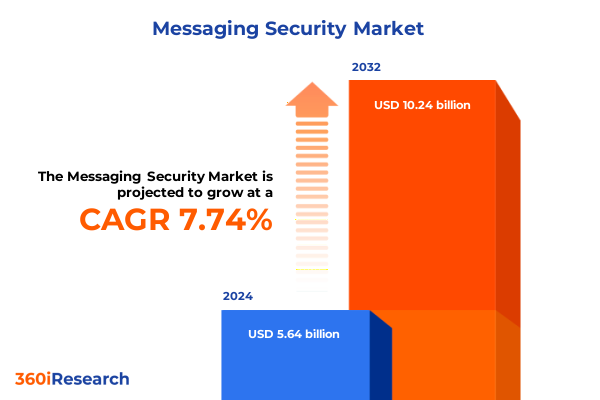

The Messaging Security Market size was estimated at USD 6.07 billion in 2025 and expected to reach USD 6.54 billion in 2026, at a CAGR of 7.75% to reach USD 10.24 billion by 2032.

Setting the Stage for Robust Messaging Security Through a Comprehensive Analysis of Threats, Technologies, and Enterprise Imperatives

Enterprises today face an unprecedented challenge as the sheer volume and variety of messaging channels expand across digital ecosystems. From chat platforms to traditional email towers, the attack surface continues to broaden, demanding robust security frameworks that can adapt to emerging threat vectors. This executive summary sets the stage for a thorough exploration of messaging security architectures and the critical factors driving adoption and innovation. By framing the discussion around enterprise imperatives and evolving risk landscapes, readers will gain clarity on the imperatives shaping strategic investments and technology roadmaps.

Moreover, this introduction underscores the necessity for a unified perspective on diverse security types, including chat security, email security, SMS security, and social media security. Each channel possesses unique control points and vulnerability profiles, and synthesizing them within a cohesive strategy is essential for reducing enterprise risk. In particular, this report highlights how organizations can reconcile operational efficiency with compliance obligations and threat mitigation, paving the way for deeper insights in subsequent sections.

Unveiling the Breakthrough Shifts Redefining Messaging Security Strategies Amidst Evolving Threat Vectors, Regulatory Landscapes, and User Behavior Dynamics

In recent years, the messaging security landscape has undergone profound shifts catalyzed by accelerated cloud adoption, the proliferation of remote work, and heightened regulatory scrutiny. Organizations are increasingly transitioning from perimeter-based defenses to zero trust models, recognizing that legacy approaches can no longer sustain the dynamic nature of modern workplaces. Furthermore, artificial intelligence and machine learning have emerged as both potent defenders and sophisticated threat enablers, prompting a reevaluation of security toolchains and data analysis methodologies.

Additionally, regulatory initiatives around privacy and data sovereignty have compelled enterprises to rearchitect their messaging infrastructures, balancing localized control with the agility of global collaboration. This realignment has been accompanied by strategic partnerships between security vendors and cloud providers, yielding integrated solutions that deliver unified policy enforcement across multiple deployment modes. Consequently, businesses must navigate a complex mosaic of technical capabilities, governance frameworks, and user-driven expectations in order to safeguard critical communications channels.

Assessing the Ripple Effects of 2025 United States Tariffs on Messaging Security Supply Chains, Solution Costs, and Vendor Ecosystem Viability

Beginning in early 2025, a new tranche of United States tariffs on imported encryption modules, networking hardware, and specialized server components has introduced fresh supply chain challenges. These levies, targeting equipment primarily manufactured in East Asia, have precipitated extended lead times and incremental cost pressures that ripple across the messaging security ecosystem. Vendors relying on hardware-accelerated encryption or proprietary appliances have had to recalibrate their pricing structures, shifting some burden to end customers while seeking alternative sourcing arrangements.

Moreover, the reclassification of certain cloud infrastructure components under existing tariff schedules has created ambiguity around cost forecasting for public, private, and hybrid cloud deployments. As a result, security architects and procurement teams are placing increased emphasis on software-centric solutions and modular licensing models to mitigate hardware risk exposure. To illustrate, several global service providers have accelerated development of virtualized threat detection modules that reduce dependence on physical appliances, thereby preserving recipe-level encryption capabilities without running afoul of tariff-related constraints.

Unlocking Market Segmentation Insights By Evaluating Security Types, Deployment Models, End Users, Components, and Organization Sizes for Strategic Clarity

Through a lens of security type analysis, chat security platforms have experienced a surge in interest as enterprises seek to secure real-time communications with advanced threat detection and compliance archiving. Email security remains foundational, with emphasis on archiving and continuity to meet governance mandates alongside encryption and data loss prevention to protect sensitive content. Equally important, email threat detection and protection services continue to evolve, leveraging AI-driven analytics to identify zero-day phishing campaigns and impersonation attempts.

In the domain of deployment mode, cloud environments have ascended as the preferred architecture for many organizations, offering elastic scalability and simplified management. Within this paradigm, hybrid cloud models enable seamless policy extension between on-premises infrastructure and public cloud platforms, while private cloud deployments appeal to enterprises with stringent data residency requirements. Concurrently, on-premises solutions persist in highly regulated sectors where direct control over hardware and network perimeter is non-negotiable.

When considering end users, enterprises across BFSI, healthcare, IT and telecom, and retail verticals are driving adoption through sector-specific compliance frameworks and digital transformation initiatives. Government agencies, too, maintain a robust security posture by mandating strict encryption standards and continuous monitoring. The component dimension reveals a balanced focus on service and solution offerings; managed and professional services augment hardware and software investments, ensuring tailored implementation and ongoing operational support.

Finally, organization size analysis underscores distinct priorities: large enterprises typically allocate budget toward integrated, multi-layered security architectures, while small and medium enterprises-including medium, micro, and small firms-gravitate toward turnkey solutions that offer rapid deployment and predictable cost structures. This segmentation matrix informs strategic decision making by highlighting where vendors can optimize delivery models and customer engagement strategies.

This comprehensive research report categorizes the Messaging Security market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Security Type

- Organization Size

- Deployment Mode

- End User

Revealing Geographical Variances in Messaging Security Adoption with Critical Regional Drivers Spanning Americas, Europe Middle East Africa, and Asia Pacific

Across the Americas, messaging security adoption is propelled by a blend of regulatory mandates and digital transformation agendas. North American enterprises, in particular, leverage advanced analytics and threat intelligence integrations to address high-profile breach scenarios and safeguard intellectual property. Simultaneously, regional players in Latin America are increasingly turning to cloud-native security solutions to leapfrog legacy infrastructures and meet evolving compliance requirements.

In Europe, Middle East, and Africa, stringent data protection regulations such as GDPR and emerging e-privacy directives serve as catalysts for deeper investment in encryption and archiving capabilities. Organizations in the Middle East and Africa are rapidly modernizing, often partnering with global vendors to access sophisticated service offerings that align with local regulatory expectations. Moreover, joint ventures between regional integrators and multinational providers are fostering knowledge transfer and boosting solution localization.

Conversely, the Asia-Pacific region is characterized by aggressive digital expansion and a burgeoning base of mobile-first users. Enterprises in APAC are embracing software-defined security models and mobile messaging encryption to support a diverse array of communication channels. At the same time, government initiatives advocating for cybersecurity maturity have accelerated public-private collaborations, driving demand for comprehensive threat detection and response platforms.

This comprehensive research report examines key regions that drive the evolution of the Messaging Security market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Solution Providers and Innovators Driving Competitive Differentiation and Collaborative Partnerships within the Messaging Security Ecosystem

A handful of legacy incumbents and disruptive newcomers now dominate the messaging security landscape, each advancing competitive differentiation through specialization and partnership ecosystems. Symantec’s integration into larger enterprise portfolios underscores the shift toward holistic security platforms, while Microsoft continues to embed threat protection within its cloud productivity suite to deliver seamless user experiences. Proofpoint’s threat intelligence services remain best-in-class for complex email threat detection, whereas Mimecast differentiates through unified archiving and continuity services that simplify compliance.

Simultaneously, next-generation providers such as Zscaler and Palo Alto Networks are capitalizing on cloud-native architectures to offer scalable chat and SMS security modules. Their success has prompted traditional network security vendors like Cisco and Check Point to accelerate cloud integration, enabling dynamic policy enforcement across messaging channels. Moreover, a growing number of specialized managed service providers collaborate with hardware vendors to deliver end-to-end implementations, blending on-premises control with cloud agility to meet diverse organizational requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Messaging Security market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Barracuda Networks, Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Forcepoint LLC

- Fortinet, Inc.

- Microsoft Corporation

- Mimecast Limited

- Proofpoint, Inc.

- Trend Micro Incorporated

Formulating Actionable Roadmaps for Industry Leaders to Strengthen Security Posture, Foster Innovation, and Ensure Resilience in Messaging Environments

Industry leaders should prioritize a zero trust framework that encompasses all messaging vectors, ensuring each user interaction is authenticated, authorized, and continuously validated. To deliver on this mandate, security architects must integrate identity and access management with real-time threat intelligence, thereby establishing a unified control plane. Furthermore, embedding machine learning within detection workflows can accelerate anomaly identification and reduce false positives, enabling security teams to focus on high-impact incidents.

Leaders are also advised to cultivate strategic partnerships with managed service providers that specialize in messaging security, outsourcing routine monitoring while retaining governance oversight. This collaborative approach not only enhances threat visibility but also optimizes operational efficiency, freeing internal resources for innovation. Additionally, implementing cross-functional governance forums will facilitate alignment between security, compliance, and business units, ensuring policy frameworks evolve in lockstep with organizational objectives.

Detailing the Rigorous Research Methodology Employed to Authenticate Insights through Data Collection, Analysis Techniques, and Quality Assurance Protocols

The research methodology underpinning this analysis comprised a multi-stage process designed to ensure data integrity and insight reliability. Secondary research involved a comprehensive audit of public filings, regulatory frameworks, and academic studies to establish foundational knowledge of messaging security dynamics. Subsequently, primary research was conducted through in-depth interviews with senior security executives, solution architects, and industry analysts, providing rich qualitative perspectives on deployment challenges and adoption drivers.

Data triangulation techniques were then applied to reconcile discrepancies and validate emerging trends, leveraging both quantitative surveys and expert panel reviews. Finally, a rigorous quality assurance protocol-encompassing peer reviews, technical validations, and scenario testing-was employed to confirm the accuracy of conclusions and recommendations. This structured approach ensures that the insights presented are both authoritative and actionable for decision-makers across enterprise and government sectors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Messaging Security market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Messaging Security Market, by Component

- Messaging Security Market, by Security Type

- Messaging Security Market, by Organization Size

- Messaging Security Market, by Deployment Mode

- Messaging Security Market, by End User

- Messaging Security Market, by Region

- Messaging Security Market, by Group

- Messaging Security Market, by Country

- United States Messaging Security Market

- China Messaging Security Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding with Strategic Takeaways Emphasizing the Imperative to Evolve Security Measures in Response to Emerging Threats and Organizational Demands

As organizations navigate an increasingly intricate threat landscape, the imperative to evolve messaging security architectures has never been clearer. This report’s strategic takeaways emphasize the necessity of unifying disparate channel defenses into coherent, policy-driven frameworks underpinned by zero trust principles. By embracing advanced analytics and machine learning, enterprises can transition from reactive posture management to predictive threat hunting.

Ultimately, success hinges on a balanced fusion of technology, process, and people. Security leaders must remain agile in adjusting to tariff-driven supply chain disruptions while continuing to invest in cloud-native and software-defined solutions. With these insights, enterprises are well-positioned to elevate their messaging security posture, ensuring resilience and adaptability in the face of future challenges.

Engage with Ketan Rohom to Secure Your Comprehensive Messaging Security Research Report and Gain the Competitive Edge Your Organization Requires

To explore how these insights can be leveraged for strategic advantage, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engaging directly with Ketan provides you access to an in-depth briefing tailored to your organization’s unique needs. You will gain clarity on enhancing resilience, accelerating technology adoption, and cultivating an agile security posture. By securing this market research report, you can empower stakeholders with data-driven decision-making tools and pragmatic implementation plans. Partnering with Ketan ensures you receive personalized guidance on integrating these findings within your operational roadmap, ultimately driving competitive differentiation and long-term growth

- How big is the Messaging Security Market?

- What is the Messaging Security Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?