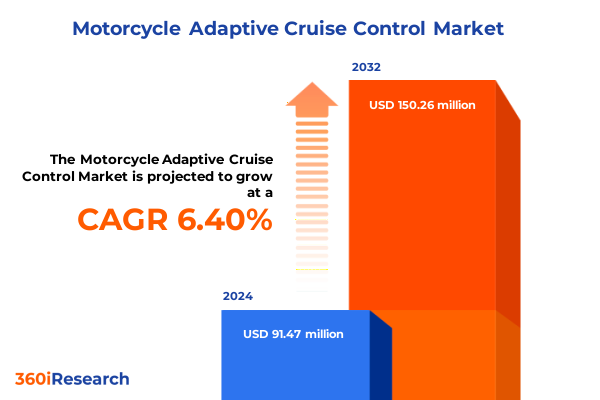

The Motorcycle Adaptive Cruise Control Market size was estimated at USD 96.89 million in 2025 and expected to reach USD 106.49 million in 2026, at a CAGR of 6.46% to reach USD 150.26 million by 2032.

Revolutionizing Rider Safety and Convenience with Cutting-Edge Motorcycle Adaptive Cruise Control Systems Shaping the Future of Two-Wheel Mobility

The landscape of rider assistance is undergoing a profound transformation as adaptive cruise control systems designed specifically for motorcycles move from concept to reality. Traditionally an attribute reserved for automobiles, this advanced technology now responds to the nuanced demands of two-wheeled vehicles, blending precision speed management with rider-centric safety features. Integrating dynamic throttle modulation and real-time distance monitoring, these systems aim to reduce fatigue during long rides and mitigate collision risks in congested traffic. Consequently, they mark a pivotal evolution in both rider convenience and overall road safety.

At the core of this evolution lies a convergence of sensor technologies, embedded software, and machine learning algorithms optimized for the unique dynamics of a motorcycle. Unlike cars, motorcycles lack the inherent stability provided by four wheels, demanding finely tuned control systems capable of rapid adjustments. Early adopters showcased the feasibility of basic speed hold functions, but the latest iterations emphasize predictive behavior analysis and adaptive responses to variable traffic patterns, delivering a level of autonomy that augments rider skill rather than replacing it.

Consumer expectations and regulatory frameworks are also shaping the adoption curve. Enthusiasts and safety advocates alike recognize the value of advanced assistance in reducing accident severity and enhancing rider confidence. Meanwhile, emerging safety mandates are beginning to consider the inclusion of assistance systems as a baseline requirement for new models. As public discourse on road safety gains momentum, motorcycle adaptive cruise control stands at the intersection of innovation and policy, poised to redefine what riders anticipate from modern motorcycles.

From Basic Speed Hold to Intelligent Radar Vision Trailblazing Transformative Shifts Reshaping the Motorcycle Adaptive Cruise Control Landscape Over Time

The journey of motorcycle adaptive cruise control has spanned a remarkable arc, from rudimentary speed maintenance to the integration of intelligent sensor fusion that mirrors human perception. Initial demonstrations focused on throttle locks and speed governors, offering riders relief from constant acceleration adjustments on highways. Over time, radar modules and ultrasonic sensors were introduced to detect obstacles, yet early systems remained confined to pre-set following distances without the agility required for real-world scenarios.

Advancements in camera-based technologies have infused new sophistication into these systems. By leveraging computer vision techniques, modern adaptive cruise control platforms can differentiate between vehicle types, anticipate braking events, and even identify road anomalies. This granular level of environmental awareness elevates performance, particularly in urban settings where split-second decisions can prevent collisions. Furthermore, the fusion of radar and camera inputs has enhanced reliability under diverse weather and lighting conditions, ensuring consistent operation across a wide range of riding environments.

Looking ahead, connectivity and machine learning will drive the next phase of transformation. Vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications promise to reduce latency in obstacle detection and facilitate cooperative adaptive responses among multiple motorcycles or vehicles on the road. In parallel, predictive analytics will calibrate cruise control behaviors based on individual rider preferences and historical traffic data. Together, these shifts herald an era in which motorcycle adaptive cruise control operates as an intelligent partner, harmonizing machine precision with rider intuition.

Analyzing the Layered Effects of 2025 United States Tariffs on Supply Chains component costs and strategic pricing in Motorcycle Adaptive Cruise Control

In 2025, the United States implemented a series of tariffs targeting imported electronic components and sensor modules critical to adaptive cruise control systems. These measures introduced layered cost pressures across supply chains, prompting manufacturers to reevaluate sourcing strategies. Companies dependent on offshore production for cameras, radar arrays, and microprocessors faced increased unit costs, which threatened to erode device affordability and slow aftermarket adoption rates.

As a direct response, many original equipment manufacturers accelerated efforts to diversify their supplier base. They pursued partnerships with regional electronics firms in North America and Mexico to mitigate tariff exposure. These initiatives not only safeguarded margins but also reduced lead times by leveraging nearshore logistics. Consequently, organizations that invested early in supply chain reconfiguration maintained greater pricing flexibility and shielded their end users from sudden sticker shock.

Beyond direct component costs, the tariffs influenced strategic pricing across OEM and aftermarket channels. While leading motorcycle brands absorbed a portion of the levy to preserve customer loyalty, aftermarket integrators adjusted installation fees to reflect new expense structures. In addition, some companies explored modular architectures that allowed users to upgrade individual sensor units post-purchase, diffusing immediate cost burdens and sustaining long-term revenue streams. These adaptive measures underscore the industry’s resilience in navigating policy-driven headwinds.

Unlocking Deep Segmentation Insights Across Sensor Vehicle Installation and End User Types to Drive Focused Strategies in Motorcycle Adaptive Cruise Control

Understanding the market for motorcycle adaptive cruise control necessitates a granular examination of sensor architectures, vehicle categories, installation avenues, and end-user applications. Sensor solutions today range from camera based platforms that deliver high-resolution imagery to radar based systems that excel in distance measurement, as well as combined configurations that fuse both capabilities for enhanced redundancy and accuracy. Each approach caters to specific performance criteria, requiring manufacturers to align design philosophies with rider expectations and environmental conditions.

The diversity of motorcycles adopting adaptive cruise control spans from adventure bikes tailored for off-road endurance to cruisers emphasizing long-haul comfort, sport models engineered for dynamic performance, and touring machines equipped for extended journeys. This variety influences not only system calibration but also rider interface design, as ergonomic constraints differ substantially between these categories. Consequently, product roadmaps must reflect the distinct dynamics of acceleration, braking, and cornering inherent to each vehicle type.

On the installation front, offerings split between aftermarket upgrades and factory-integrated OEM solutions. Aftermarket channels diverge further into offline service centers and online direct-to-consumer kits, each with unique value propositions centered on convenience, customization, and cost. Finally, the end-user spectrum encompasses individual riders seeking personal safety enhancements and commercial operators in logistics or rental fleets prioritizing operational consistency and risk reduction. These segmentation dimensions shape targeted go-to-market strategies, product feature sets, and support ecosystems.

This comprehensive research report categorizes the Motorcycle Adaptive Cruise Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Vehicle Type

- Installation Type

- End User

Mapping Regional Variations and Adoption Patterns in Motorcycle Adaptive Cruise Control across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics profoundly influence the adoption and evolution of motorcycle adaptive cruise control technologies. In the Americas, a blend of regulatory incentives and mature aftermarket infrastructures has catalyzed early uptake. Riders in urban corridors from Los Angeles to Toronto appreciate the dual benefits of reduced congestion stress and heightened accident avoidance, leading aftermarket providers to offer turnkey retrofit solutions alongside OEM integration programs.

Meanwhile, Europe, the Middle East, and Africa present a heterogeneous landscape where advanced road safety directives coexist with varying levels of infrastructural readiness. Western European nations, boasting well-developed vehicle communication networks, are at the forefront of standardizing safety assistance systems, prompting major motorcycle manufacturers to bundle adaptive cruise control as part of premium packages. In contrast, emerging markets in the Middle East and Africa exhibit growth in recreational and commercial sectors, where fleet operators in logistics and tourism identify adaptive cruise control systems as a means to enhance reliability and preserve asset value.

Asia-Pacific stands out for its dense urban centers and rapidly evolving regulatory frameworks. Countries such as Japan and South Korea, with long histories of automotive innovation, invest heavily in connected vehicle strategies that seamlessly incorporate motorcycle adaptive cruise control into broader intelligent transport systems. Simultaneously, high two-wheeler populations in Southeast Asia drive demand in both OEM and aftermarket channels, as riders seek improved safety amidst congested conditions. These regional nuances underscore the necessity for adaptable strategies that respect local dynamics while leveraging global best practices.

This comprehensive research report examines key regions that drive the evolution of the Motorcycle Adaptive Cruise Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Technological Breakthroughs and Competitive Edge in Motorcycle Adaptive Cruise Control Sector

A concentrated group of technology leaders and traditional motorcycle manufacturers is advancing the frontier of adaptive cruise control. Renowned automotive tier-one suppliers are collaborating with motorcycle OEMs to reengineer radar and camera modules that withstand distinct vibration profiles and exposure levels. In parallel, software innovators specializing in machine learning have introduced predictive algorithms capable of distinguishing between stationary obstacles and moving vehicles under complex lighting conditions.

Several motorcycle brands are forging strategic alliances with electronics start-ups to co-develop turnkey systems. These partnerships leverage the agility of technology firms in rapid prototyping alongside the production expertise and brand heritage of established two-wheeler manufacturers. The result is a pipeline of pilot programs that test modular sensor assemblies, cloud-enabled data platforms, and over-the-air software updates, ensuring continuous improvement and feature expansion well beyond initial release.

In the aftermarket domain, specialized integrators are securing exclusive distribution rights for adaptive cruise control modules designed to retrofit a broad range of motorcycle models. Their close engagement with rider communities informs iterative refinements, focusing on installation simplicity and interface intuitiveness. Collectively, these efforts drive a competitive ecosystem where collaboration and innovation converge to accelerate the mainstreaming of adaptive cruise control across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motorcycle Adaptive Cruise Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bayerische Motoren Werke AG

- Continental AG

- Denso Corporation

- Ducati Motor Holding S.p.A

- Honda Motor Co., Ltd.

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Texas Instruments Incorporated

- TVS Motor Co. Ltd.

- Valeo SA

- Yamaha Motor Co., Ltd.

- ZF Friedrichshafen AG

Translating Market Intelligence into Strategic Initiatives and Partnership Opportunities to Enhance Innovation Adoption in Motorcycle Adaptive Cruise Control

Industry leaders can capitalize on emerging opportunities by reinforcing sensor fusion capabilities and prioritizing interoperability with connected vehicle frameworks. By refining camera and radar integration under a unified software architecture, organizations can deliver more reliable obstacle detection and smoother throttle modulation. Consequently, they will differentiate their offerings in an increasingly crowded market.

In addition, forming alliances with regional electronics manufacturers can mitigate policy risks associated with tariffs while shortening supply chains. Nearshore partnerships not only preserve cost efficiencies but also foster co-development environments where local expertise informs product design. This approach enhances responsiveness to shifting regulations and rider preferences.

Furthermore, engaging end users through pilot programs and rider feedback loops accelerates product-market fit. Commercial fleet customers, in particular, can provide valuable performance data under high-utilization scenarios. Leveraging these insights through over-the-air software improvements cultivates long-term loyalty and opens avenues for subscription-based feature enhancements.

Finally, companies should invest in comprehensive training for dealerships and service centers. Equipping frontline technicians with specialized knowledge ensures seamless installations and reinforces consumer confidence. Taken together, these strategic initiatives will position organizations to lead the next wave of motorcycle adaptive cruise control adoption.

Employing Robust Mixed Methods and Rigorous Data Collection Frameworks to Ensure Reliability and Depth in Motorcycle Adaptive Cruise Control Research

This research synthesizes insights from a robust combination of primary and secondary methodologies. It incorporates qualitative interviews with senior executives at leading motorcycle manufacturers, Tier 1 electronics suppliers, and aftermarket integrators, capturing firsthand perspectives on technology adoption and industry challenges. Complementing these dialogues, structured surveys with professional riders and fleet managers provided quantitative validation of feature priorities and performance expectations.

On the secondary research front, we conducted comprehensive analyses of technical whitepapers, patent filings, and safety guidelines issued by regulatory bodies across key markets. We also reviewed peer-reviewed academic studies on sensor accuracy, system reliability, and human-machine interaction in motorcycle assistance technologies. This dual approach ensured a holistic understanding of both practical implementation hurdles and emerging technological trends.

Data triangulation underpinned our analytical rigor. We cross-referenced findings from interviews and surveys against industry benchmarks, historic pilot project outcomes, and safety incident databases. Qualitative inputs were coded thematically to identify recurring innovation drivers, while quantitative data underwent statistical validation to confirm representativeness. Ongoing peer review by subject matter experts further reinforced methodological integrity, delivering a research framework that balances depth with actionable clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motorcycle Adaptive Cruise Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motorcycle Adaptive Cruise Control Market, by Sensor Type

- Motorcycle Adaptive Cruise Control Market, by Vehicle Type

- Motorcycle Adaptive Cruise Control Market, by Installation Type

- Motorcycle Adaptive Cruise Control Market, by End User

- Motorcycle Adaptive Cruise Control Market, by Region

- Motorcycle Adaptive Cruise Control Market, by Group

- Motorcycle Adaptive Cruise Control Market, by Country

- United States Motorcycle Adaptive Cruise Control Market

- China Motorcycle Adaptive Cruise Control Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Emerging Trends to Illuminate the Strategic Imperatives for Motorcycle Adaptive Cruise Control Advancement

Drawing together the strategic threads of this study reveals a compelling narrative: motorcycle adaptive cruise control is no longer a niche experiment but a transformative force reshaping rider expectations and safety paradigms. Sensor fusion has elevated system reliability to levels where riders can confidently engage assistance features across diverse environments, from urban grids to open highways. Meanwhile, evolving policy landscapes and tariff-induced supply chain adjustments have prompted agile realignments in sourcing and pricing strategies.

Segment analysis highlights that performance requirements vary significantly across sensor types, vehicle styles, installation preferences, and end-user demands. Regional variations further underscore the importance of adaptable offerings that resonate with local regulatory frameworks and consumer cultural norms. In turn, leading companies are emerging through dynamic collaborations that blend hardware innovation with software agility, ensuring a steady flow of system enhancements and user-centric refinements.

Moving forward, the industry must embrace a holistic perspective that aligns technological prowess with strategic partnerships, supply chain resilience, and continuous feedback mechanisms. By doing so, stakeholders can accelerate market penetration, deliver enhanced safety outcomes, and position themselves at the forefront of next-generation motorcycle assistance systems.

Engage with Ketan Rohom to Unlock Premium Motorcycle Adaptive Cruise Control Insights and Propel Your Strategic Planning to the Next Level

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how our comprehensive research on motorcycle adaptive cruise control can sharpen your competitive edge. Reach out to explore tailored insights that align with your strategic priorities and operational challenges. By partnering with our seasoned team, you gain exclusive access to in-depth analyses, expert commentary, and data-driven takeaways designed to inform pivotal decisions.

Engaging with Ketan ensures a personalized briefing, where you can delve into detailed findings, request custom additions, and secure early notices on forthcoming updates. This collaboration empowers your organization to harness market intelligence, refine product roadmaps, and capitalize on emergent opportunities before competitors.

Don’t miss the chance to leverage this research for maximum impact. Contact Ketan Rohom today to schedule a consultation and transform actionable insights into measurable business outcomes.

- How big is the Motorcycle Adaptive Cruise Control Market?

- What is the Motorcycle Adaptive Cruise Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?