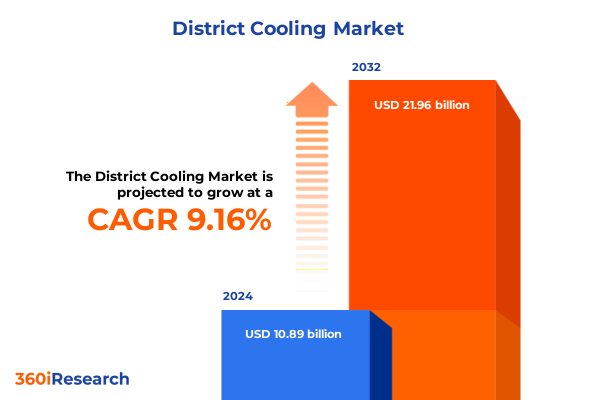

The District Cooling Market size was estimated at USD 11.86 billion in 2025 and expected to reach USD 12.92 billion in 2026, at a CAGR of 9.19% to reach USD 21.96 billion by 2032.

Pioneering the Future of Urban Cooling Through District Systems That Harmonize Energy Efficiency, Sustainability, and Resilience in City Infrastructure

District cooling has emerged as a transformative solution in contemporary urban environments, addressing the critical need for scalable and efficient thermal management. By centralizing cooling generation and distribution, these systems reduce energy consumption and environmental footprint while enhancing operational reliability. As municipal authorities and private developers strive to meet stringent sustainability goals, district cooling stands out as a strategic enabler, seamlessly integrating with smart city frameworks and renewable energy sources.

In parallel, the growing complexity of urban infrastructures has intensified the demand for resilient cooling networks capable of adapting to peak loads and extreme weather events. This necessity has spurred advances in system design, including modular plant configurations and dynamic load-balancing mechanisms. Consequently, district cooling is gaining traction not only for large commercial complexes but also for mixed-use developments and sensitive applications such as data centers and healthcare facilities. This introductory overview sets the stage for a detailed exploration of the market’s transformative shifts, tariff dynamics, segmentation insights, regional landscapes, and strategic imperatives that follow in this executive summary.

Exploring the Convergence of Regulatory Incentives and Digital Innovations Reshaping Modern District Cooling Deployments

The district cooling landscape is undergoing transformative shifts propelled by evolving regulatory frameworks, architectural innovations, and heightened customer expectations. Government incentives for low-carbon technologies and mandatory efficiency standards have catalyzed new project pipelines, encouraging stakeholders to embrace centralized cooling as a cornerstone of sustainable urban development. Notably, cities are revisiting zoning regulations to incentivize integrated utility corridors, thereby reducing infrastructural redundancy and streamlining maintenance protocols.

Technological breakthroughs have further redefined system capabilities, with advanced control platforms leveraging artificial intelligence and predictive analytics to optimize load profiles in real time. These developments are complemented by the integration of thermal storage solutions, which decouple generation from peak demand periods, thus improving peak shaving and monetizing flexible energy assets. As a result, district cooling is increasingly viewed as a multi-dimensional value proposition, delivering utility-grade reliability, financial predictability, and environmental stewardship.

Analyzing How Recent U.S. Tariff Measures Are Redefining Capital Intensity and Supply Chain Resilience in District Cooling Markets

United States tariffs enacted through 2025 have introduced a complex set of cost pressures and supply chain realignments for district cooling stakeholders. Steel and aluminum levies have elevated raw material expenditures for chillers and distribution infrastructure, prompting manufacturers to reassess procurement geographies and secure alternative sources. These adjustments are particularly consequential for large-scale closed loop and open loop systems, where infrastructure intensity amplifies tariff impacts.

In addition, the continuation of Section 301 measures on HVAC components and electronic controls has sustained a premium on import-dependent technologies, incentivizing domestic assembly and local content strategies to mitigate tariff exposure. While these shifts have increased capital expenditures in the near term, they have also spurred investment in local manufacturing hubs, fostering greater supply chain resilience. Looking ahead, industry participants are navigating a delicate balance between managing short-term cost escalations and leveraging long-term operational benefits derived from localized production and inventory optimization.

Unveiling Critical Segmentation Layers That Illuminate Technical Architectures and Application Domains in District Cooling Systems

An in-depth examination of district cooling reveals diverse perspectives when viewed through type, media, technology, application, and installation lenses. The dichotomy between closed loop and open loop configurations underscores fundamental distinctions in water recirculation management versus reliance on external water sources, each offering tailored benefits in water conservation and site-specific feasibility. Meanwhile, the choice between air cooled and water cooled heat rejection strategies profoundly influences thermal efficiency and environmental compatibility, especially in water-constrained versus thermal resource-rich regions.

Technological segmentation further highlights the spectrum of absorption and vapor compression modalities. Double-effect absorption units offer enhanced coefficients of performance compared to single-effect designs, albeit with higher complexity, whereas vapor compression chillers-ranging from centrifugal to screw and scroll variants-cater to variable load demands and modular plant architectures. Application segmentation demonstrates the breadth of district cooling adoption, from hospitality, office, and retail environments under the commercial umbrella to data center corridors serving colocation and hyperscale operators. Industrial implementations, spanning food and beverage, manufacturing, and petrochemical sectors, leverage district cooling for process stabilization, while the retrofit and new build installation categories capture both brownfield upgrades and greenfield developments.

This comprehensive research report categorizes the District Cooling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Cooling Media

- Technology

- Application

- Installation

Deciphering Regional Drivers and Infrastructure Strategies That Propel District Cooling Adoption Across Global Market Clusters

Regional dynamics in district cooling reflect the interplay of climatic demands, policy incentives, and infrastructure maturity across the Americas, Europe Middle East and Africa, and the Asia Pacific regions. In the Americas, growing urban densification and sustainability mandates in North American metros have nurtured robust project pipelines, complemented by financing schemes that de-risk public–private partnerships. South American cities, contending with emerging infrastructure needs, are selectively adopting scalable modular systems to align capital deployment with phased urban growth.

In Europe Middle East and Africa, stringent carbon reduction targets and water scarcity have converged to drive significant uptake of both air cooled and water cooled plant architectures. Gulf Cooperation Council states continue to invest in utility-scale district cooling networks to support megacity developments, while European municipalities leverage thermal storage to optimize grid interactions. Asia Pacific markets, characterized by explosive urbanization and high ambient temperatures, demonstrate the fastest adoption rates, with government-driven masterplanning and integration of waste heat recovery from power plants forming a cohesive strategy for energy-efficient district cooling deployment.

This comprehensive research report examines key regions that drive the evolution of the District Cooling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Alliances and Technology-Driven Collaborations That Define Leadership in the District Cooling Ecosystem

Leading enterprises across the district cooling value chain are distinguishing themselves through vertical integration, strategic partnerships, and innovation roadmaps. Equipment manufacturers are forging alliances with technology providers, embedding digital twin capabilities into new chiller platforms to enhance predictive maintenance and remote diagnostics. Engineering, procurement, and construction firms are augmenting their service portfolios with performance-based contracting models, tying revenue to energy savings and uptime guarantees.

On the utility side, public and private operators are expanding footprint through joint ventures with real estate developers, enabling seamless incorporation of district cooling networks into large-scale mixed-use developments. Financial institutions and infrastructure funds are increasingly underwriting greenfield projects and retrofit programs, leveraging environmental, social, and governance mandates to structure sustainable finance instruments. Collectively, these strategic maneuvers are shaping a more integrated ecosystem, where collaboration across stakeholders accelerates technology diffusion and market penetration.

This comprehensive research report delivers an in-depth overview of the principal market players in the District Cooling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADC Energy Systems

- Alfa Laval AB

- Artelia Consulting Engineers Limited

- Cetetherm

- DC Pro

- Emirates District Cooling (Emicool) LLC

- General Electric Company

- Grundfos Holding A/S

- ICAX Limited

- isoplus Piping Systems Ltd.

- Johnson Controls International PLC

- Stellar Energy

- Trane Technologies PLC

- Veolia Environnement SA

- Xylem Inc.

Strategic Pathways for Organizations to Capitalize on Emerging District Cooling Opportunities and Sustain Operational Excellence

Industry leaders seeking to capitalize on district cooling’s momentum should consider several actionable strategies to enhance competitiveness. First, fostering local manufacturing capabilities-either through joint ventures or ramping up in-region assembly-can alleviate tariff-induced cost pressures and shorten supply chains. Such initiatives should be complemented by targeting modular, standardized plant components that streamline installation timelines and lower logistical hurdles.

Secondly, executives should prioritize data-centric operations, deploying advanced analytics platforms that aggregate real-time performance metrics across plant assets. This data-driven approach not only lowers operating expenditures through predictive maintenance but also unlocks new revenue streams via performance contracting. Lastly, establishing stakeholder alignment through performance-based contracts and integrated project delivery frameworks will accelerate project approvals and secure financing, positioning organizations to lead in both new build and retrofit scenarios.

Integrating Primary Stakeholder Engagement and Multisource Validation to Develop a Comprehensive District Cooling Market Analysis

This research report leverages a multifaceted methodology to ensure robust, unbiased insights. Primary interviews with industry executives, project developers, and technology providers underpin qualitative analysis, offering firsthand perspectives on market dynamics and investment drivers. Concurrently, secondary research encompasses peer-reviewed journals, governmental policy releases, and publicly available financial filings, guaranteeing that findings reflect current regulatory landscapes and technological advances.

Quantitative data synthesis involves triangulating project databases, procurement records, and patent filings to map adoption patterns and innovation trajectories. Statistical validation techniques are applied to cross-verify input parameters, ensuring consistency across segmentation and regional analyses. Finally, expert panels provide iterative feedback to refine key assumptions and validate strategic recommendations, thereby ensuring that the report’s conclusions are grounded in both empirical evidence and practitioner experience.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our District Cooling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- District Cooling Market, by Type

- District Cooling Market, by Cooling Media

- District Cooling Market, by Technology

- District Cooling Market, by Application

- District Cooling Market, by Installation

- District Cooling Market, by Region

- District Cooling Market, by Group

- District Cooling Market, by Country

- United States District Cooling Market

- China District Cooling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Market Dynamics That Define the Ascendance of District Cooling Solutions Globally

District cooling stands at the nexus of urban sustainability, operational efficiency, and infrastructural resilience. The sector’s evolution is being driven by regulatory imperatives, technological breakthroughs, and shifting economic paradigms, all of which underscore the importance of centralized thermal management. From tariff-induced supply chain adjustments to sophisticated segmentation across types, technologies, and applications, a nuanced understanding of these factors is vital for market participants.

As the district cooling landscape continues to mature, successful organizations will be those that combine local production strategies, digital innovation, and performance-oriented business models. By aligning strategic investments with emerging regional priorities and fostering collaboration across the value chain, stakeholders can unlock significant energy savings, environmental benefits, and financial returns. This confluence of drivers positions district cooling as a critical component of future-ready urban ecosystems.

Position Your Organization at the Forefront of District Cooling Innovation by Engaging with Ketan Rohom for Your Customized Research Report

For organizations seeking to deepen their understanding of district cooling dynamics and to secure a competitive advantage, initiating a discussion with Ketan Rohom presents a decisive next step. As Associate Director of Sales & Marketing, Ketan’s expertise in aligning technical insights with strategic business objectives will ensure you access a tailored research package that addresses your specific needs. Engaging directly with Ketan will facilitate a transparent overview of the report’s comprehensive coverage, from policy influences and tariff implications to segmentation and regional outlooks.

This research report serves as a foundational resource for discerning the subtleties of supply chain intricacies, technology adoption curves, and evolving application requirements. By connecting with Ketan, you will gain clarity on customization options, delivery timelines, and the scope of ancillary services, such as bespoke data dashboards and executive briefings. Initiate contact with Ketan Rohom to secure this vital resource and propel your strategic planning with insights calibrated for the dynamic district cooling landscape.

- How big is the District Cooling Market?

- What is the District Cooling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?