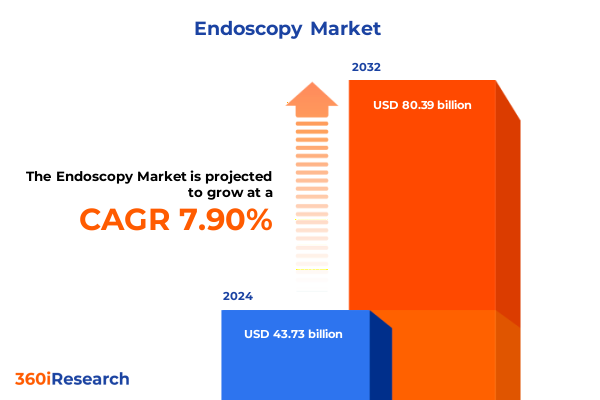

The Endoscopy Market size was estimated at USD 46.92 billion in 2025 and expected to reach USD 50.45 billion in 2026, at a CAGR of 7.99% to reach USD 80.39 billion by 2032.

Navigating a Dynamic Landscape of Technological Advances and Clinical Demands in the Global Endoscopy Sphere Enhancing Procedural Excellence

The contemporary endoscopy landscape is shaped by a confluence of technological breakthroughs, shifting clinical demands, and evolving reimbursement paradigms, all of which are redefining procedural standards globally. As minimally invasive diagnostics and therapeutics gain momentum, endoscopes have emerged as critical tools that enhance diagnostic accuracy, reduce patient recovery times, and optimize hospital throughput. This dynamic environment calls for stakeholders to remain vigilant of innovations such as high-definition imaging, enhanced ergonomics, and digital integration frameworks that collectively improve clinician workflows and patient outcomes.

Against this backdrop, the industry is experiencing intensified collaboration among device manufacturers, software developers, and service providers to co-create end-to-end solutions encompassing image analysis, real-time data sharing, and predictive maintenance. Concurrently, macroeconomic pressures and changing healthcare funding models underscore the importance of cost containment, driving interest in single-use endoscopes and scalable maintenance contracts. In essence, the intersection of clinical efficacy, cost efficiency, and technological prowess forms the foundation of today’s strategic deliberations across provider networks, payers, and regulatory bodies.

Embracing Disruptive Technological Breakthroughs and Evolving Clinical Protocols Redefining Endoscopy Practices Worldwide

In recent years, the endoscopy sector has witnessed paradigm-shifting transformations fueled by developments in digital visualization and artificial intelligence. High-definition video endoscopy has become the benchmark for real-time diagnostics, enabling clinicians to detect subtle mucosal changes with unprecedented clarity. Furthermore, the advent of AI-powered lesion detection algorithms integrated into endoscopic platforms is streamlining diagnostic workflows by providing instant decision support, thereby reducing variability and improving procedural consistency.

Beyond imaging enhancements, the proliferation of disposable endoscopes is redefining infection control protocols and supply chain strategies, particularly in high-volume clinical environments. These shifts coincide with escalating concerns over endoscope reprocessing burdens and cross-contamination risks, prompting payers and hospital administrators to reevaluate capital investments. Additionally, the convergence of telemedicine and remote proctoring tools is extending specialist expertise to underserved regions, amplifying the scope of endoscopic interventions while mitigating clinician shortages. Together, these technological and operational inflection points are reshaping clinical pathways and market expectations.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Supply Chains, Procurement Costs, and Clinical Accessibility in Endoscopy

The imposition of new tariff measures by the United States government in early 2025 has introduced a layer of complexity into endoscopic device procurement, affecting both imported equipment and key components. Elevated duties on endoscope assemblies and accessory parts have led manufacturers to reassess global supply chains, accelerate nearshoring initiatives, and renegotiate vendor agreements to mitigate cost pressures. In parallel, hospitals and ambulatory centers are experiencing upward pressure on capital budgets due to increased landed costs, prompting a reassessment of leasing versus purchasing strategies.

While some domestic producers have sought to capitalize on tariff-induced protection, consolidation among regional original equipment manufacturers is fostering capacity investments to meet rising demand. Nevertheless, clinical providers are balancing the need to secure advanced endoscope inventories against constrained operating budgets, leading to renewed emphasis on endoscope lifespan extension programs and performance-based service contracts. The net effect is a recalibration of procurement paradigms that prioritizes supply chain resilience and total cost of ownership analyses.

Unveiling Key Market Segmentation Dynamics Across Endoscope Types, Usability Models, Imaging Modalities, Healthcare Settings, and Clinical Applications

A nuanced understanding of market segmentation reveals distinct adoption patterns and value propositions across endoscope variants, usability models, imaging modalities, healthcare settings, and procedural categories. Within the realm of endoscope types, flexible instruments are prevalent for bronchial, colorectal, urological, pancreaticobiliary, and upper gastrointestinal diagnostics, whereas rigid scopes find traction in orthopedic, gynecological, and laparoscopic surgeries. Decisions between disposable and reusable devices hinge on clinical throughput, infection control imperatives, and sterilization infrastructure, with disposable scopes often favored in high-risk or emergent environments, while reusable instruments remain standard in high-volume endoscopy suites.

On the imaging front, fiber optic endoscopy retains a niche in cost-sensitive settings and specific therapeutic interventions, whereas video endoscopy commands leadership in advanced diagnostics, digital documentation, and integration with auxiliary imaging analytics. Provider segmentation further underscores that ambulatory surgical centers focus on procedural efficiency and lean inventory management, clinics emphasize versatility and cost control for outpatient diagnostics, and hospitals prioritize comprehensive endoscopy portfolios that support multidisciplinary care teams. Finally, clinical applications span gastrointestinal evaluations, gynecological screenings, respiratory diagnostics, and urological examinations, each demanding tailored scope designs, illumination sources, and accessory compatibility to deliver optimal diagnostic yield.

This comprehensive research report categorizes the Endoscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Endoscope Type

- Usability

- Imaging Technology

- End User

- Application

Analyzing Regional Growth Drivers and Challenges Across the Americas, Europe Middle East & Africa, and Asia Pacific Endoscopy Ecosystems

Regional dynamics in the endoscopy market are shaped by varied healthcare infrastructures, regulatory landscapes, and demographic pressures. Within the Americas, North American markets benefit from established healthcare networks, favorable reimbursement frameworks, and robust private sector investments that accelerate the uptake of advanced video endoscopy platforms and disposable systems. Latin American markets, however, display heterogeneous growth influenced by budgetary constraints and gradual privatization of healthcare services, driving selective adoption of cost-effective endoscope technologies.

In Europe, the Middle East, and Africa, regulatory harmonization across the European Union facilitates cross-border equipment approvals, while the Gulf Cooperation Council countries are channeling significant funding toward expanding minimally invasive surgery capabilities. Conversely, sub-Saharan regions face challenges related to infrastructure gaps and procurement complexities, creating opportunities for modular, low-maintenance endoscope designs. Across Asia Pacific, the rapid expansion of hospital networks in China and India reinforces demand for both reusable and single-use endoscopes, with Japan and South Korea leading in high-definition video scope innovation. Emerging markets such as Southeast Asia and Oceania are increasingly influenced by public-private partnerships aimed at enhancing access to advanced diagnostic tools.

This comprehensive research report examines key regions that drive the evolution of the Endoscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Through Strategic Partnerships, Digital Integration, and Competitive Differentiation in Endoscopy

The competitive landscape of endoscopy is characterized by the strategic initiatives of global device manufacturers, technology disruptors, and specialized innovators. Established medical technology leaders continue to invest heavily in R&D to refine imaging sensors, develop AI-enabled diagnostic suites, and expand accessory offerings that enhance procedural versatility. Simultaneously, niche players are carving out positions by focusing on disposable endoscope designs that address infection control and ease-of-use, securing distribution partnerships with regional medical device distributors to amplify market reach.

Strategic alliances between endoscope makers and software developers are fueling the integration of cloud-based analytics platforms, offering real-time insights into device utilization, procedural performance metrics, and preventative maintenance scheduling. In addition, select companies are exploring subscription-based business models that bundle instrumentation, service support, and data analytics to cultivate predictable revenue streams and deepen customer engagement. Mergers and acquisitions remain an active catalyst for geographic expansion, portfolio diversification, and proprietary technology access, reshaping the competitive hierarchy and driving convergence between device and digital health ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Endoscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Arthrex, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical LLC

- FUJIFILM Holdings Corporation

- Hoya Corporation

- Intuitive Surgical, Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic plc

- Mindray Medical International Limited

- Olympus Corporation

- Pentax Medical Company

- Richard Wolf GmbH

- Smith & Nephew plc

- STERIS Corporation

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Technologies, Regulatory Shifts, and Market Expansion Opportunities

Industry leaders must adopt a multifaceted approach to capture emerging opportunities and navigate advancing regulatory frameworks. Prioritizing investments in AI-driven diagnostic algorithms and high-definition imaging enhancements will differentiate portfolios and meet rising clinician expectations for precision medicine. Equally critical is forging collaborative alliances with reprocessing specialists and sterilization service providers to develop hybrid service models that balance single-use device adoption with lifecycle management for reusable scopes.

Furthermore, executives should evaluate supply chain resilience by diversifying component sourcing, consolidating key supplier relationships, and exploring nearshore manufacturing options to offset tariff pressures. To expand market access, tailored go-to-market strategies must address the unique procurement protocols of ambulatory centers versus hospital systems and leverage digital channels for clinician education and remote support. Lastly, embedding data analytics into customer-facing services will uncover actionable usage patterns, inform value-based contracting, and reinforce long-term partnerships that underpin sustainable growth.

Synthesizing Rigorous Research Methodologies and Multisource Data Collection Techniques Underpinning Endoscopy Market Intelligence

Our research methodology synthesizes insights from a blend of primary and secondary sources to ensure comprehensive market intelligence. Primary inputs include in-depth interviews with clinical experts, device procurement managers, and regulatory authorities across key regions, complemented by on-site device usage observations. The secondary research phase comprised a thorough review of regulatory filings, clinical trial outcomes, patent databases, and peer-reviewed journals, enabling triangulation of device performance trends and technology adoption rates.

Quantitative data aggregation involved analyzing trade flows, import-export statistics, and published tariff schedules to evaluate cost impacts and supply chain disruptions. Qualitative assessments were further enriched by attending industry conferences, examining white papers from technology consortia, and monitoring early-stage investment trends in digital endoscopy ventures. The fusion of these methodologies underpins robust segmentation analysis, regional insights, and competitive profiling, delivering a holistic perspective that informs strategic decision-making across the endoscopy value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Endoscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Endoscopy Market, by Endoscope Type

- Endoscopy Market, by Usability

- Endoscopy Market, by Imaging Technology

- Endoscopy Market, by End User

- Endoscopy Market, by Application

- Endoscopy Market, by Region

- Endoscopy Market, by Group

- Endoscopy Market, by Country

- United States Endoscopy Market

- China Endoscopy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Converging Insights and Strategic Imperatives Charting the Path Forward for Stakeholders in the Evolving Endoscopy Landscape

The collective insights presented underscore the transformative nature of the endoscopy sector as it adapts to escalating clinical demands, technological disruptions, and evolving economic pressures. The convergence of AI-augmented diagnostics, disposable device proliferation, and digital integration heralds a new era of procedural efficiency and patient safety. Meanwhile, the introduction of tariffs has catalyzed supply chain realignment and strategic sourcing decisions that will reverberate through procurement strategies in the near term.

Looking ahead, stakeholders must remain agile, leveraging advanced imaging capabilities, forging collaborative partnerships, and embracing data-driven service models to sustain competitive advantage. By aligning innovation road maps with regional healthcare imperatives and patient-centric care protocols, manufacturers and providers can navigate market complexities while delivering enhanced clinical outcomes. This synthesis of operational resilience, technological leadership, and strategic foresight charts a clear path forward as the endoscopy landscape continues to evolve.

Engage Directly with Ketan Rohom to Unlock Comprehensive Endoscopy Market Intelligence and Drive Strategic Growth

To acquire an in-depth analysis of the endoscopy market’s evolution and capitalize on critical insights, connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore the full scope of our intelligence offerings. Engaging directly with Ketan Rohom ensures personalized guidance on how the research applies to your strategic priorities and operational goals. By partnering with his team, you unlock tailored data interpretations, expert advisory sessions, and exclusive access to proprietary case studies that illustrate best practices across segments and regions.

Securing the comprehensive report offers a competitive edge in navigating regulatory complexities, adapting to emerging technologies, and optimizing procurement strategies under evolving tariff regimes. Ketan will facilitate rapid delivery of the report backed by premium support, including executive briefings and ongoing updates. Reach out today to transform high-level market understanding into actionable road maps that drive innovation, operational excellence, and sustainable growth within your organization.

- How big is the Endoscopy Market?

- What is the Endoscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?