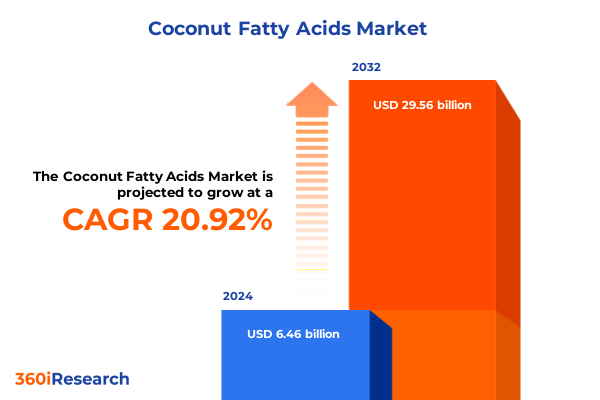

The Coconut Fatty Acids Market size was estimated at USD 7.76 billion in 2025 and expected to reach USD 9.33 billion in 2026, at a CAGR of 21.04% to reach USD 29.56 billion by 2032.

Exploring the Growing Strategic Importance of Coconut Fatty Acids in Modern Industries Driven by Innovation, Sustainability, and Health Trends Transforming Global Supply Chains

Coconut fatty acids, derived through the fractionation and purification of coconut oil, have emerged as versatile building blocks across a wide spectrum of industries. These medium-chain fatty acids possess unique physicochemical properties, including rapid absorption, oxidative stability, and antimicrobial activity, making them integral to formulations in cosmetics, pharmaceuticals, food processing, and industrial applications. Their functional benefits, coupled with a growing consumer preference for natural and sustainable ingredients, have propelled coconut fatty acids to the forefront of innovation in both mature and emerging markets.

In recent years, the convergence of health and wellness trends with the demand for clean-label and eco-friendly products has driven manufacturers to integrate capric, caprylic, lauric, and myristic acids into an expanding array of offerings. As these acids serve as emulsifiers, emollients, and specialty intermediates, their contribution to product performance and stability has become indispensable. Furthermore, advancements in extraction and purification technologies have enhanced the efficiency and consistency of coconut fatty acid supply chains, reinforcing their strategic importance.

Transitioning from traditional extraction methods to enzymatic and membrane-based processes, the industry continues to optimize yield, reduce energy consumption, and minimize environmental impact. Consequently, stakeholders across the value chain are increasingly prioritizing sustainable sourcing practices and partnering with key suppliers to establish transparent supply networks. This foundational context underscores the transformative significance of coconut fatty acids in driving innovation and supporting long-term market growth.

Identifying Pivotal Shifts in Consumer Preferences, Technological Breakthroughs, and Regulatory Landscapes Reshaping the Coconut Fatty Acids Market Worldwide

Rapid shifts in consumer preferences towards naturally derived ingredients have defined a new era for coconut fatty acids, elevating their status from commodity chemicals to high-value specialty ingredients. Driven by a surge in demand for plant-based and clean-label formulations, manufacturers have intensified investments in advanced fractionation technologies, enabling precise separation of capric, caprylic, lauric, and myristic acids to meet stringent purity specifications. This technological evolution has not only improved product performance but also opened pathways for novel applications in niche segments such as medical foods and specialty nutraceuticals.

Moreover, regulatory frameworks have adapted to support the safe incorporation of medium-chain triglycerides (MCTs) in diverse consumer products. The U.S. Food and Drug Administration’s assignment of Generally Recognized As Safe (GRAS) status to MCTs has facilitated their deployment across bakery, dairy analogues, and snack food formulations, accelerating innovation in functional food and beverage categories. Concurrently, digital supply chain platforms and blockchain-enabled traceability solutions have empowered buyers and end users to authenticate origin, quality, and sustainability credentials with unprecedented transparency.

As government policies and industry standards continue to evolve in response to environmental and health concerns, the coconut fatty acids landscape is undergoing a fundamental transformation. Stakeholders are leveraging predictive analytics and real-time market intelligence to anticipate shifts in raw material availability, assess regulatory changes, and align production strategies accordingly. These combined shifts in technology, regulation, and consumer behavior are reshaping the competitive dynamics and value propositions within the global coconut fatty acids market.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on Coconut Fatty Acid Imports, Supply Chain Resilience, and Sourcing Strategies

The United States, a major importer of coconut fatty acids, maintains a general Most-Favored-Nation duty of 5% on fatty acids of animal or vegetable origin under HTSUS 29159010, effective as of the May 2025 tariff revision. On top of this base rate, products originating from China are subject to an additional 25% Section 301 tariff, creating a cumulative duty burden of 30% and prompting global buyers to reevaluate sourcing strategies. While this dual-tariff structure protects domestic processors and mitigates supply chain risks, it also incentivizes the cultivation of alternative sourcing partnerships with major coconut-producing regions in Southeast Asia.

Additionally, preferential trade agreements offer duty-free or reduced-duty channels for countries such as Costa Rica, Indonesia, and the Philippines, enabling U.S. importers to diversify supply sources while optimizing cost structures. These divergent tariff pathways have resulted in a dynamic sourcing landscape, where importers must balance duty exposure, logistics complexity, and supplier reliability. In response, many stakeholders are engaging in forward contracts, exploring bonded warehouse options, and negotiating long-term commitments to stabilize input prices and secure supply continuity.

Consequently, the shifting tariff environment has accelerated investments in regional processing facilities within the Americas and strengthened collaborations with free trade agreement partners. These strategic adaptations illustrate the profound cumulative impact of U.S. tariff policies on procurement economics and underscore the necessity for companies to employ proactive customs planning and risk management practices.

Analyzing Distinct Product, End Use, and Distribution Channel Segments to Uncover Growth Dynamics and Competitive Advantages in the Coconut Fatty Acids Market

The coconut fatty acids market is characterized by distinct demand drivers and value creation opportunities that vary significantly by product type. Capric and caprylic acids have gained traction for high-purity applications such as specialty chemicals and antimicrobial formulations, while lauric acid continues to dominate in emollient and detergent intermediates due to its optimal chain length and performance attributes. Myristic acid, though a smaller segment, plays a critical role in fragrance fixatives and nutritional supplements, earning prominence in elite cosmetic and pharmaceutical niches.

End use industries further differentiate market dynamics: animal feed producers leverage coconut fatty acids for their digestibility and energy efficiency, whereas cosmetics manufacturers prize their skin-compatible texture and antimicrobial properties. Food processing companies incorporate these acids as emulsifiers and flavor stabilizers, and industrial manufacturers utilize them for biodegradable surfactants and lubricants. Pharmaceutical firms, in turn, exploit the rapid metabolism of medium-chain fatty acids in targeted drug delivery systems and formulation enhancements.

Distribution channels reflect evolving buyer behaviors. While traditional distributors, retailers, and wholesalers remain essential for bulk and B2B transactions, direct-to-consumer brand websites and global e-commerce platforms are capturing incremental growth by offering smaller packaging formats and traceable supply chain credentials. This omnichannel landscape demands that suppliers align logistics, quality assurance, and digital marketing strategies to meet the nuanced requirements of each customer segment and maximize return on innovation.

This comprehensive research report categorizes the Coconut Fatty Acids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End Use Industry

- Distribution Channel

Examining Regional Variations in Coconut Fatty Acid Demand Across the Americas, Europe Middle East Africa, and Asia Pacific to Inform Market Expansion Strategies

Regional demand for coconut fatty acids exhibits pronounced heterogeneity driven by production capacity, end user concentration, and trade connectivity. In the Americas, the expansion of functional food and dietary supplement sectors has spurred elevated import volumes, particularly in specialty nutrition and personal care formulations. Investment in local fractionation plants and collaboration with Central American producers have enhanced regional supply resilience and cost competitiveness.

Over in Europe, the Middle East, and Africa, regulatory rigor and sustainability mandates have cultivated a premium segment for certified organic and fair-trade coconut fatty acids. Stringent EU cosmetic regulations and rising consumer awareness around environmental impact have encouraged manufacturers to source from traceable supply chains, reinforcing partnerships with West African and East African aggregators. Meanwhile, the Middle East’s growing industrial chemicals sector is rapidly adopting coconut-derived surfactants to meet stringent biodegradability standards.

Asia Pacific continues to underpin the global supply base, with Indonesia and the Philippines commanding significant processing infrastructure. Robust domestic consumption in cosmetics and food processing, coupled with government-led sustainability initiatives, has driven capacity expansions. Cross-border integration through ASEAN trade facilitation and investments in downstream processing have strengthened APAC’s role as both a production hub and a center for research and development, setting the regional tone for innovation.

This comprehensive research report examines key regions that drive the evolution of the Coconut Fatty Acids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategies, Innovation Initiatives, and Competitive Positioning Driving the Coconut Fatty Acids Landscape Forward

Market leadership in the coconut fatty acids landscape is defined by a combination of production scale, technological innovation, and strategic partnerships. Major chemical companies have expanded their footprint through capacity augmentations and joint ventures with regional coconut oil processors, reinforcing integrated supply chains from raw material sourcing to purified fatty acid production. These partnerships enable consistent quality control and rapid response to fluctuating demand.

R&D investment has become a critical differentiator, as leading firms leverage enzymatic fractionation, membrane filtration, and green chemistry techniques to enhance yield, reduce energy consumption, and develop high-purity derivatives tailored for niche applications. Collaborations with academic institutions and biotechnology startups have further accelerated product pipeline development, particularly in specialty pharmaceutical excipients and advanced surfactant formulations.

In parallel, companies are forging sustainability alliances to achieve round-the-clock traceability and certify environmental compliance. Adoption of third-party auditing frameworks and participation in global sustainability standards underscore a commitment to transparent governance. The convergence of operational excellence, innovation capacity, and sustainability leadership defines the competitive strategies of key players, shaping the evolving hierarchy within the coconut fatty acids sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coconut Fatty Acids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3F Industries Ltd.

- AAK AB

- AAK AB

- BASF SE

- Brenntag AG

- Cargill, Incorporated

- Chemical Associates, Inc.

- Croda International Plc

- Echo Chem Pacific Sdn Bhd

- Emery Oleochemicals LLC

- Godrej Industries Limited

- IOI Oleochemical Sdn Bhd

- KLK Oleo Sdn Bhd

- Musim Mas Holdings Pte. Ltd.

- Natural Oleochemicals Sdn Bhd

- Oleon N.V.

- Pacific Oleochemicals Sdn Bhd

- Sinar Mas Group

- The Procter & Gamble Company

- Timur Oleochemicals Malaysia Sdn Bhd

- Twin Rivers Technologies, Inc.

- United Coconut Chemicals, Inc.

- Vantage Specialty Chemicals, Inc.

- VVF Loders Croklaan India Private Limited

- Wilmar International Limited

Outlining High Impact Strategic Recommendations for Industry Leaders to Capitalize on Coconut Fatty Acid Market Opportunities and Mitigate Emerging Risks

To capitalize on emerging market opportunities and mitigate geopolitical and supply chain uncertainties, industry leaders should prioritize diversification of raw material sourcing by establishing multi-region supply agreements within Southeast Asia and the Americas. Concurrently, accelerating investments in next-generation fractionation technologies and continuous processing platforms will enhance production agility and reduce operational costs.

Building transparent, digital traceability systems across the supply chain will address growing consumer and regulatory demands for sustainability and ethical sourcing. By integrating blockchain-enabled provenance tracking and third-party certification at key touchpoints, companies can reinforce trust and unlock premium pricing in high-value end markets.

Moreover, forging strategic alliances with innovative end users in pharmaceuticals and specialty chemicals will facilitate co-development of application-specific derivatives, driving differentiation and margin expansion. Finally, proactive customs planning and engagement with trade policy stakeholders can help navigate evolving tariff landscapes, optimize duty exposure, and secure long-term competitive advantage.

Detailing a Rigorous Research Framework Incorporating Primary Expert Interviews, Secondary Industry Data, and Robust Analytical Techniques

This analysis integrates a rigorous multi-stage research methodology designed to ensure data integrity and actionable insights. Primary research included in-depth interviews with executives across coconut oil processors, specialty chemical manufacturers, regulatory agencies, and end user companies, providing qualitative context around technology adoption, sourcing strategies, and demand drivers.

Secondary research entailed comprehensive review of industry publications, government trade databases, tariff schedules, and regulatory filings from the U.S. Harmonized Tariff Schedule and FDA GRAS notices. To validate quantitative and qualitative data, a triangulation approach was applied, cross-referencing trade statistics with financial reports, sustainability disclosures, and academic literature on medium-chain fatty acid applications.

Analytical frameworks such as SWOT, Porter’s Five Forces, and regression-based sensitivity analysis were employed to evaluate competitive intensity, risk factors, and revenue potential across segments. Geographic market models were calibrated using expert-derived weighting factors and trade flow adjustments to reflect 2025 tariff structures and evolving trade agreements. This systematic methodology underpins the robust findings and strategic recommendations presented within this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coconut Fatty Acids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coconut Fatty Acids Market, by Product Type

- Coconut Fatty Acids Market, by End Use Industry

- Coconut Fatty Acids Market, by Distribution Channel

- Coconut Fatty Acids Market, by Region

- Coconut Fatty Acids Market, by Group

- Coconut Fatty Acids Market, by Country

- United States Coconut Fatty Acids Market

- China Coconut Fatty Acids Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Provide Clear Strategic Direction for Stakeholders Navigating the Evolving Coconut Fatty Acids Market Ecosystem

In an era defined by sustainability mandates, health-driven innovation, and complex trade dynamics, coconut fatty acids have transcended their status as commodity derivatives to become pivotal specialty ingredients. Through advanced fractionation technologies and supportive regulatory frameworks, these medium-chain fatty acids now enable a broad spectrum of value-added applications in cosmetics, pharmaceuticals, food processing, and industrial formulations.

Regional supply chain diversification, coupled with preferential trade agreements and proactive tariff management, has become essential for maintaining cost competitiveness and supply resilience. Meanwhile, leading companies’ commitments to green chemistry, digital traceability, and collaborative R&D are shaping the market’s future direction.

As end users continue to demand higher purity, ethical sourcing, and demonstrable performance benefits, the strategic interplay between technology, policy, and consumer expectations will define winners and challengers. Stakeholders armed with deep market intelligence and agile execution capabilities will be best positioned to capture growth, drive innovation, and navigate the evolving landscape of coconut fatty acids.

Engage with Ketan Rohom to Secure Comprehensive Coconut Fatty Acids Market Intelligence and Drive Strategic Decision Making with Expert Support

To obtain the full detailed analysis of market drivers, regional trends, competitive benchmarking, and actionable recommendations for coconut fatty acids, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive research report and elevate your strategic planning.

- How big is the Coconut Fatty Acids Market?

- What is the Coconut Fatty Acids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?