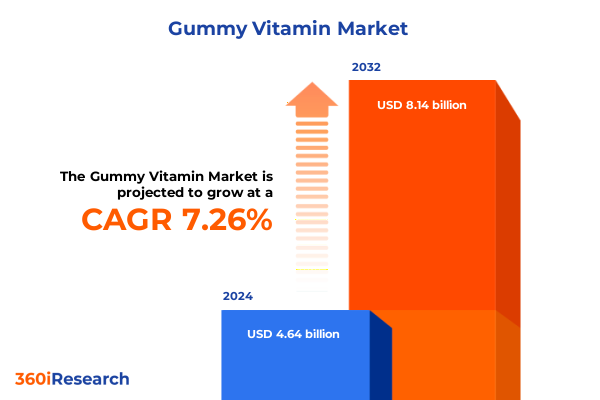

The Gummy Vitamin Market size was estimated at USD 4.96 billion in 2025 and expected to reach USD 5.30 billion in 2026, at a CAGR of 7.33% to reach USD 8.14 billion by 2032.

Exploring the Evolution and Rising Popularity of Gummy Vitamins as a Mainstay in Contemporary Health and Wellness Regimens

Over the past decade, gummy vitamins have surged in popularity as a palatable, convenient, and enjoyable alternative to traditional tablets and capsules. Fueled by a broader shift toward preventive health and wellness, these chewable supplements have captured the attention of consumers seeking a more engaging supplement experience. Today’s gummy vitamins cater to a wide array of nutritional needs, spanning essential nutrients, herbal extracts, probiotics, and specialty blends. This evolution reflects growing consumer demands for products that balance efficacy, taste, and form factor, reinforcing the role of gummy vitamins as a mainstream category within the broader dietary supplement market.

This executive summary presents a structured overview of the pivotal forces reshaping the gummy vitamin landscape. It begins by identifying the key transformative shifts in consumer behavior, formulation technologies, and retail ecosystems. Next, the analysis examines the cumulative impact of the 2025 United States tariffs on ingredient sourcing, manufacturing costs, and supply chain resilience. We then reveal segmentation insights across product type, sales channel, age group, and ingredient source, followed by a regional deep dive into the Americas, Europe, Middle East & Africa, and Asia-Pacific dynamics. The summary concludes by highlighting leading company strategies and actionable recommendations for industry leaders, outlining our rigorous research methodology, and offering a path for stakeholders to access the full market report. By synthesizing these insights, this summary equips decision-makers with the clarity and direction needed to navigate a rapidly evolving market environment.

Unpacking the Key Transformative Shifts Driving Innovation and Consumer Behavior in the Gummy Vitamin Landscape

The gummy vitamin sector has experienced a series of transformative shifts driven by converging trends in consumer expectations, scientific innovation, and retail disruption. At the forefront, personalization has emerged as a defining theme: consumers increasingly seek tailored formulations that address individual health goals rather than one-size-fits-all products. This demand has propelled manufacturers to explore data-driven customization platforms that enable shoppers to select ingredients, dosages, and flavor profiles aligned with their unique wellness objectives. As a result, the gummy format has evolved beyond basic multivitamins to include targeted solutions for digestive health, immune support, cognitive function, and stress management.

In parallel, advances in formulation technology have unlocked new possibilities for ingredient stability and bioavailability. Encapsulation techniques, pH-sensitive coatings, and novel excipients now allow heat-sensitive nutrients, live probiotic cultures, and herbal actives to retain efficacy within a chewable matrix. These innovations have expanded the palette of ingredients that can be incorporated into gummy formats, elevating the category’s functional claims and therapeutic appeal. Meanwhile, sustainability considerations-ranging from plant-based gelling agents and natural colorants to eco-friendly packaging-are transforming production practices and shaping brand narratives. Finally, the rise of omnichannel retail models, including direct-to-consumer subscriptions, social commerce, and experiential pop-up activations, underscores the sector’s dynamic evolution and reinforces the need for agility in both marketing and logistics.

Assessing the Multifaceted Effects of 2025 United States Tariffs on Ingredient Sourcing Manufacturing Costs and Supply Chain Resilience

In 2025, the United States government implemented new tariff measures targeting key raw materials and finished gummy vitamin imports, a policy shift with far-reaching consequences. Ingredient sourcing represents the most acute challenge: manufacturers that rely on overseas suppliers of gelatin, pectin, botanical extracts, and specialty nutrients faced steep cost increases, prompting many to explore alternative origins or substitute inputs. This reorientation has fostered nearshoring initiatives, as domestic producers and North American trade partners have stepped in to bridge gaps, albeit often at a premium.

At the manufacturing level, plants encountered rising operational expenditures due to both higher material expenses and tariff-induced complexities in customs clearance. Small and mid-sized producers, in particular, have absorbed a disproportionate share of these burdens, leading some to renegotiate supplier contracts or adjust product formulations to maintain price parity. From a supply chain perspective, the tariffs have accelerated efforts to enhance visibility and resilience. Industry players are investing in digital tools for real-time tracking, expanding buffer inventories, and diversifying logistics routes to mitigate potential disruptions. Ultimately, the cumulative effect of these policy changes has been a recalibration of cost structures and strategic sourcing models, compelling stakeholders to adopt more flexible, transparent, and locally anchored approaches to sustain competitive positioning.

Revealing Actionable Market Segmentation Insights Based on Product Type Sales Channel Age Demographics and Ingredient Source

An in-depth segmentation analysis reveals nuanced patterns that industry stakeholders can leverage for targeted growth initiatives. When considering product type, the market spans herbal extracts, minerals, multi vitamins, probiotics, and single vitamins, with the latter group encompassing categories such as B complex, vitamin C, and vitamin D. Each subsegment exhibits distinct consumer motivations: botanical gummy formulations often appeal to wellness enthusiasts exploring adaptogenic or herbal benefits, whereas single vitamins address specific nutrient deficiencies and preventive health routines.

Evaluating sales channels uncovers further complexity. Convenience stores, online retail outlets, pharmacy and drug stores, specialty stores, and supermarkets shape the distribution landscape. Within e-commerce, direct brand websites coexist alongside large e-commerce platforms, offering diverse consumer touchpoints. Similarly, pharmacy channels differentiate between chain banners and independent operators, each with unique merchandising strategies and loyalty programs. Shifting to consumer demographics, adults, children, prenatal, and seniors present differentiated opportunities. The children’s segment subdivides into toddlers, teenagers, and youth, while the seniors cohort comprises baby boomers and the silent generation, each bracket reflecting varying health priorities and flavor preferences. Lastly, ingredient source distinguishes between natural and synthetic origins. Natural offerings draw from fruit-based or plant-based ingredients to align with clean-label trends, whereas synthetic formulations rely on lab-synthesized compounds to ensure consistency and potency. By weaving these segmentation dimensions together, companies can precisely tailor product development, marketing messaging, and channel strategies to resonate with defined consumer cohorts.

This comprehensive research report categorizes the Gummy Vitamin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Source

- Age Group

- Sales Channel

Analyzing Regional Dynamics and Consumer Preferences Shaping the Gummy Vitamin Market Across Major Global Territories

Regional dynamics exert a profound influence on consumer tastes, regulatory landscapes, and competitive intensity within the gummy vitamin market. In the Americas, strong demand for immune-support and functional wellness formulations coexists alongside robust direct-to-consumer ecosystems. North American consumers demonstrate a willingness to invest in premium gummy formats that boast transparent ingredient sourcing and clinically backed claims, while Latin American markets are characterized by a growing middle class eager to embrace Western supplement trends and digital purchasing channels.

Across Europe, the Middle East, and Africa, regulatory frameworks vary widely, shaping product innovation and market entry pathways. European consumers have embraced clean-label and vegan formulations, driving adoption of plant-based gelling agents and natural colorants. The Middle East exhibits high demand for prenatal and children’s formulations, supported by healthcare partnerships, whereas Africa’s market remains nascent yet promising, with rising urbanization and increasing physician endorsements. In the Asia-Pacific region, traditional herbal ingredients such as ginseng and ashwagandha integrate with modern gummy delivery, appealing to both younger demographics and legacy consumers. Digital ecosystems in major Asia-Pacific economies-from super-apps in Southeast Asia to e-commerce giants in China-play a pivotal role in consumer engagement and rapid product launches, underscoring the need for agile market entry strategies.

This comprehensive research report examines key regions that drive the evolution of the Gummy Vitamin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Company Strategies Partnerships Product Innovations and Competitive Positioning in the Gummy Vitamin Sector

Leading companies in the gummy vitamin space are deploying multifaceted strategies to strengthen their market foothold and respond to evolving consumer demands. Top-tier manufacturers are forging partnerships with biotech firms to integrate advanced encapsulation technologies, ensuring enhanced nutrient stability and targeted release profiles. Simultaneously, several firms have invested in proprietary flavor development platforms, collaborating with culinary experts to craft unique taste experiences that differentiate their portfolios in crowded retail shelves and online marketplaces.

Strategic alliances with e-commerce leaders and subscription-based platforms have enabled brands to secure premium shelf space and drive recurring revenue streams. In parallel, certain players have accelerated mergers and acquisitions, acquiring niche supplement lines to expand their functional offerings in areas such as digestive health and cognitive support. Investment in in-house regulatory and quality assurance teams has also emerged as a competitive necessity, as stringent compliance standards and consumer scrutiny of label claims intensify. Ultimately, the companies that adeptly blend technological innovation, supply chain agility, and consumer-centric marketing stand to capture disproportionate gains and build lasting brand loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gummy Vitamin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bayer AG

- Boscogen Inc.

- Church & Dwight Co., Inc.

- EMF Inc.

- GlaxoSmithKline PLC

- Gummi World

- Herbaland USA

- Hero Nutritionals LLC

- Ion Labs, Inc.

- Life Science Nutritionals Inc.

- Makers Nutrition LLC

- Makers Nutrition, LLC

- Nestlé S.A.

- Nutra Solutions USA

- Pfizer, Inc.

- Pharmavite LLC

- Procaps Group

- Rainbow Light

- Santa Cruz Nutritionals Inc.

- SmartyPants Vitamins, Inc.

- Supplement Manufacturing Partner

- The Honest Company, Inc.

- Unilever PLC

- Well Aliments

- Zanon USA, Inc.

Proposing Actionable Strategic Recommendations to Drive Growth Enhance Competitiveness and Foster Sustainability in the Gummy Vitamin Industry

To thrive in an increasingly competitive and complex environment, industry leaders should adopt a series of actionable strategies. First, diversifying ingredient sourcing through a blend of domestic and nearshore partnerships can mitigate tariff exposure and enhance supply resilience. By fostering relationships with multiple suppliers across different geographies, companies can secure critical inputs while maintaining cost control.

Second, elevating digital engagement through personalized e-commerce experiences, subscription model optimization, and data-driven CRM initiatives will deepen consumer loyalty and unlock incremental revenue channels. Seamless integration of mobile apps, chatbots, and social commerce features can further reinforce brand affinity and streamline the path to purchase. Third, committing to clean-label and sustainability practices-such as plant-based gelling agents, recyclable packaging, and transparent traceability-will resonate with environmentally conscious consumers and preempt tightening regulatory requirements. In addition, investing in ongoing clinical research partnerships and publishing third-party validations will bolster credibility and justify premium positioning. By orchestrating these initiatives in concert-balancing cost efficiency with innovation-leaders can position their organizations for sustainable growth and competitive differentiation.

Outlining Rigorous Research Methodology Data Collection Analytical Framework and Validation Processes Underpinning the Market Insights

Our research methodology integrates qualitative and quantitative approaches to ensure robustness and reliability of insights. We commenced with an exhaustive secondary research phase, reviewing trade publications, regulatory filings, patent databases, and technical journals to map the competitive landscape and identify emerging formulation technologies. This was followed by primary interviews with industry executives, formulation scientists, supply chain experts, and key distributors, offering firsthand perspectives on challenges, opportunities, and best practices.

To validate hypotheses, we administered structured surveys targeting consumers across demographic cohorts, capturing attitudes, purchase behaviors, and unmet needs. Data triangulation was achieved by cross-referencing survey findings with point-of-sale analytics, e-commerce platform metrics, and financial reports. A proprietary scoring model was employed to assess supplier reliability, tariff risk exposure, and innovation potential. Finally, all findings underwent peer review and quality assurance checks to ensure analytical rigor and eliminate biases. This comprehensive approach underpins the confidence and precision of our market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gummy Vitamin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gummy Vitamin Market, by Product Type

- Gummy Vitamin Market, by Ingredient Source

- Gummy Vitamin Market, by Age Group

- Gummy Vitamin Market, by Sales Channel

- Gummy Vitamin Market, by Region

- Gummy Vitamin Market, by Group

- Gummy Vitamin Market, by Country

- United States Gummy Vitamin Market

- China Gummy Vitamin Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings from Market Drivers Consumer Trends Supply Chain Dynamics and Competitive Landscapes into a Cohesive Narrative

In conclusion, the gummy vitamin market stands at a pivotal juncture defined by rapid innovation, shifting consumer expectations, and evolving policy landscapes. The rise of personalized and functional formulations has enlarged the opportunity set, while advancements in ingredient technology have expanded the range of viable active ingredients. However, the recently implemented tariffs have introduced friction into global supply chains and elevated production costs, necessitating adaptive sourcing strategies and heightened supply chain transparency.

Segmentation analysis underscores the importance of tailoring product portfolios and channel strategies to distinct consumer cohorts, whether through single-vitamin offerings, specialty herbal blends, or targeted probiotic gummies. Regional insights reveal that nuanced regulatory environments and varied consumer preferences will reward companies that customize their approaches to local market dynamics. Leading firms are responding through strategic partnerships, technological investments, and premium positioning, while actionable recommendations emphasize supply diversification, digital engagement, sustainability commitments, and clinical validation. By synthesizing these critical findings, stakeholders can chart a clear path forward and capitalize on the sector’s growth potential with confidence.

Engaging with Ketan Rohom to Access Comprehensive Gummy Vitamin Market Research and Empower Your Strategic Decision Making Today

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the comprehensive gummy vitamin market research report. Ketan brings deep expertise in translating complex industry insights into actionable strategies that drive growth and competitive advantage. By reaching out directly, you will receive personalized guidance on how to leverage the latest data on consumer preferences, supply chain shifts, and regulatory impacts to shape your product roadmap and investment decisions.

Secure your organization’s strategic edge by arranging a consultation with Ketan today. He will walk you through key findings, tailor the report’s implications to your unique business objectives, and outline next steps for implementation. Don’t miss this opportunity to align your strategy with the most robust and current market intelligence available. Contact Ketan Rohom now to purchase the full gummy vitamin market research report and empower your team with the insights needed to outperform in an increasingly competitive landscape.

- How big is the Gummy Vitamin Market?

- What is the Gummy Vitamin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?