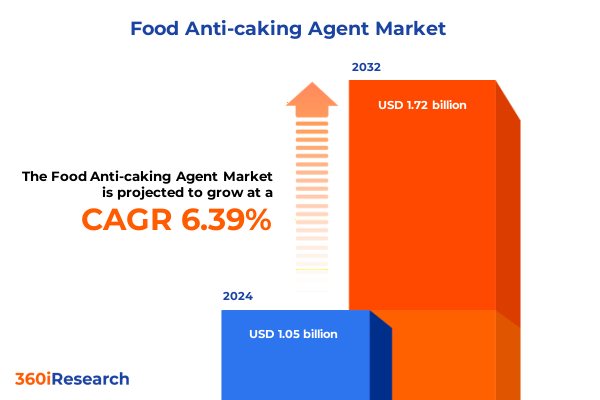

The Food Anti-caking Agent Market size was estimated at USD 1.10 billion in 2025 and expected to reach USD 1.17 billion in 2026, at a CAGR of 6.52% to reach USD 1.72 billion by 2032.

Exploring the Fundamental Roles, Safety Protocols, and Regulatory Frameworks Shaping the Adoption of Anti-Caking Agents in Food Manufacturing Worldwide

Anti-caking agents play a critical role in maintaining the flowability, stability, and overall quality of powdered and granulated food products. By mitigating moisture absorption and preventing particle agglomeration, these ingredients ensure consistent texture, precise dosing, and extended shelf life. Beyond their functional advantages, evolving regulatory frameworks and intensified consumer scrutiny of ingredient provenance have elevated the strategic significance of anti-caking agents in modern food manufacturing processes.

Recent shifts toward clean-label initiatives and sustainability mandates have prompted formulators to explore naturally derived compounds, driving an innovation cycle that balances efficacy with consumer preferences. Meanwhile, analytical methods and safety testing protocols have become more rigorous, requiring manufacturers to demonstrate compliance with stringent food safety standards. In this context, a comprehensive understanding of ingredient sources, performance characteristics, and regulatory parameters is essential for stakeholders aiming to optimize formulations and safeguard product integrity.

Analyzing Technological Innovations, Consumer Preferences, and Sustainability Mandates Redefining the Anti-Caking Agent Landscape in Food Applications

The food ingredients industry is experiencing transformative shifts as technological advancements unlock new functionalities for anti-caking agents. Novel microencapsulation techniques are enhancing moisture resistance, while surface-modified silica variants deliver improved free-flow properties under extreme environmental conditions. Simultaneously, the rise of plant-based dietary trends has spurred demand for naturally sourced cellulose derivatives and mineral-based compounds that complement clean-label positioning.

In addition to formulation innovations, heightened sustainability expectations are driving process optimization across supply chains. Manufacturers are investing in low-impact extraction methods and renewable feedstocks to reduce carbon footprints and align with corporate social responsibility goals. Regulatory agencies are also adapting compliance requirements to reflect emerging science, deploying advanced spectroscopic testing to monitor purity and detect potential contaminants. Collectively, these trends are redefining the competitive landscape and compelling ingredient suppliers to demonstrate both technical leadership and environmental stewardship.

Evaluating the Cumulative Consequences of 2025 United States Tariff Adjustments on Anti-Caking Agent Sourcing and Cost Structures

The implementation of heightened United States import tariffs in early 2025 has exerted cumulative pressures on the sourcing and logistics of key anti-caking agents. Commodities such as silica and magnesium carbonate, traditionally imported from select international producers, have seen cost structures shift as import duties compound with freight inflation and supply chain bottlenecks. These dynamics have led manufacturers to reevaluate supplier dispersion and negotiate long-term agreements to stabilize raw material availability.

Moreover, regional supply diversification strategies have emerged, with companies exploring domestic production of specialized calcium compounds and cellulose derivatives to offset elevated landed costs. While short-term margin compression has challenged certain market participants, collaborative initiatives between formulators and logistics providers are fostering innovative distribution models. These adaptive measures highlight the industry’s resilience and underscore the importance of proactive tariff mitigation planning in a landscape where trade policies continually evolve.

Deriving Strategic Insights Through Granular Analysis of Market Segmentation Dimensions and Ingredient Specializations in Anti-Caking Agents

A nuanced exploration of segmentation dimensions reveals distinct performance and procurement considerations. By type, calcium compounds excel in high-moisture systems yet require precise pH management, whereas cellulose derivatives deliver clean-label appeal with robust oil absorption capacity. Magnesium carbonate offers rapid desiccation benefits in dry blends, while silica remains the benchmark for superior flow control across diverse humidity ranges. Transitioning between granules and powder forms further influences handling characteristics, with granules facilitating reduced dust generation and powders enhancing blend uniformity under automated dosing systems.

Distribution channels shape accessibility and value delivery, with modern trade outlets offering premium-grade ingredients supported by extended logistics networks, while conventional trade continues to serve regional formulators through bulk packaging models. The rise of e-commerce platforms introduces direct-to-manufacturer options that streamline procurement cycles and enable small-batch innovation. Across applications, agents tailored for bakery and confectionery must balance moisture control with textural integrity, whereas formulations for dairy and beverages demand rapid dispersion and inert sensory profiles. Ready meals and seasonings call for targeted desiccation performance, and specialized grades for supplements underscore the need for pharmaceutical-grade purity. Finally, engagement with food and beverage manufacturers emphasizes scale and consistency, while food service operators prioritize operational simplicity and shelf-stable ingredient portfolios.

This comprehensive research report categorizes the Food Anti-caking Agent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End User

- Distribution Channel

Uncovering Regional Dynamics and Competitive Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Anti-Caking Agent Markets

Regional market dynamics are shaped by diverse regulatory frameworks, consumer behaviors, and supply chain infrastructures. In the Americas, advanced production capabilities and robust distribution networks support domestic cellulose extraction and silica processing, enabling local formulators to capitalize on rapid product development cycles. Meanwhile, cross-border logistics within North America facilitate just-in-time delivery models that reduce inventory burdens.

Within Europe, the Middle East, and Africa, regulatory harmonization efforts and evolving food safety directives influence ingredient certification requirements, prompting suppliers to secure multiple regulatory clearances. Consumer demand for clean-label formulations in Western Europe has outpaced growth in neighboring regions, while emerging markets in the Middle East and Africa are characterized by escalating investments in local manufacturing capacities. In Asia-Pacific, the convergence of population-driven consumption increases and specialized ingredient innovations has positioned the region as both a leading consumer and exporter of anti-caking agents. Strategic partnerships between local producers and multinational corporations are catalyzing technology transfer and capacity expansion to meet the nuanced needs of diverse culinary cultures.

This comprehensive research report examines key regions that drive the evolution of the Food Anti-caking Agent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Growth and Differentiation in the Global Anti-Caking Agent Industry

Leading ingredient suppliers are leveraging proprietary research platforms and collaborative consortia to drive differentiation. Global diversified agribusiness entities invest in multifunctional calcium and cellulose grades that balance cost efficiency with performance sustainability, while specialty chemical corporations prioritize the development of surface-treated silica with enhanced compatibility in complex matrices. Strategic partnerships between logistics firms and raw material producers are streamlining supply continuity, and selective acquisitions have enabled expanded geographic footprints, particularly in high-growth Asia-Pacific markets.

Innovative startups focusing on bio-derived anti-caking solutions are gaining traction through pilot programs with foodservice operators and boutique manufacturers, demonstrating the potential for fermentation-based cellulose analogues and mineral composites derived from agricultural byproducts. Through targeted alliances with academic institutions and government research agencies, these companies are validating efficacy parameters under stringent regulatory conditions. Collectively, the competitive landscape reflects a blend of legacy scale advantages and agile niche players, all converging on the shared objective of delivering safe, effective, and sustainable anti-caking technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Anti-caking Agent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Dairy Cooperative

- Alsiano A/S

- Archer-Daniels-Midland Company

- Astrra Chemicals

- BASF SE

- Batory Foods

- Bimal Pharma Pvt. Ltd.

- Brenntag SE

- Cabot Corporation

- Cargill, Incorporated

- CD Formulation

- Evonik Industries AG

- Foodchem International Corporation

- Godavari Biorefineries Ltd.

- Great American Spice Company

- Hefei TNJ Chemical Industry Co.,Ltd.

- Hydrite Chemical Co.

- ICL Group

- JELU-WERK J. Ehrler GmbH & Co. KG

- Konoshima Chemical Co.,Ltd.

- Merck KGaA

- Omya International AG

- ORLEN S.A.

- PPG Industries, Inc.

- PQ Corporation

- RIBUS Inc.

- Sigachi lndustries Limited

- Solvay S.A.

- Sweetener Supply Corporation

- Tata Chemicals Ltd.

- Vinipul Inorganics Pvt. Ltd.

- W. R. Grace and Company

- Wacker Chemie AG

Implementing Proactive Strategies and Collaborative Initiatives to Enhance Supply Chain Resilience and Innovation in Anti-Caking Agent Production

Industry leaders should prioritize supply chain diversification to mitigate geopolitical and tariff-related disruptions, exploring alternative sourcing pathways for critical ingredients such as magnesium carbonate and silica. Integrating predictive analytics into procurement workflows can enhance visibility into cost variability and delivery timelines, enabling proactive inventory adjustments. Concurrently, fostering collaborative research initiatives with academic laboratories will accelerate the development of plant-based and fermentation-derived anti-caking agents, aligning product portfolios with evolving clean-label preferences.

Furthermore, establishing cross-functional task forces that include regulatory, sustainability, and technical experts will streamline the adaptation of emerging compliance requirements into product development pipelines. Digitalizing quality assurance processes through real-time spectroscopic monitoring and blockchain-enabled traceability can reinforce consumer trust and expedite audits. By embedding these strategies into corporate roadmaps, companies will strengthen operational resilience, optimize ingredient performance, and create differentiated value propositions in an increasingly competitive environment.

Detailing Rigorous Research Design, Data Collection Protocols, and Analytical Techniques Underpinning the Anti-Caking Agent Market Study

This study employs a mixed-methods research design, combining qualitative interviews with industry participants, including formulators, procurement specialists, and regulatory authorities, to capture firsthand perspectives on ingredient performance and compliance challenges. Secondary analysis draws on peer-reviewed scientific journals, trade association publications, and publicly available regulatory documents to contextualize technical developments and legislative trends. Supply chain mapping exercises were conducted to identify key material flows, processing nodes, and logistical constraints affecting anti-caking agent distribution.

Analytical techniques integrate comparative performance benchmarking under simulated handling and humidity conditions, supplemented by case study evaluations of diverse application scenarios ranging from confectionery blends to powdered beverage systems. Data triangulation ensures the validity of insights, with cross-referencing between primary interview findings and secondary literature preventing bias. Throughout the research process, adherence to industry-standard ethical guidelines and data privacy protocols maintained the confidentiality of proprietary information while preserving analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Anti-caking Agent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Anti-caking Agent Market, by Type

- Food Anti-caking Agent Market, by Form

- Food Anti-caking Agent Market, by Application

- Food Anti-caking Agent Market, by End User

- Food Anti-caking Agent Market, by Distribution Channel

- Food Anti-caking Agent Market, by Region

- Food Anti-caking Agent Market, by Group

- Food Anti-caking Agent Market, by Country

- United States Food Anti-caking Agent Market

- China Food Anti-caking Agent Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Imperatives Illuminating Future Opportunities in the Evolving Anti-Caking Agent Sector

In synthesizing core findings, it is evident that anti-caking agents remain indispensable for ensuring product quality across a myriad of food applications. The interplay between technological innovation, regulatory evolution, and shifting consumer expectations has created both challenges and opportunities, compelling stakeholders to adopt proactive strategies and embrace collaboration. Evolving tariff landscapes and regional regulatory diversities further underscore the necessity for agile supply chain management and informed procurement decisions.

Looking forward, the convergence of sustainability imperatives and clean-label demands will continue to drive the adoption of naturally derived and low-impact anti-caking solutions. Companies that successfully integrate advanced data analytics, supply network transparency, and cross-sector partnerships will be best positioned to capture emerging opportunities. Ultimately, a holistic approach that unites technical excellence with strategic foresight will define the next era of growth and differentiation in the anti-caking agent sector.

Connect with Ketan Rohom to Secure Comprehensive Anti-Caking Agent Market Insights and Enhance Strategic Decision-Making for Your Organization

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access an unrivaled market research report that delves deep into anti-caking agent innovations, regulatory trajectories, and competitive dynamics. Partnering with Ketan will empower your organization to harness strategic insights that drive process optimization, supply chain resilience, and product innovation through a comprehensive understanding of ingredient functionalities and stakeholder expectations.

By collaborating with Ketan, you will gain personalized guidance on integrating the report’s findings into your business strategy, ensuring that new product formulations align with emerging regulatory frameworks and consumer trends. Reach out now to transform data into actionable initiatives, strengthen collaboration with raw material suppliers, and position your company at the forefront of excellence in the food ingredients sector. Secure your copy today to accelerate decision-making, reduce risk, and capture opportunities in this rapidly evolving landscape.

- How big is the Food Anti-caking Agent Market?

- What is the Food Anti-caking Agent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?