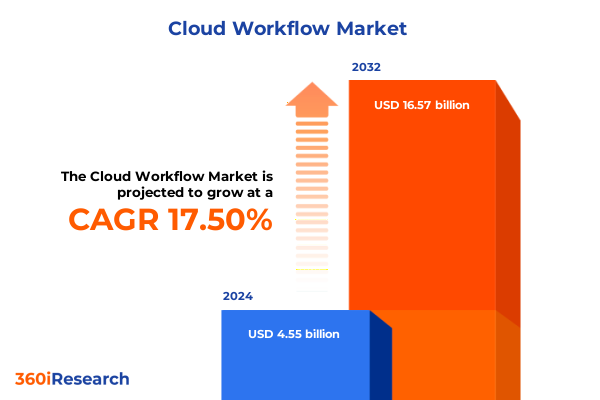

The Cloud Workflow Market size was estimated at USD 5.31 billion in 2025 and expected to reach USD 6.20 billion in 2026, at a CAGR of 17.63% to reach USD 16.57 billion by 2032.

Setting the Stage for Cloud Workflow Innovation by Highlighting Critical Industry Drivers and Emerging Automation Needs for Strategic Competitive Advantage

Organizations across industries face mounting pressure to optimize operations, enhance collaboration, and accelerate digital transformation. Cloud workflow platforms have emerged as a powerful enabler of these initiatives by streamlining process automation, enabling seamless integration among disparate systems, and offering scalable, on-demand capabilities that align with evolving business needs. This introduction examines the convergence of technological advancements, shifting workforce expectations, and regulatory imperatives that create a fertile environment for cloud workflow adoption.

As enterprises grapple with the complexity of hybrid and multi-cloud environments, they increasingly turn to workflow solutions that abstract underlying infrastructure complexities. These solutions unify processes through centralized orchestration, enabling real-time visibility and improved governance. Emerging trends in artificial intelligence, low-code development, and API-centric architectures drive platform capabilities that support rapid process iteration and continuous improvement. Additionally, the rise of remote and dispersed teams underscores the need for collaboration-centric workflows that facilitate secure, contextual interactions among stakeholders.

Building on this foundation, the subsequent sections of this executive summary explore transformative landscape shifts, the implications of recent tariff changes, tailored segmentation insights, regional dynamics, leading vendors’ strategies, actionable recommendations for industry leaders, and the research methodology underpinning these findings.

The goal of this summary is to equip decision makers with a clear understanding of the current cloud workflow ecosystem, its key drivers, and practical guidance for leveraging workflow platforms to achieve strategic objectives.

Examining How Artificial Intelligence, Low-Code Development and Integration Platforms Are Disrupting Traditional Workflow Models Across Industries

The landscape of cloud workflow is undergoing profound transformation fueled by advancements in artificial intelligence, low-code development, and robust integration platforms. AI-powered capabilities embedded in workflow engines enable predictive decision making, anomaly detection, and intelligent routing that reduce manual intervention and drive efficiency. Predictive process insights analyze historical data to forecast bottlenecks, while machine learning algorithms optimize resource allocation, promoting agility and continuous process refinement.

Meanwhile, the low-code paradigm empowers citizen developers and business analysts to rapidly design and deploy workflow applications through visual interfaces and pre-built connectors. This democratization of development accelerates time-to-value and fosters greater alignment between IT and business functions. Integration platforms as a service facilitate seamless connectivity among disparate on-premises and cloud systems, enabling end-to-end process orchestration across CRM, ERP, collaboration, and analytics solutions.

Moreover, serverless computing and microservices architectures decouple workflow logic into reusable, event-driven components that scale dynamically in response to demand. This modular approach simplifies maintenance and reduces total cost of ownership by minimizing idle infrastructure. As organizations pursue digital transformation at scale, these transformative shifts converge to create a new paradigm where cloud workflow solutions serve as the backbone of intelligent, adaptive, and resilient operations.

Unpacking the Ripple Effects of 2025 United States Tariffs on Cloud Workflow Infrastructure Costs, Technology Adoption and Supply Chain Dynamics

In 2025, a series of United States tariffs on imported semiconductor components, networking hardware, and server equipment has reverberated through cloud infrastructure supply chains and service pricing models. The imposition of additional duties on chips and data-center hardware has elevated procurement costs for hyperscale providers and third-party data center operators, compelling them to reassess sourcing strategies and vendor contracts. In response, major cloud service providers have absorbed a portion of these increased costs to maintain competitive pricing for end users, while seeking to optimize supply chains by diversifying manufacturing locations and negotiating long-term agreements.

These tariff-induced pressures have accelerated interest in edge computing and distributed data architectures. By deploying localized compute resources closer to end users, organizations mitigate exposure to hardware price volatility and reduce dependence on centralized data-center capacity. Additionally, the increased cost of hardware imports has spurred a shift toward software-defined infrastructure, with enterprises leveraging virtualized networking, storage, and compute to achieve greater flexibility and cost predictability.

Beyond hardware considerations, the tariffs have influenced vendor partnerships and mergers as service providers aim to consolidate capabilities, drive economies of scale, and secure alternative component supply lines. The cumulative effect underscores the importance of strategic supply chain management, regional diversification, and investment in software-centric innovations to sustain growth in the face of evolving trade policies.

Revealing Key Component, Deployment Model and Industry Vertical Insights Driving Tailored Cloud Workflow Solutions for Diverse Enterprise Requirements

Cloud workflow solutions encompass a broad spectrum of components and services that cater to the diverse needs of modern enterprises. Within the services domain, managed services offer end-to-end operational support, including infrastructure monitoring, patch management, and compliance governance, while professional services provide consultancy, custom development, and integration expertise. On the solutions side, platform as a service delivers a unified environment for building, deploying, and scaling workflow applications, complemented by software as a service offerings that provide out-of-the-box workflow templates, analytics, and collaboration features.

Deployment models vary across hybrid cloud, private cloud, and public cloud environments. Hybrid cloud enables seamless orchestration between on-premises systems and public cloud resources, balancing control and scale. Private cloud deployments emphasize data sovereignty and strict security policies, often preferred by highly regulated industries. Public cloud environments deliver the agility and cost efficiency of multi-tenant platforms, making them attractive for organizations with dynamic workloads.

Industry verticals drive specific workflow requirements, from banking, capital markets, and insurance processes in the financial sector to clinical trials, payer workflows, and provider-centric systems in healthcare. The information technology and telecommunications sector relies on automated provisioning, incident management, and service orchestration, while discrete and process manufacturing benefit from integrated supply chain workflows. Retail organizations optimize inventory replenishment, order fulfillment, and customer engagement across brick-and-mortar and online channels.

Large enterprises capitalize on extensive customization and global rollout capabilities, whereas small and medium businesses prioritize ease of use and predictable pricing. Workflow types range from human-centric processes that require task assignment and approvals to system-centric automations that execute event-driven operations. Integration-centric workflows connect applications, process-orchestration workflows manage multistep business logic, and task-automation workflows handle repetitive activities with minimal human input.

This comprehensive research report categorizes the Cloud Workflow market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Workflow Type

- Industry Vertical

Comparing Regional Cloud Workflow Adoption Trends and Market Drivers across the Americas, Europe Middle East & Africa and Asia-Pacific Landscapes

Across the Americas, cloud workflow adoption reflects a mature ecosystem characterized by rapid integration of artificial intelligence, a strong emphasis on data privacy regulations, and deep partnerships between technology providers and industry specialists. Organizations in North America lead in implementing advanced orchestration and analytics capabilities, while Latin American enterprises focus on modernizing legacy systems and expanding access to digital services in public sector and financial applications.

In Europe, Middle East, and Africa, regulatory frameworks such as GDPR and data sovereignty mandates shape private and hybrid cloud strategies. Enterprises in Western Europe leverage multi-cloud orchestration to ensure compliance and resilience, whereas organizations in emerging Middle Eastern markets adopt cloud workflows to accelerate digital government initiatives. In Africa, mobile-first service delivery drives workflow automation in sectors like telecommunications, banking, and healthcare.

The Asia-Pacific region exhibits a dynamic growth trajectory, balancing rapid digital transformation in developed markets with cost-sensitive deployments across emerging economies. Japan and South Korea focus on edge workflows for industry 4.0 use cases, while Australia and New Zealand invest in cloud-native orchestration for service delivery and customer experience enhancements. Southeast Asian nations prioritize scalable public cloud solutions to support e-commerce expansion and financial inclusion programs.

Regional nuances in network infrastructure, regulatory environments, and talent availability inform platform selection, deployment models, and partner ecosystems. As a result, vendors tailor their offerings and support services to align with localized requirements, driving differentiated adoption patterns across continents.

This comprehensive research report examines key regions that drive the evolution of the Cloud Workflow market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Workflow Providers and Innovators Shaping the Competitive Playing Field with Strategic Partnerships and Technology Investments

Leading technology vendors continue to expand their cloud workflow portfolios through strategic partnerships, acquisitions, and organic innovation. Hyperscale providers leverage native orchestration services integrated within their cloud platforms to simplify deployment and management, while traditional enterprise software companies enhance workflow modules with AI-driven decision engines and low-code interfaces.

Specialized middleware vendors differentiate by offering pre-built connectors, industry-specific accelerators, and managed orchestration services that bridge enterprise systems, IoT devices, and third-party applications. Collaboration platform providers integrate workflow capabilities into messaging and document management suites to streamline approval processes and content governance. At the same time, system integrators establish dedicated workflow centers of excellence to address end-to-end implementation and change management needs.

A growing number of pure-play workflow automation startups focus on niche capabilities such as robotic process automation, process mining, and conversational workflows. These agile challengers often form alliances with larger platform vendors to deliver complementary services and expand customer reach. The competitive landscape is characterized by continuous technology convergence, with mergers and strategic investments reshaping vendor ecosystems and accelerating time-to-market for advanced workflow functionalities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Workflow market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Appian Corporation

- Automation Anywhere

- Boomi

- International Business Machines Corporation

- Kissflow

- Microsoft Corporation

- Oracle Corporation

- Pegasystems Inc.

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- Software AG

- Workato

Offering Actionable Recommendations for Industry Leaders to Drive Cloud Workflow Transformation and Sustain Competitive Edge in an Accelerating Market

To capitalize on the evolving cloud workflow landscape, industry leaders should prioritize several key actions. First, invest in AI-enabled orchestration capabilities that provide predictive insights and automate decision-making across critical processes. By embedding machine learning models within workflow engines, organizations can proactively identify inefficiencies, reduce manual interventions, and accelerate cycle times.

Second, develop a robust hybrid and multi-cloud strategy that balances sovereignty, performance, and cost. Establish governance frameworks that standardize policies across environments and leverage infrastructure-as-code to maintain consistency. Engaging with a diverse partner ecosystem, including system integrators and specialized middleware providers, will ensure seamless connectivity and holistic support for complex deployments.

Third, cultivate a culture of continuous improvement and citizen development by promoting low-code tool adoption. Empower business analysts and domain experts to co-create workflow applications, foster rapid prototyping, and drive cross-functional collaboration. Provide training programs and governance guidelines to maintain control while unlocking innovation at scale.

Finally, monitor evolving trade policies, supply chain risks, and regional compliance requirements to inform procurement and deployment decisions. Implement software-defined infrastructure and edge strategies to mitigate hardware price fluctuations and ensure workload resilience. By executing these recommendations, organizations will position themselves to harness the full potential of cloud workflow solutions and sustain competitive differentiation.

Detailing the Rigorous Research Methodology Employed to Deliver Unbiased, Comprehensive Insights into the Cloud Workflow Ecosystem and Market Dynamics

The insights presented in this executive summary are grounded in a rigorous research methodology designed to ensure accuracy, relevance, and comprehensiveness. The process commenced with extensive secondary research, encompassing industry publications, regulatory filings, vendor white papers, and technical documentation to establish a foundational understanding of market drivers, technology trends, and competitive dynamics.

Following the literature review, primary research was conducted through in-depth interviews with senior executives, IT architects, and workflow specialists across diverse industry verticals. These conversations provided firsthand perspectives on adoption challenges, success factors, and future priorities. Data triangulation techniques validated findings by cross-referencing quantitative metrics with qualitative insights to minimize biases and ensure representativeness.

Market segmentation frameworks were developed based on component, deployment model, industry vertical, organization size, and workflow type criteria. This structured approach enabled nuanced analysis of adoption patterns and solution preferences. Regional assessments incorporated macroeconomic indicators, regulatory landscapes, and infrastructure maturity to contextualize comparative insights.

Finally, expert panel reviews and internal quality checks were performed to synthesize data, refine conclusions, and ensure alignment with current market realities. This multi-phase methodology delivers a balanced, fact-based perspective that supports strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Workflow market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Workflow Market, by Component

- Cloud Workflow Market, by Deployment Model

- Cloud Workflow Market, by Workflow Type

- Cloud Workflow Market, by Industry Vertical

- Cloud Workflow Market, by Region

- Cloud Workflow Market, by Group

- Cloud Workflow Market, by Country

- United States Cloud Workflow Market

- China Cloud Workflow Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Drawing Conclusions on the Future Trajectory of Cloud Workflow Adoption and Its Impact on Business Efficiency, Collaboration and Digital Transformation

As enterprises accelerate digital transformation initiatives, cloud workflow platforms have emerged as indispensable enablers of operational efficiency, agility, and collaboration. The convergence of AI-driven intelligence, low-code development, and distributed architectures reshapes traditional process models, empowering organizations to respond dynamically to evolving business and regulatory demands.

The cumulative impact of recent tariff adjustments underscores the importance of adaptable supply chain strategies and software-centric innovations. Organizations that embrace hybrid and edge deployments, coupled with proactive governance frameworks, will mitigate geopolitical risks and maintain continuity in service delivery. Segmentation insights reveal a heterogeneous landscape where component preferences, deployment models, and vertical-specific workflows drive differentiated value propositions.

Regional dynamics further emphasize the need for localized strategies that account for regulatory requirements, infrastructure maturity, and market maturity. Leading vendors continue to innovate through partnerships and targeted investments, while industry leaders can secure competitive advantage by adopting best practices in AI-enabled orchestration, low-code collaboration, and hybrid governance.

Looking forward, the trajectory of cloud workflow adoption points to deeper integration with emerging technologies such as robotic process automation, blockchain-enabled process integrity, and immersive collaboration interfaces. Organizations that align their digital roadmaps with these trends will unlock new efficiency gains, enhance customer experiences, and fortify resilience in an increasingly complex operating environment.

Engaging with Ketan Rohom to Gain Exclusive Access to the Detailed Cloud Workflow Market Research Report and Empower Your Strategic Decisions Today

To acquire the comprehensive cloud workflow market research report and gain strategic guidance tailored to your organization’s needs, engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise ensures you receive actionable insights, customized data analysis, and agile support throughout your decision-making process. Reach out now to explore tailored research options, refine your market approach, and secure your competitive advantage through in-depth knowledge. Ketan’s personalized consultation will clarify report features, review relevant data highlights, and align recommendations with your business objectives. Partnering with Ketan delivers transparency, focused guidance, and a seamless procurement journey that empowers your leadership team to implement informed cloud workflow strategies. Begin your engagement today and harness the full potential of this research asset to drive operational excellence and innovation.

- How big is the Cloud Workflow Market?

- What is the Cloud Workflow Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?