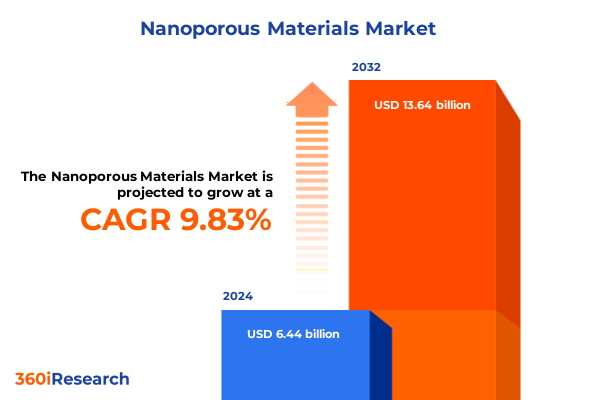

The Nanoporous Materials Market size was estimated at USD 7.00 billion in 2025 and expected to reach USD 7.61 billion in 2026, at a CAGR of 9.98% to reach USD 13.64 billion by 2032.

Unveiling the Strategic Importance of Nanoporous Materials in Modern Industries and Emerging Technological Frontiers Driving Innovation and Sustainability

The expansive realm of nanoporous materials has rapidly evolved into a cornerstone of modern industrial innovation, driven by their unparalleled surface area, tunable pore structures, and versatile chemical functionalities. From enabling next-generation energy storage solutions to advancing precision drug delivery platforms, these materials are redefining possibilities across sectors. In the context of sustainability and environmental stewardship, nanoporous substrates facilitate efficient water purification and selective gas separation, underscoring their critical role in addressing global challenges. Moreover, the fusion of computational design and synthetic chemistry has accelerated the discovery of novel frameworks that marry structural precision with application-specific performance.

As we delve into the multifaceted domain of nanoporous materials, it becomes clear that scientific breakthroughs and industry demands are tightly interwoven. Cutting-edge fabrication techniques now permit hierarchical architectures that optimize mass transport and catalytic efficiency, while advanced characterization methods reveal insights at the atomic scale. Against this backdrop, stakeholders across research institutes, chemical manufacturers, and end-use industries are converging to capitalize on the transformative potential of these materials. Consequently, understanding the strategic importance of nanoporous materials not only illuminates emerging technological frontiers but also provides a roadmap for sustained competitive advantage in an increasingly innovation-driven marketplace.

Exploring Pivotal Technological and Market Dynamics That Are Dramatically Shaping the Future Landscape of Nanoporous Materials Globally

Over the past few years, nanoporous materials have experienced transformative shifts propelled by breakthroughs in machine learning–assisted materials discovery and high-throughput screening. These advancements have dramatically shortened the development cycle for metal organic frameworks and functionalized silica gels, enabling rapid optimization of pore geometries and surface chemistries. Concurrently, the push toward greener synthesis routes-eschewing hazardous solvents and minimizing energy footprints-has elevated hydrothermal and solvothermal processes to prominence, while template synthesis strategies have matured to yield precisely defined architectures.

In parallel, demand-side dynamics are reshaping the landscape. Heightened global focus on carbon capture has spurred innovations in CO₂-selective adsorbents, while the quest for efficient hydrogen purification media has elevated microporous frameworks in energy storage applications. Furthermore, the integration of nanoporous membranes in desalination and wastewater treatment is gaining traction as regulatory bodies tighten environmental standards. These evolving use cases underscore a pivotal market transition: suppliers are no longer solely evaluated on material performance, but also on sustainability credentials, scalability of production, and alignment with circular economy principles. Taken together, these shifts signify a decisive inflection point in how nanoporous materials will be developed, manufactured, and deployed going forward.

Assessing How Recent United States Tariff Policies Introduced in 2025 Are Reshaping Global Supply Chains and Cost Structures for Nanoporous Materials

In 2025, the cumulative impact of United States tariff policies has introduced significant supply chain realignments and cost considerations for nanoporous material producers. Tariffs on imported precursors such as specialty silanes and advanced organic linkers have elevated input costs, compelling manufacturers to reassess offshore sourcing strategies and explore domestic production alternatives. As a result, regionalized supply chains have garnered increased investment, particularly in North America, where firms are accelerating capacity expansions to mitigate exposure to import duties and logistical disruptions.

Consequently, these trade measures have recalibrated strategic priorities across the value chain. Research and development teams are intensifying efforts to identify locally abundant feedstocks, while production engineers are optimizing processes for tariff-resilient inputs. End users, especially in the pharmaceutical and environmental sectors, are adopting multi-sourcing frameworks to ensure continuity of supply for applications ranging from targeted drug delivery carriers to heavy metal removal media. Although near-term cost pressures persist, the realignment has yielded a silver lining: a burgeoning ecosystem of domestic suppliers capable of delivering high-purity nanoporous materials with reduced lead times and enhanced traceability.

Revealing Critical Segmentation Insights That Illuminate Diverse Market Niches and Application Areas Within the Nanoporous Materials Landscape

A multifaceted segmentation framework reveals nuanced insights into market opportunities and technological trajectories within the nanoporous materials domain. When evaluating performance by material type, activated carbon remains a stalwart for broad-spectrum adsorption, while metal organic frameworks have surged ahead in specialized separation and sensing applications. Silica variants underscore versatility, spanning from high-surface-area supports to catalytic substrates, and zeolites continue to excel in acid and redox catalysis arenas.

Examining application-centric divisions uncovers further granularity: adsorption platforms bifurcate into liquid phase adsorption media designed for effluent polishing and vapor adsorption systems tailored to volatile organic compound capture. Catalysis offerings differentiate between acid catalysis utilized in petrochemical transformations and redox catalysis vital to fine chemical synthesis. In therapeutic contexts, drug delivery vehicles toggle between controlled release matrices and targeted delivery nanocarriers, whereas gas separation technologies specialize in CO₂ separation processes, hydrogen purification networks and hydrocarbon separation units. Sensing solutions span the gamut from biological recognition elements for biosensing assays to chemical detection arrays for environmental monitoring, while water treatment innovations address desalination challenges as well as dye removal and heavy metal sequestration.

Turning to end-use industries, chemical producers leverage nanoporous adsorbents for process intensification, and the energy storage sector integrates tailored pore architectures for high-capacity electrode materials. Environmental operations deploy these materials for remediation, whereas oil and gas entities capitalize on separation efficiencies. Pharmaceuticals apply biocompatible frameworks for targeted therapeutics. Pore size classifications further segment markets into macroporous scaffolds suited for bulk transport, mesoporous structures optimizing catalytic interfaces and microporous networks enabling molecular sieving. Production methodologies stratify the landscape between chemical vapor deposition techniques for conformal coatings, hydrothermal and solvothermal syntheses for crystalline frameworks and template-guided processes for hierarchical architectures. Finally, form factor variations-membranes engineered for selective permeation, monoliths delivering high-flux flow channels, pellets balancing pressure drop and capacity, and powders offering versatile integration-collectively shape the deployment strategies across industrial applications.

This comprehensive research report categorizes the Nanoporous Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Pore Size

- Production Method

- Form Factor

- Application

- End Use Industry

Highlighting Distinct Regional Trajectories and Growth Drivers Influencing Demand for Nanoporous Materials Across Key Global Markets Today

Regional dynamics continue to exercise a profound influence on nanoporous materials adoption, with distinctive opportunities and challenges characterizing each market. In the Americas, robust investment in carbon capture initiatives and advanced water treatment infrastructures is accelerating demand for adsorption media and membrane technologies. North American players are simultaneously benefiting from supportive government incentives aimed at bolstering domestic manufacturing of critical materials, while Latin American markets present emerging horizons for low-cost adsorbent deployment in agricultural and mining runoff applications.

Across Europe, Middle East, and Africa, regulatory frameworks-particularly in the European Union-are driving stringent emission targets and water quality standards, stimulating uptake of high-performance separation and catalytic solutions. The Middle East is expanding petrochemical capacities, thus generating demand for zeolite and silica catalysts, while African initiatives in potable water access are catalyzing investments in desalination membranes. In the Asia-Pacific region, Asia’s manufacturing prowess underpins large-scale solvothermal and hydrothermal production facilities, meeting surging requirements for metal organic frameworks and activated carbons. Simultaneously, Pacific Rim countries are pioneering research in next-generation nanoporous materials for energy conversion applications, supported by public-private consortia and academic–industry partnerships that facilitate rapid technology transfer and commercialization.

This comprehensive research report examines key regions that drive the evolution of the Nanoporous Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Leading Innovators Strategic Collaborators and Emerging Players Shaping Competitive Dynamics and Innovation Trajectories in Nanoporous Materials

Innovation leaders and strategic collaborators are redefining the competitive contours of the nanoporous materials market, as established chemical conglomerates partner with specialized technology firms to co-develop application-specific solutions. Several global corporations have leveraged their deep processing expertise to commercialize advanced metal organic frameworks for gas separation and storage, while emerging specialists in template synthesis have introduced proprietary pathways for hierarchical pore structuring that address the unique needs of catalytic processes.

Meanwhile, biotechnology and pharmaceutical enterprises are engaging with materials developers to integrate mesoporous carriers into controlled release and targeted delivery platforms, thereby broadening therapeutic windows. In parallel, energy storage innovators are collaborating with academic research centers to tailor microporous materials for high-performance electrode incorporation, fostering next-generation batteries and supercapacitors. Strategic alliances between membrane manufacturers and desalination plant operators have also emerged, optimizing system-level throughput and salt rejection rates. Collectively, these concerted efforts underscore an ecosystem where cross-functional partnerships and open innovation paradigms drive rapid iteration, ensuring that the market’s competitive landscape remains dynamic and opportunity-rich.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nanoporous Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACS Material LLC

- Albemarle Corporation

- BASF SE

- Calgon Carbon Corporation

- CarboTech AC GmbH

- Chemviron Carbon SA

- Clariant AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- Ingevity Corporation

- JACOBI CARBONS GROUP

- Johnson Matthey Plc

- KMI Zeolite Inc.

- Kuraray Co., Ltd.

- Merck KGaA

- Nanosys, Inc.

- PQ Corporation

- Protech Minerals LLC

- Strem Chemicals, Inc.

- Tosoh USA, Inc.

- TPR CO.,LTD.

- USALCO, LLC

- Zeochem AG

- Zeolyst International

- Zeotech Corporation

Providing Actionable Strategic Recommendations to Industry Leaders for Navigating Disruption and Capturing Value in the Evolving Nanoporous Materials Sector

Industry leaders seeking to capitalize on evolving nanoporous material dynamics should prioritize investments in sustainable synthesis and advanced process intensification. By integrating green chemistry principles into hydrothermal and solvothermal methods, organizations can reduce environmental footprints while meeting stringent regulatory mandates. Additionally, diversifying supply chains through regional production hubs can mitigate tariff-induced cost pressures and strengthen resilience against geopolitical risks.

Further, enterprises are advised to cultivate cross-sector collaborations that align material characteristics with precise application requirements. Co-development agreements between framework developers and end users in gas separation or catalytic processing can accelerate time-to-market and facilitate tailored performance optimization. Embracing digital twins and machine learning models within research pipelines can also drive predictive design of nanoporous architectures, enabling rapid identification of high-potential candidates. Finally, establishing pilot-scale manufacturing lines for membranes, monoliths, and powders will validate scalability and reduce commercialization lead times, empowering stakeholders to swiftly translate laboratory innovations into industrial realities.

Elucidating the Robust and Transparent Research Methodology Underpinning the Insights and Analyses Presented in This Comprehensive Market Study

This comprehensive market study is founded on a rigorous, multi-tiered research methodology designed to ensure accuracy, relevance, and transparency. The research process commenced with an exhaustive review of peer-reviewed scientific literature, patent filings, and technical white papers to map the technological landscape and identify emerging innovation clusters. Concurrently, secondary data sources-including industry reports, regulatory databases, and trade publications-were systematically analyzed to contextualize market drivers, barriers, and regional dynamics.

Primary research entailed structured interviews and proprietary surveys with key opinion leaders, including R&D heads, process engineers, and procurement specialists across chemical, energy storage, environmental, oil and gas, and pharmaceutical sectors. These insights were further validated through a triangulation approach, cross-referencing quantitative data points with qualitative feedback. Finally, a panel of subject-matter experts conducted peer reviews to vet findings, ensuring that the synthesized insights reflect real-world practices and strategic imperatives. This layered methodology guarantees that the resulting analyses are both comprehensive and deeply grounded in industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nanoporous Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nanoporous Materials Market, by Material Type

- Nanoporous Materials Market, by Pore Size

- Nanoporous Materials Market, by Production Method

- Nanoporous Materials Market, by Form Factor

- Nanoporous Materials Market, by Application

- Nanoporous Materials Market, by End Use Industry

- Nanoporous Materials Market, by Region

- Nanoporous Materials Market, by Group

- Nanoporous Materials Market, by Country

- United States Nanoporous Materials Market

- China Nanoporous Materials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Strategic Takeaways and Forward-Looking Perspectives on How Nanoporous Materials Will Influence Future Technological and Commercial Frontiers

The synthesis of these insights underscores the transformative potential of nanoporous materials across diverse industrial spheres. Technological advancements in material design, coupled with intensified market demand for sustainable and high-performance solutions, are setting the stage for accelerated adoption. While tariff-induced realignments present near-term challenges, they similarly unlock opportunities for domestic capacity building and supply chain diversification. Furthermore, segmentation and regional analyses highlight compelling niches-from macro-scale flow reactors in chemical plants to meso- and microporous architectures in energy storage and environmental remediation-where targeted strategies can generate outsized impact.

Moving forward, organizations that adeptly integrate sustainable manufacturing practices, leverage computational materials science, and forge strategic collaborations will be best positioned to navigate market complexities. In sum, the dynamic interplay of innovation, regulation, and strategic partnerships will define the competitive contours of the nanoporous materials landscape in the years ahead.

Engage with Our Associate Director of Sales Marketing Today to Secure Actionable Insights and Drive Strategic Advantage Through Our Nanoporous Materials Report

Harnessing in-depth analysis and forward-looking perspectives on global nanoporous material trends can substantially enhance strategic decision making and catalyze growth initiatives. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to access unparalleled market intelligence and unlock actionable insights tailored to your organizational priorities. By securing the full report, you gain a competitive edge grounded in comprehensive research methodologies and expert validation, empowering your teams to pioneer innovation and navigate market complexities with confidence. Reach out today to transform data into decisive strategies and propel your enterprise toward sustained success in the dynamic landscape of nanoporous materials.

- How big is the Nanoporous Materials Market?

- What is the Nanoporous Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?