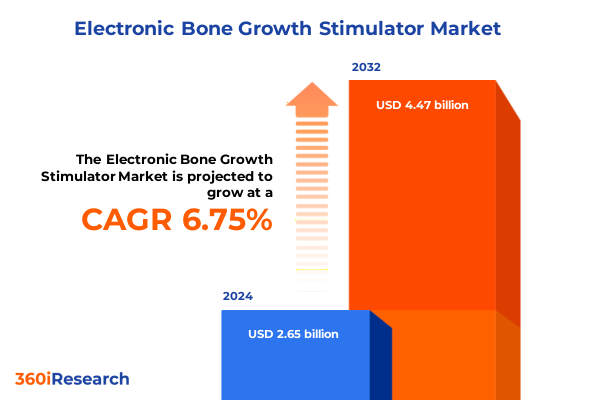

The Electronic Bone Growth Stimulator Market size was estimated at USD 2.81 billion in 2025 and expected to reach USD 2.99 billion in 2026, at a CAGR of 6.83% to reach USD 4.47 billion by 2032.

Driving the Future of Orthopedic Recovery Through Advances in Electronic Bone Growth Stimulation Technology and Patient-Centric Care Models

Electronic bone growth stimulators have redefined the approach to orthopedic healing by harnessing advanced biophysical stimuli to accelerate bone regeneration. These devices apply electrical, ultrasonic, or electromagnetic fields to fracture sites and fusion masses, triggering cellular processes that enhance osteoblast activity and improve mineral deposition. As the prevalence of complex fractures, spinal fusions, and joint fusions continues to rise across aging and active populations alike, the role of stimulators in reducing nonunion rates and shortening recovery timelines has become ever more critical. Moreover, the convergence of technological innovation and patient-centric care models has shifted these devices from niche specialties toward mainstream clinical pathways.

In recent years, the proliferation of both invasive and noninvasive stimulator technologies has expanded treatment options for clinicians. Invasive electrical systems ensure direct delivery of current across the fracture gap, often reserved for challenging nonunions, while noninvasive modalities-ranging from capacitive and inductive coupling to pulsed electromagnetic field and low intensity pulsed ultrasound-offer greater convenience for outpatient and home-based therapy. This diversity of product types enables tailored protocols that align with surgeon preferences, patient lifestyles, and procedural complexity. Consequently, electronic stimulators now integrate into perioperative care plans for foot and ankle, joint, and spinal fusion surgeries with increasing frequency, supporting enhanced patient satisfaction and optimized clinical outcomes.

Beyond clinical efficacy, stimulators have attracted attention for their ability to ease the burden on hospital resources. By reducing secondary procedures and shortening overall treatment duration, these devices contribute to cost containment and improve bed turnover rates. Adoption across ambulatory surgical centers and home healthcare settings is accelerating, fueled by streamlined device interfaces, rechargeable power sources, and telemonitoring capabilities. As healthcare providers seek to balance quality outcomes with economic pressures, electronic bone growth stimulation has emerged as a cornerstone technology in comprehensive orthopedic care pathways.

Embracing Revolutionary Shifts Transforming the Landscape of Bone Regeneration Through Regulatory Progress Reimbursement Dynamics and Technological Breakthroughs

The landscape of electronic bone growth stimulation is undergoing transformative shifts driven by intersecting forces in regulation, reimbursement, and technology. On the regulatory front, recent updates to FDA guidance have clarified pathways for accessory devices and software integrations, enabling manufacturers to secure faster clearances for digital enhancements and remote monitoring platforms. Concurrently, payers have begun to refine coverage policies to recognize the long-term value of stimulators in reducing nonunion complications and lowering readmission rates. Although variability persists across regional coding and reimbursement schemes, the trend toward evidence-based coverage has solidified the clinical credibility of these devices.

Technological breakthroughs are reshaping device form factors and patient engagement models. Manufacturers now embed IoT capabilities into stimulator systems, allowing real-time therapy optimization and adherence tracking via smartphone applications. Advanced materials and battery technologies have facilitated the development of lightweight, ergonomic wearables that patients can seamlessly incorporate into daily routines. Moreover, the integration of artificial intelligence into therapy management algorithms promises personalized treatment regimens based on individual healing trajectories, anatomical characteristics, and activity levels. As these innovations mature, they unlock new opportunities for remote care delivery and telehealth collaborations between surgeons and rehabilitation teams.

Patient preferences are also driving fundamental changes in how stimulators are positioned within care pathways. Growing demand for drug-free, noninvasive modalities-especially among aging populations wary of opioid use-has expanded the addressable market for pulsed electromagnetic field and ultrasound-based systems. Healthcare providers are responding by introducing bundled care models that combine stimulators with early mobilization protocols and virtual physiotherapy sessions. These integrated approaches not only enhance patient experience but also reinforce multidisciplinary collaboration among orthopedic surgeons, rehabilitation specialists, and home health providers. Together, these regulatory, reimbursement, and technological shifts are redefining the role of electronic bone growth stimulators as indispensable tools in modern orthopedic practice.

Assessing the Far-Reaching Cumulative Impact of 2025 United States Tariff Reforms on Electronic Bone Growth Stimulator Supply Chains and Costs

The introduction of sweeping U.S. tariffs in 2025 has reshaped the economics of electronic bone growth stimulators by imposing a universal 10 percent duty on all imported medical devices, eliminating the preferential treatment that previously benefited non-U.S. manufacturers. Reciprocal escalations have further targeted key regions: products from the European Union now incur a 20 percent tariff, while stimulators originating in China face an aggregate rate exceeding 50 percent when combined with preexisting Section 301 levies. Imports from Canada and Mexico, once duty-free under trade agreements, are now subject to a 25 percent tariff, triggering immediate cost pressures for manufacturers reliant on North American supply chains.

These tariff measures have reverberated throughout the distribution network, as device makers and component suppliers grapple with higher raw material costs-particularly aluminum and steel used in housing and coil assemblies. To protect margins, some firms have begun passing incremental duties to end users, intensifying budgetary strain on hospital procurement and ambulatory centers. Consequently, providers have reported delays in capital equipment upgrades and are evaluating alternative sourcing strategies. In response, leading device manufacturers are accelerating supplier diversification initiatives, renegotiating contracts with domestic partners, and exploring partial onshoring of critical components to mitigate exposure to future trade volatility.

Beyond direct cost implications, the tariff environment has prompted strategic realignment among market participants. Mid-tier and emerging players are seizing opportunity to differentiate through vertically integrated manufacturing models and by establishing regional assembly hubs that bypass punitive duties. Simultaneously, established companies have deepened investment in value-added services-such as therapy monitoring platforms and bundled support programs-to strengthen customer loyalty amid pricing fluctuations. While the tariff landscape continues to evolve, one clear outcome is the heightened emphasis on supply chain resilience and agile procurement practices as foundational elements of long-term competitive advantage.

Unlocking Strategic Insights by Analyzing Core Segmentation Dimensions Shaping the Electronic Bone Growth Stimulator Market’s Competitive and Clinical Landscape

An in-depth examination of market segmentation reveals the nuanced interplay between product innovations, distribution models, clinical applications, and end-user preferences. Within the product landscape, invasive electrical systems-traditionally reserved for complex nonunion cases-remain a critical option for surgeons seeking predictable outcomes in high-risk patients. At the same time, low intensity pulsed ultrasound has strengthened its foothold in fresh fracture management, leveraging compelling clinical studies that demonstrate reductions in healing time. Noninvasive electrical therapies, whether delivered via capacitive coupling pads or inductive coil systems, are rapidly gaining traction in outpatient and home-based care as convenience and patient adherence become central considerations. Pulsed electromagnetic field technologies, available in low and medium frequency variants, continue to diversify with miniaturized portable units and enhanced battery life catering to long-term post-operative regimens.

Distribution channels further shape market dynamics, as direct sales teams maintain deep relationships with large hospital systems, while specialized distributors extend reach into community centers and orthopedic clinics. The rise of e-commerce has introduced a new vector for patient acquisition, enabling at-home devices to be purchased with minimal intermediaries and often bundled with virtual training modules. This multi-channel approach allows companies to tailor engagement strategies to the preferences of healthcare providers and consumers alike, reinforcing brand presence across both institutional and retail touchpoints.

Clinical application remains a cornerstone of segmentation insights. Spinal fusion procedures drive a significant portion of device utilization, given the high incidence of nonunion risks and the premium placed on reducing secondary surgeries. Joint fusions for hip, knee, and shoulder have also emerged as key use cases, supported by specialized device adaptations. Nonunion fracture repair, including foot and ankle fusion, underscores the importance of both invasive and noninvasive modalities in resolving challenging bone healing scenarios. Finally, end-user environments reflect diverse utilization patterns: ambulatory surgical centers and home healthcare providers increasingly adopt portable stimulators to enhance patient convenience, while hospitals and orthopedic clinics continue to rely on advanced console-based systems within integrated surgical recovery suites.

This comprehensive research report categorizes the Electronic Bone Growth Stimulator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Revealing the Vital Role of Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific in Advancing Bone Growth Stimulation Adoption

Regional dynamics exert a profound influence on the adoption and evolution of electronic bone growth stimulators. In the Americas, mature healthcare infrastructures, robust reimbursement environments, and the prevalence of ambulatory surgical centers create fertile ground for both institutional and home-based therapies. The United States, in particular, benefits from well-defined coding pathways and a high volume of orthopedic procedures, driving steady demand for advanced stimulator technologies. Meanwhile, in Canada, the public procurement process emphasizes value-based purchasing, encouraging manufacturers to demonstrate cost-effectiveness alongside clinical efficacy.

Over in Europe, Middle East, and Africa, the regulatory framework under the Medical Device Regulation has introduced greater harmonization and transparency, albeit accompanied by more stringent clinical evidence requirements. Countries such as Germany and the United Kingdom are pushing price negotiation models that prioritize cost containment, prompting suppliers to refine their value propositions through enhanced service offerings and local manufacturing partnerships. In the Middle East and Africa, adoption remains concentrated in major urban centers supported by international hospital chains, where demand for cutting-edge orthopedic solutions aligns with broader investments in healthcare modernization.

Asia-Pacific markets are characterized by rapid growth in elective orthopedic procedures, fueled by aging demographics and rising healthcare expenditure. Japan and Australia showcase advanced reimbursement pathways for stimulator technologies, while emerging markets like China and India experience accelerated adoption driven by increasing procedural volumes and improving insurance coverage. Local device makers in these regions are capitalizing on competitive manufacturing costs to introduce more affordable systems, challenging multinational incumbents to adapt their channel strategies and product portfolios to maintain market share.

This comprehensive research report examines key regions that drive the evolution of the Electronic Bone Growth Stimulator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Competitive and Collaborative Strategies of Leading Electronic Bone Growth Stimulator Companies Driving Innovation and Market Leadership

A competitive analysis highlights a diverse roster of key players shaping the electronic bone growth stimulator ecosystem. Legacy medical device companies have bolstered their portfolios through targeted acquisitions, integrating specialized stimulation modules into broader orthopedic franchises. Challenger brands, leveraging agile development cycles, have disrupted traditional distribution models by emphasizing direct-to-consumer channels and digital engagement tools. Across the spectrum, firms are investing in research collaborations with academic centers to validate new waveform designs and explore combination therapies that pair electrical stimulation with biologics or scaffold materials.

Partnerships between device manufacturers and software innovators are accelerating, as data-driven platforms enable real-time monitoring of therapy adherence and healing progress. These alliances not only enhance the clinical evidence base but also foster subscription-based service models, providing recurring revenue streams. In addition, strategic ventures with large hospital networks and ambulatory chains have secured preferred provider agreements, ensuring early access to next-generation stimulators for key opinion leaders.

Moreover, the rise of home healthcare providers as significant end users has prompted companies to refine support services, including remote training, troubleshooting hotlines, and integrated mobile applications. This holistic approach underscores a shift toward patient empowerment, where device makers assume a broader role in care coordination. As competitive differentiation increasingly hinges on the totality of hardware, software, and service offerings, market leaders are deploying ecosystem strategies to lock in long-term partnerships with payers, providers, and patients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Bone Growth Stimulator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altis Biologics (Pty) Ltd

- Biomedical Tissue Technologies Pty Ltd.

- Bioventus Inc.

- BTT Health GmbH

- DJO Global Inc.

- Elizur Corporation

- Ember Therapeutics, Inc.

- Fintek Bio-Electric Inc.

- Harvest Technologies Corporation

- HIGHRIDGE Inc.

- IGEA S.p.A.

- Isto Biologics

- ITO Co., Ltd.

- Kinex Medical Company

- Kinex Medical Company, LLC

- Medtronic plc

- Orthofix Medical Inc.

- Ossatec Benelux B.V.

- Regen Lab SA

- Smith & Nephew plc

- Stimulate Health Inc.

- Stryker Corporation

- VQ OrthoCare

- Zimmer Biomet

Empowering Industry Leaders with Actionable Recommendations to Optimize Strategic Investment Regulatory Engagement and Patient-Centered Innovation Pathways

Industry leaders should prioritize diversification across product modalities to address the full spectrum of clinical scenarios, from complex nonunion cases to routine fracture management. By offering a comprehensive suite that spans invasive electrical, noninvasive electrical, ultrasound, and electromagnetic solutions, device makers can strengthen their value proposition for both surgeons and payers. In parallel, expanding investment in real-world evidence programs will facilitate more favorable reimbursement decisions, demonstrating clear cost savings in reduced reoperation rates and shorter inpatient stays.

Supply chain resilience must be elevated to a strategic imperative. Proactive identification of alternate suppliers, nearshoring of key components, and dynamic inventory strategies will mitigate the impact of evolving tariff landscapes and geopolitical disruptions. Concurrently, engaging with policymakers to advocate for targeted tariff exemptions under healthcare-critical categories can preserve affordability and protect patient access.

Finally, embracing digital transformation will unlock new patient engagement models, from AI-guided therapy personalization to telehealth-integrated adherence monitoring. Partnerships with software developers and telemedicine platforms can streamline remote care delivery, enhancing convenience for patients and reducing burdens on traditional outpatient facilities. By aligning commercial strategies with digital health innovations, companies can drive smarter adoption curves and sustain differentiation in an increasingly competitive field.

Detailing a Robust Research Methodology Integrating Primary Data Collection Expert Interviews and Rigorous Secondary Analysis to Ensure Insight Validity

This analysis is underpinned by a multi‐layered research methodology that integrates both primary and secondary data sources to ensure rigor and validity. Primary insights were gathered through structured interviews with orthopedic surgeons, rehabilitation specialists, and procurement executives across leading healthcare institutions. Their firsthand perspectives on clinical efficacy, device preferences, and reimbursement challenges form the qualitative foundation of the study.

Complementing expert interviews, a targeted survey of ambulatory surgical centers, hospitals, and home healthcare providers captured quantitative data on device utilization patterns, procurement cycles, and end‐user sentiment. These findings were cross‐referenced with detailed secondary research, including regulatory filings, peer‐reviewed clinical publications, and company financial reports. Government databases and trade statistics further informed analyses of tariff impacts and regional adoption trends.

Throughout the study, data triangulation techniques were applied to reconcile disparate information sources and validate key insights. A series of internal workshops and peer reviews with industry analysts and clinical advisors provided continuous quality checks. This rigorous approach ensures that the conclusions and recommendations presented within this report reflect a comprehensive, accurate, and actionable depiction of the electronic bone growth stimulator market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Bone Growth Stimulator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Bone Growth Stimulator Market, by Product Type

- Electronic Bone Growth Stimulator Market, by Application

- Electronic Bone Growth Stimulator Market, by End User

- Electronic Bone Growth Stimulator Market, by Distribution Channel

- Electronic Bone Growth Stimulator Market, by Region

- Electronic Bone Growth Stimulator Market, by Group

- Electronic Bone Growth Stimulator Market, by Country

- United States Electronic Bone Growth Stimulator Market

- China Electronic Bone Growth Stimulator Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights into Strategic Imperatives and Opportunities Defining the Evolving Electronic Bone Growth Stimulation Landscape for Enhanced Patient Outcomes

The strategic landscape for electronic bone growth stimulators is defined by a convergence of technological innovation, regulatory evolution, and shifting market dynamics. As device modalities proliferate-from invasive to portable noninvasive systems-manufacturers have both the opportunity and the imperative to address diverse clinical needs across the spectrum of orthopedic care. Regional and distribution complexities underscore the necessity for tailored go‐to‐market strategies, while the 2025 tariff environment highlights the value of resilient supply chain architectures.

Looking ahead, companies that couple differentiated product portfolios with compelling clinical evidence and responsive reimbursement engagement will capture the lion’s share of growth opportunities. Embedding digital capabilities-such as AI‐driven therapy personalization and telemonitoring-will accelerate adoption and reinforce long‐term patient adherence. At the same time, strategic partnerships and targeted advocacy efforts will be essential to navigating pricing pressures and market access barriers.

Ultimately, the future of bone regeneration lies in delivering integrated solutions that unite hardware, software, and service, optimizing both patient outcomes and economic value. Stakeholders who act decisively on these imperatives will secure leadership positions in a rapidly evolving market and, most importantly, contribute to more efficient, effective, and patient‐centered orthopedic care solutions.

Contact Ketan Rohom Today to Access Authoritative Market Intelligence on Electronic Bone Growth Stimulators for Strategic Growth and Competitive Advantage

Unlock unparalleled competitive edge and strategic clarity by securing the comprehensive market research report. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to access the full analysis, uncover hidden opportunities, and tailor actionable strategies that align with your organizational goals. Whether you seek in-depth segmentation data, regional breakdowns, or insights into the latest regulatory and tariff impacts, this report equips you with the intelligence necessary to outpace competitors and drive sustained growth in the electronic bone growth stimulator space.

- How big is the Electronic Bone Growth Stimulator Market?

- What is the Electronic Bone Growth Stimulator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?