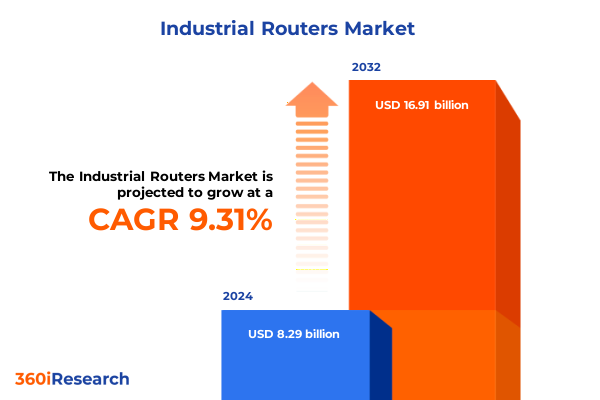

The Industrial Routers Market size was estimated at USD 9.03 billion in 2025 and expected to reach USD 9.86 billion in 2026, at a CAGR of 9.36% to reach USD 16.91 billion by 2032.

Pioneering Industrial Connectivity Strategies to Drive Digital Transformation and Operational Resilience Across Global Industrial Ecosystems

Industrial routers have emerged as the strategic backbone of modern industrial operations, enabling seamless communication between IT and OT domains and driving real-time data exchange across manufacturing floors, energy grids, and critical infrastructure. As digital transformation accelerates, the convergence of traditional networking with advanced Internet of Things (IoT) architectures has elevated the role of industrial routers from mere connectivity enablers to essential components of resilient, secure, and intelligent systems. This evolution is underscored by projections that IoT solutions will capture between $2.8 trillion and $6.3 trillion in economic value by 2025, with the factory setting alone contributing up to $3.3 trillion globally, highlighting the transformative potential of interconnected devices in optimizing asset performance and operational workflows.

Against this backdrop, leading technology providers are redefining industrial networking to support the demands of artificial intelligence, edge computing, and zero-trust security models. For instance, recent innovations showcase AI-powered management capabilities and quantum-resistant encryption techniques embedded directly into router firmware, underscoring the urgent need for network infrastructure that can simultaneously scale, secure, and simplify operations in an era of exploding data volumes and growing cyber threats.

Moreover, the establishment of strategic manufacturing hubs-such as Cisco’s advanced production site in Chennai-demonstrates how global supply chains are adapting to regional growth opportunities and geopolitical considerations. By aligning local production with global R&D and engineering efforts, these initiatives foster agility in product development and ensure continuity of supply amid shifting trade dynamics, reinforcing why industrial routers are now pivotal in shaping resilient, future-ready industrial ecosystems.

Leveraging AI Integration, Next-Generation Wireless, and Edge Computing to Revolutionize Industrial Network Security, Resilience, and Performance in Modern Operations

The industrial networking landscape is undergoing a profound metamorphosis driven by the integration of artificial intelligence, next-generation wireless technologies, and edge computing. Recent accolades, such as the Industrial IoT Company of the Year award recognizing innovation in cybersecurity and AI readiness, reflect how market leaders are embedding machine learning algorithms and deep packet inspection directly into routers to anticipate threats and self-optimize network performance, thereby minimizing downtime and fortifying operational continuity in critical environments.

Simultaneously, the proliferation of wireless IoT devices is reshaping connectivity requirements across industrial sites. The introduction of 64-bit Arm-based edge computers with dual-wireless 5G/LTE and Wi-Fi 6 capabilities exemplifies the shift toward multi-modal transport layers that deliver ultra-low latency and high throughput. Such platforms, designed for operation between -40°C and 70°C with ten years of OS maintenance, underscore the industry’s push toward converged solutions that marry compute, connectivity, and security in a single hardened form factor, addressing the exponential growth of active wireless IoT nodes projected to exceed 110 million by 2028.

These transformative shifts also extend to the embrace of open standards and modular architectures that simplify integration with cloud platforms and third-party analytics engines. By adopting standardized industrial protocols, such as OPC UA and Profinet, enterprises can build interoperable networks that accelerate digital twin implementations, predictive maintenance, and real-time analytics-establishing a new paradigm where the network is both the enabler and the guardian of connected operations.

Evaluating the Cascading Effects of Section 301, Section 232, and Reciprocal Tariffs on Industrial Router Supply Chains and Cost Structures in 2025

The cumulative impact of United States trade policies on industrial router supply chains and cost structures has intensified in 2025 due to overlapping tariff measures. Since July 2018, Section 301 tariffs have imposed a 25% duty on a broad array of China-origin goods-including networking equipment-creating a foundational tariff layer that directly affects router imports and component sourcing. To compound this, semiconductors classified under HTS chapters 8541 and 8542 experienced a tariff rate increase from 25% to 50% on January 1, 2025, placing additional upward pressure on the prices of router ASICs, memory modules, and integrated processing units critical to high-performance networking.

Concurrent reciprocal tariffs enacted under the International Emergency Economic Powers Act raised duties on certain imports to as high as 125% in early April 2025, before a trade understanding in Geneva on May 12, 2025, recalibrated reciprocal tariffs on China-origin goods to 10%. Despite this reduction, Section 301 and Section 232 (targeting steel at 25% and aluminum at 10%) remain in full effect, sustaining a layered tariff landscape that inflates enclosure, chassis, and connector costs for industrial router manufacturers.

Moreover, the retention of IEEPA-based tariffs on specific goods from Canada and Mexico has introduced additional complexity in regional sourcing strategies. As a result, provider margins and end-user pricing must accommodate these cumulative duties, compelling market participants to pivot toward tariff engineering solutions-such as bill-of-materials restructuring and strategic supplier diversification-to mitigate risk and preserve competitive positioning.

Unveiling Comprehensive Segment Dynamics Across Connectivity Technologies, Applications, Router Types, Protocols, Port Configurations, and Management Models for Targeted Insights

A deep dive into industrial router market segments reveals a multifaceted landscape driven by diverse connectivity technologies, specialized application requirements, and evolving operational models. Connectivity options span Bluetooth variants-both BLE and Classic-to cellular networks across 3G, 4G LTE, and the bifurcated Non-Standalone and Standalone 5G architectures. Wired connections remain indispensable via Fast Ethernet, Gigabit Ethernet, Ten Gigabit Ethernet, and an expanding suite of Wi-Fi standards, including 802.11ac, 802.11n, and the emerging 802.11be. This layered connectivity portfolio empowers enterprises to tailor network designs for bandwidth, latency, and environmental considerations.

Application-wise, industrial routers address critical sectors such as energy and utilities-ranging from power generation to water treatment-while manufacturing automation spans automotive, food and beverage, and pharmaceuticals. In resource extraction and processing, solutions are optimized for both surface and underground mining, as well as downstream and upstream operations in oil and gas. Transportation and logistics deployments extend from automotive fleet management to maritime and rail networks, each demanding unique reliability and security profiles.

Router type differentiation further enhances market alignment, with fixed, mobile, and rugged devices-sub-categorized into extreme, military, and standard grades-ensuring tailored resilience against shock, vibration, and harsh temperature extremes. Communication protocols like Ethernet/IP, Modbus TCP, OPC UA, and Profinet underpin seamless integration between devices and control systems. Meanwhile, port configurations ranging from two to more than eight ports cater to varying node densities, and management architectures span fully managed platforms to unmanaged plug-and-play solutions, enabling organizations to balance operational control with cost efficiency.

This comprehensive research report categorizes the Industrial Routers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Technology

- Deployment Environment

- End-use Industry

- Sales Channel

Mapping Regional Industrial Router Trends, Adoption Drivers, and Strategic Opportunities Across Americas, EMEA, and Asia-Pacific Markets

The industrial router market exhibits distinct regional characteristics shaped by infrastructure maturity, regulatory environments, and strategic priorities. In the Americas, emphasis on digital transformation within manufacturing and utilities has accelerated the adoption of AI-ready networks and integrated cybersecurity frameworks. Leading vendors are collaborating with key industry players on validated design guides and joint solution offerings to streamline hardware deployments and comply with stringent data sovereignty requirements.

Europe, the Middle East, and Africa (EMEA) present a heterogeneous arena where regulatory standards, such as GDPR and IEC 62443, drive rigorous security and privacy mandates. Infrastructure modernization initiatives-particularly in energy distribution and transport corridors-are fostering demand for routers that support IEC 61850 and advanced SCADA integration. Event showcases like ees Europe 2025 underline the region’s focus on resilient grid and substation automation, with certifications and interoperability playing a pivotal role in buying decisions.

In Asia-Pacific, rapid industrialization and smart city investments are creating robust growth trajectories for industrial routers. Nations such as India are emerging as both prolific consumer and pivotal manufacturing hubs, exemplified by the strategic expansion of networking device production facilities in Chennai. This regional ecosystem benefits from supportive government policies, local R&D capabilities, and cost-efficiencies that drive both domestic uptake and export potential for advanced networking solutions.

This comprehensive research report examines key regions that drive the evolution of the Industrial Routers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Technology Leaders Shaping Industrial Router Innovations through AI-Ready Architectures, Cybersecurity Certifications, and Strategic Manufacturing Hubs

Leading technology providers are setting the pace for industrial router innovation through strategic investments in cybersecurity, AI integration, and localized manufacturing capabilities. Cisco has reinforced its industrial networking leadership by embedding AI-powered threat detection and secure segment-based architectures into its Catalyst IR and C9000 series. The company’s recognition as Industrial IoT Company of the Year underscores its commitment to validated design blueprints and deep IT-OT collaboration that streamlines complex deployments and accelerates time to value.

Moxa continues to distinguish itself with a robust portfolio of certified secure routers, achieving the world’s first IEC 62443-4-2 Security Level 2 certification for its EDR-G9010 and TN-4900 series. By integrating intrusion prevention, deep packet inspection, and hardware-based secure boot mechanisms into its MX-ROS platform, Moxa addresses the escalating cyber threats facing critical infrastructure. This security-first approach, combined with an extensive global certification profile, positions Moxa as a go-to solution for industries demanding uncompromising reliability and compliance.

Other emerging players are leveraging niche strengths-such as software-defined networking flexibility, ultra-low-power mobile routers optimized for remote sites, and cloud-native management platforms-to carve differentiated market positions. The competitive landscape is thus characterized by both established incumbents and agile innovators, each advancing proprietary capabilities to meet evolving industrial connectivity and security requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Routers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Alcatel-Lucent Enterprise

- Antaira Technologies, Inc.

- Belden Inc.

- Cisco Systems, Inc.

- D-Link Corporation

- Digi International Inc.

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Insys icom GmbH

- Juniper Networks, Inc by Hewlett Packard Enterprise Company

- Mikrotik SIA

- Moxa Inc.

- NetModule AG by Belden Inc.

- Nokia Corporation

- Peplink

- Phoenix Contact GmbH & Co. KG

- Robustel

- Schneider Electric SE

- Siemens AG

- Sierra Wireless, Inc. by Semtech Corporation

- TELTONIKA group

- Ubiquiti Inc.

- Westermo Network Technologies AB

- ZTE Corporation

Strategic Imperatives for Industry Leaders to Optimize Router Investments, Fortify Network Security, and Capitalize on Emerging Connectivity Technologies

To navigate the complexities of a rapidly evolving industrial routing environment, industry leaders should adopt a multi-pronged strategic approach. First, prioritize modular hardware architectures that allow post-deployment scalability and firmware upgrades, minimizing capital churn and ensuring future-proof performance. By selecting platforms with open API support and adherence to emerging standards, organizations can seamlessly integrate new wireless interfaces and security tool chains as network demands evolve.

Second, implement zero-trust security frameworks by leveraging routers with built-in intrusion prevention, segmentation, and hardware-based root of trust. Regular firmware updates and vulnerability scanning must be embedded into maintenance cycles to address newly discovered threats. Partnerships with certified device manufacturers that comply with global cybersecurity regulations will further safeguard critical operations.

Third, optimize total cost of ownership through strategic supplier diversification and tariff-aware supply chain design. By incorporating dual-sourcing strategies for key components and exploring regional manufacturing hubs, companies can mitigate the impact of cumulative tariff burdens and logistical disruptions. An agile procurement model and tariff avoidance engineering-such as in-bond manufacturing zones-will help preserve margin integrity.

Finally, cultivate cross-functional governance structures that unite IT, OT, and procurement stakeholders. Establishing collaborative governance forums and champion roles will accelerate decision-making, align network roadmaps with broader digital initiatives, and ensure coherent adoption of next-generation router technologies and services.

Robust Research Methodology Integrating Primary Expert Interviews, Secondary Data Analysis, and Advanced Triangulation for Comprehensive Market Insights

This analysis is grounded in a robust research methodology that triangulates primary and secondary data to deliver actionable market insights. Primary research involved in-depth interviews with technology decision-makers across manufacturing, utilities, and transportation sectors, supplemented by expert consultations with industry analysts, protocol standards bodies, and cybersecurity specialists. These qualitative inputs provided nuanced perspectives on deployment drivers, operational pain points, and emerging feature requirements.

Secondary research encompassed a comprehensive review of corporate press releases, regulatory filings, patent databases, and authoritative publications such as white papers from leading networking providers and standards organizations. Trade events, such as Cisco Live and ees Europe, were systematically analyzed to capture real-time product launches, certification milestones, and collaborative ecosystem developments. Publicly available tariff notices and Federal Register entries were also examined to chart policy impacts on supply chain cost structures.

Quantitative data sources included proprietary surveys on equipment sourcing strategies, pricing trend analyses, and network performance benchmarks, cross-referenced with macroeconomic indicators and regional infrastructure investment statistics. This multi-dimensional research framework ensures that findings reflect both the granular realities of industrial router deployments and the broader strategic trends shaping the market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Routers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Routers Market, by Product Type

- Industrial Routers Market, by Connectivity Technology

- Industrial Routers Market, by Deployment Environment

- Industrial Routers Market, by End-use Industry

- Industrial Routers Market, by Sales Channel

- Industrial Routers Market, by Region

- Industrial Routers Market, by Group

- Industrial Routers Market, by Country

- United States Industrial Routers Market

- China Industrial Routers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Industrial Router Market Insights to Inform Strategic Decision-Making and Accelerate Technological Adoption in Digital Transformation Journeys

In the face of accelerating digital transformation and escalating cybersecurity threats, industrial routers have transcended their traditional role to become pivotal assets in the architecture of connected operations. The convergence of AI-enabled network management, multi-modal high-speed connectivity, and stringent security protocols underscores the criticality of selecting routers that balance performance, resilience, and compliance. Market segmentation across connectivity technologies, applications, and device typologies reveals tailored opportunities for enterprises to align router capabilities with their unique operational imperatives.

The cumulative weight of Section 301, Section 232, and reciprocal tariffs has introduced a new calculus in sourcing strategies, prompting organizations to adopt tariff avoidance mechanisms and modular supply chains. Regional insights highlight divergent growth trajectories: the Americas focus on AI and cybersecurity, EMEA on regulatory-driven standards compliance, and Asia-Pacific on manufacturing scale and cost-effective innovation.

Leading vendors like Cisco and Moxa exemplify divergent pathways to market leadership-one through AI-infused network architectures and validated global design blueprints, the other through first-mover cybersecurity certifications and dual-wireless edge computing platforms. By synthesizing these trends, decision-makers can chart a clear path to deploy industrial routers that deliver robust connectivity, uncompromising security, and long-term operational agility in the journey toward Industry 4.0.

Engage with Ketan Rohom to Secure Your Custom Industrial Router Market Research Report and Unlock Actionable Insights for Strategic Competitive Advantage

To secure an authoritative and customized industrial router market research report tailored to your strategic requirements, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings deep expertise in translating complex market data into actionable insights that drive decision-making and competitive differentiation. Whether you seek in-depth analysis of segment dynamics, tariff impacts, or emerging technological trends, Ketan can guide you through the report’s breadth and arrange a personalized briefing to align the deliverables with your specific business objectives. Engage with Ketan today to unlock exclusive findings, proprietary data visualizations, and expert recommendations that will empower your organization to navigate the evolving industrial connectivity landscape with confidence and precision. Your next strategic advantage is one conversation away.

- How big is the Industrial Routers Market?

- What is the Industrial Routers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?