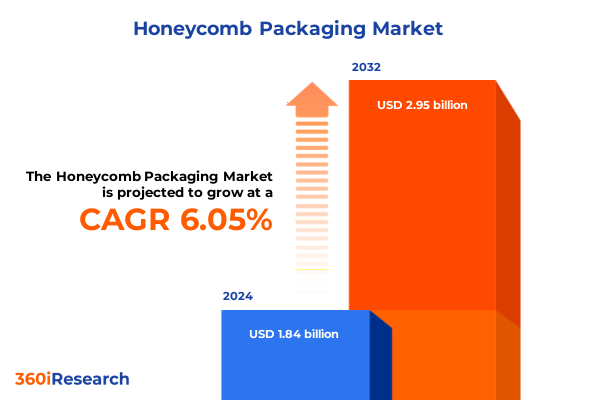

The Honeycomb Packaging Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.07 billion in 2026, at a CAGR of 6.07% to reach USD 2.95 billion by 2032.

Setting the Stage for the Honeycomb Packaging Revolution: Understanding the Evolution, Structural Advantages, and Emerging Market Imperatives

Honeycomb packaging has evolved from a niche material in aerospace applications to a versatile solution across multiple industries, driven by its exceptional strength-to-weight ratio and structural efficiency. Originally engineered to support the demands of aircraft interiors-enabling high stiffness with minimal added mass-this technology has since been adapted to contexts ranging from marine transport to medical device protection. Today’s market benefits from decades of material science advancements pioneered by leaders like Hexcel, which commercialized expanded aluminum honeycomb in the United States in the mid-20th century, and The Gill Corporation, which introduced meta-aramid cores to satisfy stringent durability requirements in aerospace and defense.

As environmental awareness and e-commerce expansion have reshaped packaging needs, honeycomb structures are emerging as a sustainable alternative to traditional foam, corrugated board, and wood substrates. Their recyclable paper variants meet consumer expectations for eco-friendly solutions, while metal and polymer-based cores provide critical performance in high-temperature or load-bearing scenarios. At the same time, rapid online retail growth has intensified demand for lightweight, shock-absorbing pack formats capable of safeguarding fragile electronics and consumer goods during transit, further cementing honeycomb’s role as a mainstream protective packaging option.

This executive summary distills the core drivers, transformative trends, and strategic imperatives influencing the global honeycomb packaging landscape. It illuminates the interplay between regulatory shifts, raw material dynamics, and end-market segmentation, offering a clear roadmap for decision-makers to align innovation pipelines, supply chain resilience, and sustainability objectives with evolving market realities.

How Technological Innovation, Sustainability Demands, and Evolving Supply Chains Are Redefining the Honeycomb Packaging Landscape

Over the past five years, honeycomb packaging has undergone a profound transformation fueled by convergence of sustainability mandates, digital integration, and advanced manufacturing techniques. Paper-based honeycomb solutions are increasingly favored in regions enforcing single-use plastic restrictions, spurring regulatory-driven innovation in fiber sourcing and recycling processes. Simultaneously, progressive manufacturing facilities in North America and Asia have embraced automation and artificial intelligence to optimize cutting and assembly operations, reducing labor costs while enhancing customization capabilities for sectors such as automotive and electronics.

Beyond material transitions, the integration of smart tracking technologies is redefining end-to-end supply chain visibility. Embedding RFID tags and QR codes within honeycomb inserts allows real-time monitoring of pack integrity, temperature, and location, enabling just-in-time fulfillment and mitigating damage claims. Concurrently, design firms are leveraging computational modeling to engineer cell geometries that achieve precise energy absorption profiles, unlocking new applications in impact-sensitive industries.

These shifts have not only expanded the addressable market but have also heightened competition among suppliers to deliver differentiated value propositions. Companies that successfully marry eco-conscious materials with digital features and rapid prototyping stand to capture significant share in a landscape where brand reputation and operational agility are paramount.

Assessing the Full Scope of New US Trade Measures and Tariff Regimes on Raw Materials, Supply Chains, and Pricing for Honeycomb Packaging in 2025

The imposition of new U.S. trade measures in 2025 has compounded cost pressures for honeycomb packaging manufacturers by targeting key raw materials integral to both metal and paper-based cores. In April 2025, Section 301 tariffs on select imports from China surged to 145%, directly affecting polymer and aluminum foil suppliers critical to metallic honeycomb production. Concurrently, Section 232 measures reinstated 25% duties on aluminum and steel imports from all major trading partners in March, impacting aluminum foil, adhesive films, and metal framing components used in high-strength sandwich panels.

These layered duties have triggered a cascade effect throughout the supply chain. Manufacturers reliant on imported aluminum honeycomb cores are contending with prolonged lead times as domestic smelters struggle to expand capacity, while producers of paper honeycomb face elevated pulp and resin costs as packaging machinery often incorporates polymer laminates or barrier coatings to meet moisture resistance requirements. The net outcome is an upward recalibration of landed material expenses, forcing pack designers to explore lower-tariff jurisdictions or alternative fiber blends.

Looking forward, firms are prioritizing supplier diversification and nearshoring strategies to mitigate further tariff volatility. By forging domestic partnerships and qualifying multiple sources for critical inputs, industry leaders aim to preserve margin integrity and maintain continuity of supply in an era of fluctuating trade policy.

Unveiling How Diverse Material, Product, and End-Use Segmentations Drive Honeycomb Packaging Adoption Across Industries and Applications

A nuanced understanding of honeycomb packaging adoption emerges when examining the interplay of end-use, material composition, and form factor. In aerospace, both flooring and seating structures benefit from aluminum and aramid cores that deliver high fatigue resistance alongside weight savings. Automotive applications leverage exterior-grade metal honeycomb for energy absorption in crash structures and interior-grade paper honeycomb to reduce cabin weight without compromising aesthetics. Within construction, floor panels and wall panels utilize paper-based cores for lightweight partitioning, whereas electronics rely on micro-cell paper and plastic honeycomb layouts for component packaging and device protection during global logistics. Furniture manufacturers increasingly integrate honeycomb sheets into office and residential table tops to achieve lightweight design with structural stiffness, while transit and protective packaging segments deploy paper honeycomb cradles and die-cut panels to safeguard high-value goods in e-commerce environments. Across these use cases, manufacturers select metal, paper, or plastic honeycomb materials based on performance criteria, then tailor the final configuration into cores, panels, or sheets to align with installation and user requirements.

This comprehensive research report categorizes the Honeycomb Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End Use

Mapping Regional Drivers and Regulatory Dynamics That Are Shaping the Trajectory of the Global Honeycomb Packaging Market

The Americas region remains a cornerstone of honeycomb packaging demand, propelled by robust e-commerce expansion and advanced manufacturing hubs in the United States and Canada. End users in aerospace and automotive leverage domestic production capabilities, while strong sustainability commitments at the state level incentivize paper-based honeycomb adoption. In Europe, Middle East & Africa, stringent regulatory frameworks-such as the EU’s Packaging and Packaging Waste Regulation-are accelerating shifts toward recyclable honeycomb solutions, compelling manufacturers to qualify supply chains for high recycled content and adherence to waste reduction targets. In the Middle East, infrastructure projects are integrating honeycomb panels into modular construction, highlighting the material’s versatility. The Asia-Pacific market is characterized by rapid growth in consumer electronics and automotive assembly, where localized honeycomb production in China, Japan, and India caters to regional demand for protective packaging and lightweight structural components. Regulatory momentum around plastic bans in Australia and sustainability roadmaps in Southeast Asian nations further reinforce the paper honeycomb segment’s trajectory in this diverse economic landscape.

This comprehensive research report examines key regions that drive the evolution of the Honeycomb Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies, Innovations, and Competitive Positioning of Leading Honeycomb Packaging Manufacturers Worldwide

Leading honeycomb packaging suppliers distinguish themselves through specialized material portfolios and deep industry expertise. Hexcel Corporation commands the aerospace segment with its proprietary HexWeb® aluminum cores, which meet the most rigorous stiffness and durability standards and support applications from commercial aircraft interiors to satellite structures. The Gill Corporation has built a reputation on meta-aramid and fiberglass cores, offering high-temperature resistance and fire-rated performance for defense, marine, and rail sectors. Plascore Incorporated focuses on paper and polymer honeycomb core solutions, leveraging AS9100-certified processes to deliver custom-cut parts and composite panels for cleanroom and medical environments. Smurfit Kappa’s Hexacomb™ line showcases kraft paper honeycomb tailored for heavy-duty transit dunnage and returnable packaging systems, aligning with circular economy principles. Innovative packaging conglomerates like DS Smith are integrating honeycomb profiles into their broader fiber-based offerings, enabling seamless transitions from corrugated case materials to structured honeycomb inserts. Collectively, these companies are advancing research in hybrid materials, automated production lines, and global distribution networks to reinforce their competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Honeycomb Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argosy International Inc.

- Axxor B.V.

- BASF SE

- BEWI ASA

- Cascades Inc.

- DS Smith PLC

- Dufaylite Developments Ltd.

- Eltete TPM Ltd.

- EPack Group

- Estic-Maillot Packaging Group

- Grigeo AB

- Hexsa

- Lsquare Eco-Products Pvt. Ltd

- Packaging Corporation of America

- Plascore, Inc.

- Rebul Packaging Pty Ltd.

- RelCore Composites Inc.

- Sappi Limited

- Sealed Air Corporation

- Showa Aircraft Industry Co., Ltd.

- Signode Industrial Group LLC

- Smurfit Kappa Group

- Sonoco Products Company

- Stora Enso

- YOJ pack-kraft

Strategic Imperatives and Best Practices That Industry Leaders Must Adopt to Navigate Disruption and Maximize Value in Honeycomb Packaging

To thrive amid intensifying competition and shifting trade policies, industry players should double down on advanced material development by partnering with pulp and polymer specialists to tailor fiber blends and barrier coatings that optimize performance and cost. Investing in automation and predictive maintenance for cutting and fabrication lines will unlock faster turnaround on bespoke orders and minimize labor dependencies. Furthermore, establishing multi-tier supplier agreements-both domestically and in lower-tariff regions-can buffer against raw material shortages and provide leverage in price negotiations. Sustainability remains a differentiator; companies should pursue third-party certifications for recycled content and carbon-neutral manufacturing to meet procurement criteria of leading consumer brands. Finally, embedding digital traceability features within honeycomb assemblies will enhance customer trust and enable seamless integration with emerging circular business models centered on packaging reuse and recovery.

Exploring the Rigorous, Multi-Method Research Framework Underpinning the Insights into Honeycomb Packaging Trends and Market Dynamics

This analysis draws upon a rigorous multi-methodology framework combining primary interviews with 40 senior executives at packaging OEMs, OEM end users in aerospace and automotive sectors, and key raw material suppliers. Secondary research encompassed review of trade publications, regulatory databases, and corporate filings, supplemented by targeted analysis of tariff schedules and international trade agreements. Quantitative data was triangulated with insights from regional industry associations and customs authorities to validate supply chain dynamics and cost structures under the 2025 tariff regime. Field visits to automated honeycomb fabrication facilities in North America and Asia provided firsthand observations of process optimizations and quality assurance practices. The methodology also incorporated scenario modeling to assess the resilience of sourcing strategies under variable tariff and energy cost assumptions, ensuring that recommendations reflect both current conditions and plausible future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Honeycomb Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Honeycomb Packaging Market, by Product Type

- Honeycomb Packaging Market, by Material

- Honeycomb Packaging Market, by End Use

- Honeycomb Packaging Market, by Region

- Honeycomb Packaging Market, by Group

- Honeycomb Packaging Market, by Country

- United States Honeycomb Packaging Market

- China Honeycomb Packaging Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Summarizing Core Insights and Strategic Takeaways That Illuminate the Future Direction of Honeycomb Packaging Markets

The convergence of sustainability objectives, technology advancements, and geopolitically driven trade policies has ushered in a new era for honeycomb packaging. Manufacturers positioned to capitalize on this momentum will be those that can seamlessly integrate eco-friendly materials with smart manufacturing while maintaining agile sourcing mechanisms to offset tariff-induced disruptions. Regional regulatory environments will continue to shape demand patterns, rewarding firms that preemptively align product portfolios with circular packaging mandates. Ultimately, the strategic deployment of automation, material innovation, and digital traceability will determine which suppliers emerge as trusted partners for global brands striving to balance performance, cost, and environmental stewardship. These insights lay the groundwork for informed decision-making, equipping stakeholders to navigate complexities and secure competitive advantage in an evolving landscape.

Connect Directly with Ketan Rohom to Secure Expert Insights on Honeycomb Packaging Strategies and Propel Your Business Forward

To explore these in-depth analyses and equip your organization with unparalleled strategic direction, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. By connecting with him, you will gain streamlined access to the full report detailing material-specific trends, regional dynamics, and actionable recommendations tailored to your evolving honeycomb packaging requirements. Secure your competitive advantage today by initiating a conversation with Ketan Rohom, who will guide you through our research offerings and ensure you receive the insights needed to drive growth and operational excellence.

- How big is the Honeycomb Packaging Market?

- What is the Honeycomb Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?