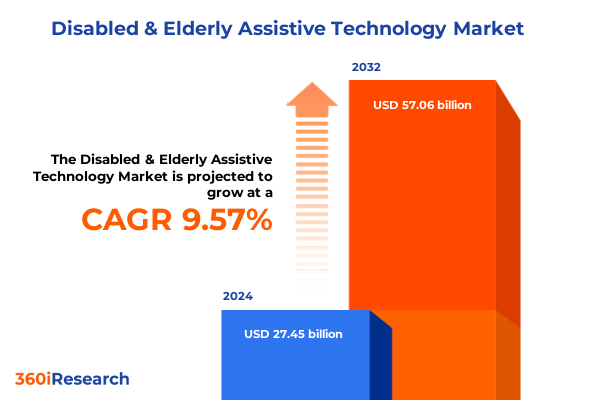

The Disabled & Elderly Assistive Technology Market size was estimated at USD 29.97 billion in 2025 and expected to reach USD 32.73 billion in 2026, at a CAGR of 9.63% to reach USD 57.06 billion by 2032.

Unveiling the critical drivers and compelling overview of assistive technologies reshaping the lives of disabled and elderly populations

The demographic shift toward an aging population and the steadily rising prevalence of chronic and degenerative conditions are fueling unprecedented demand for assistive technologies that enhance daily living. As longevity increases globally, the prevalence of mobility challenges, sensory impairments, and cognitive decline has placed assistive solutions at the forefront of both clinical and consumer innovation. Stakeholders across healthcare, manufacturing, and public policy are recognizing the critical role these technologies play in preserving autonomy and improving outcomes for elderly and disabled individuals.

In response to this evolving landscape, regulatory bodies and payers have begun to adapt their frameworks to support greater adoption of assistive devices. Reimbursement policies are gradually expanding beyond traditional hearing and mobility aids to encompass newer categories such as speech generating devices and smart sensor-based monitors. Such policy adaptations are essential not only to alleviate caregiver burden but also to incentivize manufacturers to invest in design enhancements that prioritize user comfort and interoperability.

Technological breakthroughs in electronics, materials science, and artificial intelligence are rapidly converging to enable next-generation solutions. Whether through compact microcontroller-based hearing aids, pressure-sensor-enabled fall detectors, or intuitive text-to-speech software, these innovations are setting new benchmarks for performance and user engagement. This introduction underscores the confluence of demographic imperatives, policy evolution, and technological progress that is driving the assistive technology landscape toward unprecedented levels of accessibility and personalization.

Understanding the transformative technological and societal shifts revolutionizing assistive solutions for the disabled and elderly demographic

The intersection of digital health and assistive technology is catalyzing transformative shifts that redefine how support is delivered to users with diverse needs. Remote monitoring platforms now enable seamless integration between daily living aids and telehealth services, granting healthcare professionals real-time visibility into user behavior and adherence. This shift not only expands access in underserved areas but also creates feedback loops that inform iterative product improvements.

Concurrently, the maturation of artificial intelligence is unlocking new possibilities in sensory augmentation. Machine learning-powered vision aids can identify text and objects in the environment, feeding auditory or haptic cues to end users. In parallel, AI-driven hearing aids continuously adapt to ambient noise conditions, optimizing speech clarity without manual adjustments. These advances are erasing conventional trade-offs between form factor and functionality, paving the way for solutions that are both discreet and highly capable.

As a result of these combined technological and societal shifts, the entire paradigm of assistive design is moving toward individualized, data-informed experiences. Device form factors are increasingly minimalistic, leveraging wireless connectivity to offload compute requirements to cloud-based platforms. User engagement is enhanced through companion smartphone applications that offer real-time analytics, social connectivity features, and voice-activated controls. Together, these developments mark a departure from one-size-fits-all solutions, ushering in an era of highly adaptive, user-centric assistive ecosystems.

Assessing the cumulative impact of United States import tariffs introduced through 2025 on the assistive technology supply chain and pricing dynamics

Since the implementation of Section 301 tariffs on imports from key manufacturing hubs, the cumulative cost burden on components essential to assistive devices has increased markedly through 2025. Electronics integral to hearing aids, sensor modules for fall detection, and advanced materials for mobility aids have all been subject to additional duties. This escalation in input costs has translated into higher baseline pricing pressures for finished devices, challenging manufacturers to absorb or pass through these expenses.

The layered effect of tariffs introduced over multiple years has contributed to margin compression across the supply chain. Suppliers of microcontroller-based modules and wireless communication chips have faced cost headwinds that ultimately affect OEM production budgets. In response, some manufacturers have explored tariff engineering strategies or sought alternative sourcing from regions not subject to punitive duties, though these efforts often entail trade-offs in lead times and component performance.

To mitigate ongoing tariff impacts, leading organizations are accelerating efforts toward nearshoring assemblies and establishing regional manufacturing hubs. Concurrently, design teams are optimizing product architectures to leverage locally available materials and simplified assembly processes. These strategic shifts reflect a broader imperative: preserving innovation velocity and affordability while navigating an increasingly complex global trade environment.

Looking ahead, the resilience of assistive technology supply chains will hinge on dynamic tariff management, robust supplier diversification, and adaptive pricing strategies that align with evolving regulatory landscapes.

Delivering deep segmentation insights across product types end users distribution channels and technology categories fueling market differentiation

A nuanced examination of product type segmentation reveals distinct user experiences and innovation pathways. Communication aids encompass a spectrum from portable speech generating devices to versatile text-to-speech software, each tailored to address varying levels of verbal impairment. Daily living aids range from ergonomic bathing and dressing supports to adaptive feeding systems designed to bolster independence in routine tasks. Meanwhile, hearing aids incorporate behind-the-ear, in-the-ear, and bone conduction technologies, offering calibrated solutions for a wide range of auditory conditions. Mobility aids, including crutches, manual and powered wheelchairs, and walkers, continue to evolve with lightweight materials and motorized enhancements, while vision aids such as braille devices, electronic glasses, and magnifiers integrate tactile and electronic interfaces to address diverse visual challenges.

End user segmentation underscores the importance of personalized design and targeted distribution. Cognitively impaired individuals benefit from simplified interfaces and intuitive feedback loops, whereas elderly users prioritize comfort and unobtrusiveness as functional requirements. Hearing impaired users demand high-fidelity audio reproduction, while physically disabled segments-spanning amputation, neuromuscular disorders, and spinal cord injury-require bespoke mobility and prosthetic integrations. Visually impaired users seek solutions that bridge tactile and electronic functionalities, reflecting a convergence of sensory augmentation and haptic feedback.

Distribution channels shape product accessibility and customization workflows. Direct sales models enable tailored consultations and fitting services, while hospital and clinic networks leverage both hospital supply chains and specialized rehabilitation centers to integrate devices into care plans. Online channels, including leading e-commerce platforms and manufacturer websites, expand reach and offer convenience, although they necessitate robust digital engagement strategies and remote fitting protocols. Retail channels, through pharmacies and specialty stores, deliver convenience and in-person demonstrations, especially for entry-level solutions.

Technology segmentation intersects these categories by delineating electronic, mechanical, sensor-based, and smart solutions. Electronic devices, driven by microcontroller-based and wireless subsystems, facilitate real-time communication and data exchange. Mechanical aids utilize precision-engineered materials to optimize load distribution and user comfort. Sensor-based products, leveraging motion and pressure sensors, enable fall detection and activity monitoring, while smart solutions combine connectivity, AI analytics, and user interfaces to deliver adaptive experiences. This multi-dimensional segmentation framework illuminates the complex interplay of user needs, distribution strategies, and technological capabilities driving market differentiation.

This comprehensive research report categorizes the Disabled & Elderly Assistive Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Distribution Channel

Exploring key regional dynamics across the Americas Europe Middle East Africa and Asia Pacific influencing assistive technology adoption trends

In the Americas, the aging baby boomer demographic and robust reimbursement frameworks have created fertile ground for rapid adoption of assistive solutions. Public and private healthcare systems collaborate closely to extend coverage to a wider array of devices, from advanced mobility aids to AI-enabled vision systems. North American markets continue to lead in product innovation, supported by strong clinical trial networks and venture capital investment that fuel new entrants and spur strategic partnerships.

Within Europe, Middle East, and Africa, regulatory harmonization efforts and cross-border healthcare initiatives are unlocking regional distribution efficiencies. The European Union’s Medical Device Regulation has driven manufacturers to standardize quality management processes, accelerating product roll-outs across member states. In the Middle East, government-backed health modernization programs are channeling resources into assistive infrastructure, while in select African markets, nonprofit collaborations and social enterprises are bridging accessibility gaps in rural areas.

Asia-Pacific stands out for its dynamic manufacturing capabilities and rapidly evolving digital ecosystems. Japan and South Korea are spearheading innovations in sensor-based and smart technologies, with established electronics firms entering the assistive sector. In China and India, localized production and cost-effective supply chains are driving volume adoption, while digital health platforms are integrating assistive devices into broader chronic disease management programs. Across the region, rising incomes and government initiatives aimed at elder care are propelling demand for a new generation of connected, user-friendly solutions.

This comprehensive research report examines key regions that drive the evolution of the Disabled & Elderly Assistive Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading manufacturers and innovators driving advancements and competitive differentiation in the global assistive technology arena

Leading mobility aid manufacturers are redefining user expectations through ergonomic design and electric propulsion. Established players have enhanced their product lines with modular architectures, enabling users to upgrade components such as battery systems and seating supports without full device replacement. At the same time, emerging innovators are leveraging lightweight composite materials to deliver portable mobility platforms with integrated digital controls.

In the hearing aid domain, top-tier hearing solutions providers continue to push the envelope with AI-driven noise-cancellation algorithms and seamless Bluetooth connectivity. Competitive differentiation now depends on ecosystem partnerships with smartphone developers and telehealth providers, allowing real-time audiologist support and personalized sound profiles that adapt to changing acoustic environments.

Vision aid specialists have made strides in bridging tactile and digital interfaces. Through collaborations with research institutions, these companies are integrating haptic feedback systems into electronic glasses and braille displays. Concurrently, research-heavy entrants are exploring wearable sensor arrays that translate visual data into auditory and vibrational cues, venturing into entirely new modalities of sensory substitution.

Across distribution channels, technology providers and retail networks are forging strategic alliances to expand service capabilities. Companies with strong direct-to-consumer channels are investing in virtual fitting and remote calibration tools, while healthcare system suppliers refine their integration processes to streamline device deployment in clinical settings. Together, these leading organizations are charting the course for the industry’s next wave of innovation and competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disabled & Elderly Assistive Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BraunAbi

- Cochlear Limited

- Doro AB

- Drive DeVilbiss Healthcare, Inc.

- Etac AB

- Freedom Scientific, Inc.

- GN Store Nord A/S

- Handicare Group

- Handicare Group AB

- Hango Healthcare

- Invacare Corporation

- Medline In

- Med‑El Medical Electronics GmbH

- Ottobock SE & Co. KGaA

- Permobil AB

- Philips Healthcare

- Pride Mobility Products Corporation

- ResMed

- Siemens Healthineers AG

- Sonova Holding AG

- Starkey Hearing Technologies, Inc.

- Stryker Corporation

- Sunrise Medical LLC

- Tobii Dynavox LLC

- Whirlpool Corporation

- William Demant Holding A/S

Actionable strategic recommendations to empower industry leaders in optimizing product portfolios partnerships and go to market execution

Industry leaders should accelerate investments in connected and AI-enabled assistive solutions that offer predictive analytics and adaptive features. By prioritizing modular architectures, companies can future-proof product lines and reduce total cost of ownership for end users. Collaboration with digital health platforms will be crucial to integrate data streams into clinician workflows, thereby enhancing remote monitoring and outcome measurement capabilities.

Strategic partnerships across the value chain are critical to mitigate supply chain risks and optimize go-to-market strategies. Engaging with regional manufacturing hubs and local suppliers can offset tariff exposures and shorten lead times, while alliances with rehabilitation centers and hospital networks can streamline product adoption. Joint ventures with technology firms and universities will further accelerate the development of next-generation sensor-based and smart assistive systems.

To maximize market penetration, organizations should refine their distribution mix by expanding e-commerce capabilities and enhancing direct sales through virtual consultation tools. Simultaneously, strengthening relationships with pharmacies and specialty retail outlets will ensure broader access for entry-level products. Integrating customer success frameworks that include training modules and after-sales support will reinforce user satisfaction and brand loyalty across diverse demographic segments.

Outlining the comprehensive research methodology incorporating primary interviews secondary data analysis and rigorous data triangulation protocols

The research methodology for this analysis combined primary research through in-depth interviews with stakeholders spanning device manufacturers, healthcare providers, and regulatory experts. These interviews provided nuanced perspectives on innovation pipelines, reimbursement landscapes, and supply chain challenges, forming the basis for qualitative validation of secondary data findings.

Secondary research involved a comprehensive review of peer-reviewed journals, government and nonprofit white papers, and publicly available regulatory filings. This desk research facilitated the identification of technology trends, patent filings, and clinical data that informed the segmentation framework and regional analyses. Rigorous source triangulation ensured that multiple independent data points corroborated each key insight.

Quantitative insights were refined through data triangulation, which integrated information from diverse channels, including trade associations, professional forums, and proprietary databases. This approach allowed the cross-checking of anecdotal evidence against documented patterns, enhancing the overall reliability of the conclusions drawn. The resulting methodology adheres to the highest standards of market research rigor and transparency, ensuring that decision-makers can trust the integrity of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disabled & Elderly Assistive Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disabled & Elderly Assistive Technology Market, by Product Type

- Disabled & Elderly Assistive Technology Market, by Technology

- Disabled & Elderly Assistive Technology Market, by End User

- Disabled & Elderly Assistive Technology Market, by Distribution Channel

- Disabled & Elderly Assistive Technology Market, by Region

- Disabled & Elderly Assistive Technology Market, by Group

- Disabled & Elderly Assistive Technology Market, by Country

- United States Disabled & Elderly Assistive Technology Market

- China Disabled & Elderly Assistive Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing critical insights and framing future implications derived from the comprehensive analysis of the assistive technology landscape

Bringing together demographic trends, regulatory shifts, and cutting-edge technologies, this analysis underscores the transformative potential of assistive solutions in enhancing independence for disabled and elderly users. The convergence of AI, connectivity, and human-centered design is setting new benchmarks for device performance and accessibility, reshaping the landscape in profound ways.

Segmentation insights reveal that a multi-dimensional approach-encompassing product type, end-user requirements, distribution pathways, and technology tiers-is essential for market differentiation. Regional variations further highlight the importance of localized strategies, from reimbursement navigation in North America to innovation collaborations in Asia Pacific.

In navigating the complexities of tariff environments and global supply chains, industry leaders must adopt agile sourcing and design optimization strategies. By aligning product roadmaps with regulatory evolutions and channel dynamics, organizations can deliver scalable, affordable, and high-impact solutions. This comprehensive synthesis provides the strategic lens required to chart a course for long-term growth and meaningful social impact.

Take decisive action now secure direct access to expert market intelligence and partner with our Associate Director for tailored research insights

To explore the full breadth of tailored insights and to secure your competitive advantage in this rapidly advancing field, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise encompasses the intersection of product development, regulatory considerations, and distribution strategies that will empower your organization to make data-backed decisions. Direct engagement ensures comprehensive access to in-depth analyses, executive summaries, and proprietary data visualizations that have been meticulously compiled to guide your next strategic move.

Seize this opportunity to transform your understanding into action. Contact Ketan today to purchase the complete market research report and obtain a custom-fitted consultation that aligns with your organizational goals and innovation roadmaps. Investing in this intelligence now will catalyze your roadmap and solidify your position as a pioneer in the assistive technology ecosystem.

- How big is the Disabled & Elderly Assistive Technology Market?

- What is the Disabled & Elderly Assistive Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?