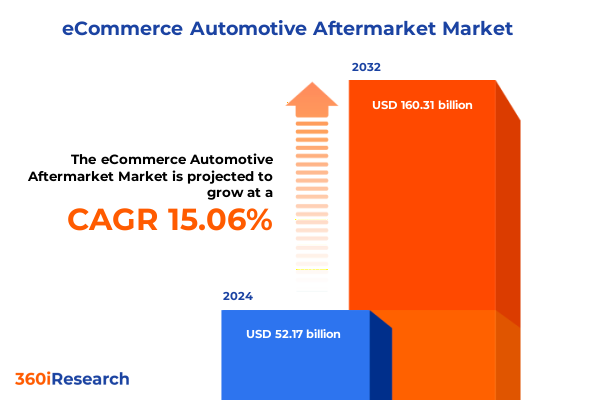

The eCommerce Automotive Aftermarket Market size was estimated at USD 59.89 billion in 2025 and expected to reach USD 68.17 billion in 2026, at a CAGR of 15.10% to reach USD 160.31 billion by 2032.

Charting the Future Trajectory of the eCommerce Automotive Aftermarket in the United States Amidst Emerging Digital and Regulatory Dynamics

The e-commerce revolution has redefined the automotive aftermarket landscape, compelling stakeholders to embrace digital channels as primary conduits for parts distribution and customer engagement. In the wake of heightened consumer expectations for speed, transparency, and personalized service, industry participants are compelled to reconfigure legacy processes, invest in advanced analytics, and forge strategic alliances to maintain relevance. This transformative journey is underscored by a broader shift toward platform-based ecosystems, where data-driven insights guide inventory management, predictive maintenance offerings, and dynamic pricing strategies.

Moreover, an increasingly complex regulatory environment and evolving trade policies have elevated the importance of supply chain resilience and operational agility. As tariff regimes fluctuate and raw material costs diversify across global suppliers, aftermarket players must implement real-time monitoring and risk mitigation frameworks. Against this backdrop, the digital-first mindset is no longer optional but foundational to capturing market share and fostering brand loyalty. This executive summary sets the stage for a comprehensive exploration of the forces reshaping the United States automotive aftermarket in 2025, providing a strategic lens through which decision-makers can anticipate challenges and capitalize on emerging opportunities.

Navigating the Convergence of Digital Innovation, Consumer Experience Expectations, and Sustainability Imperatives Redefining the Aftermarket Landscape

The automotive aftermarket has entered a phase of radical transformation driven by converging technological, environmental, and consumer-centric forces. Advanced analytics and artificial intelligence have empowered suppliers and retailers to deliver hyper-personalized shopping experiences, recommending parts and maintenance schedules based on telematics data and vehicle-specific usage patterns. At the same time, augmented reality tools are influencing how technicians train and how end-users visualize component fitment in real time, reducing return rates and enhancing customer satisfaction.

Sustainability imperatives are also reshaping raw material sourcing and end-of-life considerations, as circular economy models gain traction. Recycled brake pads, remanufactured engine components, and bio-based coolant systems are becoming mainstream, reflecting both consumer demand and regulatory pressures. Coupled with the accelerating adoption of electric vehicles, which require specialized drivetrain parts and unique maintenance protocols, these developments are compelling aftermarket players to diversify offerings and upskill technical teams. The net result is an ecosystem in flux, where agility and foresight are the most valuable differentiators.

Assessing the Far-Reaching Effects of the 2025 United States Tariff Policies on Supply Chains, Pricing Structures, and Competitive Dynamics

The introduction of new tariffs in early 2025 has sent ripples through the automotive aftermarket, prompting immediate adjustments in procurement and pricing strategies. Many suppliers reliant on cross-border trade have experienced increased input costs, which have necessitated a reevaluation of supplier contracts and logistics networks. In response, businesses have accelerated initiatives to nearshore or reshore critical manufacturing processes, thereby reducing exposure to tariff volatility.

Pricing strategies have evolved accordingly, with some aftermarket retailers absorbing marginal cost increases to preserve competitive positioning, while others have implemented tiered surcharge models tied to fluctuating container freight indices. Negotiations with key distributors now incorporate dynamic clauses for tariff pass-through and collaborative inventory pooling agreements. This shift has underscored the necessity of transparent communication along the value chain, as stakeholders seek to balance margin protection with customer-centric pricing. Ultimately, the 2025 tariffs have catalyzed a more collaborative, data-driven approach to supply chain management within the aftermarket e-commerce ecosystem.

Unveiling the Critical Role of Product Type, Sales Channels, and Vehicle Class in Shaping Consumer Behavior and Supply Chain Strategies

Insights into product type segmentation reveal that body and interior components have sustained robust online demand as consumers pursue customization and aesthetic upgrades. Brakes remain a cornerstone category, driven by safety regulations and year-round maintenance cycles, with sensor diagnostics and pad replacements forming significant subsegments of ongoing sales. Engine parts, spanning everything from camshafts to gaskets and pistons, have seen growing interest in remanufactured and high-performance variants, reflecting a combination of cost-conscious repair and enthusiast-driven enhancements. Performance parts, including cold air intakes, exhaust systems, and forced induction components, continue to attract a niche yet influential enthusiast base, reinforcing the need for specialized e-commerce offerings. Meanwhile, suspension, steering, and drivetrain items round out the core spectrum of consumer and commercial needs, underscoring the breadth of opportunities within aftermarket portfolios.

Sales channel segmentation underscores the divergent strategies of direct websites versus third-party e-commerce platforms. Proprietary websites enable brand owners to cultivate loyal customer communities, leverage first-party data, and cross-sell extended warranties or installation services. Conversely, aggregated marketplaces offer unparalleled reach, expedited fulfillment options, and integrated logistics frameworks that benefit smaller suppliers lacking scale. The interplay between these channels demands a hybrid approach, where curated platform partnerships complement direct engagement initiatives.

Vehicle type segmentation further refines these insights by highlighting distinct purchasing behaviors among passenger car owners and commercial fleet operators. Light and heavy commercial vehicle segments demonstrate high-value, recurring demand for preventative maintenance parts and rapid restocking protocols, while passenger car consumers prioritize convenience, transparent fitment guidance, and bundled service offerings. Recognizing these nuanced distinctions allows aftermarket e-commerce leaders to tailor marketing, fulfillment, and technical support strategies to the unique needs of each audience.

This comprehensive research report categorizes the eCommerce Automotive Aftermarket market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sales Channel

- Vehicle Type

Exploring Distinctive Market Dynamics Across the Americas, EMEA, and Asia-Pacific Regions Influencing Automotive Aftermarket E-Commerce Growth

Regional dynamics exert a profound influence on automotive aftermarket e-commerce, with each geography navigating its own blend of regulatory frameworks, consumer preferences, and infrastructural maturity. In the Americas, there is a pronounced emphasis on integrating telematics-driven predictive maintenance and leveraging vast logistics networks to ensure rapid delivery across sprawling distribution footprints. Latin American markets, while still emerging in online adoption, are witnessing a gradual shift toward digital platforms as internet penetration deepens and cross-border trade agreements facilitate component availability.

Across Europe, the Middle East, and Africa, stringent emissions standards and right-hand drive vehicle populations necessitate precise parts compatibility solutions, supported by multilingual customer interfaces and region-specific cataloging. The proliferation of aftermarket service chains in Eastern Europe and the Gulf Cooperation Council states underscores the importance of modular inventory strategies that balance global SKUs with local demand patterns.

In Asia-Pacific, rapid urbanization and growing vehicle parc are driving demand for cost-effective maintenance solutions delivered via mobile-first e-commerce platforms. Southeast Asian markets stand out for their embrace of digital wallets and super-app integration, while Australia and New Zealand continue to leverage hybrid omnichannel models that blend online ordering with curbside pickup and third-party installation partnerships. Collectively, these regional insights inform a global playbook for optimizing fulfillment, regulatory compliance, and customer experience across diverse market contexts.

This comprehensive research report examines key regions that drive the evolution of the eCommerce Automotive Aftermarket market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Aftermarket E-Commerce Players Driving Innovation, Strategic Partnerships, and Market Penetration Trends

Leading players in the automotive aftermarket e-commerce arena are distinguished by their ability to marry platform innovation with deep industry expertise. Market veterans have invested heavily in proprietary logistics networks, leveraging regional fulfillment centers and drop-shipping partnerships to guarantee same-day or next-day delivery in key metros. These incumbents are also deploying machine-learning algorithms to optimize inventory levels, forecast part failures, and recommend complementary products during the checkout process.

Meanwhile, disruptive entrants are carving out specialized niches by bundling diagnostic tools, IoT-enabled sensor subscriptions, and remote technical support. Strategic alliances between technology firms and traditional distributors are enabling seamless integration of repair tutorials, virtual fittings, and augmented reality service guides directly within e-commerce interfaces. Collaborative ventures with OEM-certified remanufacturers and aftermarket innovators are further enhancing product portfolios, ensuring compatibility with emerging powertrain architectures.

Across the competitive landscape, companies are differentiating through tiered membership programs, predictive maintenance subscriptions, and targeted marketing campaigns informed by proprietary vehicle telematics data. By aligning investment in digital capabilities with deep aftermarket domain knowledge, these players are setting new benchmarks for customer satisfaction and operational efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the eCommerce Automotive Aftermarket market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advance Auto Parts, Inc.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Arch Auto Parts by Transtar Holding Co.

- AutoAnything

- AutoZone Inc.

- CARiD by PARTS iD, Inc.

- CarParts.com, Inc.

- Das Ersatzteil GmbH

- eBay Inc.

- Flipkart Private Limited

- National Automotive Parts Association

- nopCommerce

- OE Connection

- O’Reilly Automotive, Inc.

- Pep Boys

- RevolutionParts.

- Robert Bosch GmbH

- RockAuto, LLC

- Sana Commerce

- Sears, Roebuck and Co.

- SimplePart by InfoMedia

- X-Cart Holdings LLC

Implementing Strategic Imperatives for Industry Leaders to Capitalize on Digital Transformation, Cross-Border Trade, and Consumer Personalization

Industry leaders must prioritize the development of end-to-end digital ecosystems that integrate predictive maintenance, parts cataloging, and seamless checkout experiences. Investing in advanced analytics platforms will enable real-time demand forecasting, dynamic pricing adjustments, and intelligent inventory replenishment, thereby reducing stockouts and minimizing capital tied up in slow-moving parts. Simultaneously, diversifying the supplier base through nearshoring and strategic trade alliances will mitigate tariff exposure and enhance supply chain resilience.

To capture both mass-market and enthusiast segments, companies should implement tiered loyalty programs that reward recurring purchases and maintenance subscriptions. Personalized marketing campaigns, grounded in first-party data collected from direct website interactions and telematics integrations, can drive deeper engagement and higher average order values. Moreover, forging partnerships with logistics specialists and regional distributors will expand geographic reach while maintaining cost efficiency.

Embracing sustainability through remanufactured parts, eco-friendly packaging, and circular economy initiatives will resonate with environmentally conscious consumers and comply with emerging regulatory frameworks. Finally, upskilling sales and service teams to support augmented reality diagnostics and virtual training modules will ensure technical proficiency and reinforce brand credibility.

Elucidating the Structured Research Framework Employed to Capture Qualitative and Quantitative Insights Within the Aftermarket E-Commerce Sector

This analysis synthesizes qualitative and quantitative research conducted over a six-month period, beginning with comprehensive secondary research of industry publications, trade association reports, and regulatory filings. Primary research activities included structured interviews with senior executives at aftermarket distributors, digital platform providers, and OEM remanufacturing partners to validate key trends and competitive strategies. Segmentation frameworks were applied to categorize the market by product type, sales channel, and vehicle class, enabling targeted deep dives into high-priority subsegments.

Data triangulation ensured the reliability of insights, cross-referencing supply chain analytics with consumer survey data and in-market transaction records. Regional variations were examined through collaboration with local distributors and e-commerce talent in major hubs across the Americas, EMEA, and Asia-Pacific. The methodology also incorporated scenario planning to assess potential impacts of tariff adjustments, evolving trade agreements, and emergent regulatory standards. Limitations of the study are acknowledged, including variability in data granularity among regions and the rapidly changing technology adoption rates that may outpace data collection timelines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eCommerce Automotive Aftermarket market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eCommerce Automotive Aftermarket Market, by Product Type

- eCommerce Automotive Aftermarket Market, by Sales Channel

- eCommerce Automotive Aftermarket Market, by Vehicle Type

- eCommerce Automotive Aftermarket Market, by Region

- eCommerce Automotive Aftermarket Market, by Group

- eCommerce Automotive Aftermarket Market, by Country

- United States eCommerce Automotive Aftermarket Market

- China eCommerce Automotive Aftermarket Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Consolidating Key Findings to Illuminate Strategic Opportunities and Future Trajectories for Automotive Aftermarket E-Commerce Stakeholders in 2025

The confluence of digital innovation, evolving trade policies, and dynamic consumer expectations is reshaping the automotive aftermarket at an unprecedented pace. Stakeholders who harness advanced analytics, embrace omnichannel distribution strategies, and proactively manage supply chain risks will secure a competitive edge. Segmentation analysis underscores the importance of product-specific marketing and tailored fulfillment solutions, while regional perspectives highlight the need for market-specific customization and logistical agility.

As tariff regimes continue to influence sourcing decisions, aftermarket e-commerce players must balance cost management with service excellence, adopting flexible procurement frameworks and transparent pricing models. Collaboration across the ecosystem-spanning OEMs, remanufacturers, logistics specialists, and digital platform providers-will be essential to drive scale and innovation. Ultimately, those organizations that marry deep domain expertise with a forward-looking digital strategy will thrive, capitalizing on the aftermarket’s growth potential while navigating regulatory and geopolitical headwinds.

Connect with Ketan Rohom to Secure Comprehensive Insights and Custom Analysis That Empower Your Strategic Decisions in the Automotive Aftermarket Sector

Ready to gain unparalleled visibility into evolving consumer preferences, regulatory landscapes, and competitive strategies in the automotive aftermarket e-commerce arena? Connect with Ketan Rohom, an Associate Director specializing in sales and marketing intelligence for automotive aftermarket research, to learn how our granular analysis can inform your investment prioritization, channel optimization, and go-to-market strategies. By partnering directly with the report’s author, you secure tailored briefings, expedited data extracts, and responsive consulting on tariff implications, regional expansion, and product innovation roadmaps. Elevate your decision-making with data-driven insights and hands-on guidance that translate into measurable competitive advantage and sustainable growth.

- How big is the eCommerce Automotive Aftermarket Market?

- What is the eCommerce Automotive Aftermarket Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?