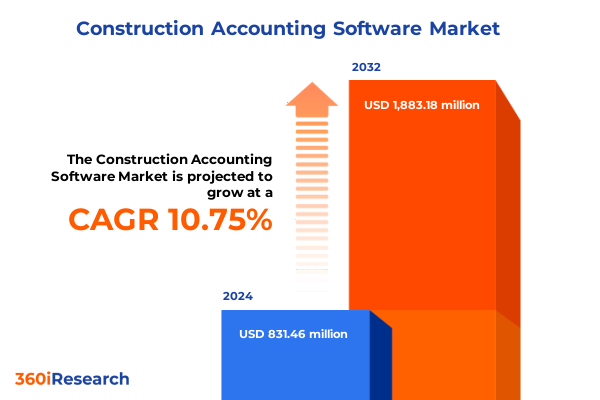

The Construction Accounting Software Market size was estimated at USD 921.14 million in 2025 and expected to reach USD 1,013.57 million in 2026, at a CAGR of 10.75% to reach USD 1,883.18 million by 2032.

Transformative introduction to construction accounting software as technologies drive operational agility and financial control across project lifecycles

The construction industry is in the midst of an unprecedented transformation as businesses seek to integrate financial management and operational execution more closely than ever before. Historically reliant on manual processes and disparate systems, project teams have faced challenges in achieving real-time visibility into budgets labor costs and resource utilization. This dynamic landscape has driven an urgent demand for standardized accounting solutions tailored to the unique workflows of construction firms and specialty contractors.

Against this backdrop the emergence of dedicated construction accounting platforms has empowered organizations to consolidate financial data within a single ecosystem. Firms are leveraging automation to eliminate redundant data entry accelerate month-end close cycles and reduce the risk of errors. As a result leadership teams are able to shift focus from transactional tasks to strategic decision making which, in turn, strengthens competitive positioning and profitability.

Embracing cloud-native architectures has further revolutionized how accounting information is accessed and managed. By mobilizing controllers project managers and field crews on shared dashboards organizations are driving tighter collaboration across geographically dispersed teams. These innovations are unlocking new levels of agility in responding to cost overruns unforeseen delays and shifting client requirements.

Collectively these trends underscore the critical role of accounting software in modern construction practice. This executive summary provides a focused exploration of transformative shifts regulatory impacts segmentation nuances regional dynamics competitive landscapes and strategic recommendations-delivering a roadmap for decision makers seeking to harness the full potential of construction accounting solutions.

Emerging paradigm shifts reshaping construction accounting with intelligent automation AI integration and seamless collaboration across project management

The convergence of intelligent automation and artificial intelligence is redefining how construction accounting functions are executed and optimized. Machine learning-enabled tools now analyze historical cost data to forecast budget variances flag anomalies in real time and streamline invoice approvals. Consequently organizations can reallocate resources proactively and reduce financial leakage across multiple projects.

Moreover the proliferation of application programming interfaces has catalyzed a wave of integrated ecosystems. By seamlessly connecting accounting modules with project management time tracking procurement and equipment maintenance, firms are eliminating data silos and accelerating information flow. This tight interoperability not only enhances accuracy but also supports end-to-end process standardization across the enterprise.

In parallel mobile and tablet-based solutions are equipping field teams with direct access to expense reporting job costing and payroll functions. Field-driven data collection reduces paperwork delays while consolidating information at the source. As a result field supervisors can resolve discrepancies immediately and uphold compliance with prevailing labor regulations.

Furthermore the rise of embedded analytics within core accounting platforms is empowering non-financial stakeholders. By surfacing intuitive visualizations of cash flow trends overhead allocations and subcontractor performance these tools democratize financial insights beyond the finance department. This broadened accessibility is fostering a culture of accountability and enabling more informed, data-backed decisions at every level of the organization.

Comprehensive analysis of 2025 United States tariffs revealing cumulative effects on construction material costs supply chains and accounting practices

In 2025 the continuation of United States tariffs on imported steel and aluminum has had a cascading impact on construction material costs. Initially enacted under national security provisions these measures have maintained pressure on raw material prices, causing contractors to reassess supply strategies and cost structures. The extended duty rates have elevated the importance of tracking landed costs from import through installation.

Consequently accounting teams are now required to capture tariff expenses within project budgets at a granular level. This mandates more sophisticated cost coding as well as the integration of duty calculators directly into procurement and invoice-capture workflows. By automating these calculations organizations can avoid manual errors and ensure compliance with evolving trade regulations.

Moreover the volatility induced by tariff fluctuations has underlined the need for scenario modeling capabilities. Advanced construction accounting platforms are being adopted to simulate cost impacts under different duty scenarios and to quantify the budgetary implications across project portfolios. These forward-looking insights enable more robust contract negotiations and contingency planning.

In addition, the interplay between tariffs and global supply chain disruptions has spurred closer collaboration between finance and procurement teams. By consolidating vendor performance data with cost analysis, decision makers can optimize supplier selection and mitigate risk. This holistic approach ensures that tariff considerations are embedded within strategic sourcing decisions and financial reporting practices.

Segmentation insights revealing how deployment models company scales applications and end user profiles drive construction accounting software evolution

Segmentation analysis reveals differentiated adoption patterns across deployment models, organizational scales, application focus and end user profiles. Cloud-based solutions have seen accelerated uptake among firms seeking to reduce IT overhead and enable real-time collaboration across decentralized teams. Conversely, on-premises deployments remain prevalent among larger enterprises with stringent data sovereignty policies and established infrastructure investments, reflecting a cautious approach to cloud migration.

When examining company size, large enterprises leverage integrated accounting environments to manage complex multi-jurisdictional projects with high transaction volumes, whereas small and medium enterprises prioritize ease of configuration rapid deployment and cost-effective subscription models. This divergence underscores the necessity for vendors to offer modular platforms that address both enterprise-grade scalability and SME accessibility.

Application demand further stratifies the market according to specific financial workflows. Cost estimation functionality is bifurcated between conceptual estimation capabilities for early feasibility studies and detailed estimation modules for precise cost breakdowns. Equipment management spans asset tracking to maintenance scheduling, while financial management extends from accounts payable modules to accounts receivable workflows. Meanwhile payroll management encompasses both onboarding and processing features, and project management integrates field-centric management with comprehensive office-based controls.

Additionally end user segmentation highlights tailored requirements across building owners, engineering firms, general contractors and specialty contractors. Within the building owner segment further distinctions arise between commercial portfolios, large industrial facilities and tracts of residential development. Each profile brings unique reporting requirements, regulatory compliance needs and integration imperatives, underscoring the importance of configurable solutions that adapt to diverse operational contexts.

This comprehensive research report categorizes the Construction Accounting Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Type

- Company Size

- Application

- End User

Global regional dynamics shaping construction accounting software adoption across Americas Europe Middle East Africa and Asia Pacific economic hubs

Regional dynamics play a pivotal role in shaping the trajectory of construction accounting software adoption. In the Americas market participants are rapidly embracing cloud-native platforms, driven by robust capital investment trends in large-scale infrastructure projects. North American contractors are integrating accounting suites with energy-focused modules to navigate stringent regulatory standards and complex tax regimes, while Latin American markets are prioritizing modular solutions that address cross-border currency management and regional compliance nuances.

Across Europe the Middle East and Africa, emphasis is placed on multi-currency support and multi-entity consolidation, enabling cross-border construction conglomerates to maintain consistent financial governance across subsidiaries. European firms are integrating environmental, social and governance reporting capabilities within their accounting workflows to satisfy evolving EU directives, whereas Middle Eastern contractors are focused on built-in localization features such as zakat calculations and performance bond tracking. In Africa, emerging markets are adopting mobile-first solutions to overcome connectivity challenges and to digitalize on-site cash flow management.

Asia Pacific presents a tapestry of maturity levels, from highly digitized markets in Australia and Japan to rapidly developing economies in Southeast Asia and South Asia where digital transformation is accelerating. Local language support and compliance with varied GST and VAT frameworks are critical for APAC deployments, while advanced analytics integrations are particularly valued in Singapore and South Korea where data-driven decision making is foundational to government infrastructure initiatives.

Collectively these regional insights underscore the imperative for solution providers to deliver flexible architectures capable of accommodating diverse regulatory landscapes, localization demands and technology readiness levels. This complexity demands a nuanced go-to-market strategy that aligns core platform capabilities with region-specific requirements and cultural considerations.

This comprehensive research report examines key regions that drive the evolution of the Construction Accounting Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive profile synthesis of leading construction accounting software providers highlighting strategic strengths and innovation trajectories

The competitive landscape of construction accounting software is characterized by a blend of established enterprise vendors and innovative niche challengers. Leading providers have strengthened their market positions through strategic acquisitions that enhance end-to-end project lifecycle integrations. These alliances have expanded the scope of financial modules available, from advanced revenue recognition engines to comprehensive subcontractor management features.

In parallel, emerging vendors have differentiated themselves by embedding artificial intelligence into core accounting workflows to automate repetitive tasks and by offering open APIs for seamless third-party integrations. These entrants are particularly appealing to mid-market firms seeking to avoid monolithic systems in favor of a best-of-breed approach. Their agile development roadmaps allow for rapid feature releases in response to user feedback, accelerating adoption among growth-oriented contractors.

Moreover, the advent of subscription-based pricing models has lowered barriers to entry for new customers and created recurring revenue streams that fund continuous innovation. Vendors that offer flexible licensing tiers aligned to the breadth of modules deployed are gaining traction across both SME segments and larger enterprises, reflecting a broader shift towards consumption-based pricing in the software industry.

Looking ahead, competitive differentiation will hinge on the ability to deliver predictive analytics, deeper ERP integration and industry-specific content libraries. Companies that invest in expanding their partner ecosystems, enhancing mobile interfaces and proving rapid time-to-value in deployment will secure a leadership edge in an increasingly crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Accounting Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archdesk Ltd.

- Autodesk, Inc.

- B2W Software, Inc.

- Bluebeam, Inc.

- Buildertrend Solutions, Inc.

- Buildxact Software Limited

- Clear Estimates, LLC

- CoConstruct, LLC

- Contractor Foreman, Inc.

- Estimator360, LLC

- Heavy Construction Systems Specialists, Inc.

- InEight, Inc.

- PlanSwift Software, LLC

- Procore Technologies, Inc.

- ProEst Estimating Software, Inc.

- Pronamics Pty Ltd

- RedTeam Software, LLC

- Sage Group plc

- Stack Construction Technologies, Inc.

- UDA Technologies, Inc.

Strategic recommendations for industry leaders to leverage construction accounting software capabilities accelerate growth and mitigate financial risks

To capitalize on evolving market dynamics industry leaders should invest in unified platforms that integrate accounting with project management procurement and equipment maintenance. By consolidating these functions within a single solution, organizations can eliminate redundant data entry, accelerate workflow handoffs and improve auditability across the project lifecycle.

In addition, decision makers should leverage embedded analytics and scenario modeling tools to anticipate cost overruns and to optimize resource allocation. By building forecasting capabilities into financial close processes leaders can proactively adjust budgets, renegotiate supplier contracts and align stakeholder expectations before issues escalate.

Furthermore, establishing cross-functional governance forums that include finance procurement operations and technology teams will foster shared accountability for digital transformation initiatives. Structured governance frameworks ensure that system upgrades, customizations and integration roadmaps remain aligned to overarching business objectives and compliance mandates.

Finally, organizations must prioritize talent development by upskilling accounting and project management personnel on new platform functionalities and data interpretation techniques. Investing in role-based training programs accelerates user adoption, mitigates the risk of implementation delays and maximizes return on software investments.

Robust research methodology outlining data collection analysis frameworks validation underpinning insights into construction accounting software landscapes

This research methodology is rooted in a combination of secondary and primary research phases designed to ensure comprehensive coverage and accuracy. Secondary data was sourced from industry publications peer-reviewed journals and reputable government economic databases, providing a foundational understanding of market drivers technology trends and regulatory impacts.

The primary research phase involved in-depth interviews with a diverse pool of stakeholders including CFOs controllers project managers and IT leaders across construction subsectors. These conversations yielded qualitative insights into adoption barriers feature preferences integration challenges and best practices for deployment.

Quantitative data was triangulated through anonymized surveys that captured platform usage statistics, satisfaction levels and investment priorities. Analytical frameworks such as SWOT and Porter’s Five Forces were applied to distill competitive dynamics, while scenario analysis models assessed the sensitivity of adoption rates to economic variables such as tariff changes and capital expenditure trends.

Validation of findings was achieved through iterative reviews with advisory panels comprised of industry consultants and subject matter experts. This rigorous approach ensured that each insight reflects both empirical evidence and real-world applicability, providing decision makers with a reliable basis for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Accounting Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Accounting Software Market, by Deployment Type

- Construction Accounting Software Market, by Company Size

- Construction Accounting Software Market, by Application

- Construction Accounting Software Market, by End User

- Construction Accounting Software Market, by Region

- Construction Accounting Software Market, by Group

- Construction Accounting Software Market, by Country

- United States Construction Accounting Software Market

- China Construction Accounting Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Comprehensive synthesis positioning construction accounting software as a strategic linchpin for financial oversight excellence and competitive advantage

This executive summary synthesizes the key findings of a multifaceted study on construction accounting software, underlining its transformative impact on financial governance project efficiency and operational transparency. By integrating accounting, project management and analytics, leading organizations are achieving tighter control over budgets and more accurate forecasting, which translate into meaningful competitive advantages.

The analysis highlights the imperative of accommodating evolving regulatory environments such as the 2025 tariffs scenario, while also addressing the distinct needs of varied deployment models, company sizes, application areas and end user segments. Regional variations further complicate the landscape, necessitating adaptable solutions that balance global standards with localized compliance requirements.

Ultimately, construction accounting software has emerged as a strategic linchpin that enables firms to optimize resource utilization, elevate stakeholder confidence, and drive sustained profitability. Stakeholders equipped with these insights are positioned to make data-driven decisions that align technology investments with long-term business objectives and market exigencies.

Reach out directly to Ketan Rohom Associate Director Sales & Marketing to secure your comprehensive construction accounting software insights report today

Looking to drive unparalleled financial clarity and operational efficiency within your construction projects Reach out directly to Ketan Rohom Associate Director Sales & Marketing to secure your comprehensive construction accounting software insights report today Ketan’s expertise in aligning software capabilities to real-world construction workflows ensures you gain targeted recommendations and actionable data to support your strategic initiatives By connecting with Ketan you will receive a tailored engagement outlining the scope of the report its key deliverables and the support options available Our team is committed to delivering a seamless purchasing experience and empowering your organization with the intelligence needed to outpace competition in a rapidly evolving market

- How big is the Construction Accounting Software Market?

- What is the Construction Accounting Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?