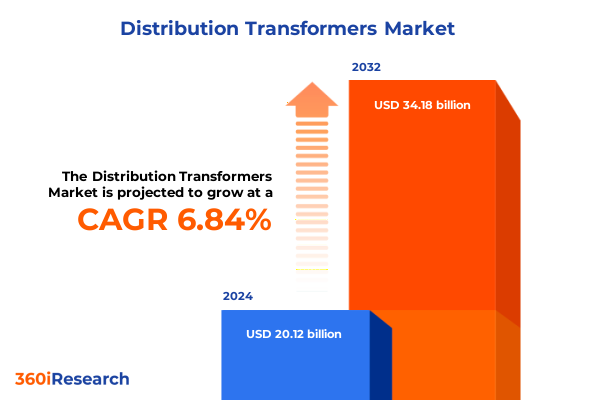

The Distribution Transformers Market size was estimated at USD 21.41 billion in 2025 and expected to reach USD 22.80 billion in 2026, at a CAGR of 6.91% to reach USD 34.18 billion by 2032.

Exploring the Critical Role and Emerging Dynamics Shaping the Distribution Transformer Market in Today’s Evolving Energy Landscape

The ever-increasing complexity of global energy systems has thrust distribution transformers into a pivotal role within modern power infrastructure. These critical assets sit at the intersection of generation, transmission, and end-use, converting voltage levels to facilitate efficient energy delivery to homes, businesses, and industrial facilities. Recent years have witnessed a surge in demand driven by grid modernization initiatives, renewable energy integration, and electrification of transportation. As utilities strive to enhance reliability and resilience, distribution transformers have become essential enablers of advanced metering, two-way power flows, and distributed generation.

Amid this backdrop, stakeholders-from manufacturing leaders to regulatory bodies-are navigating a landscape where technological innovation and policy shifts converge. Advances in materials, digital monitoring, and predictive maintenance are transforming how distribution transformers are designed, deployed, and managed. Concurrently, evolving standards around sustainability and energy efficiency are raising the bar for performance, driving new product features such as low-loss cores and eco-friendly insulating fluids. This introduction lays the foundation for understanding how emerging dynamics are reshaping the distribution transformer market and setting the stage for the detailed analysis that follows.

Identifying the Fundamental Technological and Regulatory Shifts Reshaping the Competitive Landscape of Distribution Transformers Globally

In recent years, the distribution transformer industry has undergone transformative shifts driven by rapid technological advancements and regulatory evolution. Digitalization has emerged as a cornerstone innovation, with smart sensors and IoT-enabled monitoring systems enabling real-time diagnostics and remote asset management. These capabilities reduce unplanned outages, optimize load balancing, and extend equipment lifespan through condition-based maintenance strategies. Additionally, the incorporation of advanced core materials, such as nano-crystalline alloys and amorphous steel, has markedly reduced no-load losses, aligning with stringent energy-efficiency mandates established by governmental authorities and industry consortia.

Regulatory frameworks and policy incentives have further catalyzed change. In many jurisdictions, grid operators and utilities are required to meet aggressive targets for renewable integration and carbon reduction, propelling the deployment of distribution transformers capable of managing bidirectional power flows from rooftop solar arrays, energy storage systems, and electric vehicle charging stations. Meanwhile, evolving standards for dielectric fluids-favoring biodegradable, non-PCB alternatives-are driving suppliers to innovate formulations that balance environmental compliance with operational performance. Together, these factors underscore a landscape in which competitive advantage increasingly hinges on agility, digital maturity, and adherence to evolving regulatory benchmarks.

Assessing the Cumulative Consequences of U.S. Tariffs on the Distribution Transformer Sector Through Mid-2025 and Beyond for Market Stakeholders

The introduction of new U.S. tariffs in 2025 has exerted a cumulative impact on distribution transformer supply chains, manufacturing costs, and project timelines. With tariffs applied to critical raw materials such as grain-oriented electrical steel and key components imported from Mexico, Canada, and China, manufacturers have faced increased input costs that reverberate through pricing structures. As a result, utilities and commercial end-users have encountered rising procurement expenses, prompting some grid modernization projects to be deferred or restructured to accommodate higher capital requirements.

Simultaneously, the tariff environment has accelerated domestic production initiatives and spurred collaboration among equipment suppliers, regulatory agencies, and financial institutions. Stakeholders are re-examining global supplier portfolios, engaging in nearshoring strategies, and exploring tariff-exemption programs under existing free trade agreements. While these measures have helped ease short-term disruptions, extended lead times for transformer modules and accessories remain a concern. Consequently, project planners are adjusting procurement schedules, redistributing budgets, and incorporating risk-mitigation clauses to manage potential delays. These cumulative effects highlight the importance of strategic supply-chain resilience and proactive policy navigation for maintaining momentum across critical infrastructure deployments.

Uncovering Deep Market Segmentation Insights Revealing How Cooling, Phase, Capacity, Mounting, End-User, Installation, and Channels Drive Demand

The distribution transformer market exhibits multifaceted segmentation driven by a variety of technical and commercial parameters. Cooling type segmentation reveals distinct advantages between oil-filled designs, which offer superior thermal performance suitable for high-capacity applications, and dry-type variants that prioritize safety and environmental compliance in indoor or sensitive installations. Phase type segmentation further distinguishes single-phase units optimized for residential and small commercial networks from three-phase transformers engineered for heavier industrial loads and utility distribution feeders. Capacity range segmentation underscores unique usage profiles across sub-500 kVA units deployed in residential enclaves, mid-range 500 to 2500 kVA transformers serving commercial, industrial, and municipal grids, and premium systems exceeding 2500 kVA for large-scale infrastructure.

Mounting type segmentation mirrors deployment environments, with pad-mounted transformers offering compact footprints and accessible serviceability in urban landscapes, while pole-mounted units deliver cost-effective solutions for rural and low-density distribution circuits. End-user segmentation delineates the divergent demands of commercial facilities, industrial complexes, and utility networks, each imposing specific performance, reliability, and customization requirements. Installation type segmentation contrasts indoor installations-where space constraints and fire-safety standards drive transformer selection-with outdoor units engineered for weather resilience and minimal maintenance. Finally, distribution channel segmentation reflects the evolving purchasing behaviors of stakeholders, balancing traditional offline distributor relationships with the convenience and transparency of online procurement platforms. Collectively, these segmentation insights provide a nuanced understanding of how product attributes align with diverse customer needs.

This comprehensive research report categorizes the Distribution Transformers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cooling Type

- Phase Type

- Capacity Range

- Mounting Type

- End-User

- Installation Type

- Distribution Channel

Illuminating Regional Market Dynamics Demonstrating How Distribution Transformer Demand Varies Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics significantly influence distribution transformer demand and strategic priorities across global markets. In the Americas, aging infrastructure coupled with ambitious grid modernization programs is driving utilities to replace legacy transformers and integrate advanced technologies. Investments under federal and state initiatives emphasize grid resilience, grid-edge intelligence, and renewable energy accommodation, positioning North America as a leader in smart distribution networks. Latin American markets, by contrast, are characterized by constrained budgets, where affordability and long-term reliability are paramount, prompting a blend of refurbished transformer deployments and incremental modernization efforts.

Europe, the Middle East, and Africa present a tapestry of regulatory regimes and energy priorities. European utilities are heavily focused on decarbonization targets, favoring low-loss materials and sustainable dielectric fluids to minimize carbon footprints. The Gulf Cooperation Council and North African utilities, in pursuit of rapid electrification and diversification of energy sources, are investing in high-capacity pad-mounted transformers capable of managing solar plant outputs and hybrid grid architectures. Meanwhile, Sub-Saharan Africa’s electrification initiatives hinge on cost-effective, durable transformer solutions that can withstand challenging environmental conditions and limited maintenance infrastructure.

In Asia-Pacific, rapid urbanization, industrial expansion, and ambitious renewable energy installations are fueling some of the world’s fastest transformer consumption growth rates. China’s mature manufacturing ecosystem continues to supply global export markets, while India’s "Make in India" program is amplifying domestic production capacity. Southeast Asia and Oceania, striving for both grid extension and smart grid capabilities, are exploring partnerships with OEMs to co-develop customized transformer designs that address regional voltage profiles, climate resilience, and digital integration. Across these regions, the interplay of policy drivers, economic development agendas, and technological adoption shapes a varied yet interlinked global transformer market.

This comprehensive research report examines key regions that drive the evolution of the Distribution Transformers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Positioning and Strategic Initiatives of Leading Distribution Transformer Manufacturers Influencing Market Growth Trajectories

Competitive dynamics within the distribution transformer market are characterized by the strategic positioning and innovation imperatives of leading OEMs and specialist suppliers. Major multinational corporations have leveraged scale advantages and global service networks to offer comprehensive portfolios spanning conventional oil-filled transformers to digital-ready units equipped with embedded sensors and communication modules. These incumbents are investing in localized manufacturing facilities across key regions to mitigate geopolitical risks and tariff constraints, while enhancing lead-time responsiveness and after-sales support.

Concurrently, agile challengers and regional champions are carving out niches through focused expertise in specialty transformer types, proprietary low-loss core materials, or value-added service offerings such as turnkey refurbishment and end-of-life recycling. Partnerships between transformer manufacturers and software vendors are gaining traction, resulting in hybrid solutions that combine hardware excellence with AI-driven asset-management platforms. Additionally, financing arrangements and utility-as-a-service models are emerging as differentiators, enabling end-users to align capital expenditures with operational budgets. These strategic moves underscore the imperative for market participants to balance product innovation, supply-chain optimization, and customer-centric service models to strengthen competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distribution Transformers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ALSTOM Holdings

- Bharat Heavy Electricals Limited

- Bowers Electricals Ltd.

- Celme S.r.l.

- CG Power & Industrial Solutions Ltd.

- DAIHEN Corporation

- Eaton Corporation PLC

- Elsewedy Electric

- Emerson Electric Co.

- Federal Pacific by Electro-Mechanical, LLC

- Fuji Electric Co., Ltd.

- Harmonics Limited

- HD HYUNDAI ELECTRIC CO., LTD.

- Hitachi, Ltd.

- Hubbell Incorporated

- Imefy Group

- Kiran Power Rectification Services Pvt. Ltd.

- Kirloskar Electric Company

- Kotson Pvt. Ltd.

- Marsons Limited

- Mitsubishi Electric Corporation

- MSC Transformers Pvt Ltd.

- Olsun Electrics Corporation

- Ormazabal

- Prolec-GE Waukesha, Inc.

- Schneider Electric SE

- Servokon System Limited

- SGB-SMIT Group

- Siemens AG

- Toshiba Energy Systems & Solutions Corporation

- Transcon Industries

- Voltamp

- Wilson Power Solutions Ltd.

Actionable Strategies and Operational Recommendations to Help Industry Leaders Navigate Tariffs, Technological Shifts, and Evolving Customer Requirements

Industry leaders seeking to capitalize on market growth and mitigate emerging risks should pursue a multi-pronged strategy. First, investment in supply-chain resilience is essential: diversifying suppliers, nearshoring critical production steps, and securing tariff exemptions through trade-agreement negotiations can buffer against future policy shifts. Second, prioritizing innovation in both product design and service delivery will differentiate offerings, whether through advanced core materials for reduced losses or digital monitoring systems that unlock predictive maintenance capabilities and operational efficiency gains.

Third, forging collaborative partnerships with utilities, technology providers, and financial institutions will accelerate go-to-market speed and reduce project financing hurdles. Tailored financing solutions can ease the integration of next-generation transformers into grid modernization programs. Fourth, companies should leverage data analytics to uncover customer usage patterns, enabling customization of transformer ratings, mounting configurations, and maintenance schemes. Finally, fostering a culture of continuous improvement-including sustainability audits, lifecycle analysis, and circular-economy initiatives-will enhance brand credibility and align with evolving regulatory and social responsibility expectations. By adopting these actionable recommendations, industry leaders can navigate tariff headwinds, harness technological shifts, and deliver customer-centric solutions at scale.

Detailing the Rigorous Research Methodology and Data Collection Framework Underpinning Our Comprehensive Distribution Transformer Market Analysis

Our research methodology integrates rigorous primary and secondary data collection processes to ensure robust and defensible insights. Primary research involved in-depth interviews with senior executives at utilities, distribution transformer OEMs, and leading installers, complemented by surveys across procurement and engineering teams to validate demand drivers, pain points, and technology adoption rates. Secondary research encompassed the systematic review of government regulations, tariff schedules, industry association reports, and academic publications, enabling triangulation of quantitative and qualitative inputs.

Market sizing and segmentation analyses were grounded in bottom-up modeling, leveraging installation volumes, average unit pricing, and replacement cycles within defined cooling, phase, capacity, mounting, end-user, installation, and procurement channel categories. Regional demand projections were cross-checked against capital expenditure plans published by utilities and infrastructure funding programs. Competitive landscape assessments drew on financial disclosures, patent filings, and merger-and-acquisition activity to evaluate market share shifts and innovation trajectories. Finally, all findings underwent validation workshops with subject-matter experts to ensure accuracy and relevance. This comprehensive approach underpins the credibility of our distribution transformer market insights and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distribution Transformers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distribution Transformers Market, by Cooling Type

- Distribution Transformers Market, by Phase Type

- Distribution Transformers Market, by Capacity Range

- Distribution Transformers Market, by Mounting Type

- Distribution Transformers Market, by End-User

- Distribution Transformers Market, by Installation Type

- Distribution Transformers Market, by Distribution Channel

- Distribution Transformers Market, by Region

- Distribution Transformers Market, by Group

- Distribution Transformers Market, by Country

- United States Distribution Transformers Market

- China Distribution Transformers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings Highlighting Market Trends, Tariff Impacts, Segmentation and Regional Insights to Inform Executive Decision-Making

The distribution transformer market stands at a crossroads of innovation, policy evolution, and shifting customer requirements. Technological breakthroughs in digital monitoring and advanced materials are enabling more efficient, reliable, and sustainable transformer solutions. Concurrently, the introduction of U.S. tariffs in 2025 is reshaping supply chains, accelerating domestic manufacturing initiatives, and imposing new cost structures that must be managed strategically. Detailed segmentation insights reveal how product specifications-ranging from cooling types to mounting configurations-align with diverse deployment environments and end-user imperatives.

Regional analysis underscores the differentiated pace of grid modernization and electrification across the Americas, EMEA, and Asia-Pacific, highlighting unique drivers such as decarbonization mandates, rural electrification needs, and renewable integration targets. Competitive profiling illustrates how leading OEMs and regional specialists are innovating through localized production, collaborative partnerships, and digital service models. Finally, actionable recommendations emphasize the necessity of supply-chain diversification, targeted innovation investment, and customer-centric financing structures. Together, these synthesized findings equip executives with a cohesive, fact-based framework to navigate uncertainties, capitalize on growth opportunities, and steer strategic decisions in the evolving distribution transformer landscape.

Engage with Ketan Rohom to Unlock In-Depth Distribution Transformer Market Insights and Secure Your Comprehensive 2025 Industry Report Today

To obtain a detailed, data-driven exploration of distribution transformer market dynamics, tailored to your strategic objectives, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will provide you with personalized guidance on how this comprehensive report can accelerate your decision-making, mitigate risks associated with tariffs and supply chain volatility, and uncover growth opportunities across all segments and regions. Don’t miss the chance to leverage expert insights, proprietary analysis, and actionable recommendations that can propel your organization ahead of competitors. Reach out today to secure your copy of the full market research report and embark on a path toward greater resilience and profitability in the evolving energy infrastructure landscape.

- How big is the Distribution Transformers Market?

- What is the Distribution Transformers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?