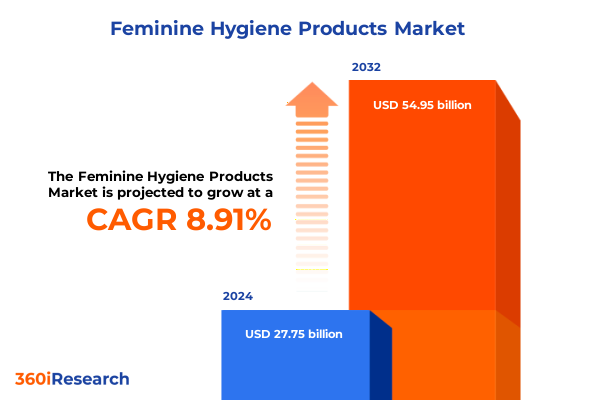

The Feminine Hygiene Products Market size was estimated at USD 30.18 billion in 2025 and expected to reach USD 32.83 billion in 2026, at a CAGR of 8.93% to reach USD 54.95 billion by 2032.

Mapping the New Frontiers of Feminine Hygiene Products Amid Shifting Consumer Priorities, Sustainability Trends, and Market Innovations

The feminine hygiene market has transcended its traditional role to become a vibrant arena of innovation and transformation. In an era marked by heightened consumer awareness and evolving socio-cultural attitudes, products once viewed as basic necessities now embody personal values, health priorities, and environmental commitments. This shift is catalyzing a wave of creativity as brands respond to demands for safer, more sustainable alternatives that align with modern lifestyles.

Moreover, the rapid ascent of e-commerce and direct-to-consumer platforms is redefining how women discover and procure menstrual care products. Ease of access, discreet delivery, and recurring subscription models are reshaping purchasing behaviors, allowing brands to forge stronger connections and gather real-time feedback. Simultaneously, new entrants are leveraging digital marketing and community-based storytelling to challenge legacy players, further intensifying competition.

Against this backdrop, regulatory and legislative developments are gaining momentum, particularly around ingredient transparency and chemical safety. State-level bans on PFAS in menstrual products underscore the urgency of accountability, compelling manufacturers to reassess supply chains and product formulations. As technological advancements and shifting demographics converge, the feminine hygiene sector stands at a pivotal crossroads, poised for continued reinvention and growth.

Charting the Transformative Shifts Redefining Feminine Care Landscapes Through Sustainability, Digitalization, and Regulatory Advances

Environmental sustainability and digital innovation are propelling the industry into a transformative chapter. Consumers are increasingly prioritizing biodegradable pads, organic cotton tampons, and reusable menstrual cups, reflecting a collective consciousness about reducing plastic waste and toxic exposures. Regulatory initiatives across multiple states now require disclosure of hazardous chemicals in product packaging, reinforcing the shift toward ingredient transparency and sparking reformulations that favor ecological integrity.

In parallel, the rise of omnichannel distribution is empowering brands to meet consumers wherever they shop-online or in physical stores. Subscription services have matured, offering personalized bundles that anticipate fluctuating needs across heavy flow, light flow, and medium flow days. Data analytics harnessed from digital platforms enable precise targeting by age segments, facilitating innovative outreach to teens navigating early menstruation and adults seeking premium or organic options. This convergence of sustainability commitments and digital engagement strategies is redefining competitive advantage and expanding market boundaries.

Evaluating the Cumulative Effects of United States Tariff Policies Implemented in 2025 on Feminine Hygiene Supply Chains and Costs

The tariff increases implemented in 2025 have introduced significant complexities to the supply chains of feminine hygiene products in the United States. Leading manufacturers such as Kimberly-Clark reported a production cost impact of USD 300 million tied to tariffs of up to 145% on imports from China, coupled with reciprocal duties from supplier nations and retaliatory levies by trading partners. These elevated costs are prompting strategic responses, including supply chain reengineering, near-shoring of final assembly to Mexico and Central America, and negotiations for preferential trade terms under existing agreements.

Menstrual cup producers, dependent on medical-grade silicone sourced primarily from Asian suppliers, are particularly exposed to these trade barriers. A 25% duty on silicone pelleted components has increased per-unit costs, forcing some brands to reassess their pricing structures and explore localized manufacturing investments in the United States. Meanwhile, distributors and retailers are recalibrating inventory strategies to mitigate uncertainty, often absorbing a portion of tariff-related expenses to preserve shelf space for sustainable and premium product lines.

Moreover, gendered tariff analyses reveal that products categorized as “women’s goods” face disproportionately higher average duties in many economies, exacerbating price pressures and potentially limiting access among cost-sensitive demographics. Collectively, these factors underscore the critical need for agile sourcing and diversified supplier networks to navigate the evolving trade environment.

Deriving Actionable Insights from Product Type, Material, Packaging, Demographic, and Distribution Channel Segmentation to Drive Growth

A nuanced understanding of segmentation can unlock targeted growth opportunities in the feminine hygiene market. When examining product types, menstrual cups and sponges are gaining traction among eco-conscious consumers seeking reusable solutions, while sanitary napkins-categorized across heavy, medium, and light flow variants-remain indispensable for mass-market appeal. Tampons, likewise differentiated by absorbency levels, continue to command loyalty among users who prioritize convenience and discretion.

Material segmentation reveals that non-woven fabrics dominate due to cost efficiency, yet organic cotton is rapidly emerging as the preferred choice for health-oriented purchases, driven by concerns around synthetic fibers and chemical residues. Regular cotton maintains a steady presence in value tiers, appealing to price-sensitive segments and broader distribution channels.

Packaging type influences consumer perception and purchasing behaviors. Individual wrappers offer hygiene and convenience for on-the-go usage, whereas multi-pack and bulk formats cater to subscription models and value seekers. Adult consumers aged 20-35 are gravitating toward subscription-based packaged bundles, while mature cohorts aged 36 plus often favor traditional retail outlets. Teens aged 13-19 require tailored messaging and discreet packaging to foster brand trust.

Finally, distribution channel segmentation underscores that convenience stores and supermarkets enable immediate replenishment, pharmacies provide product expertise, and online retail channels drive innovation in personalized offerings. This integrated segmentation lens empowers stakeholders to refine their value propositions and tailor product portfolios to evolving consumer preferences.

This comprehensive research report categorizes the Feminine Hygiene Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Packaging Type

- Distribution Channel

Illuminating Regional Variations in Feminine Hygiene Preferences and Regulatory Environments Across Americas, EMEA, and Asia-Pacific

Regional dynamics illustrate divergent growth vectors and regulatory landscapes across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States leads with robust e-commerce adoption and legislative momentum on ingredient disclosure, while Latin American markets are witnessing rising demand for affordable, locally sourced disposable options amid expanding retail infrastructures. Canada’s market is characterized by early adoption of organic and reusable products, benefitting from supportive provincial regulations.

Within Europe, stringent chemical safety standards and national bans on PFAS have catalyzed reformulations and innovation, particularly in biodegradable sanitary pads and period underwear. Middle Eastern markets, though nascent, are showing increasing interest in premium and imported brands, fueled by growing urbanization and shifting cultural attitudes. African regions, by contrast, face challenges related to distribution and affordability, creating space for NGOs and social enterprises to drive educational and donation-based initiatives.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes are fueling exponential growth in both disposable and reusable segments. Domestic manufacturers are scaling production to meet regional demand, while multinational players leverage strategic partnerships to navigate complex tariff frameworks and local regulatory requirements. Cultural sensitivities around menstruation persist but are gradually diminishing through digital advocacy and educational campaigns, further broadening market access.

This comprehensive research report examines key regions that drive the evolution of the Feminine Hygiene Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying the Strategic Imperatives of Leading Players Reshaping the Feminine Hygiene Ecosystem Through Innovation and Collaboration

Leading companies are reshaping the feminine hygiene landscape through strategic investments and collaborations. Procter & Gamble continues to leverage its R&D capabilities to refine absorbent materials and pilot biodegradable pad prototypes, underscoring its commitment to sustainability. Kimberly-Clark has embarked on supply chain diversification, combining near-shoring and long-term supplier agreements to mitigate tariff impacts and maintain affordability for core brands such as Kotex. Unilever is integrating digital feedback loops into product development, using consumer insights from e-commerce platforms to accelerate innovation cycles for tampon and pantyliner lines.

Niche players are also making significant inroads. Cora and Rael have pioneered subscription-based models for organic cotton tampons and pads, while DivaCup and Thinx are expanding manufacturing capacities to meet surging demand for reusable menstrual cups and period underwear. These companies exemplify agile market responses, aligning product portfolios with health, environmental, and convenience values that resonate across age segments.

Collaborative ventures between established multinationals and emerging brands are becoming increasingly common. Joint initiatives in sustainable packaging and refill schemes are blurring traditional competitive boundaries, highlighting a broader industry shift toward ecosystem building rather than zero-sum competition. This collaborative ethos is likely to intensify as the regulatory emphasis on ingredient transparency and circular economy principles continues to mount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feminine Hygiene Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Drylock Technologies NV

- Edgewell Personal Care LLC

- Essity Aktiebolag

- First Quality Enterprises Inc.

- Hengan International Group Company Ltd.

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Natracare LLC

- Ontex Group NV

- Premier FMCG Pvt. Ltd.

- Premier Hygiene Limited

- Procter & Gamble Co.

- Unicharm Corporation

- Vivanion Group

Outlining Actionable Recommendations to Propel Market Leadership in Feminine Hygiene Through Innovation, Sustainability, and Operational Excellence

Industry leaders must prioritize investments in sustainable materials and supply chain resilience to safeguard their competitive positions. By accelerating the adoption of certified organic cotton and exploring alternative biodegradable polymers, companies can address rising consumer concerns about chemical exposures and environmental impacts. Furthermore, strategic near-shoring of critical components and regional assembly hubs will buffer cost volatility induced by tariff fluctuations, ensuring reliable access to core raw materials.

Simultaneously, expanding digital channels and refining subscription-based frameworks will enhance consumer engagement and retention. Customized offerings that adapt to individual flow intensities and lifestyle preferences can leverage data analytics to deliver personalized value. Brands should also intensify collaboration with healthcare professionals and advocacy groups to build credibility and educate end users on product safety and optimal use, thereby reducing barriers to adoption for innovative formats like menstrual cups and sponges.

Finally, proactive regulatory engagement and transparent ingredient disclosure will foster trust among stakeholders. Establishing third-party certification programs and supporting state-level legislative initiatives can position companies as industry stewards. This multi-pronged approach-combining material innovation, digital excellence, stakeholder collaboration, and regulatory leadership-will empower market participants to navigate complexity and drive sustainable growth.

Detailing the Rigorous Research Methodology Employing MultiSource Data, Expert Validation, and Triangulation to Ensure Robust Findings

This analysis integrates a comprehensive research methodology, beginning with an exhaustive review of public sources, including corporate disclosures, regulatory filings, and credible news outlets. Specialist databases tracking trade policies and tariff schedules were consulted to quantify the impact of recent duty changes. Data triangulation was achieved by cross-referencing supply chain disruptions reported by leading manufacturers with independent tariff studies.

Expert interviews with supply chain managers, regulatory affairs executives, and sustainability officers provided qualitative depth, illuminating practical challenges in material sourcing and compliance. The segmentation framework was validated through consumer surveys and retail sales data, ensuring alignment with real-world purchasing behaviors. Trade association reports and academic publications on environmental impacts supplemented insights on ingredient safety and circular economy principles.

Regional analyses were underpinned by localized market studies and government documents detailing chemical regulations and e-commerce penetration rates. Company profiles were constructed through a combination of financial reports, press releases, and partnership announcements, capturing strategic initiatives in innovation and collaboration. This multi-layered approach ensures that findings are robust, actionable, and reflective of evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feminine Hygiene Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feminine Hygiene Products Market, by Product Type

- Feminine Hygiene Products Market, by Material

- Feminine Hygiene Products Market, by Packaging Type

- Feminine Hygiene Products Market, by Distribution Channel

- Feminine Hygiene Products Market, by Region

- Feminine Hygiene Products Market, by Group

- Feminine Hygiene Products Market, by Country

- United States Feminine Hygiene Products Market

- China Feminine Hygiene Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Perspectives on Navigating the Future of Feminine Hygiene Through Strategic Innovation, Sustainability, and Regulatory Foresight

The feminine hygiene market stands at the convergence of consumer empowerment, sustainability imperatives, and dynamic regulatory landscapes. Companies that embrace material innovation, from organic cotton to next-generation biodegradable polymers, will differentiate themselves in a crowded field. Digital platforms, paired with subscription-based conveniences, will continue to redefine engagement, offering real-time insights that feed back into product development and marketing strategies.

In parallel, regulatory momentum around ingredient disclosure and chemical safety is reshaping supply chains and compelling greater transparency. Firms that proactively align with emerging state-level bans on PFAS and other harmful substances will earn consumer trust and preempt compliance risks. Regional market variations, from the e-commerce-driven Americas to the heavily regulated EMEA and high-growth Asia-Pacific, necessitate nimble, localized approaches that respect cultural nuances and distribution dynamics.

Looking ahead, collaboration across the value chain-between established multinationals and innovative challengers-will drive the next wave of product excellence. This cooperative spirit, underpinned by rigorous research and stakeholder engagement, will unlock new pathways for sustainable growth and ensure that feminine hygiene remains at the forefront of health, well-being, and environmental stewardship.

Empowering Decision Makers to Access In Depth Market Intelligence and Connect with Ketan Rohom for Your Customized Research Needs

Don’t miss the opportunity to gain unparalleled insights into the dynamic feminine hygiene market. Contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to obtain a comprehensive customized report tailored to your strategic objectives and unlock data-driven decision-making today!

- How big is the Feminine Hygiene Products Market?

- What is the Feminine Hygiene Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?