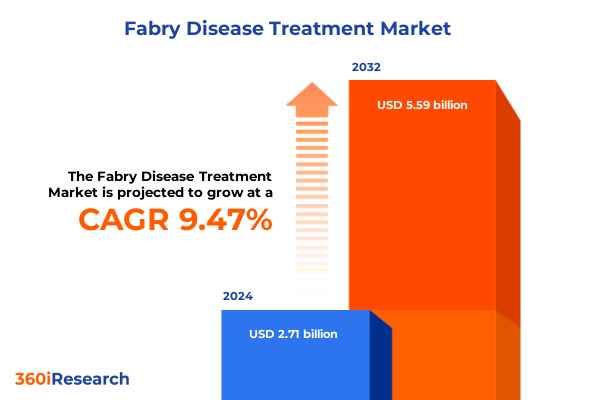

The Fabry Disease Treatment Market size was estimated at USD 2.94 billion in 2025 and expected to reach USD 3.20 billion in 2026, at a CAGR of 9.57% to reach USD 5.59 billion by 2032.

Unveiling Fundamental Drivers and Strategic Considerations That Define the Emerging Landscape of Fabry Disease Treatment Innovation and Access

Fabry disease poses one of the most complex challenges in rare genetic disorders, driven by the deficiency of the alpha-galactosidase A enzyme and leading to progressive organ damage across renal, cardiac, and neurological systems. The introduction of enzyme replacement therapy more than two decades ago marked a significant milestone, yet the persistent unmet needs of heterogenous patient populations and limitations in long-term efficacy continue to propel research into novel modalities. In response, the evolving therapeutic ecosystem is embracing next-generation approaches such as molecular chaperones and gene therapy vectors, which promise targeted delivery, durable responses, and improved quality of life.

Against this backdrop, stakeholders are navigating an increasingly intricate matrix of regulatory pathways, reimbursement complexities, and competitive dynamics. Meanwhile, patient advocacy groups and real-world evidence initiatives are reshaping the dialogue around treatment value and access. By weaving together insights from clinical trial outcomes, manufacturing scalability considerations, and evolving market access frameworks, this introduction grounds readers in the foundational factors driving the imperative for innovation. Consequently, the ensuing analysis will illuminate how technological breakthroughs, policy shifts, and strategic collaborations are converging to redefine the future trajectory of Fabry disease management.

Exploring the Pivotal Transformations and Technological Breakthroughs Redefining How Fabry Disease Therapeutics Are Developed Delivered and Utilized

The Fabry disease therapeutic arena has undergone a paradigm shift as scientific breakthroughs intersect with commercial imperatives, heralding a new era of personalized and potentially curative interventions. In recent years, gene therapy platforms leveraging adeno-associated virus vectors and lentiviral constructs have progressed from preclinical innovations to early-phase clinical trials, reflecting a broader industrial commitment to one-time treatment strategies. Concurrently, pharmacological chaperones such as migalastat have demonstrated the feasibility of oral administration, enhancing patient adherence and broadening the spectrum of manageability in amenable mutation carriers.

Moreover, substrate reduction therapies targeting upstream metabolic pathways are gaining momentum, expanding the armamentarium beyond traditional enzyme replacement. Real-world data collection, facilitated by digital health tools and patient registries, has further refined understanding of long-term safety and efficacy, fueling adaptive regulatory programs that fast-track high-impact candidates. This convergence of advanced analytics, flexible reimbursement agreements, and strategic partnerships between biotechnology pioneers and established pharmaceutical manufacturers underscores a transformative shift. As a result, the market is poised to transition from chronic management modalities toward integrated care models that prioritize durability, convenience, and patient-centered outcomes.

Assessing the Comprehensive Consequences and Strategic Repercussions of 2025 United States Tariffs on the Fabry Disease Treatment Supply Chain Market Dynamics

In 2025, the United States implemented new tariff measures targeting key components and biologics associated with Fabry disease treatments, a move driven by broader trade policy objectives. These levies have introduced additional cost pressures on manufacturers relying on specialized raw materials and fill-finish services typically sourced from global suppliers. Consequently, production expenditures have climbed, prompting companies to reevaluate their supply chain footprints and explore nearshoring of critical operations. This strategic realignment, in turn, has affected timelines for drug availability, with some pipeline candidates experiencing delays as logistical networks are restructured.

Furthermore, the price elasticity inherent in orphan disease therapies has limited the ability to pass through full incremental costs to end-users, compelling manufacturers to absorb a portion of the tariff burden or engage in value-based contracting to mitigate payer resistance. In parallel, importers and distributors have sought to renegotiate contracts and diversify sourcing to circumvent tariff exposure, while regulatory agencies are reviewing how trade instruments intersect with accelerated approval pathways. Therefore, understanding the cumulative impact of these tariffs is essential for stakeholders aiming to preserve profitability without compromising patient access or innovation incentives.

Revealing Insights into Fabry Disease Treatment Market Segmentation across Therapy Types Patient Categories Distribution Channels and Administration Routes

A nuanced comprehension of market segmentation reveals that the Fabry disease treatment landscape extends across a spectrum of therapy types, each offering distinct clinical benefits and operational considerations. Chaperone therapy, exemplified by oral agents such as migalastat, caters to patients with amenable mutations and underscores the shift toward noninvasive treatment regimens. Meanwhile, enzyme replacement therapy, delivered intravenously through agents like agalsidase alfa and agalsidase beta, remains foundational for individuals with classic disease manifestations, demanding robust hospital and infusion center infrastructures. In contrast, gene therapy strategies utilizing adeno-associated viral or lentiviral platforms hold transformative potential for achieving durable remission, albeit subject to manufacturing scalability and long-term safety monitoring. Additionally, substrate reduction therapies such as lucerastat and venglustat target metabolic precursors, presenting an alternative pathway for alleviating glycosphingolipid accumulation in both adult and pediatric populations.

When considering end-user distribution, hospitals and specialty clinics dominate infusion-based services, whereas home healthcare adoption is accelerating in response to patient convenience preferences and cost optimization imperatives. Distribution channels are correspondingly diverse: hospital pharmacies and specialized dispensing units primarily manage complex biologics, while retail and online pharmacies facilitate greater access to oral therapies. Intravenous administration remains the mainstay for enzyme replacement, juxtaposed with the growing prevalence of oral routes in chaperone and substrate reduction modalities. Patient demographics also shape market dynamics, as adult cohorts often present with comorbidities requiring integrated care, whereas pediatric patients necessitate early intervention frameworks. Moreover, the therapeutic approach diverges between curative aspirations inherent in gene therapy research and palliative strategies aimed at symptom management. Finally, reimbursement tiers-ranging from government insurance through private plans and out-of-pocket funding-play a critical role in determining treatment adoption, particularly in regions where access programs and insurance coverage vary significantly.

This comprehensive research report categorizes the Fabry Disease Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Route Of Administration

- Patient Type

- Therapy Approach

- Reimbursement Tier

- End User

- Distribution Channel

Highlighting Nuanced Regional Trends and Strategic Imperatives Spanning the Americas Europe Middle East Africa and Asia Pacific in Fabry Disease Therapeutics

Regional dynamics significantly influence strategic priorities across key geographies, beginning with the Americas where the United States leads in innovation thanks to robust funding for rare disease research and expedited regulatory pathways. However, cost containment efforts by public and private payers have intensified scrutiny of long-term value, driving manufacturers to pursue outcomes-based agreements and patient support initiatives. In Canada and Latin America, access disparities persist due to limited reimbursement frameworks, prompting localized partnerships and tiered pricing models to bridge affordability gaps.

Conversely, the Europe, Middle East, and Africa sphere presents a mosaic of market environments: Western European nations benefit from centralized healthcare systems and collaborative HTA processes that facilitate widespread adoption of advanced therapies, while Southern and Eastern regions experience heterogeneous coverage that delays patient access. In parts of the Middle East, government-led programs and philanthropic contributions play a pivotal role in securing treatment availability, whereas sub-Saharan areas face infrastructural and logistical barriers that impede distribution. Meanwhile, the Asia-Pacific territory is characterized by dynamic growth trajectories in countries such as Japan, South Korea, and Australia, where regulatory alignment with global standards accelerates entrant approval. Yet emerging markets in Southeast Asia and India are marked by cost sensitivity and nascent reimbursement pathways, necessitating innovative commercial models and localized clinical studies. As a result, organizations must tailor strategies that navigate regional complexities and optimize patient reach across these diverse landscapes.

This comprehensive research report examines key regions that drive the evolution of the Fabry Disease Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Profiles and Core Competencies of Leading Companies Driving Innovation in Fabry Disease Treatment Development and Commercialization

Leading organizations in the Fabry disease arena exhibit a wide range of strategic competencies, with some focusing on next-generation modalities while others consolidate existing therapies through expanded indications and manufacturing excellence. Prominent chaperone therapy developers have leveraged robust molecular screening platforms to identify patient subsets most likely to benefit, thereby enhancing clinical trial efficiency and payer confidence. Meanwhile, established biopharmaceutical firms specializing in enzyme replacement have invested heavily in manufacturing optimization, ensuring consistent supply and reducing batch variability for products such as agalsidase alfa.

On the gene therapy front, nimble biotechnology companies have forged collaborations with contract development and manufacturing organizations to scale vector production, while simultaneously engaging in global regulatory dialogues to define safety and efficacy benchmarks. Substrate reduction pioneers are differentiating through oral formulation innovations and engaging patient advocacy groups to build real-world evidence networks. Across reimbursement landscapes, companies are adopting holistic patient support programs that integrate digital adherence monitoring and personalized disease management, thereby reinforcing product value propositions. Consequently, understanding each player’s unique blend of R&D focus, manufacturing capacity, regulatory acumen, and market access initiatives is vital for gauging competitive positioning and potential partnership opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fabry Disease Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amicus Therapeutics, Inc.

- Avrobio, Inc.

- Chiesi Farmaceutici S.p.A.

- E-Scape Bio, Inc.

- Freeline Therapeutics Holdings plc

- Green Cross Corporation

- Idorsia Pharmaceuticals Ltd.

- ISU Abxis Co., Ltd.

- JCR Pharmaceuticals Co., Ltd.

- M6P Therapeutics

- Nippon Shinyaku Co., Ltd.

- Orphazyme ApS

- Protalix BioTherapeutics, Inc.

- Resolve Therapeutics, LLC

- Sangamo Therapeutics, Inc.

- Sanofi S.A.

- Swedish Orphan Biovitrum AB

- Takeda Pharmaceutical Company Limited

- Zambon S.p.A.

Proposing Actionable Strategic Recommendations for Industry Stakeholders to Capitalize on Emerging Opportunities in Fabry Disease Treatment Landscape

Industry leaders seeking to maintain and enhance their competitive edge should prioritize integrated cross-functional programs that align R&D, commercial, and patient engagement teams around shared goals. To this end, establishing strategic alliances with specialized contract development and manufacturing organizations can mitigate capacity constraints and accelerate time to market, particularly for complex biologics and gene therapy vectors. Moreover, crafting outcomes-based reimbursement structures in collaboration with payers and health technology assessment bodies will not only address affordability concerns but also generate actionable real-world evidence to support long-term value propositions.

In parallel, investing in digital health platforms that facilitate remote monitoring and patient-reported outcomes can strengthen adherence and provide granular data for iterative product optimization. Additionally, organizations should explore asset-light approaches in emerging regions by partnering with local distributors and participating in regional clinical initiatives, thereby balancing market penetration with risk management. By adopting a dual focus on curative potential and palliative support across diverse patient demographics, stakeholders can ensure comprehensive care pathways that resonate with healthcare providers and patients alike. Ultimately, an agile, data-driven framework coupled with stakeholder-centric engagement will empower industry participants to capitalize on the next wave of therapeutic advancements.

Detailing Rigorous Research Methodology Employed in Compiling Comprehensive Insights on Fabry Disease Treatment Market Dynamics and Trends

The insights presented in this analysis are underpinned by a rigorous research methodology that blends primary and secondary data sources, ensuring both depth and breadth of coverage. Initially, a comprehensive review of peer-reviewed literature, regulatory filings, clinical trial databases, and patent registries established a foundational understanding of the scientific advances and competitive pipelines. Concurrently, in-depth interviews were conducted with key opinion leaders, clinical investigators, payers, and patient advocacy representatives to capture diverse perspectives on treatment value, access challenges, and emerging adoption drivers.

Subsequently, quantitative data points were triangulated with proprietary patient registry information and health economics models to validate market access barriers and reimbursement trends. The methodology further incorporated scenario planning workshops to assess the potential impact of regulatory policy shifts and trade measures on supply chain viability. Throughout this process, data integrity was maintained via standardized verification protocols and multistage peer reviews by subject matter experts. Consequently, the resulting analysis offers a holistic, evidence-based roadmap that reflects the latest trends, mitigates biases, and supports strategic decision-making for stakeholders across the Fabry disease continuum.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fabry Disease Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fabry Disease Treatment Market, by Treatment Type

- Fabry Disease Treatment Market, by Route Of Administration

- Fabry Disease Treatment Market, by Patient Type

- Fabry Disease Treatment Market, by Therapy Approach

- Fabry Disease Treatment Market, by Reimbursement Tier

- Fabry Disease Treatment Market, by End User

- Fabry Disease Treatment Market, by Distribution Channel

- Fabry Disease Treatment Market, by Region

- Fabry Disease Treatment Market, by Group

- Fabry Disease Treatment Market, by Country

- United States Fabry Disease Treatment Market

- China Fabry Disease Treatment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Strategic Takeaways to Illuminate Future Trajectories of Fabry Disease Treatment Innovations and Market Considerations

Drawing together the myriad threads of innovation, policy, and commercial strategy, this synthesis underscores the intricate interplay between technological breakthroughs and market realities in Fabry disease treatment. The ascendancy of gene therapy and substrate reduction approaches promises to redefine long-term outcomes, yet the enduring relevance of established enzyme replacement and chaperone modalities highlights the importance of therapeutic diversity. Moreover, evolving reimbursement frameworks and outcome-based contracting models will be pivotal in aligning stakeholder incentives and ensuring sustainable access in both mature and emerging markets.

Furthermore, the effects of trade policies and supply chain realignments serve as a reminder that macroeconomic forces can materially influence timelines, cost structures, and competitive dynamics. Regional variations-from the research-intensive environment of North America to the heterogeneous access landscape across Europe, the Middle East, and Africa, as well as the dynamic growth in Asia Pacific-demand tailored strategic approaches. Ultimately, those organizations that integrate scientific agility with patient-centric value propositions and robust market access planning will be best positioned to navigate the evolving Fabry disease landscape. This culmination of key takeaways provides a clear perspective on where the field stands today and the trajectories that will shape its future.

Seize Strategic Advantage Today by Engaging with Ketan Rohom to Access In-Depth Fabry Disease Treatment Market Analysis and Customized Industry Insights

The report offers an unparalleled deep dive into the evolving Fabry disease treatment landscape, equipping stakeholders with the intelligence needed to outpace competition and optimize strategic decision-making. To secure comprehensive access and unlock customized analysis aligned with your organizational objectives, connect with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the report’s value proposition and facilitate seamless procurement. Engage today to leverage actionable insights that will drive your market positioning and ensure informed execution of your business strategies.

- How big is the Fabry Disease Treatment Market?

- What is the Fabry Disease Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?