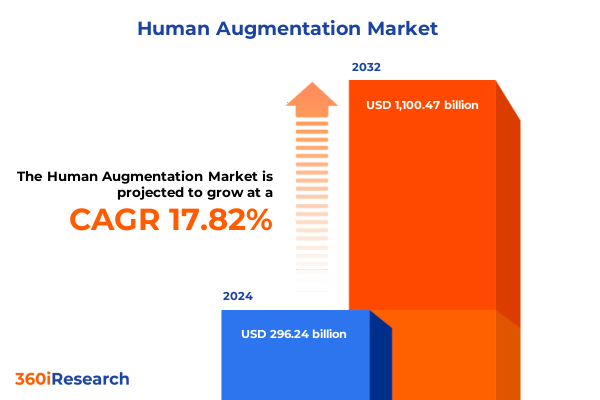

The Human Augmentation Market size was estimated at USD 345.51 billion in 2025 and expected to reach USD 402.97 billion in 2026, at a CAGR of 17.99% to reach USD 1,100.47 billion by 2032.

Exploring the Dynamic Fusion of Biology and Technology That Is Redefining Human Capability and Industry Frontiers

Human augmentation represents an extraordinary convergence of biology and technology that redefines the boundaries of human potential. Over recent years, the maturation of exoskeletons, implantable devices, neural interfaces, and wearable sensors has transitioned speculative science into tangible reality. This introduction offers a concise yet comprehensive overview of the forces driving this transformation. Technological innovation has accelerated as artificial intelligence, additive manufacturing, and advanced materials converge, enabling solutions once the exclusive domain of science fiction.

Amid this rapid evolution, regulatory frameworks are striving to catch up with the pace of discovery, balancing patient safety and ethical considerations against the imperative to foster innovation. Public and private stakeholders are collaborating on pilot programs that test the real-world viability of augmentation solutions across healthcare, defense, manufacturing, and entertainment sectors. Meanwhile, clinical trials and field deployments demonstrate measurable improvements in mobility, sensory function, and cognitive support. As investor interest intensifies and cross-disciplinary research flourishes, human augmentation has emerged as one of the most dynamic frontiers in technology, promising to enhance quality of life, drive productivity, and create new paradigms of human-machine symbiosis.

Unpacking the Confluence of AI, Exoskeleton Evolution, and Immersive Wearables That Are Revolutionizing the Augmentation Ecosystem

A wave of transformative shifts is restructuring the human augmentation landscape, ushering in novel approaches to how people interact with technology. First, the integration of machine learning algorithms with neural interfaces has dramatically improved the accuracy and responsiveness of cognitive enhancement tools, enabling real-time decision support and personalized memory assistance applications. These developments have propelled research institutions and corporate labs to pursue increasingly complex protocols that blur the lines between therapeutic interventions and elective enhancements.

Simultaneously, the proliferation of industrial exoskeletons designed for assembly assistance and logistics support has addressed acute labor shortages in manufacturing, catalyzing widespread adoption of strength enhancement solutions. These devices are evolving from bulky prototypes to streamlined designs that leverage lightweight actuators and efficient power systems, thereby minimizing user fatigue. In parallel, the advent of haptic gloves and smart clothing offers refined sensory augmentation, providing tactile feedback that enriches virtual reality experiences and aids rehabilitation programs. As these innovations converge, ecosystem players are exploring new business models centered on services, software analytics, and predictive maintenance, marking a pivotal shift from one-off product sales to continuous, subscription-based engagements.

Assessing How Recent U.S. Trade Tariff Measures Are Reshaping Supply Chains and Manufacturing Strategies in Human Augmentation

In 2025, new trade tariffs enacted by the U.S. government introduced a complex layer of cost pressures and supply chain recalibrations across the human augmentation sector. While the stated objective was to bolster domestic manufacturing of critical device components-such as power systems, sensors, and rare earth magnetic materials-the immediate repercussions manifested in higher input costs and elongated procurement cycles. Manufacturers reliant on imported medical-grade alloys and semiconductor chips faced challenges in securing consistent yields and maintaining production schedules.

This policy shift prompted leading device producers to accelerate their strategy of nearshoring, developing partnerships with North American suppliers to mitigate geopolitical risks and align with emerging regulatory incentives. At the same time, defense contractors adapted by diversifying their sourcing of tactical training exosuits and surveillance support wearables to include regional manufacturing hubs in Mexico and Canada. Although these adjustments increased upfront capital investments, they also reinforced risk management frameworks and reinforced local supply chain resilience. The healthcare industry, from patient monitoring wearables to implantable brain stimulators, witnessed an uptick in clinical collaborations aimed at validating domestically produced alternatives, thereby preserving continuity of care while navigating the evolving tariff landscape.

Unveiling a Layered Segmentation Matrix That Reveals Interdependencies Among Technologies, End Users, Applications, and Foundational Components

The market analysis unfolds through a multidimensional segmentation framework that illuminates the interplay between technology types, end-user industries, applications, and core components. Within technology types, exoskeleton innovations span full body solutions to specialized lower and upper limb systems, while implantable devices include advanced brain stimulators, cochlear implants, and emerging retinal prosthetics. In parallel, neural interfaces differentiate between invasive and non-invasive systems, and wearable devices range from high-precision haptic gloves to smart clothing and glass-based augmented reality platforms.

Turning to end users, defense organizations are leveraging soldier enhancement modules alongside surveillance support platforms, and advanced training modules are redefining tactical readiness. Healthcare facilities deploy augmentation systems across patient monitoring, rehabilitation therapies, and surgical assistance workflows. Manufacturing sectors apply assistive walking exoskeletons in assembly lines, integrate logistics support wearables in warehouses, and adopt quality inspection tools powered by embedded sensors. In sports and entertainment environments, performance training suits and virtual reality engagement gear are reshaping audience experiences. Application-based insights examine cognitive enhancement offerings such as decision support systems, mobility solutions that facilitate walking and running support, sensory augmentation fields extending hearing and vision capabilities, and strength enhancement devices designed for load carriage.

Ultimately, each segment is underpinned by a critical component taxonomy encompassing hardware elements like actuators and sensors, sophisticated software platforms ranging from analytics engines to control environments, and specialized services including consulting, maintenance, and user training. This layered segmentation ensures a holistic view of market dynamics, highlighting areas where cross-segment collaboration and component innovation intersect to drive new growth opportunities.

This comprehensive research report categorizes the Human Augmentation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Application

- End User Industry

Highlighting Regional Innovation Hotspots and Policy Landscapes That Influence the Adoption and Customization of Augmentation Solutions Globally

Geographically, the human augmentation sector displays distinct growth trajectories and innovation hotspots across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In North America, robust R&D ecosystems, coupled with supportive government funding for defense and healthcare applications, have accelerated the commercialization of implantable neural interfaces and industrial exoskeletons. Collaboration between federal agencies and private consortia has fostered a conducive environment for pilot programs in surgical assistance and patient monitoring solutions.

Across Europe, the Middle East, and Africa, innovation is often driven by cross-border partnerships that leverage Europe’s strength in medical device certification alongside the Middle East’s focus on performance training in sports entertainment sectors. Regulatory harmonization efforts in the European Union have streamlined approval pathways for wearable augmentation devices, while Gulf states invest in smart clothing and virtual reality experiences to bolster tourism and entertainment. In Africa, low-cost wearable solutions aimed at rehabilitation are gaining traction through humanitarian projects and international grants.

In the Asia-Pacific, government-backed investment is fueling large-scale deployments of exoskeletons in manufacturing hubs, and local startups are making strides in smart glasses and haptic technologies. Collaborative innovation clusters across China, Japan, South Korea, and Australia are advancing implantable device prototypes, while the region’s expansive consumer electronics infrastructure underpins rapid prototyping cycles and agile production. By understanding these regional nuances, stakeholders can tailor go-to-market strategies that align with local policy landscapes, talent pools, and infrastructure capacities.

This comprehensive research report examines key regions that drive the evolution of the Human Augmentation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Innovators and Collaborative Ventures Are Steering the Future of Exoskeletons, Neural Interfaces, and Smart Wearables

In the evolving tapestry of human augmentation, a select group of companies has emerged as bellwethers for innovation, strategic partnerships, and thought leadership. Leading exoskeleton developers are deepening collaborations with automotive and aerospace OEMs to integrate full-body and lower limb systems into industrial operations that demand both precision and safety. Prominent medical device manufacturers are advancing implantable brain stimulators and retinal implants through multinational clinical trials, underscoring a commitment to both medical efficacy and scalable production.

Simultaneously, frontier startups in the neural interface domain have secured venture funding to refine non-invasive brain-machine communication platforms, while established technology firms are integrating these interfaces into consumer-grade wearables that bridge rehabilitation and gaming applications. In the software and services domain, analytics providers are forging alliances with device makers to deliver end-to-end solutions, combining real-time data monitoring with predictive maintenance to optimize device uptime. Across the board, companies are pursuing mergers, joint ventures, and licensing agreements to expand their intellectual property portfolios, accelerate time-to-market, and access complementary expertise, thereby navigating the competitive landscape with agility and foresight.

This comprehensive research report delivers an in-depth overview of the principal market players in the Human Augmentation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Alphabet Inc.

- Apple Inc.

- Bionik Laboratories Corp.

- Boston Scientific Corporation

- Cyberdyne Inc.

- Ekso Bionics Holdings, Inc.

- General Motors Company

- Hocoma AG

- Huawei Technologies Co., Ltd.

- Lockheed Martin Corporation

- Medtronic plc

- Meta Platforms, Inc.

- Microsoft Corporation

- Ottobock SE & Co. KGaA

- Panasonic Holdings Corporation

- Parker-Hannifin Corporation

- Raytheon Technologies Corporation

- ReWalk Robotics Ltd.

- Samsung Electronics Co., Ltd.

- Sarcos Technology and Robotics Corporation

- Sony Group Corporation

- Toyota Motor Corporation

Outlining Strategic Imperatives to Drive Innovation, Foster Cross-Sector Partnerships, and Enhance Regulatory and Supply Chain Resilience

Industry leaders must embrace a multipronged strategy to capitalize on emerging opportunities while mitigating systemic risks. First, intensifying R&D investments in materials science and machine learning algorithms will yield next-generation augmentation platforms that are lighter, more efficient, and capable of self-learning adaptations. Equally important is the cultivation of strategic partnerships across sectors-uniting defense, healthcare, and manufacturing stakeholders to co-create solutions that address specialized use cases and streamline commercialization pathways.

Moreover, organizations should proactively engage with regulatory bodies to help shape pragmatic frameworks that balance safety with innovation agility. Establishing pilot programs and sandbox environments can demonstrate real-world efficacy and build regulatory confidence. To fortify supply chain resilience, diversifying component sourcing and nearshoring critical manufacturing capabilities will reduce exposure to geopolitical volatility. Finally, embedding user-centric design and comprehensive training services in product offerings will enhance adoption, adherence, and long-term value capture.

Detailing a Rigorously Triangulated Research Approach That Combines Expert Interviews, Scholarly Reviews, and Multi-Stage Validation Protocols

This research leverages an integrated methodology that synthesizes qualitative and quantitative insights drawn from primary and secondary sources. Primary research comprised in-depth interviews with industry executives, academic thought leaders, regulatory authorities, and end-user representatives, ensuring diverse perspectives on technological performance, usability, and market readiness. Concurrently, secondary research involved a systematic review of scholarly articles, patent databases, technical whitepapers, and relevant government publications to establish a robust contextual framework.

Data triage and triangulation were employed to cross-verify findings, with thematic analysis guiding the identification of key trends and inflection points. A multi-stage validation process included peer reviews by independent experts, ensuring the integrity and reliability of the conclusions. The resulting insights reflect an exhaustive examination of product lifecycles, funding flows, regulatory trajectories, and competitive dynamics, providing stakeholders with a comprehensive blueprint for informed decision-making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Human Augmentation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Human Augmentation Market, by Component

- Human Augmentation Market, by Technology Type

- Human Augmentation Market, by Application

- Human Augmentation Market, by End User Industry

- Human Augmentation Market, by Region

- Human Augmentation Market, by Group

- Human Augmentation Market, by Country

- United States Human Augmentation Market

- China Human Augmentation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Synthesizing How Converging Innovation, Policy Shifts, and Collaborative Ecosystems Are Shaping the Future Trajectory of Augmented Humanity

As human augmentation technologies progress from nascent prototypes to commercially viable solutions, they hold the promise to redefine human health, productivity, and interaction paradigms. The interplay between device innovation, regulatory evolution, and global supply chain dynamics underscores the complexity of this burgeoning sector. Yet, the convergence of cross-industry expertise, accelerated R&D funding, and agile manufacturing strategies is poised to unlock unprecedented value.

Looking ahead, key success factors will include the ability to integrate adaptive AI systems within wearable and implantable platforms, the establishment of resilient localized supply networks, and the forging of strategic alliances that span public and private spheres. While challenges around ethics, data privacy, and equitable access persist, they also provide an opportunity for responsible leadership and collaborative governance. Ultimately, stakeholders who navigate these dynamics with foresight and adaptability will shape the trajectory of augmentation solutions, driving a future where human potential is fully empowered by technological ingenuity.

Seize the Opportunity to Access In-Depth Human Augmentation Market Intelligence by Partnering with Ketan Rohom for Exclusive Report Purchase

To procure the full-depth market research report and unlock unparalleled strategic insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss customized licensing options, request sample chapters, and explore volume discounts. Starting a conversation with Ketan will connect you with a dedicated team capable of addressing specific inquiries about scope, methodology, and deliverables tailored to your organization’s needs. Engage today to translate these comprehensive findings into actionable strategies, gain competitive advantage, and position your enterprise at the forefront of human augmentation innovation.

- How big is the Human Augmentation Market?

- What is the Human Augmentation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?