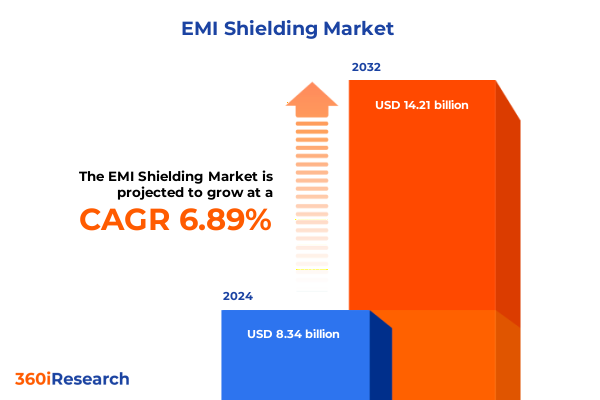

The EMI Shielding Market size was estimated at USD 8.86 billion in 2025 and expected to reach USD 9.44 billion in 2026, at a CAGR of 6.97% to reach USD 14.21 billion by 2032.

Setting the Stage for Electromagnetic Interference Shielding Solutions Amid Escalating Connectivity Demands and Rapid Technological Convergence

The proliferation of high-speed wireless networks, interconnected devices, and ever-smaller electronics has elevated electromagnetic interference shielding from a specialized engineering concern to a strategic imperative for every technology-driven enterprise. As 5G deployments accelerate worldwide, devices operating in complex frequency bands demand robust protection to maintain signal integrity and prevent cross-system disruptions. The rollout of fifth-generation networks has catalyzed demand for advanced semiconductors, antennas, sensors, and power management solutions, all of which must be shielded effectively against electromagnetic noise to ensure reliable performance and regulatory compliance.

Concurrently, the relentless miniaturization of components and the integration of multiple functions into single packages have dramatically increased the density of electronic assemblies. This trend intensifies electromagnetic coupling and radiative emissions within compact footprints, making traditional metal enclosures and foils insufficient for many modern applications. Manufacturers are responding by adopting thin conductive coatings, flexible films, and lightweight foams that deliver targeted shielding performance without adding bulk or compromising design freedom. These materials enable engineers to address interference across a broad frequency spectrum, from sub-megahertz magnetic fields to multi-gigahertz radio frequencies, in products ranging from smartphones to medical implants.

Illuminating Transformative Shifts in EMI Shielding Solutions Driven by Material Science Breakthroughs and Regulatory Evolution

Recent breakthroughs in material science have fundamentally altered the landscape of EMI shielding, offering new performance dimensions that were previously unattainable with conventional metal alloys. Conductive polymers now provide a versatile platform for molding complex geometries, while solution-processable metallized inks and molecular layer deposition techniques enable conformal coatings at the package level. Meanwhile, nanomaterials such as carbon nanotubes, graphene, and emerging MXenes boast exceptional conductivity and surface area, translating into superior absorption and reflection characteristics. Metamaterials-engineered structures with tailored electromagnetic responses-have unlocked frequency-selective shielding capabilities, allowing designers to fine-tune protection for specific bands without over-engineering the entire enclosure.

Alongside material innovation, additive manufacturing and advanced simulation tools have redefined how shielding solutions are designed, produced, and validated. Three-dimensional printing enables rapid prototyping of intricate shields and gaskets, reducing time-to-market and allowing for greater customization. Smart shielding materials, equipped with embedded sensors and actuators, adapt to changing electromagnetic environments in real time, offering dynamic protection for critical systems. At the same time, regulatory committees and standards bodies are updating measurement methodologies and compliance thresholds to address these advanced materials and novel device architectures. Technical gatherings such as the ANSC C63 meetings are refining test site validation protocols and expanding frequency coverage up to 40 GHz, while revisions to automotive and medical EMC standards demand more sensitive testing approaches and integration of digital twin simulations in the certification process.

Assessing the Ripple Effects of New US Tariff Measures on Electromagnetic Shielding Supply Chains and Cost Structures

In early 2025, the United States government enacted a series of tariff measures under various trade authorities, aiming to bolster domestic manufacturing and address national security concerns. These actions included reciprocal tariffs on a broad range of electronics imports and targeted duties on metals and components deemed critical to technological sovereignty. Notably, the administration’s announcements signaled potential phased increases in duties-up to 200% on certain categories-providing a transition period for supply chain adjustments. Such measures have injected uncertainty into sourcing strategies for EMI shielding materials, as manufacturers weigh the trade-off between short-term cost increases and long-term supply resilience.

The tariff schedule published by U.S. Customs outlines significant variations by country of origin, with rates ranging from 10% on key electronics suppliers such as Japan, Korea, and members of U.S. free trade agreements, to punitive levels-exceeding 145%-on imports from certain jurisdictions. While exemptions were granted retroactively for discrete semiconductors and select electronic goods, ambiguity remains around composite assemblies containing shielding elements, as classification depends on HTS codes and end-use definitions. This complexity has prompted many producers to engage custom brokers and legal advisors to navigate eligibility criteria and refund procedures, adding administrative overhead and affecting cash flow for smaller enterprises.

Amidst this evolving trade environment, companies are re-evaluating their supply chains, seeking to diversify inputs, on-shore critical processes, and negotiate long-term agreements with both domestic and foreign suppliers. The cumulative impact of these tariff measures extends beyond direct duties, influencing inventory carry strategies, contract terms, and collaborative R&D projects aimed at developing alternative materials that are less exposed to import restrictions. As the industry adapts, transparency and agile procurement protocols have become essential to maintain uninterrupted access to high-performance EMI shielding solutions.

Unveiling Core Segmentation Perspectives Spanning Material, Shielding Type, Technique, End Use, and Distribution Nuances

Effective market strategies for electromagnetic interference shielding hinge on a nuanced understanding of product and application segments. By material category, solutions range from flexible conductive coatings and paints to rigid metal enclosures, each offering distinct trade-offs in cost, weight, and ease of integration. Conductive polymers provide design flexibility for conformal shields, while EMC filters and specialized absorbers address high-frequency noise in sensitive circuits, and metallic shields deliver broad-spectrum defense in rugged environments.

Shielding solutions can also be distinguished by type, with cable wraps and braided sleeves protecting harnesses and interconnects, component-level shields safeguarding individual modules, enclosure shields forming complete Faraday cages, and sheet shields providing retrofittable barriers. At the technique level, designers choose between absorption-based materials that convert electromagnetic energy into heat and reflection-based barriers that deflect interference away from critical components.

Across end-use industries, aerospace and defense require materials that meet MIL-STD performance while minimizing weight. Automotive applications demand robust shields for electric drivetrain systems and advanced driver assistance modules. Consumer electronics favor ultra-thin films for smartphones and wearables, and healthcare sectors require biocompatible and sterilizable shielding for medical devices. Industrial and telecommunications equipment benefit from heavy-duty filters and custom gaskets, and IT infrastructure relies on modular rack-mount shields and conductive enclosures.

Distribution channels further shape go-to-market strategies, with offline sales driving project-based OEM programs and online platforms enabling rapid procurement of standard shielding tapes, films, and foam gaskets. Integrators and design firms leverage digital storefronts for small-lot orders, while large manufacturers negotiate long-term contracts through established distributor networks.

This comprehensive research report categorizes the EMI Shielding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Shielding Type

- Shielding Technique

- End-Use

- Distribution Channel

Deciphering Regional Dynamics in the Americas, Europe Middle East Africa, and Asia-Pacific for EMI Shielding Adoption

In the Americas, the convergence of advanced telecommunications infrastructure and the shift toward electric mobility is fueling demand for next-generation EMI shielding. The United States leads with widespread 5G network rollouts, driving component demand for antennas, RF modules, and power management systems that must comply with stringent FCC Part 15 emissions limits. This environment has accelerated innovation in materials and manufacturing processes for shielding solutions tailored to automotive, industrial, and consumer electronics applications.

Europe, the Middle East, and Africa (EMEA) are characterized by diverse regulatory landscapes and a strong emphasis on sustainability and local content requirements. The European Union’s action plan to bolster electric vehicle adoption and enforce regional battery production quotas underscores a strategic shift toward on-shore manufacturing of critical components. Concurrently, adherence to EMC Directive 2014/30/EU and automotive standards such as CISPR 25 drives demand for lightweight, high-performance shields in EV battery packs and vehicle infotainment systems. Manufacturers across the region are forging partnerships between material specialists and OEMs to develop multifunctional shielding solutions that meet these evolving mandates.

In Asia-Pacific, the world’s dominant electronics manufacturing hub, rapid industrialization and government initiatives like China’s strategic industrial programs have cemented the region’s leadership. Accounting for more than 60% of global electronics output, Asia-Pacific suppliers continue to refine high-volume production of conductive films, metal foils, and composite shields, while local R&D efforts focus on advanced nanomaterial integration for emerging 5G, IoT, and autonomous vehicle applications. China’s sustained investment in core manufacturing capabilities and subsidies for next-gen technologies underpin a robust ecosystem for scalable EMI shielding innovation.

This comprehensive research report examines key regions that drive the evolution of the EMI Shielding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the EMI Shielding Landscape with Cutting-Edge Solutions

Leading material science innovators are shaping the EMI shielding landscape with high-performance absorbers and magnetic shields that meet exacting frequency and environmental requirements. Companies such as 3M leverage decades of expertise to deliver peel-and-stick composites with tunable permeability and bandwidth, while Henkel has partnered with nanotechnology firms to integrate graphene and carbon nanotube formulations that enhance shielding efficiency by over 20% in consumer electronics and automotive systems.

Beyond raw materials, specialist solution providers are developing end-to-end offerings that encompass design support, rapid prototyping, and large-scale manufacturing. Parker Hannifin and PPG Industries supply engineered coatings and films for enclosure and component shielding, while Leader Tech and MG Chemicals cater to niche applications with custom metal and polymer composites. Meanwhile, RTP Company and Tech Etch deliver precision-machined foils and stamped shields for high-volume OEM programs.

System integrators and contract manufacturers rely on established distributors and collaborative partnerships to ensure supply chain resilience and technical support. Laird Technologies, for example, has expanded its capabilities through strategic acquisitions of Steward Inc. and Supercool AB, enhancing its portfolio with ferrite-based noise filters and thermoelectric assemblies that complement traditional shielding offerings. These moves reinforce Laird’s position as a single-source provider of comprehensive EMI and thermal management solutions for aerospace, medical, and telecom infrastructure sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the EMI Shielding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abrisa Technologies

- artience Co., Ltd.

- Avery Dennison Corporation

- Bal Seal Engineering, LLC by Kaman Corp.

- BASF SE

- Boyd Corporation

- Celanese Corporation

- Compagnie de Saint-Gobain S.A.

- Daniels Manufacturing Corporation

- Deep Coat Industries

- Denver Rubber Company

- DuPont de Nemours, Inc.

- EMP Shield Inc.

- ETS-Lindgren Inc.

- GEOMATEC Co., Ltd.

- Graphenest, S.A.

- Guangzhou Fang Bang Electronics Co., Ltd.

- Henkel AG & Co. KGaA

- Holland Shielding Systems BV

- Huntsman Corporation

- Jinan EMI Shielding Technology Co. Ltd.

- Lamart Corporation

- MADPCB

- Meta Materials Inc.

- MG Chemicals

- Mitsubishi Chemical Group Corporation

- Modus Advanced, Inc.

- Murata Manufacturing Co., Ltd.

- NANOTECH ENERGY INC.

- NV Bekaert SA

- OIKE & Co., Ltd.

- Omega Shielding Products, Inc.

- Panasonic Industry Co., Ltd.

- Parker Hannifin Corporation

- Polycase

- PPG Industries, Inc.

- RTP Company

- Saudi Basic Industries Corporation

- Solvay S.A.

- STMicroelectronics N.V.

- Stockwell Elastomerics, Inc.

- Tatsuta Electric Wire & Cable Co., Ltd.

- TE Connectivity Corporation

- Tech Etch, Inc.

- TEXAS INSTRUMENTS INCORPORATED

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities in EMI Shielding

To navigate the rapidly evolving EMI shielding environment, industry leaders should prioritize development of sustainable material platforms that reduce environmental impact while maintaining performance. Establishing partnerships with raw material suppliers and nanotechnology firms can accelerate innovation in recyclable and low-carbon shielding composites. Concurrently, companies must assess their vulnerability to trade measures and diversify sourcing by qualifying alternate suppliers and exploring regional manufacturing agreements.

Embracing advanced modeling and digital twin simulations early in the design cycle will enable prediction of electromagnetic hotspots and virtual validation of shielding strategies, decreasing reliance on costly physical prototypes. Investing in additive manufacturing capabilities for rapid prototyping and small-batch production can streamline product iteration and support custom shielding architectures. Collaboration with third-party testing labs specializing in medical, automotive, and aerospace EMC testing will ensure compliance with the latest regulatory updates and facilitate faster time-to-market.

Finally, organizations should cultivate a data-driven approach to product development and supply chain management. Leveraging real-time analytics and AI-powered procurement platforms can optimize inventory levels, contract negotiations, and risk assessments. By integrating these actionable imperatives into their strategic roadmap, companies can unlock new growth avenues, strengthen resilience against external disruptions, and deliver differentiated EMI shielding solutions that meet the exacting demands of modern electronics.

Articulating a Robust Research Methodology Integrating Qualitative Expert Interviews and Quantitative Data Triangulation

This analysis draws upon a structured research framework that integrates both qualitative and quantitative methodologies. Expert interviews were conducted with senior engineers, procurement executives, and regulatory specialists across key end-use sectors to capture firsthand perspectives on material preferences, performance challenges, and emerging application requirements.

Secondary data inputs were gathered from public policy documents, standards publications, and trade association reports, including FCC orders, ANSC C63 meeting notes, and global trade bulletins. Triangulation of disparate sources-including tariff schedules, import/export data, and corporate announcements-ensured validation of key insights and identification of consistent trends.

A rigorous data-triangulation process combined thematic analysis of qualitative inputs with statistical evaluation of industry metrics. Emphasis was placed on synthesizing technology adoption curves, regulatory timelines, and supply chain disruptions to present an integrated view of market dynamics. This approach provides both strategic and operational stakeholders with a comprehensive understanding of the forces shaping the EMI shielding domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EMI Shielding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EMI Shielding Market, by Material

- EMI Shielding Market, by Shielding Type

- EMI Shielding Market, by Shielding Technique

- EMI Shielding Market, by End-Use

- EMI Shielding Market, by Distribution Channel

- EMI Shielding Market, by Region

- EMI Shielding Market, by Group

- EMI Shielding Market, by Country

- United States EMI Shielding Market

- China EMI Shielding Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Consolidating Critical Takeaways to Empower Strategic Decision Making in Electromagnetic Interference Shielding

In an era defined by unprecedented connectivity and device convergence, electromagnetic interference shielding has emerged as a critical enabler of reliable and compliant electronic systems. The interplay of advanced materials, manufacturing innovations, and dynamic trade policies underscores the complexity of supply chains and product development strategies.

Organizations that proactively invest in sustainable material platforms, agile prototyping capabilities, and diversified sourcing will gain a strategic edge in addressing the evolving demands of aerospace, automotive, healthcare, and consumer electronics sectors. By embracing digital simulation tools and forging collaborative partnerships across the value chain, industry participants can mitigate risks, accelerate innovation, and deliver differentiated shielding solutions.

The insights presented in this executive summary illuminate both the challenges and opportunities inherent in the EMI shielding landscape. Leveraging these findings, decision-makers can chart a clear path forward-one that balances performance, compliance, and resilience-to safeguard the integrity of tomorrow’s electronic devices.

Connect with an Associate Director of Sales & Marketing to Secure Comprehensive EMI Shielding Insights and Drive Strategic Advantage

For personalized guidance and to acquire the comprehensive market research report on electromagnetic interference shielding, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you receive tailored insights and strategic analysis to support your decision-making. Engage with Ketan today to explore how this in-depth study can inform your innovation, procurement, and expansion strategies in the EMI shielding domain.

- How big is the EMI Shielding Market?

- What is the EMI Shielding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?