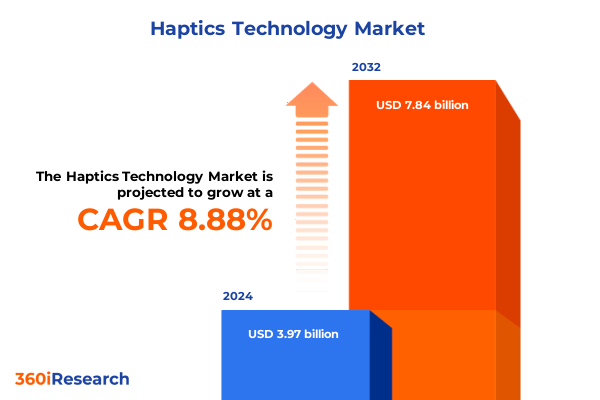

The Haptics Technology Market size was estimated at USD 6.14 billion in 2025 and expected to reach USD 6.66 billion in 2026, at a CAGR of 8.77% to reach USD 11.07 billion by 2032.

Uncover the Foundations of Haptics Technology and Its Role in Shaping Immersive Experiences Across Gaming, Healthcare, Automotive, and Industrial Applications

The emergence of haptics technology has transformed the way humans interact with digital environments by introducing tactile sensations that bridge the physical and virtual worlds. At its core, haptics integrates actuators, sensors, and software to simulate touch, pressure, and texture, creating immersive experiences that extend beyond visual and auditory stimuli. From nuanced vibrations in mobile devices to force feedback in advanced surgical robots, haptic interfaces are redefining human–machine interaction by making digital processes more intuitive, engaging, and accessible.

Technological breakthroughs in electroactive polymers, piezoelectric materials, and high-resolution motion sensors have accelerated the refinement of haptic feedback systems. These materials offer greater responsiveness and energy efficiency, while miniature controllers and cloud-based software platforms enable real-time adaptation and personalization. Consequently, industries such as gaming, automotive, healthcare, and industrial automation are rapidly incorporating haptics to enhance user experiences, improve safety, and unlock novel applications that were previously unattainable through visual or auditory channels alone.

Looking ahead, the integration of artificial intelligence and machine learning promises to elevate haptics by enabling predictive feedback patterns based on user behavior, environmental context, and application-specific requirements. This convergence of technologies underscores the strategic importance of understanding the evolving haptics landscape, identifying key drivers of adoption, and mapping out the competitive dynamics that will shape the next generation of interactive systems.

Explore the Dramatic Shifts in Haptics Technology Landscape Driven by Advancements in Materials Science, AI Integration, and Cross-Industry Collaboration

Recent advancements in haptics technology have catalyzed transformative shifts by merging materials science innovations with sophisticated software algorithms. Electroactive polymers now offer flexible surface actuation, allowing wearables and garments to deliver subtle tactile cues, while electromagnetic actuators have become more compact and energy-efficient, enabling seamless integration into consumer electronics. Paired with high-precision motion sensors and adaptive controllers, these hardware improvements have given rise to multitiered feedback systems that accurately replicate real-world touch sensations.

Moreover, the convergence of artificial intelligence with haptic feedback systems has unlocked new dimensions of interactivity. In automotive design, machine-learning algorithms calibrate actuator responses based on driver behavior patterns, enhancing safety alerts without causing distraction. In healthcare, AI-driven platforms interpret sensor data from rehabilitation equipment to adjust therapy regimens in real time, improving patient outcomes. This synergy between AI and haptics is fostering unprecedented customization, where personal preferences and usage contexts inform dynamic feedback profiles.

Cross-industry collaborations are further accelerating innovation by uniting expertise in robotics, software development, and sensor engineering. Joint ventures between tech firms and automotive OEMs have resulted in advanced driver assistance systems that leverage tactile alerts to warn drivers of lane departures. In industrial training, partnerships with simulation specialists now deliver haptic-enabled virtual reality modules for employee skills development. These collaborative efforts are not only driving rapid commercialization but also establishing the interoperability standards necessary for scalable haptics deployment across diverse application domains.

Analyze the Cumulative Impact of 2025 United States Tariffs on Haptics Technology Supply Chains, Component Costs, and Strategic Sourcing Decisions Across Industries

In 2025, the United States enacted a series of tariffs targeting the import of haptic components, particularly those sourced from major Asian suppliers. These duties, which range up to 25% on select actuators and sensors, have created significant cost pressures across supply chains. Manufacturers that previously relied on cost-effective imports are recalibrating sourcing strategies to mitigate tariff impacts, while some have accelerated efforts to diversify production locales to regions with favorable trade agreements.

The imposition of tariffs has also sparked strategic reconsiderations regarding vertical integration. Several leading actuator producers are evaluating in-house sensor development and controller assembly to retain greater control over input costs and production timelines. This shift toward localized manufacturing and assembly has introduced operational challenges, including the need to establish new quality assurance protocols and to upskill local labor forces. Nonetheless, these measures are expected to bolster long-term resilience by reducing dependency on external suppliers vulnerable to trade policy fluctuations.

Beyond direct component costs, tariff-driven supply disruptions have prompted downstream stakeholders to explore alternative materials and design architectures. For instance, developers of piezoelectric actuators are experimenting with hybrid material blends to lower reliance on tariffed imports, while software teams are optimizing haptic rendering algorithms to achieve comparable performance with lower force outputs. Collectively, these responses illustrate how trade policies are reshaping the competitive landscape, nudging the haptics industry toward greater supply chain robustness and innovation in component-level design.

Unveil Critical Segmentation Insights Spanning Components, Technology Types, Connectivity Options, Applications, and End Users in the Haptics Market

Insight into haptics technology segmentation reveals that each layer-from core hardware components to application contexts and end users-presents distinct value drivers and technical challenges. Component analysis encompasses actuators, controllers, sensors, and software, with actuator research focusing on electroactive polymers, electromagnetic, piezoelectric, and pneumatic variants that offer diverse force, frequency, and energy profiles. Sensor technologies integrate motion detection, pressure quantification, and touch sensitivity, while controller platforms and software engines orchestrate precise feedback timing and intensity.

Technology-wise, haptics splits into force-based systems, which generate directional push or pull sensations for applications like surgical simulators, and tactile solutions, which deliver surface-level vibrations or texture cues common in wearables and mobile devices. Connectivity further differentiates the ecosystem into wired devices that prioritize stable, low-latency feedback for professional applications, and wireless devices that emphasize user mobility in consumer and gaming contexts.

Application segmentation spans automotive interfaces-where advanced driver assistance alerts and infotainment controls leverage haptic cues-to consumer electronics segments including gaming consoles, smartphones, tablets, and wearable gadgets that rely on nuanced vibrations for immersive user engagement. The healthcare domain employs haptics in medical devices for precise tool manipulation and in rehabilitation equipment for guided therapy, while industrial uses range from robotics that feel and respond to environmental changes to virtual reality training modules that simulate hands-on tasks. Finally, end-user delineation between aftermarket solutions and OEM integrations underscores divergent procurement cycles, customization requirements, and service-level expectations.

This comprehensive research report categorizes the Haptics Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology Type

- Connectivity

- Interface Form Factor

- Application

- End User

Reveal How Regional Dynamics Shape Haptics Technology Adoption in the Americas, Europe Middle East and Africa, and Asia-Pacific Through Varied Industry Requirements

Regional dynamics play a pivotal role in shaping haptics technology adoption, with distinct drivers emerging across the Americas, Europe Middle East and Africa, and Asia-Pacific territories. In the Americas, consumer demand for enhanced gaming experiences and the rapid uptake of touchscreen interfaces drive strong interest in advanced actuators and immersive feedback modules. The robust automotive manufacturing base further amplifies demand for haptic-enabled driver alerts and infotainment controls, fostering partnerships between technology vendors and OEMs.

Conversely, Europe Middle East and Africa regions emphasize rigorous safety and regulatory compliance, particularly in medical and automotive sectors. Strict standards for medical device certification have led to the development of high-precision force haptic systems for surgical simulations and patient rehabilitation. Meanwhile, automotive haptic controls are meticulously designed to meet EU and regional safety directives, encouraging collaboration between component suppliers and regulatory bodies to ensure seamless integration.

Asia-Pacific stands out as both a manufacturing powerhouse and a rapidly expanding consumer market for haptics-enabled devices. High-volume production capabilities in countries such as China, South Korea, and Japan support cost-effective scaling of sensors and actuators, while an innovation-driven culture in regional tech hubs accelerates the development of novel tactile applications in smartphones, gaming hardware, and wearable electronics. In addition, growing investments in industrial automation and virtual reality training across the region underscore a rising appetite for integrated haptic solutions that enhance operational productivity.

This comprehensive research report examines key regions that drive the evolution of the Haptics Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight Leading Haptics Technology Innovators and Strategic Collaborations That Are Shaping the Future of Actuators, Sensors, and Software Platforms

The haptics technology market is driven by a cohort of innovators that span established electronics conglomerates and agile startups. Leading component manufacturers continue to push the boundaries of actuator efficiency and sensor sensitivity through targeted research collaborations and strategic acquisitions. These firms frequently partner with software developers to refine haptic rendering engines, ensuring seamless integration with popular operating systems and vertical application platforms.

At the same time, emerging companies specializing in mid-air haptic projection and wearable tactile devices have garnered attention by introducing disruptive form factors and novel interaction paradigms. Their rapid prototyping capabilities and customer-centric design approaches enable them to address niche market needs, such as gesture-based control interfaces and personalized feedback profiles. Collaborations between these agile disruptors and incumbent players foster cross-pollination of ideas, accelerating time to market for integrated solutions.

Furthermore, technology alliances and industry consortia are facilitating the development of unified communication protocols and interoperability standards. These cooperative efforts aim to lower barriers to adoption by ensuring that haptic peripherals and applications can function seamlessly across diverse hardware ecosystems. As ecosystem maturity progresses, strategic partnerships between component vendors, software houses, and end-user organizations will remain critical to driving widespread commercialization and scaling high-value haptic use cases.

This comprehensive research report delivers an in-depth overview of the principal market players in the Haptics Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Immersion Corporation

- AAC Technologies Holdings Inc.

- Texas Instruments Inc.

- HaptX Inc.

- Ultraleap Limited

- Cirrus Logic, Inc.

- Synaptics Incorporated

- Microchip Technology Incorporated

- Infineon Technologies AG

- TDK Corporation

- Johnson Electric Holdings Limited

- Alps Alpine Co., Ltd.

- Boréas Technologies Inc.

- Haption SAS

- 3D Systems, Inc.

- Analog Devices, Inc.

- D-BOX Technologies Inc.

- Elara Systems, Inc.

- Force Dimension

- KEMET by Yageo Corporation

- Merkel Haptic Systems Pvt Ltd.

- Meta Platforms, Inc

- Microchip Technology Inc.

- Nokia Corporation

- Razer Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Tactical Haptics, Inc.

- Tanvas, Inc.

Drive Advantage with Actionable Strategic Recommendations for Industry Leaders Seeking to Leverage Haptics in Automotive, Healthcare, and Consumer Electronics

Industry leaders seeking to harness the potential of haptics technology should prioritize deep collaboration across hardware, software, and end-user segments to deliver seamless value propositions. By embedding iterative user testing and feedback loops into product development cycles, organizations can refine haptic profiles that resonate with target audiences and create differentiated experiences. This customer-centric approach reduces time to market and enhances product stickiness.

Investing in supply chain resilience is equally critical amid volatile trade policies and component shortages. Companies should explore dual sourcing strategies that leverage diversified manufacturing hubs and flexible contractual frameworks. At the same time, cultivating in-house expertise in materials engineering and software integration will provide greater control over quality benchmarks and innovation velocity.

Strategic engagement with regulatory bodies and standards organizations can streamline certification pathways, particularly for safety-critical applications in automotive and medical domains. By contributing to interoperability working groups, businesses can influence protocol specifications and accelerate ecosystem adoption. Finally, allocating resources to targeted pilot programs within high-potential verticals-such as advanced driver assistance or remote rehabilitation-can generate compelling use cases that validate ROI and inform broader rollouts.

Describe the Comprehensive Research Methodology Combining Secondary Data Analysis, Expert Interviews, and Rigorous Qualitative and Quantitative Approaches to Validate Findings

This research is underpinned by a comprehensive methodology that integrates rigorous secondary data analysis, expert interviews, and a blend of qualitative and quantitative techniques. Initial desk research consolidated publicly available information from academic journals, patent filings, and reputable technology news outlets to establish a foundational understanding of haptics market drivers, technological breakthroughs, and competitive dynamics.

Subsequent expert consultations involved structured interviews with key stakeholders, including hardware engineers, software architects, and end-user representatives from leading automotive, healthcare, and consumer electronics firms. These dialogues provided nuanced perspectives on development challenges, adoption barriers, and emerging use cases. Concurrently, quantitative surveys captured end-user preferences and willingness to pay across diverse demographic segments, enriching the analysis with statistically significant data points.

All findings were triangulated through cross-validation techniques, ensuring consistency between secondary research insights and primary data inputs. Where discrepancies arose, follow-up interviews and targeted data collection efforts resolved uncertainties. This iterative approach to validation underlines the credibility of the insights and supports the actionable recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Haptics Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Haptics Technology Market, by Offering

- Haptics Technology Market, by Technology Type

- Haptics Technology Market, by Connectivity

- Haptics Technology Market, by Interface Form Factor

- Haptics Technology Market, by Application

- Haptics Technology Market, by End User

- Haptics Technology Market, by Region

- Haptics Technology Market, by Group

- Haptics Technology Market, by Country

- United States Haptics Technology Market

- China Haptics Technology Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarize the Strategic Imperatives and Emerging Opportunities in Haptics Technology That Will Define the Next Wave of Innovation and Industry Transformation

The haptics technology landscape is poised for accelerated innovation as advancements in materials science, artificial intelligence, and cross-industry collaboration converge. Strategic imperatives for success include deepening integration between hardware and software ecosystems, strengthening supply chain resilience, and actively participating in standards development to unlock synergies across disparate devices and applications.

Emerging opportunities lie in high-value verticals such as automotive driver assistance, immersive medical training, and next-generation consumer entertainment. By deploying targeted pilot programs, industry players can demonstrate compelling use cases that pave the way for broader adoption. Meanwhile, agility in design iteration and a commitment to user-centric feedback loops will differentiate market leaders from followers.

Ultimately, organizations that proactively align their innovation roadmaps with evolving regulatory frameworks and customer expectations will shape the next wave of haptics-driven experiences. This transformation will redefine human–machine interfaces, enabling more natural, intuitive, and engaging digital interactions that span industries and user demographics.

Engage Directly with Ketan Rohom to Secure Your Customized Haptics Technology Market Research Report Tailored for Strategic Business Insights and Growth Planning

To secure comprehensive and tailored market intelligence on haptics technology, engaging with Ketan Rohom provides a direct path to strategic insights that drive business growth. By contacting Ketan Rohom, you gain personalized guidance on how the research findings align with your organization’s unique objectives and can request customized data slices that address specific technology segments, regional analyses, and application landscapes. This collaboration ensures that you receive timely and actionable intelligence to inform product development roadmaps, supply chain strategies, and go-to-market plans.

Partnering with an industry expert streamlines your decision-making process by translating complex data into clear strategic directions. Whether you aim to refine actuator designs for automotive interfaces, optimize sensor integration in medical devices, or explore new wireless haptic applications, direct access to the full report unlocks the depth of analysis needed to stay ahead of competitors. Reach out to Ketan Rohom today to discuss your requirements, explore sample insights, and expedite your purchase process for a customized haptics technology market research report.

- How big is the Haptics Technology Market?

- What is the Haptics Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?