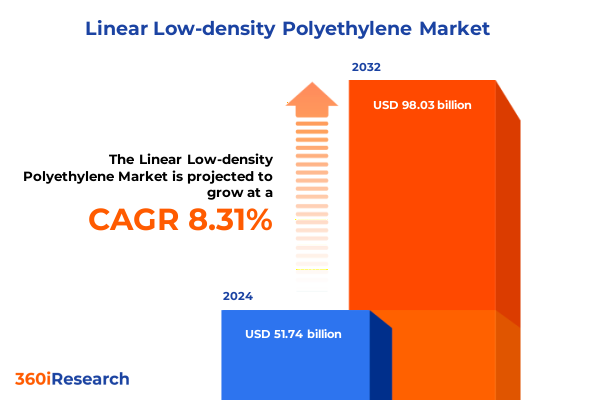

The Linear Low-density Polyethylene Market size was estimated at USD 55.20 billion in 2025 and expected to reach USD 58.89 billion in 2026, at a CAGR of 8.55% to reach USD 98.03 billion by 2032.

Introducing the Dynamic World of Linear Low-Density Polyethylene: Exploring Its Unique Material Characteristics and Emerging Market Foundations

Linear low-density polyethylene represents a versatile class of polyolefin materials characterized by its unique combination of mechanical strength, flexibility, and processability. Distinguished by its linear backbone with controlled short-chain branching, this material balances toughness and elongation more effectively than conventional low-density polyethylene, providing improved performance in applications that demand both resilience and clarity. Its density range, typically spanning from 0.915 to 0.925 grams per cubic centimeter, confers a moderate crystallinity that enhances puncture resistance while maintaining low-temperature impact strength.

Manufacturers tailor its melt flow index through catalyst selection-often using metallocene or Ziegler-Natta systems-to optimize processing via film extrusion, injection molding, blow molding, or rotational molding. The adjustable rheology and crystallization kinetics support its use in stable greenhouse films that regulate temperature, mulching films that conserve soil moisture, and silage coverings that preserve forage quality in agriculture. Likewise, automotive components benefit from its balanced stiffness and flexibility in both exterior trim and under-the-hood applications. Transitioning seamlessly into construction markets, this thermoplastic excels in vapor barriers, roofing membranes, and pipe insulation, providing durable protection against moisture and temperature variations. Driven by its multifaceted performance attributes, linear low-density polyethylene serves as a cornerstone material across an expansive range of industrial and consumer segments.

Uncovering Pivotal Transformations Reshaping the Linear Low-Density Polyethylene Landscape Amid Sustainability and Technological Innovation

Over the past decade, the linear low-density polyethylene landscape has undergone transformative shifts driven by sustainability imperatives, technological advancements, and evolving end-use requirements. Chemical producers have adopted novel catalyst technologies, such as single-site metallocene systems, to refine molecular weight distribution and branching architecture. These innovations have unlocked higher clarity films and improved mechanical properties, extending the material’s reach into performance-sensitive applications in electronic insulation and flexible packaging. In parallel, digitalization of production processes through advanced process control and real-time monitoring has enhanced operational efficiency and reduced waste streams, aligning with corporate sustainability goals.

Meanwhile, the circular economy has emerged as both a regulatory and commercial priority, compelling stakeholders to integrate mechanically recycled and chemically recycled content into linear low-density polyethylene grades. Collaborative efforts among resin suppliers, film converters, and waste-management firms have yielded high-performance recycled blends with minimal compromise on clarity or tensile strength. In regions with extended producer responsibility mandates, manufacturers have scaled up take-back programs and invested in chemical depolymerization routes to generate feedstock from post-consumer films. These coordinated initiatives are reshaping value chains, compelling traditional players to forge alliances with recycling technology providers and downstream brand owners in order to satisfy sustainability targets and consumer expectations.

Assessing the Combined Effects of United States Tariff Measures on Linear Low-Density Polyethylene Supply Chains and Competitiveness in 2025

In 2025, cumulative tariff measures enacted by the United States have exerted notable pressure on linear low-density polyethylene supply chains and cost structures. Building upon earlier Section 301 levies, recent adjustments introduced additional duties targeting key importing regions. These escalated tariffs have amplified landed resin costs for domestic polymer processors reliant on imported material, prompting a shift toward locally produced grades or alternative resin classes whenever feasible.

Price volatility intensified as converters negotiated pass-through mechanisms, leading to sporadic surcharges on finished flexible packaging and stretch film products. End-market participants in agriculture and construction experienced margin compression as input costs rose, compelling some to explore multi-sourcing strategies or regional production hubs in tariff-exempt zones. The elevated duty environment also fostered increased upstream investment in U.S. polymer capacity expansions, as global suppliers sought to circumvent trade barriers and maintain customer access. Despite these adaptive measures, the combined impact of tariffs has underscored the critical importance of supply chain resilience, tariff engineering, and strategic inventory management in safeguarding operational continuity.

Deriving Strategic Insights from Layered Segmentations Defining the Linear Low-Density Polyethylene Market Across Applications, Grades, and Manufacturing Processes

A comprehensive examination of market segments reveals intricate demand patterns influenced by end-use priorities and processing considerations. Application requirements drive distinct material selections; agricultural films demand optimized puncture resistance for greenhouse, mulch, and silage applications, with the latter two benefiting from black or clear mulch options to regulate soil temperature and moisture retention. Within the automotive sector, exterior panels and trim leverage robust impact performance, while interior cabin elements and under-the-hood components require materials with consistent thermal resistance and chemical tolerance. Construction utilities encompass roofing membranes and vapor barriers requiring continuous barrier integrity, alongside pipe insulation solutions that balance thermal insulation with mechanical robustness.

Grade differentiation hinges upon metallocene or Ziegler-Natta catalyst routes, each delivering tailored molecular architectures that influence clarity, strength, and process latitude. Manufacturers employ film extrusion for flexible packaging formats-ranging from bags and liners to shrink and stretch films-while injection molding and blow molding facilitate rigid and semi-rigid components in consumer goods, toys, and sporting equipment. Rotational molding serves niche industrial applications such as geomembranes, and granule versus powder forms address compounding ease or specialized end-process blending. Density choices between high and standard densities further calibrate stiffness and toughness thresholds, enabling formulators to meet precise performance specifications across diverse manufacturing platforms.

This comprehensive research report categorizes the Linear Low-density Polyethylene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Manufacturing Process

- Form

- Density

- Application

Exploring Regional Dynamics Influencing Linear Low-Density Polyethylene Adoption and Growth Patterns Across the Americas, Europe, and Asia-Pacific Markets

Regional dynamics display contrasting growth trajectories influenced by regulatory frameworks, feedstock availability, and demand structures. In the Americas, robust energy pricing and established petrochemical infrastructure support expansive resin production and export opportunities, driving strong uptake in flexible packaging and agricultural films across North and South America. Meanwhile, Europe, Middle East & Africa operate under stringent recycled content mandates and circular economy directives that accelerate demand for certified recycled and chemically depolymerized grades, fostering innovation in compostable film blends and enhanced barrier packaging.

Across Asia-Pacific, burgeoning consumer markets and infrastructure investment propel adoption in construction membranes, consumer goods, and automotive parts, with local producers enhancing capacity to satisfy swift market expansion. Government initiatives promoting domestic polyethylene output in key Asia Pacific economies have spurred joint ventures and capacity debottlenecking projects, improving availability and price competitiveness. Together, these regional dynamics underscore the importance of crafting bespoke supply chain strategies that align production footprints, regulatory compliance, and end-market growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Linear Low-density Polyethylene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovation Pathways of Leading Linear Low-Density Polyethylene Producers Shaping Global Market Leadership

A handful of global players continue to define competitive benchmarks through scale advantages, innovation pipelines, and integrated value chains. LyondellBasell applies its proprietary metallocene catalysts to deliver enhanced clarity and barrier properties, targeting premium film applications. ExxonMobil leverages its extensive polyolefin integration to optimize supply reliability while rolling out recycled-enhanced resins under its certified circular polymers portfolio. SABIC focuses on regional manufacturing expansions, bolstering capacity in the Middle East and Asia Pacific to meet surging demand for industrial and consumer segments.

Chevron Phillips Chemical differentiates through specialty grades designed for high-performance stretch films and advanced automotive components, while Braskem emphasizes biopolymer blends and bio-based feedstocks in response to sustainability mandates. Dow’s global operations deploy advanced process controls to bolster consistency in extrusion and molding grades, complementing its innovation agenda for agricultural films that extend canopy life. Together, these companies shape market dynamics through targeted investments in catalyst technology, circularity initiatives, and regionally tailored product portfolios that address evolving end-use requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Linear Low-density Polyethylene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- LG Chem Ltd.

- Lotte Chemical Corporation

- Mitsui Chemicals, Inc.

- PetroChina Company Limited

- Reliance Industries Limited

- Repsol S.A.

- Sasol Limited

- SK Geo Centric Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- TotalEnergies SE

Strategic Roadmap for Industry Leaders to Accelerate Growth, Enhance Sustainability, and Capitalize on Innovation in the Linear Low-Density Polyethylene Sector

Industry leaders seeking to strengthen their market positions should pursue multifaceted strategies that encompass technological, operational, and sustainability dimensions. Prioritizing advanced catalyst adoption will enable development of next-generation resin grades with tighter molecular weight distributions, improved mechanical performance, and lower energy footprints during processing. Simultaneously, forging partnerships with recycling technology providers offers a pathway to integrate certified recycled content or chemically recycled feedstocks, supporting compliance with emerging circular economy regulations and enhancing brand value among environmentally conscious customers.

Operational resilience can be elevated by establishing geographically diversified production sites and leveraging strategic alliances to mitigate tariff impacts and feedstock supply disruptions. Investing in digital process monitoring and predictive maintenance reduces downtime, optimizes throughput, and lowers operational costs. From a market perspective, calibrating product portfolios to address high-growth applications such as advanced packaging films, agricultural mulches, and automotive light-weighting components will unlock premium margin opportunities. By embedding sustainability targets into R&D roadmaps and supply chain strategies, industry participants can future-proof their operations against tightening environmental standards while capturing long-term value.

Delineating Rigorous Research Methodologies and Analytical Frameworks Underpinning the Comprehensive Study of Linear Low-Density Polyethylene Market Dynamics

The research underpinning this report integrates comprehensive data collection, stakeholder engagement, and triangulation techniques to ensure robust insights. Initial desk research encompassed detailed review of industry publications, patent filings, regulatory frameworks, and corporate disclosures to map market developments and technology trends. This was complemented by primary interviews with resin producers, converters, end-users, and recyclers, providing first-hand perspectives on operational challenges, product requirements, and strategic priorities.

Quantitative analyses involved segmentation modeling across applications, grades, manufacturing methods, forms, and density tiers, validated through supply chain feedback loops. Qualitative assessments employed a SWOT framework and Porter’s Five Forces analysis to identify competitive pressures, growth drivers, and risk factors. Regional market dynamics were examined through policy reviews and trade flow studies, enabling an integrated understanding of global demand patterns. Finally, findings were synthesized to develop actionable recommendations, ensuring alignment between industry realities and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Linear Low-density Polyethylene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Linear Low-density Polyethylene Market, by Grade

- Linear Low-density Polyethylene Market, by Manufacturing Process

- Linear Low-density Polyethylene Market, by Form

- Linear Low-density Polyethylene Market, by Density

- Linear Low-density Polyethylene Market, by Application

- Linear Low-density Polyethylene Market, by Region

- Linear Low-density Polyethylene Market, by Group

- Linear Low-density Polyethylene Market, by Country

- United States Linear Low-density Polyethylene Market

- China Linear Low-density Polyethylene Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Strategic Perspectives on the Future Evolution and Value Creation Opportunities Within the Linear Low-Density Polyethylene Market Landscape

Looking ahead, the linear low-density polyethylene market is poised for continued evolution driven by sustainability imperatives, technological breakthroughs, and shifting consumption behaviors. The adoption of recycled and bio-based feedstocks will gain further momentum as regulatory frameworks tighten and consumer preference for eco-friendly solutions intensifies. Advances in catalyst design and process control will unlock specialty resin grades with precise performance characteristics, enabling growth in premium applications such as high-barrier packaging, advanced films for greenhouse cultivation, and lightweight automotive components.

Concurrently, regional dynamics will shape investments, with producers optimizing global footprints to balance proximity to feedstock sources, end-market demand, and regulatory compliance. Partnerships spanning the value chain-from waste collectors to brand owners-will underpin circular economy initiatives and create new business models centered on post-use material retrieval and repurposing. Ultimately, players that effectively integrate innovation, sustainability, and operational agility will deliver superior value and secure market leadership in the dynamic realm of linear low-density polyethylene.

Engage with Ketan Rohom to Explore Customized Research Solutions and Secure Your Expert Linear Low-Density Polyethylene Market Intelligence Today

To gain customized insights, detailed data, and tailored strategic guidance, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will offer personalized consultation to align the findings of this comprehensive market intelligence with your business objectives, ensuring you capture growth opportunities and mitigate risks effectively. Engage today to secure your copy of the full market research report and empower your decision-making with cutting-edge analysis and actionable recommendations in the linear low-density polyethylene sector.

- How big is the Linear Low-density Polyethylene Market?

- What is the Linear Low-density Polyethylene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?