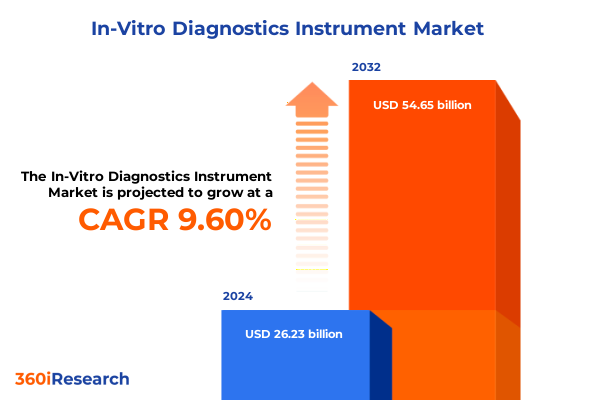

The In-Vitro Diagnostics Instrument Market size was estimated at USD 28.50 billion in 2025 and expected to reach USD 30.97 billion in 2026, at a CAGR of 9.74% to reach USD 54.65 billion by 2032.

Setting the Stage for the Next Generation of In Vitro Diagnostics Instruments Shaping Healthcare Outcomes and Driving Innovations Globally

In vitro diagnostics instruments serve as the cornerstone of modern healthcare, enabling clinicians and laboratory professionals to detect, diagnose, and monitor a wide array of diseases with unprecedented accuracy. These instruments encompass a spectrum of technologies from high-throughput chemistry analyzers in central laboratories to rapid point-of-care testing devices in clinical and community settings. The convergence of rising chronic disease incidence, expanding preventive care initiatives, and an aging global population has elevated the strategic importance of reliable diagnostic instrumentation in delivering both cost-effective and patient-centric outcomes.

Over recent years, the role of diagnostics has shifted from a supporting function to a proactive driver of health system efficiency and personalized medicine approaches. Early disease detection minimizes treatment costs and improves patient prognoses, making in vitro diagnostics integral to value-based care models. Moreover, growing investments in laboratory infrastructure and regulatory harmonization across key markets are underpinning ongoing enhancements in test accuracy, throughput, and connectivity. As stakeholders across the healthcare continuum increasingly recognize diagnostics’ pivotal influence on patient pathways, in vitro instrument manufacturers are well positioned to deliver essential solutions that advance universal health coverage and clinical decision support.

Unveiling the Transformative Shifts Revolutionizing In Vitro Diagnostics Instrumentation and Delivering Unprecedented Precision in Patient Care

The in vitro diagnostics landscape is witnessing transformative shifts propelled by digital convergence, advanced molecular techniques, and evolving care delivery models. Artificial intelligence and machine learning algorithms are revolutionizing data interpretation, enabling predictive analytics and real-time decision support that enhance diagnostic precision and reduce human error. Simultaneously, integration of microfluidics, next-generation sequencing, and lab-on-a-chip platforms is enabling miniaturized and high-throughput testing configurations, thereby accelerating turnaround times and expanding test menus into molecular and genetic applications.

Another defining trend is the migration of diagnostic capabilities closer to the patient through point-of-care and decentralized testing models. Advances in portable and handheld analyzers are breaking the confines of centralized laboratories, delivering rapid test results in outpatient clinics, remote locations, and even home settings. This decentralization not only optimizes patient flow and reduces system bottlenecks but also supports telehealth platforms by feeding timely diagnostic data into virtual care workflows. Together, these shifts underscore a fundamental reimagining of the diagnostic continuum, where precision, connectivity, and accessibility converge to shape next-generation care pathways.

Analyzing the Cumulative Impact of 2025 United States Tariffs on the In Vitro Diagnostics Instrument Sector and Supply Chain Resilience

The introduction of new tariffs by the United States in 2025 has introduced significant headwinds for the in vitro diagnostics instrument sector, affecting both direct import costs and broader supply chain dynamics. Tariffs on key components-ranging from semiconductor chips and electronic assemblies to specialized polymers-have elevated production expenses for overseas manufacturers serving the U.S. market. For instance, China-origin medical device inputs now face duties of up to 145 percent, creating immediate cost pressures and prompting strategic stockpiling by leading instrument vendors.

In addition, the imposition of a 25 percent duty on steel- and aluminum-containing products further affects the manufacturing of cathode assemblies, housing frames, and other critical instrument components, reinforcing the need for reconfigured supply chain strategies. As a result, many multinational manufacturers are accelerating investments in domestic production facilities and diversifying sourcing across Southeast Asia and Europe to mitigate tariff exposure. While these measures aim to preserve competitive pricing and maintain timely delivery, the cumulative tariff impact is reshaping global operations, as industry players balance near-term cost management with long-term supply chain resilience.

Illuminating Segmentation Insights That Define In Vitro Diagnostics Instruments by Type Application Technology End User and Configuration Nuances

A nuanced understanding of market segmentation offers critical insights into product innovation, competitive positioning, and strategic investment priorities across the in vitro diagnostics instrument landscape. Instruments span an array of types-chemistry, coagulation, hematology, immunoassay, microbiology, molecular diagnostics, and point-of-care analyzers-each differentiated by throughput, analytical technique, and clinical application. Chemistry and hematology analyzers maintain a prominence in centralized laboratories due to their scalability and extensive test menus, while immunoassay and molecular platforms are driving precision diagnostics through targeted biomarker detection and genetic analysis.

The application spectrum further refines market dynamics, as instruments tailored for autoimmune, cardiac marker, diabetes, infectious disease, and oncology testing respond to shifting global health priorities. Oncology and infectious disease assays, in particular, leverage high-sensitivity immunoassay and next-generation sequencing modalities to identify biomarkers at minimal concentrations, reinforcing the role of diagnostics in early intervention and therapeutic monitoring. Technological segmentation reveals layered subcategories: chromatography techniques such as affinity and liquid chromatography cater to proteomic and metabolomic analyses, whereas fluorescence and mass spectrometry expand capabilities in molecular profiling. Similarly, cytometry divides into flow and image cytometry, addressing diverse cellular analysis needs.

End users range from academic research institutions pursuing exploratory studies to diagnostic laboratories requiring high-throughput automation and hospitals prioritizing rapid turnaround for critical care scenarios. Configuration preferences span from benchtop and floor-standing systems in established labs to handheld and portable devices enabling field deployment. By intersecting these segmentation dimensions, industry stakeholders can pinpoint white-space opportunities, align R&D pipelines with unmet clinical needs, and optimize product portfolios for differentiated value delivery.

This comprehensive research report categorizes the In-Vitro Diagnostics Instrument market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Technology

- Configuration

- Application

- End User

Revealing Critical Regional Dynamics Shaping In Vitro Diagnostics Instrument Adoption Trends across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics are pivotal in shaping the in vitro diagnostics instrument market, driven by divergent healthcare infrastructures, regulatory ecosystems, and demographic profiles. In the Americas, the United States leads with a sophisticated reimbursement framework and well-established clinical laboratory networks. High adoption rates of advanced immunoassay and molecular diagnostic instruments are fueled by robust capital expenditure budgets and public-private partnerships that support precision medicine initiatives. Meanwhile, Latin American markets are gradually expanding their laboratory infrastructure, with targeted investments in point-of-care and portable solutions to address accessibility gaps in remote and underserved populations.

Europe, the Middle East, and Africa (EMEA) present a composite of mature and emerging market segments. Western European countries operate under stringent regulatory oversight and often lead in adopting high-throughput automation and standardized quality protocols. Eastern Europe and the Middle East are prioritizing laboratory capacity building through modernization grants and regional consortiums, while Africa is increasingly relying on mobile and decentralized testing platforms to bridge infrastructure deficits and contain infectious disease outbreaks.

The Asia-Pacific region stands out for accelerated expansion driven by large patient populations, rising healthcare expenditures, and government-led screening programs. Nations such as China, India, and Australia are scaling up domestic manufacturing of diagnostic instruments to reduce import dependencies, complemented by strategic collaborations with multinational technology providers. Across all regions, the interplay of regulatory harmonization efforts and targeted public health interventions continues to redefine instrument penetration rates and investment priorities.

This comprehensive research report examines key regions that drive the evolution of the In-Vitro Diagnostics Instrument market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading In Vitro Diagnostics Instrument Manufacturers Driving Innovation Collaborations and Differentiation in a Competitive Global Environment

Leading stakeholders in the in vitro diagnostics instrument space are distinguished by their ability to balance cutting-edge innovation with scalable manufacturing and global distribution networks. Industry frontrunners deploy integrated R&D platforms that converge artificial intelligence, advanced optics, and molecular biology to develop instruments capable of multiplexed testing and real-time data analytics. These firms leverage strategic alliances with reagent and consumables suppliers to secure end-to-end workflow solutions, ensuring sustained consumable revenue streams and enhanced customer loyalty.

Collaborative ventures between established diagnostics companies and emerging biotech firms are accelerating the co-development of targeted assays and companion diagnostics, particularly in the oncology and infectious disease segments. Concurrently, mergers and acquisitions remain a powerful lever for entering adjacent technology domains-such as lab automation and digital health platforms-broadening product portfolios while driving operational synergies. Simultaneously, manufacturers are investing in regional manufacturing footprints and digital service capabilities to optimize time to market, reduce logistic complexities, and provide predictive maintenance offerings that minimize instrument downtime.

As competitive differentiation increasingly hinges on software-enabled services and ecosystem integration, top-tier players are prioritizing cloud-based connectivity and subscription-based business models. This approach not only fosters recurring revenue but also creates data-driven feedback loops that inform product enhancements and facilitate personalized customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-Vitro Diagnostics Instrument market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- BioMérieux S.A.

- Danaher Corporation

- EKF GmbH

- F. Hoffmann-La Roche Ltd

- Hologic, Inc.

- Illumina, Inc.

- Mesolonghi Diagnostics

- Ortho Clinical Diagnostics

- PerkinElmer, Inc.

- PHC Corporation

- Qiagen N.V.

- Roche Diagnostics

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Tulip Diagnostics (P) Ltd

Actionable Strategic Recommendations Empowering In Vitro Diagnostics Instrument Industry Leaders to Enhance Resilience Agility and Sustainable Growth

To thrive in the evolving in vitro diagnostics instrument landscape, industry leaders must adopt a suite of strategic actions that fortify resilience, amplify agility, and unlock sustainable growth. First, prioritizing supply chain diversification is essential; businesses should establish multi-regional supplier networks and maintain buffer inventories of critical components to mitigate geopolitical and tariff-related disruptions. Concurrently, investing in modular manufacturing and flexible automation platforms can facilitate rapid scale-up or reallocation of production across geographies.

Second, embedding digital capabilities throughout the instrument lifecycle-from design and calibration to remote diagnostics and predictive maintenance-will enhance customer value propositions and support shift toward service-oriented revenue streams. Enabling secure, cloud-based data integration with laboratory information systems and electronic health records ensures seamless workflow integration and real-world evidence generation. Third, forging collaborative partnerships with academic, clinical, and technology partners accelerates the translation of emerging biomarkers and AI-driven applications into validated assay panels, reducing time to market and enhancing competitive differentiation.

Finally, refining regulatory and reimbursement strategies through proactive engagement with health authorities and payers will optimize product access and adoption. By aligning new instrument features with clinical utility endpoints and health economics outcomes, manufacturers can secure favorable coverage pathways and drive broader market acceptance.

Comprehensive Research Methodology Employed to Analyze the In Vitro Diagnostics Instrument Market through Primary Secondary and Analytical Techniques

The methodology underpinning this research integrates rigorous secondary and primary data collection with analytical modelling to deliver a comprehensive view of the in vitro diagnostics instrument market. Secondary research involved systematic review of scientific literature, regulatory filings, industry white papers, and digital health publications to map technological advancements, clinical applications, and regulatory frameworks. Data from governmental health agencies, international standard-setting bodies, and peer-reviewed journals were synthesized to establish baseline market characteristics and emerging trends.

Primary research comprised structured interviews and surveys with key stakeholders, including laboratory directors, clinical pathologists, procurement officers, and technology executives. These interactions provided nuanced insights into procurement criteria, unmet clinical needs, adoption barriers, and service expectations. Quantitative data points were validated through triangulation across multiple sources, ensuring consistency and reliability. The analytical framework employed cross-segmentation techniques to assess instrument performance against clinical use cases, regional regulations, and end-user preferences.

Finally, strategic scenarios were developed using a combination of qualitative expert inputs and scenario planning methodologies to evaluate the potential impact of regulatory changes, tariff adjustments, and disruptive innovations. This multi-layered approach ensures that the findings reflect both current realities and plausible future trajectories in the in vitro diagnostics instrument domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-Vitro Diagnostics Instrument market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-Vitro Diagnostics Instrument Market, by Instrument Type

- In-Vitro Diagnostics Instrument Market, by Technology

- In-Vitro Diagnostics Instrument Market, by Configuration

- In-Vitro Diagnostics Instrument Market, by Application

- In-Vitro Diagnostics Instrument Market, by End User

- In-Vitro Diagnostics Instrument Market, by Region

- In-Vitro Diagnostics Instrument Market, by Group

- In-Vitro Diagnostics Instrument Market, by Country

- United States In-Vitro Diagnostics Instrument Market

- China In-Vitro Diagnostics Instrument Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights on the Evolution and Strategic Imperatives for the In Vitro Diagnostics Instrument Sector in Light of Emerging Trends and Market Dynamics

As the in vitro diagnostics instrument sector continues to evolve, its trajectory will be shaped by the interplay of technological innovation, regulatory dynamics, and shifting care delivery paradigms. Precision molecular platforms and AI-enabled analytical engines are set to redefine diagnostic accuracy and workflow automation, enabling earlier disease detection and more personalized treatment plans. At the same time, geopolitical factors and tariff policies will necessitate agile supply chain management and strategic localization of manufacturing assets.

Regional market maturation will be uneven, with advanced economies focusing on high-throughput and integrated digital ecosystems, while emerging markets prioritize low-cost, portable solutions to address infrastructure constraints. Key growth areas will include decentralized testing for chronic disease monitoring, next-generation sequencing–based oncology assays, and fully connected point-of-care analyzers embedded within telehealth frameworks. Meanwhile, industry leaders will differentiate through holistic service models, harnessing cloud connectivity and subscription services to foster ongoing engagement and optimize instrument performance.

Ultimately, success in this dynamic environment will depend on the ability to anticipate clinical needs, navigate regulatory complexities, and deliver cohesive solutions that balance technological sophistication with operational efficiency. Stakeholders who adopt a forward-looking posture-embracing collaboration, digital transformation, and customer-centric strategies-will be well positioned to capture value across the diagnostic continuum.

Engage with Ketan Rohom to Acquire the In Vitro Diagnostics Instrument Market Research Report and Unlock Actionable Intelligence for Sales and Marketing Excellence

Engaging with Ketan Rohom offers a seamless gateway to unlocking the full potential of your organization’s strategic planning through comprehensive insights tailored to the in vitro diagnostics instrument market. As Associate Director, Sales & Marketing, Ketan Rohom brings deep expertise in translating complex research findings into actionable intelligence that drives measurable growth and competitive advantage. By collaborating directly, you will gain prioritized access to proprietary data analyses, bespoke market scenarios, and advisor-led discussions that address your unique challenges and objectives.

This personalized engagement ensures that your decision-making is underpinned by robust qualitative and quantitative evidence, enabling your teams to swiftly capitalize on emerging opportunities while mitigating potential risks. Whether you seek to refine product positioning, evaluate partnership prospects, or optimize go-to-market strategies, Ketan Rohom’s guidance will align research insights with your strategic imperatives. To explore customized research packages, schedule a detailed demonstration, or request an executive briefing, reach out and take the decisive step toward informed leadership in the in vitro diagnostics instrument arena.

- How big is the In-Vitro Diagnostics Instrument Market?

- What is the In-Vitro Diagnostics Instrument Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?