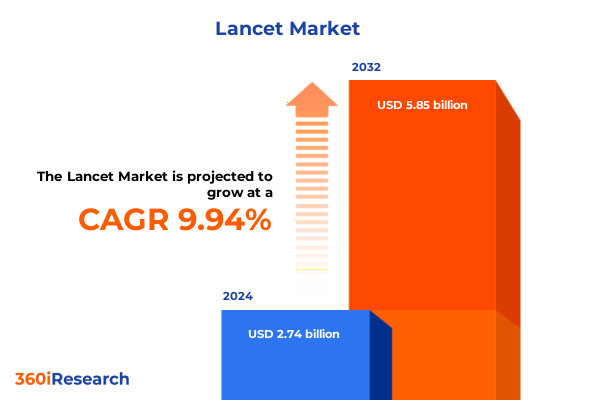

The Lancet Market size was estimated at USD 3.01 billion in 2025 and expected to reach USD 3.30 billion in 2026, at a CAGR of 9.96% to reach USD 5.85 billion by 2032.

Exploring the Critical Role of Lancets in Modern Healthcare Delivery and the Evolving Dynamics Shaping the Market Landscape

Lancets play a pivotal role in modern healthcare by enabling precise and reliable capillary blood sampling, a fundamental step in diagnosing and monitoring chronic conditions such as diabetes. With the rising prevalence of diabetes in the United States-where 38.4 million people, or 11.6 percent of the population, are living with diabetes-demand for user-friendly and safe lancet devices has surged. This trend is further underscored by data indicating that over half of adults with diabetes require routine self-testing, driving robust adoption of both home and clinical lancing systems.

Uncovering the Transformative Shifts Reshaping Lancet Manufacturing, Regulatory Environments, and Clinical Adoption Patterns Globally

The lancet industry is undergoing transformative shifts driven by technological breakthroughs, evolving regulatory frameworks, and changing end-user expectations. In production hubs across China and India, manufacturers have doubled down on automation and capacity expansion, supported by over sixty global investment initiatives dedicated to ergonomic, minimally invasive lancet designs. Meanwhile, European producers are spearheading sustainability with biodegradable materials and lifecycle assessment platforms, reflecting a deeper integration of environmental priorities in product development. Transitioning from traditional needle formats, the market has seen more than three hundred new safety lancet models introduced in the past year, each featuring single-click activation and instant retraction systems to minimize the risk of needlestick injuries.

Assessing the Cumulative Impact of Recent United States Tariffs on the Supply Chain, Cost Structures, and Accessibility of Lancets in 2025

Recent tariff measures enacted by the United States have compounded the complexity of lancet supply chains, as medical device imports face steep additional duties. Under Section 301 measures, syringes and needles now incur a one hundred percent tariff, a shift formalized in late 2024 after extensive public review and revised implementation schedules. These duties, combined with tariffs reaching up to one hundred forty-five percent on certain components sourced from China, have created ripple effects throughout the industry, disrupting established procurement channels and prompting urgent discussions on tariff exemptions. Healthcare facilities, particularly those dependent on imported safety lancets, have experienced elevated costs and sporadic stockouts, underscoring the need for supply chain diversification and domestic capacity enhancements.

Deriving Key Segmentation Insights from Product Types, Gauge Sizes, Pricing Tiers, and End User Dynamics in the Lancet Market

Analysis of product type segmentation reveals that adjustable-depth lancets offer clinicians and home users a versatile solution for varied skin thicknesses, securing a strong foothold in both diabetic care and gestational diabetes management. Fixed-depth lancets, with their calibrated penetration, maintain popularity in high-volume diagnostic centers due to their consistency and ease of use. Safety lancets, integrating instant needle retraction, have become the standard in hospitals and clinics, especially within large care facilities where sharps safety is paramount. Gauge size considerations further inform market preferences: the 28G lancet provides rapid blood flow for robust hemoglobin testing, while the 30G and 33G options cater to users prioritizing minimal pain and reduced tissue trauma during glucose checks. Pricing tier insights indicate that economy lancets command attention in cost-sensitive public health programs, while premium lancets-with features such as ergonomic grips and micro-thin needles-address the demands of specialist clinics and discerning home users. Standard-tier lancets bridge these extremes, offering a balanced value proposition for middle-market buyers. End-user segmentation highlights that diagnostic centers drive demand for fixed-depth and blade-type lancets, whereas home healthcare remains the fastest growing segment, particularly among Type 2 diabetes patients who favor adjustable-depth devices for routine monitoring. Hospitals and clinics, classified by scale, exhibit distinct procurement patterns: large systems leverage bulk purchasing contracts for safety lancets, medium hospitals prioritize a mix of safety and fixed-depth models, and smaller clinics opt for cost-effective, standard-tier lancing solutions.

This comprehensive research report categorizes the Lancet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gauge Size

- Pricing Tier

- End User

Distilling Key Regional Insights by Examining the Americas, Europe Middle East & Africa, and Asia Pacific Lancet Consumption Patterns

Regional analyses demonstrate that the Americas continue to lead in per-capita lancet consumption, fueled by advanced healthcare infrastructure and comprehensive reimbursement schemes that support frequent self-testing among the 38 million Americans with diagnosed diabetes. In Europe, Middle East, and Africa, manufacturers face simultaneous pressures from the EU’s Packaging and Packaging Waste Regulation and the dual conformity requirements of the Medical Device Regulation and Battery Regulation, compelling device makers to innovate in recyclable and energy-efficient packaging while maintaining CE compliance. Asia-Pacific markets, led by China with 140.9 million adults with diabetes and India with 74.2 million, present both immense scale and diverse buyer profiles; local manufacturing initiatives in these regions are expanding capacity for economy and standard-tier lancets to address rural and urban demand, while premium lancets find traction in high-income urban centers seeking advanced features.

This comprehensive research report examines key regions that drive the evolution of the Lancet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Competitive Company Strategies and Innovations Driving Growth and Differentiation in the Global Lancet Industry

Major companies are deploying distinct strategies to capture market share and differentiate their offerings. Becton, Dickinson and Company has announced a substantial expansion of its U.S. production lines for syringes and needles, enhancing domestic safety lancet capacity by over forty percent through multi-million dollar investments in Connecticut and Nebraska. Roche, with its Diagnostics division advancing point-of-care systems, is integrating automated lancing modules within glucose meters to streamline patient workflows and uphold its commitment to net-zero emissions under the Science Based Targets initiative. Owen Mumford leads in sustainability, securing Science Based Targets initiative approval for net-zero greenhouse gas emissions by 2045 and channeling efforts into lifecycle assessment platforms that inform the development of eco-conscious lancet lines. Smaller innovators such as Sarstedt and Nipro are forging strategic partnerships with telehealth and home diagnostics firms to embed lancets within subscription-based monitoring kits, while continuously refining needle gauge and depth configurations to enhance patient comfort.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lancet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AdvaCare Pharma

- Advin Health Care

- Amkay Products Pvt. Ltd.

- Apothecaries Sundries Manufacturing Co.

- ARKRAY, Inc.

- B. Braun SE

- Becton, Dickinson and Company

- Bioactiva Diagnostica GmbH

- Chongqing New World Trading Co., Ltd.

- Deluxe Scientific Surgico Pvt. Ltd.

- F. Hoffmann-La Roche Ltd.

- Hebei Xinle Sci&Tech Co., Ltd.

- HTL-STREFA S.A.

- JiangSu Huida Medical Instruments Co., Ltd.

- Medtronic PLC

- Medtrue Enterprise Co, Ltd.

- Narang Medical Limited

- Nipro Medical Corporation

- Owen Mumford Limited

- Phoenix Healthcare Solution, LLC

- Proexamine Surgicals Private Limited

- Sara HealthCare Pvt.Ltd.

- Sarstedt AG & Co. KG

- Shanghai Kohope Medical Devices Co., Ltd.

- Smith Medical by ICU Medical, Inc.

- Sterimed Group

- Terumo Corporation

Formulating Actionable Recommendations to Empower Industry Leaders to Navigate Market Complexities and Accelerate Lancet Category Advancement

Industry leaders should prioritize supply chain resilience by diversifying sourcing across regions and establishing strategic partnerships with domestic manufacturers to mitigate the effects of tariff volatility. Integrating sustainability from concept to disposal not only aligns with evolving regulatory requirements but also resonates with buyers seeking environmentally responsible healthcare products; adopting lifecycle assessment tools and pursuing comprehensive emissions targets can yield competitive advantage. Accelerating the development of digital lancet solutions-incorporating Bluetooth connectivity, depth-sensing feedback, and cloud-based analytics-will address growing demands for seamless integration with telehealth platforms and remote monitoring services. Engaging with policymakers to advocate for targeted tariff exclusions on critical medical devices, including lancets, can help stabilize procurement costs and avert supply shortages. Cultivating flexible pricing models that reflect diverse end-user needs-from public health programs to specialty clinics-while maintaining premium product lines will ensure balanced revenue streams across market segments.

Outlining Rigorous Research Methodologies Underpinning Data Collection, Analysis, and Validation in the Comprehensive Lancet Study

This research leveraged a multi-phased approach combining primary and secondary data collection to ensure robust, validated insights. Primary interviews were conducted with senior executives from leading lancet manufacturers, procurement specialists at major hospital networks, and C-suite home healthcare providers to capture first-hand perspectives on market dynamics. Secondary analysis encompassed a thorough review of trade policy filings, tariff schedules, and regulatory notices to quantify the impact of recent U.S. and EU measures. Proprietary shipment and customs data were analyzed to track volume shifts across key trade lanes, while sustainability disclosures and lifecycle assessments provided a basis for environmental benchmarking. Throughout the study, analytical rigor was maintained via cross-validation of data sources and iterative review by subject matter experts to uphold the highest standards of accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lancet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lancet Market, by Product Type

- Lancet Market, by Gauge Size

- Lancet Market, by Pricing Tier

- Lancet Market, by End User

- Lancet Market, by Region

- Lancet Market, by Group

- Lancet Market, by Country

- United States Lancet Market

- China Lancet Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Insights Synthesizing Market Trends, Challenges, and Strategic Imperatives Shaping the Future of the Lancet Landscape

In conclusion, the lancet market stands at an inflection point shaped by surging demand from a growing diabetic population, transformative technological innovations, and an increasingly complex regulatory and trade environment. Segmentation insights underscore the nuanced preferences across product types, gauge sizes, pricing tiers, and end users, while regional analyses reflect the dual imperatives of scale and sustainability. Key players are redefining strategies through domestic capacity expansions, digital integration, and ambitious environmental commitments. To thrive in this landscape, industry stakeholders must adopt a holistic approach that blends supply chain agility, regulatory engagement, and forward-looking product development.

Engaging Opportunity to Connect with Ketan Rohom for Tailored Lancet Market Intelligence and Strategic Growth Insights

Are you ready to leverage the comprehensive insights from this report to inform your strategic decisions and stay ahead of market shifts? Contact Ketan Rohom, Associate Director of Sales & Marketing, who brings deep expertise in healthcare market intelligence and can guide you through customized solutions. Engage directly to discuss how our data-driven analysis can address your unique challenges and accelerate your growth in this critical market segment. Reach out to arrange a personalized consultation and secure access to the full report today

- How big is the Lancet Market?

- What is the Lancet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?