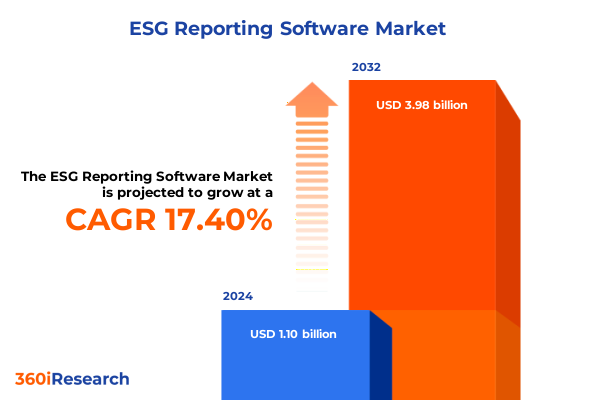

The ESG Reporting Software Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.50 billion in 2026, at a CAGR of 17.51% to reach USD 3.98 billion by 2032.

Laying the Foundation for Effective ESG Reporting Through Strategic Integration of Advanced Software Solutions in Modern Corporate Governance Environments

The growing imperative for transparent, verifiable, and decision-ready sustainability information has elevated ESG reporting from a compliance exercise to a core strategic capability. Organizations are contending with expanding regulatory requirements, heightened investor scrutiny, and stakeholder expectations that extend well beyond environmental stewardship to include social equity and governance standards. This has generated an urgent demand for robust, scalable reporting platforms capable of aggregating diverse data sets, standardizing metrics, and producing analytically rich outputs. Consequently, enterprises are abandoning fragmented spreadsheet processes in favor of integrated solutions that underpin consistent disclosures and facilitate executive-level decision making.

As digital transformation accelerates across industries, ESG reporting software has emerged as a critical enabler of transparency, risk management, and competitive differentiation. Leading platforms combine automated data ingestion, configurable frameworks aligned to global standards, and real-time analytics. This convergence of capabilities not only drives operational efficiency but also ensures responsiveness to emerging regulations such as the Corporate Sustainability Reporting Directive and evolving SEC guidance. Moreover, technological advances in artificial intelligence and machine learning are empowering organizations to detect patterns, automate data quality checks, and forecast performance, thereby reducing manual overhead and elevating confidence in reported outcomes.

Transitioning to a software-driven reporting regime delivers a multifaceted value proposition: enhanced data governance, audit readiness, and the ability to demonstrate progress against climate targets and social commitments. Coupled with a modular architecture, these platforms support phased implementations, allowing enterprises to prioritize critical functions while scaling seamlessly. This flexibility is transformative for organizations embarking on ambitious sustainability agendas, as it aligns reporting workflows with overarching corporate strategies.

This introduction sets the stage for a deeper examination of the transformative shifts reshaping the ESG software landscape, from emerging regulatory dynamics to advanced technology integration.

Navigating the Convergence of Regulatory Pressures Data Transparency and Stakeholder Demands Redefining the ESG Software Technology Landscape

Organizations are navigating a rapidly evolving ESG landscape characterized by an intensifying convergence of regulatory mandates, investor expectations, and technological opportunity. Global transparency initiatives and jurisdictional requirements are driving a paradigm shift away from periodic disclosures toward continuous performance tracking. In parallel, stakeholders demand granular insight into environmental footprints, social impacts, and governance integrity, compelling enterprises to adopt comprehensive digital platforms rather than legacy processes.

Technological innovation is catalyzing this transition. Cloud-native architectures facilitate real-time collaboration across geographically dispersed teams, while on-premises deployments offer enterprises greater control over critical data. Artificial intelligence and advanced analytics are embedded into reporting frameworks, enabling automated anomaly detection, predictive insights, and scenario modeling. Consequently, decision-makers can proactively address compliance gaps, optimize resource allocation, and align ESG initiatives with financial objectives.

Moreover, integration with existing enterprise resource planning and risk management systems ensures that ESG metrics are not siloed but are woven into the broader business intelligence fabric. This interoperability fosters a holistic view of organizational performance, where sustainability considerations inform corporate strategy, operational planning, and stakeholder engagement. As a result, ESG reporting software is evolving from a back-office function to a strategic tool that drives resilience and competitive differentiation in an increasingly sustainability-driven marketplace.

Assessing the Broad Repercussions of 2025 Tariff Adjustments on ESG Reporting Workflows Supply Chains and Compliance Risk Profiles Across Industries

The United States’ escalation of tariffs in early 2025 has introduced a new dimension of complexity into supply chains and reporting obligations. Companies operating across borders are experiencing elevated import duties on critical raw materials and finished goods, which in turn exert pressure on cost structures, procurement strategies, and risk profiles. For ESG reporting software providers, this environment has underscored the necessity of robust scenario-analysis modules and enhanced supply chain traceability functions.

In response to tariff-induced volatility, enterprises are leveraging software capabilities to map supplier ecosystems, quantify emissions across extended value chains, and assess social risks associated with tariff-driven sourcing shifts. These platforms now integrate dynamic cost calculators and compliance trackers, facilitating real-time adjustments to procurement decisions and disclosure narratives. The ability to model multiple tariff scenarios enables organizations to quantify environmental and financial tradeoffs, ensuring that reporting reflects both economic impacts and sustainability outcomes.

Additionally, the tariff landscape has heightened the importance of governance modules that document policy changes, board-level decisions, and stakeholder communications. By centralizing policy documentation and audit trails, ESG reporting software helps enterprises maintain regulatory compliance and demonstrate proactive management of tariff-related risks. This cumulative impact of 2025 tariffs has, therefore, accelerated the maturation of software features that support agile, transparent, and resilient ESG reporting workflows.

Unveiling Segmentation Insights Demonstrating How Deployment Options Components Solutions Services Scales and Industry Verticals Shape Software Adoption

A nuanced understanding of market segmentation illuminates the diverse deployment preferences, functional requirements, and industry-specific drivers that shape ESG reporting software adoption. When considering deployment mode, organizations weighing cloud and on-premises options must balance data sovereignty concerns against the agility of software-as-a-service models. Cloud solutions often enable faster updates and streamlined collaboration, whereas on-premises implementations maintain tighter governance over sensitive datasets.

From a component perspective, the dichotomy between services and software frames the total cost of ownership and innovation cadence. Licenses provide perpetual access to core modules, while subscription offerings deliver continuous feature enhancements and support. This duality ensures that enterprises can align their procurement strategy with budgetary cycles and technological roadmaps.

Exploring solution segmentation reveals distinct workflows for compliance management, data management, reporting and analytics, and risk management. Each solution area addresses targeted pain points: compliance management streamlines regulatory adherence, data management safeguards integrity, reporting and analytics provide stakeholder-ready visualizations, and risk management uncovers potential disruptions to sustainability objectives.

Service type further refines market dynamics, with managed services offering end-to-end implementation, monitoring, and optimization, while professional services deliver advisory expertise for bespoke configurations. This distinction enables enterprises to tailor engagements based on internal capabilities and maturity levels.

Organization size influences the selection of large enterprise versus small and medium-business frameworks, each with differentiated user access controls, scalability paths, and ecosystem integrations. Finally, industry vertical considerations-from banking, financial services, and insurance through energy, utilities, government, healthcare, technology, manufacturing, and retail-drive unique reporting standards, data collection protocols, and stakeholder priorities.

This comprehensive research report categorizes the ESG Reporting Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Component

- Solution

- Service Type

- Organization Size

- Industry Vertical

Examining Distinct Regional ESG Reporting Software Trends Illuminating Drivers Opportunities and Regulatory Nuances across the Americas EMEA and Asia Pacific

Regional nuances profoundly influence the maturity and adoption of ESG reporting software across the Americas, EMEA, and Asia-Pacific. In the Americas, robust regulatory frameworks and voluntary reporting regimes converge to drive comprehensive disclosures. Corporate entities leverage advanced analytics modules to align with emerging state-level climate mandates and investor-led standards, fostering a competitive environment for software innovation.

Moving to Europe, the Middle East, and Africa, stringent directives such as the Corporate Sustainability Reporting Directive create a baseline for standardized disclosures, prompting regional headquarters to deploy solutions that ensure consistency across multinational operations. Additionally, the emergence of digital identity initiatives and carbon border adjustment mechanisms in the region is accelerating the incorporation of supply chain transparency features.

In Asia-Pacific, rapid economic growth and evolving regulatory landscapes have given rise to a dual approach. Multinational subsidiaries often adopt leading-edge platforms to satisfy home-market requirements, whereas domestic enterprises prioritize solutions that address unique local mandates and cultural nuances in social governance. This bifurcation is catalyzing a hybrid adoption model where global and regional best practices coalesce.

Collectively, these regional insights underscore the importance of adaptable architectures, configurable frameworks, and localized content libraries that resonate across jurisdictional boundaries while maintaining global consistency.

This comprehensive research report examines key regions that drive the evolution of the ESG Reporting Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading ESG Reporting Software Innovators Their Strategic Differentiators Partnerships and Evolving Offerings in a Competitive Technology Ecosystem

Leading providers in the ESG reporting software arena distinguish themselves through strategic partnerships, integrated ecosystems, and differentiated service models. Some established players reinforce their market positions by aligning with major cloud providers and enterprise resource planning platforms, ensuring seamless data integration and unified governance frameworks. Others emphasize open APIs and modular architectures to foster extensibility and third-party innovation.

A second cohort of vendors focuses on vertical specialization, delivering tailored templates, taxonomy libraries, and risk-assessment algorithms optimized for sectors such as financial services, energy, and consumer goods. Their deep domain expertise reduces implementation time and enhances stakeholder confidence in reported metrics.

Innovation is further driven by partnerships with data aggregators and research institutions, enabling real-time benchmarking and peer-comparative analytics. This collaborative approach enhances the depth of environmental impact assessments and social risk analyses, while also facilitating scenario planning for evolving regulatory landscapes.

Emerging players are carving niches with AI-driven anomaly detection, natural language processing for narrative disclosures, and blockchain-enabled traceability modules. By prioritizing user experience and mobile accessibility, these innovators are democratizing ESG reporting across organizational hierarchies, empowering sustainability champions at all levels.

Collectively, the vendor ecosystem spans global incumbents, specialized challengers, and agile startups, all competing to deliver differentiated capabilities that address the multifaceted demands of modern ESG reporting.

This comprehensive research report delivers an in-depth overview of the principal market players in the ESG Reporting Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apiday SAS

- Arbor Eco

- AuditBoard, Inc.

- Benchmark Gensuite

- Cority Software Inc.

- Credibl

- Diligent Corporation

- Greenly

- International Business Machines Corporation

- KEY ESG

- LucaNet AG

- Microsoft Corporation

- MSCI Inc.

- NAVEX Global, Inc.

- Novata

- Novisto

- Persefoni, Inc.

- Prophix Software Inc.

- Sphera Solutions GmbH

- Workiva Inc.

Translating Industry Dynamics and Software Capabilities into Strategic Recommendations for ESG Leaders to Enhance Performance and Governance Outcomes

Industry leaders seeking to elevate their ESG reporting capabilities should first invest in a comprehensive technology audit to identify gaps in data collection, governance, and stakeholder engagement workflows. Prioritizing integrations with existing enterprise systems will help eliminate data silos and establish a single source of truth, enhancing both accuracy and audit readiness. Implementing a phased rollout that begins with high-impact modules-such as automated compliance management and real-time analytics-enables quick wins and builds organizational momentum.

Next, organizations must cultivate cross-functional collaboration by establishing clear governance structures that include representatives from finance, sustainability, IT, and risk management. This integrated approach ensures that ESG metrics are contextualized within broader strategic objectives and financial reporting frameworks. Providing tailored training and change management support will accelerate user adoption and reinforce the cultural shift toward data-driven decision making.

To stay ahead of evolving regulations, enterprises should leverage scenario modeling tools that simulate the impact of emerging policy changes, tariffs, and market shifts. By incorporating artificial intelligence and machine learning capabilities, organizations can proactively identify anomalies, forecast trends, and optimize resource allocation to meet sustainability commitments.

Finally, continuous improvement protocols-such as post-implementation reviews and stakeholder feedback loops-will enable iterative enhancements and ensure that the reporting platform evolves in parallel with organizational goals.

Elucidating Methodological Rigor and Analytical Frameworks Underpinning Comprehensive Research into ESG Reporting Software Market Dynamics and Adoption Patterns

This analysis is grounded in a multi-stage research approach designed to ensure methodological rigor and analytical completeness. The primary research phase involved in-depth interviews with sustainability officers, IT architects, and compliance specialists across diverse industry verticals. These conversations provided firsthand insights into common implementation challenges, feature preferences, and impact metrics.

Concurrently, secondary research encompassed a systematic review of regulatory publications, industry white papers, and thought-leadership articles to contextualize emerging standards and technological advances. Data points were cross-verified through multiple sources to enhance reliability, and conflicting information was reconciled via expert panel discussions.

Quantitative data analysis employed advanced statistical techniques to identify adoption patterns, feature utilization rates, and user satisfaction benchmarks. Qualitative thematic analysis was applied to interview transcripts, enabling the extraction of best practices and pain points. Triangulation of findings across these methodologies supported a robust narrative that balances depth with objectivity.

All findings were validated through a peer review process involving external sustainability consultants and technology experts, ensuring that the resulting insights reflect both current market realities and forward-looking trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ESG Reporting Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ESG Reporting Software Market, by Deployment Mode

- ESG Reporting Software Market, by Component

- ESG Reporting Software Market, by Solution

- ESG Reporting Software Market, by Service Type

- ESG Reporting Software Market, by Organization Size

- ESG Reporting Software Market, by Industry Vertical

- ESG Reporting Software Market, by Region

- ESG Reporting Software Market, by Group

- ESG Reporting Software Market, by Country

- United States ESG Reporting Software Market

- China ESG Reporting Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Closing the Narrative with a Compelling Synthesis of Strategic Insights for ESG Reporting Software and a Perspective on Sustainability Integration

Bringing together the strategic, technological, and regional insights, this report underscores the transformative potential of advanced ESG reporting software to drive transparent, auditable, and forward-thinking sustainability programs. By embracing integrated platforms that combine compliance management, data governance, analytics, and risk assessment, organizations can meet regulatory demands, satisfy stakeholder expectations, and enhance decision-making processes.

The tariff-related challenges of 2025, along with evolving jurisdictional requirements across the Americas, EMEA, and Asia-Pacific, highlight the importance of adaptable solutions that support scenario modeling, supply chain traceability, and dynamic policy tracking. Segmentation analysis reveals that deployment flexibility, component choices, solution scope, service delivery models, organizational scale, and industry-specific needs all converge to shape a nuanced adoption landscape.

In this competitive ecosystem, software vendors differentiate on the basis of strategic partnerships, vertical expertise, AI-driven modules, and modular architectures. Organizations are therefore encouraged to align their procurement strategies with long-term sustainability objectives, ensuring that chosen platforms not only address immediate compliance imperatives but also support continuous improvement.

Ultimately, the synthesis of research findings demonstrates that a deliberate, data-centric approach to ESG reporting software can unlock significant efficiencies, foster stakeholder trust, and embed sustainability at the heart of corporate strategy.

Initiating Your Journey to Policy Driven ESG Reporting Excellence Engage with Ketan Rohom to Secure Your Comprehensive Software Market Intelligence Report Today

To explore the full scope of actionable insights and industry benchmarks, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Your engagement will initiate a personalized consultation aimed at understanding your unique organizational challenges and aligning them with the most effective ESG reporting software solutions. Seize the opportunity to access an in-depth market intelligence report that delves into technological differentiators, regulatory best practices, and implementation roadmaps tailored for your enterprise. By collaborating with Ketan Rohom, you will gain prioritized access to expert briefings and proprietary data that can streamline decision-making and accelerate your sustainability goals. Reach out today to transform ESG strategy from aspiration to measurable performance.

- How big is the ESG Reporting Software Market?

- What is the ESG Reporting Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?