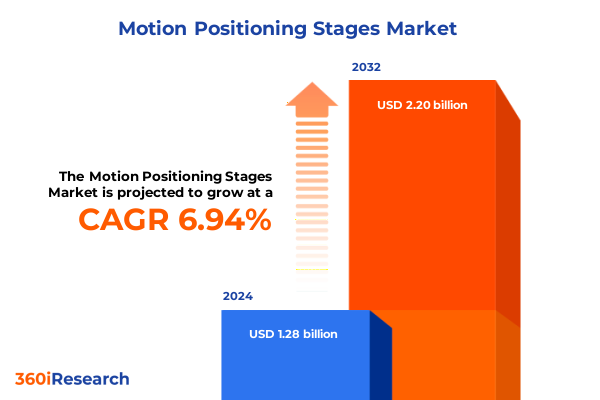

The Motion Positioning Stages Market size was estimated at USD 1.28 billion in 2024 and expected to reach USD 1.37 billion in 2025, at a CAGR of 6.94% to reach USD 2.20 billion by 2032.

Breakthrough Advancements in Motion Positioning Stages Elevate Precision Automation and Measurement Across Critical Industrial Applications

The evolution of precision motion positioning stages has become a cornerstone for industries demanding exacting accuracy, exceptional repeatability, and seamless integration with complex automation systems. Cutting-edge applications spanning aerospace testing rigs, semiconductor lithography platforms, and advanced laboratory instrumentation all rely on these solutions for micrometer-level adjustments and stability under varied operational conditions. Recent advancements in mechanical design, miniaturization, and control algorithms have enabled stage developers to transcend traditional performance barriers, delivering systems that accommodate increasingly stringent tolerances and faster throughput requirements.

As digital transformation continues to drive smart manufacturing initiatives, the convergence of robotics, machine vision, and artificial intelligence has elevated the role of positioning stages from passive components to active elements in adaptive process chains. This shift underscores the necessity for scalable configurations that can be rapidly customized to specific tasks, whether aligning optical fibers in telecommunications or executing high-precision sample preparation in life sciences research. The growing emphasis on plug-and-play interoperability, supported by open architecture controls and standardized communication protocols, further accelerates the adoption of advanced positioning platforms.

Against this backdrop of innovation and integration, stakeholders across R&D, production engineering, and quality assurance must navigate a complex landscape of technological choices. By understanding the critical drivers of stage performance-such as travel range, load capacity, and feedback resolution-organizations can make strategic investments that bolster productivity, reduce downtime, and safeguard product quality.

Emerging Technological and Market Dynamics Are Reshaping Motion Positioning Stage Development and Integration in Smart Manufacturing Ecosystems

The landscape for motion positioning stages is undergoing a transformative shift as Industry 4.0 paradigms give rise to fully interconnected production environments. Rather than operating as standalone modules, stages are now expected to exchange real-time data with peripheral sensors, analytics engines, and supervisory control systems. This connectivity enables closed-loop optimization, where adaptive motion profiles and predictive maintenance routines are continuously refined based on machine learning insights. Such intelligence not only extends component lifespans but also minimizes unplanned stoppages, translating into measurable improvements in overall equipment effectiveness.

Simultaneously, the relentless drive toward miniaturization has compelled designers to adopt novel bearing technologies and high-power density actuation mechanisms. Air bearings, renowned for frictionless motion, and magnetic levitation systems are increasingly deployed to achieve nanometer-scale precision without the wear issues associated with traditional mechanical bearings. Alongside these hardware innovations, software advancements in motion control algorithms-such as feedforward compensation and real-time vibration suppression-further elevate stage performance, enabling ultra-smooth trajectories even at high acceleration profiles.

These technological breakthroughs coincide with a broader market trend toward modularity and configurability. Manufacturers are now offering customizable plug-in units that can be mixed and matched to create tailored multi-axis assemblies, thereby reducing time to market for bespoke solutions. This modular ethos extends from simple linear positioning tables to complex rotary indexing systems, empowering end-users to balance functionality, cost, and development timelines with unprecedented flexibility.

Analysis of 2025 United States Tariff Measures Illuminates Their Profound Effects on Precision Stage Supply Chains and Cost Structures

The imposition of new tariffs on imported precision motion stage components in 2025 has introduced complex cost pressures across global supply chains. Elevated duties on key subassemblies, including linear guide rails and specialized bearing elements, have prompted many integrators and OEMs to reassess sourcing strategies. As a result, some manufacturers are shifting toward domestic suppliers or near-shoring operations to mitigate exposure to price fluctuations, leading to a reconfiguration of production footprints and supplier networks.

This policy environment has also triggered downstream implications for product pricing and procurement cycles. Procurement teams, facing higher landed costs, are opting for extended lead times to aggregate orders and negotiate volume rebates. Conversely, a subset of high-precision applications with critical delivery timelines has led to a willingness to absorb incremental surcharge impacts in exchange for guaranteed stock availability. This divergence underscores the strategic imperative for cost-management frameworks that balance total cost of ownership against performance and service level requirements.

In response to these developments, several stage designers have diversified their component portfolios to include domestically produced bearings and drive modules, reducing reliance on tariff-affected imports. Concurrently, service providers are expanding refurbishment and retrofit offerings, enabling end-users to prolong the lifespan of existing motion systems rather than investing in entirely new platforms. Together, these adaptive measures illustrate the sector’s resilience in navigating evolving trade regulations while preserving the precision and reliability that end-users demand.

Comprehensive Multi-Dimensional Segmentation Reveals Critical Insights into Movement Type Axis Configuration and Bearing Preferences

A granular examination of movement type segmentation reveals that rotary positioning solutions remain indispensable for applications requiring angular displacement, such as antenna alignment and wafer inspection, whereas linear stages continue to dominate tasks demanding translational accuracy over extended ranges, including material handling and optical rail systems. Goniometer units occupy a critical niche, delivering compound angular adjustments in microscopy and spectroscopy setups where multi-degree tilting is essential for precise beam steering and sample orientation.

Axis configuration significantly influences system complexity and integration flexibility. Single-axis modules are prized for their simplicity, cost efficiency, and high repeatability in point-to-point positioning scenarios. In contrast, multi-axis assemblies, often configured in stacked orthogonal layouts, enable comprehensive motion paths necessary for 3D scanning, flight simulation platforms, and robotic end-effector positioning in aerospace assembly lines.

Bearing type selection further delineates performance tiers. Air bearings lead when nanometer-scale smoothness and zero backlash are paramount, albeit at a premium cost and with additional infrastructure requirements. Magnetic bearings offer frictionless operation with lower maintenance needs, while mechanical bearings balance cost and stiffness for mid-range precision tasks. The choice between manual and motorized drive mechanisms hinges on throughput demands: manual stages excel in laboratory contexts with infrequent adjustments, whereas motorized drives underpin automated production cells requiring repeatable, high-speed motion.

Load capacity stratification-from sub-20 kilogram optical tables to heavy-duty systems exceeding 140 kilograms for satellite testing rigs-underscores the breadth of application demands. End-user domains such as aerospace and defense, automotive assembly, biotechnology research, consumer electronics manufacturing, healthcare diagnostics, laboratory automation, and semiconductor fabrication each impose unique performance vectors. Notably, within aerospace and defense, specialized subsegments like radar testing and spacecraft alignment prioritize ultra-high reliability and environmental robustness, while healthcare applications, spanning medical imaging systems to surgical robotics, pivot on stringent biocompatibility and sterility requirements.

This comprehensive research report categorizes the Motion Positioning Stages market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Movement Type

- Axis Type

- Bearing Type

- Drive Mechanism

- Load Capacity

- End-User

- Sales Channel

Regional Performance and Demand Patterns Highlight Varied Adoption and Growth Trajectories across Americas Europe Middle East Africa and Asia Pacific

In the Americas region, strong demand for automation in the biomedical and semiconductor sectors continues to drive adoption of precision positioning stages. Leading research universities and contract research organizations invest in high-resolution rotary and goniometer systems for advanced spectroscopy and microscopy applications. Concurrently, aerospace and defense contractors leverage heavy-load linear stages to calibrate sensors and assemble critical flight hardware under strict regulatory standards.

Across Europe, the Middle East, and Africa, emphasis on energy efficiency and environmental compliance has elevated the adoption of low-friction magnetic and air bearing stages. The precision optics industry, particularly in photonics hubs such as Germany’s Bavaria region, integrates multi-axis configurations into laser alignment processes. At the same time, rapid growth in Middle Eastern aerospace testing facilities is spurring demand for modular, reconfigurable motion platforms capable of withstanding extreme environmental conditions.

Asia-Pacific markets demonstrate a diverse landscape, with China leading in consumer electronics assembly and India expanding its biotechnology research base. South Korean and Japanese manufacturers, renowned for their semiconductor fabrication expertise, continue to push the boundaries of nanometer-scale positioning through innovative drive mechanisms. In Australia, emerging applications in renewable energy testing and mineral analysis are unlocking new use cases for both manual and motorized stages, bridging the gap between established industrial demand and pioneering scientific exploration.

This comprehensive research report examines key regions that drive the evolution of the Motion Positioning Stages market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Motion Positioning Stage Manufacturers Offer Insights into Competitive Innovations and Portfolio Strategies

Industry frontrunners such as Aerotech Inc. have cemented their reputation by delivering modular multi-axis systems integrated with cutting-edge control software, catering to both R&D laboratories and high-volume production lines. PI (Physik Instrumente) continues to spearhead innovations in piezo-driven nanopositioning stages, enabling sub-nanometer resolution for critical applications in quantum computing research and ultra-precision metrology.

Thorlabs expands its presence in life sciences and photonics through a diversified portfolio of linear and rotary stages optimized for rapid prototyping and academic use. Newport Corporation emphasizes turnkey motion solutions that combine rigid mechanical design with intuitive user interfaces, targeting photonics manufacturers and space instrumentation integrators. Meanwhile, MKS Instruments, bolstered by its acquisition of leading vacuum component suppliers, offers integrated motion packages tailored for semiconductor processing environments.

Emerging players are also making inroads by focusing on niche applications and customization services. These agile firms leverage localized manufacturing to reduce lead times and improve after-sales support. Collaborative ventures between component suppliers and system integrators further highlight a trend toward vertically coordinated supply chains, where co-development initiatives accelerate the introduction of next-generation stage architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motion Positioning Stages market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerotech, Inc.

- Akribis Systems Pte. Ltd.

- ALIO Industries LLC by Allied Motion, Inc.

- Automotion Components by Wixroyd Group

- Bell-Everman, Inc.

- Chuo Precision Industrial Co., Ltd.

- Colombo Filippetti S.p.A.

- Del-Tron Precision, Inc.

- Dover Motion

- Edmund Optics Inc.

- Eitzenberger GmbH

- ETEL SA by HEIDENHAIN Corporate Group

- FUYU Technology Co., Ltd.

- Föhrenbach GmbH

- GMT Global Inc.

- Griffin Motion, LLC

- H2W Technologies, Inc.

- HIWIN Technologies Corp.

- ISEL Germany AG

- Isotech, Inc.

- Kohzu Precision Co.,Ltd.

- Lintech

- Micronix USA

- Motion Solutions by Novanta Corporation

- MotionLink Ltd.

- Nabeya Bi-tech Kaisha

- Newport Corporation by MKS Instruments, Inc.

- Optimal Engineering Systems, Inc.

- OptoSigma by Sigma Koki Group

- OWIS GmbH

- Parker Hannifin Corporation

- Physik Instrumente (PI) SE & Co. KG

- Rockwell Automation Inc.

- SCHNEEBERGER Holding AG

- Standa Ltd.

- Sumitomo Heavy Industries, Ltd.

- THK Co., Ltd.

- Thorlabs, Inc.

- Velmex Inc.

- WEISS GmbH

- WITTENSTEIN SE

- XERYON BVBA

- Zaber Technologies Inc.

Practical Recommendations Empower Industry Leaders to Optimize Precision Stage Adoption Supply Chain Resilience and Technological Collaboration

To navigate the increasing complexity of precision motion systems, industry leaders should prioritize flexible architectures that allow rapid reconfiguration and scalability. Integrating standardized communication protocols and open control platforms will foster interoperability and reduce integration overhead, enabling faster time to market for customized solutions. In parallel, establishing strong partnerships with both component suppliers and end-users can facilitate co-innovation, ensuring that next-generation stage designs directly address emerging application requirements.

Supply chain resilience must be addressed through diversified sourcing strategies. Companies are advised to cultivate relationships with domestic and near-shore suppliers of critical bearing and drive components, mitigating the impact of fluctuating trade policies and tariff structures. Additionally, investing in refurbishment and upgrade programs provides a sustainable pathway to extend equipment lifecycles and control total cost of ownership.

Finally, technology roadmaps should incorporate a continuous feedback loop from field deployments. By collecting performance data and maintenance metrics, product development teams can refine control algorithms, enhance predictive maintenance models, and optimize future hardware iterations. Embracing this data-driven approach will empower organizations to maintain competitive advantage through incremental innovation and improved reliability.

Rigorous Mixed-Methodology Framework Combines Primary Interviews Secondary Research and Quantitative Analysis for Comprehensive Insights

The research framework underpinning this analysis combines a multi-tiered methodology to ensure both depth and breadth of insight. Primary data collection involved in-depth interviews with design engineers, application specialists, and procurement managers across key end-use segments, providing firsthand perspectives on performance priorities and procurement dynamics. Complementing these discussions, structured surveys captured quantitative assessments of feature preferences, integration challenges, and service level expectations.

Secondary research encompassed a thorough review of technical literature, patent filings, industry white papers, and regulatory frameworks related to mechanical positioning technologies. This desk research was supplemented by analysis of public financial disclosures and corporate product roadmaps, enabling cross-validation of competitive strategies and R&D investments. Data triangulation ensured consistency between qualitative intelligence and documented market developments.

Finally, all findings were synthesized through rigorous data modeling techniques and validated with expert panel reviews. This iterative process of feedback and refinement guaranteed that the conclusions and strategic recommendations presented in this report accurately reflect real-world challenges and emerging opportunities within the precision motion positioning stage landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motion Positioning Stages market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motion Positioning Stages Market, by Movement Type

- Motion Positioning Stages Market, by Axis Type

- Motion Positioning Stages Market, by Bearing Type

- Motion Positioning Stages Market, by Drive Mechanism

- Motion Positioning Stages Market, by Load Capacity

- Motion Positioning Stages Market, by End-User

- Motion Positioning Stages Market, by Sales Channel

- Motion Positioning Stages Market, by Region

- Motion Positioning Stages Market, by Group

- Motion Positioning Stages Market, by Country

- United States Motion Positioning Stages Market

- China Motion Positioning Stages Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Summarizing Critical Takeaways Reveals the Strategic Impact of Emerging Trends Policy Shifts and Technological Innovations on Market Evolution

This examination of precision motion positioning stages underscores the confluence of technological innovation, policy shifts, and evolving end-user demands that define the sector’s trajectory. Key transformative forces-ranging from AI-driven control strategies and advanced bearing systems to the strategic impacts of trade regulations-have collectively shaped supplier strategies, product architectures, and go-to-market approaches.

Segmentation insights reveal that diverse application requirements necessitate a spectrum of movement types, axis configurations, bearing technologies, and drive mechanisms, each calibrated to specific precision, load, and throughput criteria. Regional analysis highlights how geographic clusters of semiconductor fabrication, aerospace testing, and life sciences research drive localized adoption patterns, with nuanced differences in infrastructure readiness and regulatory environments influencing procurement decisions.

Ultimately, companies that embrace flexible, data-informed development processes, coupled with resilient supply chain strategies and collaborative partnerships, will be best positioned to capitalize on emerging opportunities. By aligning product roadmaps with the precise needs of end-use applications and anticipating the implications of trade and policy developments, industry stakeholders can secure a sustainable competitive edge in the rapidly evolving world of motion positioning technology.

Connect Directly with Associate Director Ketan Rohom to Unlock Tailored Insights and Secure Your Copy of the Detailed Industry Report Today

To explore the full depth of precision motion positioning stages and harness tailored strategic insights, reach out to Associate Director Ketan Rohom. By engaging directly, you can access personalized guidance on selecting the optimal solutions for your unique operational requirements. Ketan’s expertise spans the latest technological breakthroughs, market dynamics, and application best practices, ensuring you make informed decisions with confidence. Secure your comprehensive report today and leverage in-depth analysis to accelerate innovation, improve time-to-market, and enhance competitive advantage.

- How big is the Motion Positioning Stages Market?

- What is the Motion Positioning Stages Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?