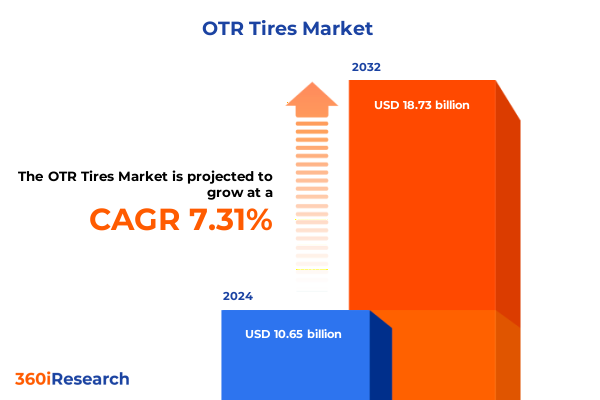

The OTR Tires Market size was estimated at USD 11.40 billion in 2025 and expected to reach USD 12.21 billion in 2026, at a CAGR of 7.34% to reach USD 18.73 billion by 2032.

Unraveling the Evolving OTR Tire Industry Landscape Amid Technological, Environmental, and Operational Shifts Shaping Market Priorities

The off-the-road tire industry has entered a pivotal phase where technology, environmental mandates, and shifting end-user demands are converging to redefine success. As machines grow more sophisticated and applications more varied, stakeholders are seeking tires that deliver superior durability, optimized traction, and measurable reductions in operational costs. Against this backdrop, industry participants must reconcile the dual imperatives of advancing product performance while adhering to increasingly stringent regulatory frameworks aimed at carbon reduction and resource efficiency.

Today’s market is characterized by heightened collaboration between equipment OEMs and tire manufacturers to co-develop solutions that seamlessly integrate tire monitoring systems and predictive analytics. This digital transformation not only enhances uptime but also supports warranty compliance and data-driven maintenance planning. Concurrently, emerging applications in precision agriculture and smart infrastructure projects are elevating requirements for bespoke tire compounds and tread architectures that meet exacting load capacities and terrain profiles.

Looking beyond conventional criteria, decision-makers are prioritizing sustainability credentials, circular economy initiatives, and cradle-to-grave lifecycle assessments. In this evolving environment, the players that successfully balance innovation, regulatory compliance, and operational value will define the next chapter of growth.

Navigating Disruptive Innovations and Regulatory Developments Redefining Off-the-Road Tire Applications and Value Chains Across Industries

Rapid advancements in material science and digital connectivity are catalyzing transformative changes across the off-the-road tire value chain. Smart tires embedded with Internet of Things sensors are now enabling real-time monitoring of pressure, temperature, and wear, allowing fleet operators to implement condition-based maintenance that dramatically reduces unplanned downtime. Furthermore, the proliferation of autonomous vehicles in mining and construction settings has spurred the introduction of tires designed to withstand higher speeds and continuous operation under variable load conditions.

At the same time, regulatory developments centered on emissions reduction and sustainable sourcing are reshaping raw material procurement. Manufacturers are exploring bio-based rubber alternatives and investing in closed-loop recycling programs to meet supplier diversity mandates and circular economy objectives. This shift is prompting a reevaluation of traditional bias construction in favor of radial designs that offer not only fuel-efficiency gains but also simplified retreading processes.

In distribution and aftermarket services, digital platforms are streamlining order fulfillment and enhancing customer engagement through predictive reordering and performance dashboards. As these disruptive forces converge, industry leaders must align R&D investments with evolving application requirements and regulatory expectations, positioning themselves to capture value in a rapidly diversifying marketplace.

Assessing the Far-Reaching Consequences of New United States Tariffs on Raw Material Costs, Imports, and Supply Chain Resilience in 2025

In early 2025, the United States implemented a new tranche of tariffs targeting key components of off-the-road tires, including specialty steel belts, synthetic rubber precursors, and select compound additives. These measures have introduced greater volatility into supply chains, as importers face elevated duties that cascade through to material procurement costs. Domestic producers have attempted to mitigate these pressures by ramping up local alloy steel production, yet capacity constraints and lead times remain inefficient compared to established import channels.

The ripple effect of these tariffs has extended to aftermarket networks, where service providers are encountering longer restocking cycles and price adjustments that challenge maintenance budgets. Some operators are responding by consolidating orders and renegotiating long-term agreements to secure favorable duty-inclusive rates. Others have initiated dual-sourcing strategies, engaging both domestic mills and duty-free zones to create buffer inventories that dampen cost spikes.

Collectively, these adaptive approaches are reshaping the competitive landscape and underscoring the importance of supply chain resilience. Stakeholders who proactively redesign procurement frameworks-integrating duty engineering, tariff classification expertise, and bonded warehouse solutions-are achieving steadier margin performance despite ongoing trade complexities.

Deriving Strategic Imperatives from Segment-Specific Performance and Preferences Spanning Product Types, Sizes, Capacities, and Applications

Insights derived from segment performance reveal distinct strategic imperatives for product development and go-to-market tactics. Within product type dynamics, radial constructions are commanding attention for their superior structural stability and retread economics, whereas bias configurations retain relevance in applications demanding extreme side-wall flexibility. Tire size preferences correspond to equipment specifications, with 29–45-inch diameters dominating standard loader and dozer applications, and above-45-inch models reserved for high-tonnage haul trucks; niche operations continue to deploy below-29-inch variants in compactors and mini‐loaders where maneuverability is critical.

Layered atop these dimensional considerations, load capacity segments influence compound formulations and ply designs. High and ultra-high capacity tires are engineered for the rigors of mining and large-scale construction, featuring reinforced belts and advanced mixing processes, while medium and low capacity ranges serve agricultural tractors and light industrial machinery, emphasizing cost efficiency and soil preservation. Vehicle type segmentation further refines R&D focus, as agricultural machinery demands flotation properties, construction equipment requires traction optimization, industrial assets prioritize wear resistance, and mining rigs necessitate ultimate puncture protection.

Finally, application-driven needs span from agricultural tractors and graders to dump trucks and loaders, each bearing unique tread pattern and side-wall design criteria. Distribution channel insights highlight the differential roles of aftermarket and original equipment penetration; offline retail continues to anchor service networks, whereas online retail platforms are accelerating lead-time compression and transparency. The integration of these nuanced segmentation factors is guiding tailored product roadmaps and targeted marketing investments.

This comprehensive research report categorizes the OTR Tires market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Tire Size

- Load Capacity

- Vehicle Type

- Application

- Distribution Channel

Unearthing Regional Differentiators Impacting Off-the-Road Tire Demand and Innovation Trajectories Across Americas, EMEA, and Asia-Pacific Sectors

Regional dynamics are exerting outsized influence on product innovation, procurement strategies, and service models within the off-the-road tire landscape. In the Americas, expansive agricultural operations and large-scale infrastructure projects are driving demand for versatile radial tires with integrated monitoring capabilities. OEM partnerships in North America are pivoting toward localized retreading facilities and bonded logistics corridors to reduce dependency on cross-border imports, while Latin American markets are embracing mixed‐material compounds that balance cost and durability under varied climatic conditions.

Across Europe, the Middle East, and Africa, regulatory regimes in the European Union are catalyzing a shift toward eco-design compliance, with compliance frameworks like Ecolabel pushing manufacturers to validate lower rolling resistance and recyclable content. In the Middle East, rapid urbanization and mega-project developments in construction are propelling bulk purchases of high-load capacity bias tires, even as local assembly hubs emerge to curtail lead times. African mining hotspots, particularly in Southern Africa, are demanding premium traction solutions paired with comprehensive field service agreements that guarantee uptime in remote locations.

Meanwhile, Asia-Pacific continues to exhibit dual momentum from industrial expansion and agricultural modernization. Southeast Asian infrastructure upgrades are increasing demand for mid-sized loaders and graders fitted with radial bias hybrids, whereas China’s focus on smart farming is fostering adoption of sensor-enabled tractor tires. Australia’s mining sector remains at the forefront of ultra-large diameter tire innovations, driving global R&D collaboration between domestic suppliers and multinational tire corporations.

This comprehensive research report examines key regions that drive the evolution of the OTR Tires market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategic Initiatives, Technological Collaborations, and Competitive Positioning to Capitalize on OTR Tire Market Shifts

Leading tire manufacturers are deploying multifaceted strategies to maintain competitive edge and capture emerging opportunities. Michelin has intensified its focus on digital tire management platforms, collaborating with telematics providers to deliver integrated solutions that track performance from dispatch through retirement. Bridgestone, leveraging its mobility vision, has launched a series of next-generation radial compounds that incorporate bio-sourced polymers, underscoring its commitment to sustainable development and circular economy partnerships.

Goodyear has doubled down on joint ventures with equipment OEMs, embedding advanced sensing technologies within tread layers to optimize fleet efficiency. Continental continues to expand its retreading network, capitalizing on service bundles that reduce total cost of ownership for industrial customers. In parallel, BKT and Titan have pursued capacity expansions in key geographies, aligning production footprints with rising demand from agricultural and mining operators in emerging economies.

Yokohama has differentiated through material innovation, introducing proprietary polymer blends that enhance cut resistance and extend service intervals in harsh terrains. Collectively, these organizations are enhancing vertical integration, harnessing digital platforms, and forging strategic alliances that extend beyond traditional tire manufacturing into maintenance, recycling, and data analytics ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the OTR Tires market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addo India

- Apollo Tyres Ltd.

- Balkrishna Industries Limited

- Bridgestone Corporation

- Cabot Corporation

- CEAT Ltd.

- Continental AG

- Duratech Industrial Group Limited

- Eastman Industries Limited

- Emerald Tyre Manufacturers Limited

- Giti Tire

- Global excel Tyres Co.,ltd

- Goodyear Tire & Rubber Company

- Haian Rubber Group Co., Ltd.

- ITR Group

- JK Tyre & Industries Ltd.

- Magna Tyres Group

- Michelin Corporation

- MRF Ltd.

- Nokian Heavy Tyres Ltd

- Pirelli & C. S.p.A.

- Prometeon Tyre Group S.R.L.

- Sumitomo Rubber Industries, Ltd.

- Titan International, Inc.

- Yokohama Tire Corporation

Formulating Practical, High-Impact Strategies for Industry Leaders to Enhance Supply Chain Agility, Sustainability, and Technological Adoption in OTR Operations

Industry leaders should prioritize the diversification of raw material sourcing to mitigate exposure to tariff fluctuations and supply disruptions. Establishing strategic alliances with domestic steel mills and bio-rubber producers can unlock preferential pricing structures and reinforce supply chain visibility. In parallel, allocating R&D resources toward advanced compound formulations-incorporating recycled content and sustainable feedstocks-will not only align with evolving regulatory mandates but also resonate with end users increasingly focused on environmental stewardship.

Companies must accelerate the integration of digital tire monitoring solutions into their portfolios, offering subscription-based analytics services that generate recurring revenue streams. By bundling data-driven maintenance advisories with aftermarket support, manufacturers can deepen customer relationships and differentiate their product offerings. Further, investing in modular manufacturing capabilities capable of rapid size and construction reconfiguration will provide agility in responding to shifting equipment specifications and regional demand patterns.

Finally, developing comprehensive training programs for distribution partners and service technicians will ensure consistent implementation of best practices across global networks. Prioritizing localized retreading and repair hubs in proximity to major equipment clusters will shorten turnaround times and bolster overall fleet uptime, delivering tangible value to end users while strengthening brand loyalty.

Outlining Rigorous Mixed-Method Research Processes and Analytical Frameworks Employed to Deliver Comprehensive OTR Tire Industry Intelligence

This research employs a rigorous mixed-method approach to deliver nuanced insights into the off-the-road tire landscape. Primary data collection comprised in-depth interviews with OEM procurement executives, fleet maintenance managers, and distribution channel owners across key regions. These qualitative engagements were complemented by field observations at major construction sites, agricultural cooperatives, and mining operations to validate end-user requirements and performance benchmarks.

Secondary research encompassed analysis of industry white papers, regulatory filings, and patent registries to trace technological trajectories and compliance frameworks. Supply chain mapping leveraged both proprietary databases and customs records to chart materials flows and tariff exposure points. Data triangulation methodologies ensured that findings were corroborated through multiple lenses, enhancing reliability.

Analytical frameworks integrated PESTEL evaluations, value chain decomposition, and segment profitability diagnostics to identify critical levers of differentiation. The outcome is a comprehensive intelligence suite that supports strategic decision-making without relying on static forecasts, instead illuminating dynamic market forces and actionable pathways for competitive advantage.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our OTR Tires market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- OTR Tires Market, by Product Type

- OTR Tires Market, by Tire Size

- OTR Tires Market, by Load Capacity

- OTR Tires Market, by Vehicle Type

- OTR Tires Market, by Application

- OTR Tires Market, by Distribution Channel

- OTR Tires Market, by Region

- OTR Tires Market, by Group

- OTR Tires Market, by Country

- United States OTR Tires Market

- China OTR Tires Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights and Highlighting Critical Trends Guiding Strategic Decision-Making in the Off-the-Road Tire Ecosystem Today

The synthesis of technological innovations, regulatory developments, and supply chain realignments paints a clear picture: agility and sustainability will define competitive success within the off-the-road tire sector. Stakeholders who embrace digital transformation-by embedding smart sensors and leveraging analytics-will unlock new value propositions that extend beyond traditional product performance metrics. Concurrently, the growing influence of environmental standards and circular economy principles necessitates proactive material strategy and collaborative ecosystem engagement.

While tariffs introduce complexity, they also create opportunities for reshoring and local partnership models that enhance resilience. Regional disparities underscore the importance of tailored approaches: what works in the Americas’ agricultural heartlands may differ fundamentally from Europe’s compliance-driven markets or Asia-Pacific’s infrastructure-led growth corridors. By aligning segmentation strategies with these nuanced regional profiles, manufacturers can optimize resource allocation and accelerate time to market.

Ultimately, the companies that integrate these insights into cohesive action plans-balancing innovation, operational efficiency, and stakeholder collaboration-will lead the industry forward, delivering sustained value to investors, customers, and communities alike.

Connect with Ketan Rohom to Unlock Specialized Off-the-Road Tire Market Insights and Secure Your Customized Research Report Investment Today

Embarking on the acquisition of this comprehensive analysis equips decision-makers with the critical intelligence to navigate competitive pressures, optimize procurement strategies, and capitalize on emerging opportunities within the off-the-road tire domain. To secure your personalized copy of this in-depth market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. With an expert consultative approach, Ketan will ensure you receive tailored insights aligned to your unique organizational priorities. Engage today to unlock strategic advantage and drive lasting impact across your operations.

- How big is the OTR Tires Market?

- What is the OTR Tires Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?