and accelerating cloud migration initiatives to contain hardware-related tariff impacts.

Service providers and software vendors have responded to these tariff-induced challenges by diversifying supply chains, renegotiating agreements with regional partners, and optimizing hardware utilization through consolidation efforts. Virtualization and containerization techniques offer pathways to reduce physical footprint, while partnerships with chip manufacturers in non-tariff jurisdictions have emerged as a hedge against future trade policy volatility. Consequently, the balance between cloud and on-premise solutions is being recalibrated as enterprises weigh the benefits of operational resilience against escalating import duties.

Looking ahead, the cumulative effect of these tariffs is fostering a shift toward cloud-native content management offerings and the consumption of infrastructure as a service, enabling organizations to offload hardware procurement risks. Vendors that can deliver cost-effective, tariff-resilient solutions while maintaining compliance and performance SLAs are gaining strategic advantage. Ultimately, tariff dynamics are accelerating a broader migration away from capital-intensive deployments toward subscription-based, software-as-a-service models in the enterprise content management landscape.

Exploring Multi-Dimensional Segmentation Insights to Illuminate Application, Deployment, Component, Organization, and Industry Adoption Patterns

The application dimension reveals that enterprises are leveraging collaboration platforms, document management systems, records management solutions, web content management tools, and workflow automation frameworks to orchestrate end-to-end content lifecycles. Within this spectrum, content analytics platforms utilizing metadata extraction, sentiment analysis, and text analytics are generating actionable intelligence from unstructured data. Meanwhile, digital asset management environments encompassing audio asset organization, design file versioning, imaging workflows, and video content repositories are empowering creative and marketing teams to streamline multimedia production and distribution.

Deployment preferences span on-premise infrastructures and cloud environments, with the latter gaining momentum through hybrid cloud configurations that blend public cloud elasticity, private cloud control, and hosted third-party services. This mix affords organizations the ability to maintain sensitive workloads within private enclaves while scaling collaborative projects and analytics tasks in public clouds, thereby optimizing cost and performance. As a result, decision-makers are defining cloud strategies that align with security postures, data sovereignty mandates, and dynamic capacity requirements.

Component analysis underscores the growing prominence of services-both managed offerings and professional engagements-alongside traditional software licenses. Managed services deliver ongoing operational support, while professional services, including consulting, integration, support maintenance, and training, facilitate seamless implementations. On the software side, organizations balance perpetual license holdings with subscription licenses to align investments with usage patterns and budget models. This blend of services and licensing approaches is enhancing flexibility and accelerating time to productivity for diverse enterprise audiences.

The landscape further segments by organization size, encompassing large enterprises, mid-market companies, and small businesses each with distinct budget constraints, governance requirements, and adoption velocities. Industry vertical adoption also varies significantly, as financial services, education, government, healthcare, manufacturing, and retail sectors apply content management platforms to address use cases ranging from compliance reporting to patient record management, supply chain documentation, and omnichannel customer engagement.

This comprehensive research report categorizes the Cloud Enterprise Content Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Organization Size

- Application

- Industry Vertical

Analyzing Regional Dynamics across Americas, Europe Middle East & Africa, and Asia Pacific to Identify Strategic Growth and Maturity Variations

The Americas region leads in cloud content management adoption, propelled by extensive digital transformation initiatives and a robust ecosystem of cloud service providers. Enterprises in North America benefit from early access to innovative features and broad API integrations, while Latin American organizations are accelerating modernization efforts to address remote work demands and cross-border collaboration. This maturity is supported by advanced compliance frameworks and scalable infrastructure investments that reinforce governance and interoperability across diverse business units.

In Europe, Middle East, and Africa, regulatory compliance and data sovereignty imperatives are driving demand for localized cloud offerings and sovereign data centers. Organizations across the European Union must navigate GDPR requirements, while Middle Eastern entities prioritize digital government programs and national content directives. African markets are witnessing nascent cloud engagement, with infrastructure initiatives boosting connectivity. As a result, regional cloud content management deployments are characterized by hybrid configurations that balance global provider capabilities with localized service needs.

Within Asia Pacific, rapid digital adoption, government mandates for e-governance, and burgeoning e-commerce ecosystems are fueling cloud content management growth. Markets such as Australia and New Zealand exhibit high maturity levels, leveraging advanced automation and analytics, whereas Southeast Asia and South Asia are scaling cloud investments to overcome legacy infrastructure limitations. Consequently, the Asia Pacific region is emerging as a dynamic arena for platform innovation, regional partnerships, and competitive pricing models tailored to diverse market requirements.

This comprehensive research report examines key regions that drive the evolution of the Cloud Enterprise Content Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Enterprise Content Management Providers to Highlight Innovative Solutions, Strategic Partnerships, and Competitive Differentiators

Leading global technology vendors are enhancing their cloud content management portfolios through a combination of native cloud architectures, AI-infused analytics, and deep integrations with productivity suites. These providers differentiate by embedding intelligent content services directly into collaboration platforms, enabling tasks such as automated metadata tagging and contextual content recommendations at the point of use. Their roadmaps emphasize microservices scalability, open APIs for seamless third-party integrations, and enterprise-grade security controls to support hybrid deployments and cross-functional workflows.

Specialist content management companies are competing by focusing on niche capabilities and vertical-specific solutions, such as secure healthcare document exchange, government records archiving, and financial services compliance reporting. Partnerships with hyperscale cloud providers enable these vendors to deliver sovereign cloud instances and regionally distributed data centers, addressing stringent privacy and performance requirements. Moreover, strategic alliances with analytics and AI firms are accelerating feature enhancements that transform static repositories into intelligent information hubs capable of driving downstream process automation.

Recent mergers and acquisitions have further reshaped the competitive landscape, combining complementary portfolios to offer end-to-end content lifecycle management. Established players are absorbing smaller innovators to integrate advanced digital asset management, workflow orchestration, and low-code development capabilities into holistic platforms. This consolidation trend underscores the importance of interoperability, ease of customization, and vendor stability. Consequently, enterprises evaluating their content management options must weigh vendor maturity, partner ecosystems, and the agility to adapt to evolving business needs.

Additionally, open-source and community-driven platforms are gaining traction among organizations seeking cost transparency and extensibility. These solutions often leverage modular architectures and permissive licensing to enable rapid experimentation, while ecosystem marketplaces provide plug-and-play connectors for emerging technologies. For enterprises willing to invest in internal expertise, these community-backed offerings present an alternative path to proprietary platforms, fostering collaborative innovation and reducing vendor lock-in risks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Enterprise Content Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Aldec, Inc.

- Alfresco Software, Inc.

- ANSYS, Inc.

- Cadence Design Systems, Inc.

- Docuware GmbH by Ricoh

- Epicor Software Corporation by Clayton, Dubilier & Rice

- Fabsoft Software, Inc

- Hewlett Packard Enterprise Company

- Hyland Software, Inc.

- International Business Machines Corporation

- KYOCERA Document Solutions

- Lexmark International, Inc. by Apex Technology Co., Ltd.

- Micro Strategies Inc.

- Microsoft Corporation

- Newgen Software Inc.

- Oracle Corporation

- Silvaco, Inc.

- Tietoevry Oyj

- Xerox Holdings Corporation

- Xilinx, Inc. by Advanced Micro Devices, Inc.

- Zuken Inc.

Providing Actionable Recommendations for Industry Leaders to Leverage Emerging Technologies, Optimize Governance, and Drive Ecosystem Integration

Industry leaders should prioritize the adoption of cloud-first strategies that align with broader digital transformation objectives. By embracing microservices-based ecosystems and leveraging hybrid cloud models, organizations can maintain control over sensitive content while scaling collaboration capabilities. It is essential to develop a clear migration roadmap that balances risk mitigation with incremental modernization, ensuring that legacy systems are retired only after critical functions have been validated in cloud environments.

Furthermore, embedding AI-driven analytics across content lifecycles will unlock deeper insights and accelerate decision-making processes. Initiatives centered on metadata enrichment, sentiment analysis, and intelligent search can transform static repositories into proactive intelligence engines. To maximize ROI, organizations must invest in change management programs that foster user adoption, provide training on new capabilities, and establish governance frameworks that enforce data quality and ethical AI usage.

Strengthening security and compliance postures remains paramount; leaders should implement unified governance controls that span content ingestion, storage, and distribution. This entails automating policy enforcement, conducting continuous risk assessments, and integrating advanced encryption practices. Collaboration with legal and risk teams will ensure alignment with evolving regulatory landscapes, while regular audits and scenario-based testing will validate the effectiveness of controls.

Finally, cultivating strategic partnerships with technology vendors, system integrators, and niche innovators is critical to sustaining competitive advantage. By participating in open standards consortia and developer communities, organizations can influence roadmap priorities and co-create solutions tailored to specific industry challenges. Establishing an ecosystem of certified partners will streamline implementations, reduce total cost of ownership, and accelerate access to emerging features and specialized expertise.

Outlining a Comprehensive Research Methodology Combining Qualitative Inquiries, Quantitative Analyses, and Rigorous Data Triangulation Techniques

This study employs a multi-phased approach, beginning with extensive secondary research that incorporates vendor documentation, technical whitepapers, regulatory publications, and peer-reviewed journals. Detailed reviews of patent filings and technology roadmaps provided context for emerging capabilities. The secondary phase also included an analysis of publicly available case studies and industry associations’ reports to map technology adoption patterns and operational best practices across sectors.

In the primary research phase, in-depth interviews were conducted with a diverse group of stakeholders, including enterprise CIOs, IT directors, solution architects, and compliance officers. These conversations yielded qualitative perspectives on strategic objectives, implementation challenges, and success metrics. Additionally, a structured survey captured quantitative data regarding deployment models, application usage, and satisfaction drivers across organization sizes and regions.

Data triangulation techniques were applied to validate findings, cross-referencing insights from primary interviews, survey responses, and secondary sources. Statistical analysis of survey inputs identified significant correlations and trends, while thematic coding of qualitative input surfaced emerging themes. The combined methodology ensured a holistic, unbiased view of the cloud enterprise content management landscape, providing a robust foundation for the strategic insights and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Enterprise Content Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Enterprise Content Management Market, by Component

- Cloud Enterprise Content Management Market, by Deployment

- Cloud Enterprise Content Management Market, by Organization Size

- Cloud Enterprise Content Management Market, by Application

- Cloud Enterprise Content Management Market, by Industry Vertical

- Cloud Enterprise Content Management Market, by Region

- Cloud Enterprise Content Management Market, by Group

- Cloud Enterprise Content Management Market, by Country

- United States Cloud Enterprise Content Management Market

- China Cloud Enterprise Content Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Key Findings and Strategic Implications to Synthesize Cloud Enterprise Content Management Trends, Challenges, and Opportunities

The analysis highlights a clear trajectory toward cloud-centric content management, driven by technological advancements in AI, automation, and microservices. Regulatory imperatives and tariff considerations are accelerating the shift from on-premise infrastructure to subscription-based models, while segmentation analysis underscores differentiated needs across applications, deployments, components, organization sizes, and industry verticals. Regional variations reflect maturity gradients that influence vendor strategies and adoption timelines, emphasizing the importance of localized compliance and partner ecosystems.

For enterprises aiming to navigate this evolving landscape, the strategic focus must encompass cloud-first adoption frameworks, integration of intelligent analytics, and comprehensive governance structures. Vendors that offer modular, API-rich platforms with embedded security and compliance controls will be best positioned to capture emerging opportunities. Moreover, the ability to forge partnerships and co-innovate through open standards will distinguish market leaders. The convergence of these factors sets the stage for a new era of content-driven value creation and operational resilience.

Engage with Associate Director Sales & Marketing to Unlock Exclusive Access to the Comprehensive Cloud Enterprise Content Management Market Report

To gain deeper insights into the transformative trends shaping cloud enterprise content management and to secure a competitive edge, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. This comprehensive, research-backed report offers a granular examination of key market drivers, segmentation dynamics, regional nuances, and proactive recommendations that business leaders can deploy immediately. Engage directly to discuss tailored licensing options, executive briefings, and exclusive advisory sessions designed to align strategic imperatives with operational realities.

- How big is the Cloud Enterprise Content Management Market?

- What is the Cloud Enterprise Content Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?