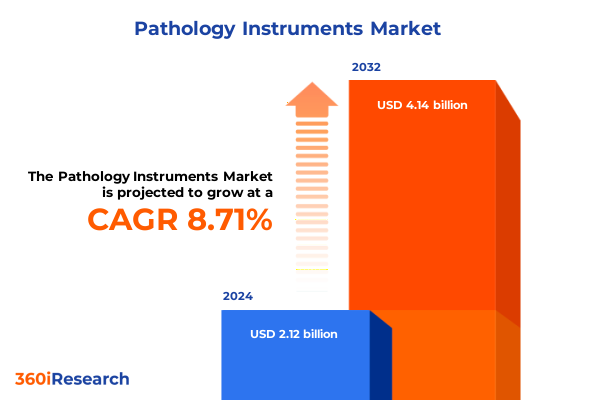

The Pathology Instruments Market size was estimated at USD 2.29 billion in 2025 and expected to reach USD 2.48 billion in 2026, at a CAGR of 8.81% to reach USD 4.14 billion by 2032.

Setting the stage for precision-driven pathology diagnostics with cutting-edge imaging and processing technologies reshaping laboratory workflows

The pathology instruments arena has undergone a significant transformation, driven by rapid technological advancements and evolving clinical demands. Emerging innovations in imaging, processing, and analysis have converged to enable unprecedented precision in disease diagnosis and research applications. In particular, the shift toward digital pathology, coupled with robust data analytics tools, is redefining how laboratories operate and how pathologists interpret samples. This dynamic interplay of hardware and software solutions underscores the critical role of advanced instrumentation in modern healthcare delivery.

As healthcare systems worldwide grapple with rising chronic disease prevalence and the need for faster, more accurate diagnostic workflows, investment in pathology instruments has emerged as a strategic priority. Advances in fluorescence imaging, high-throughput tissue processing, and automated staining platforms are enabling laboratories to increase throughput, reduce manual error, and optimize turnaround times. Consequently, organizations across clinical diagnostics, research institutes, and pharmaceutical development are placing greater emphasis on instrument performance, integration capabilities, and scalability. This foundational landscape sets the stage for understanding the profound shifts shaping the market.

Exploring how digital transformation and automation milestones have redefined sample analysis and workflow efficiencies across pathology labs

Over the past decade, the pathology instruments market has witnessed transformative shifts that have fundamentally altered operational paradigms. Foremost among these is the widespread adoption of digital pathology systems, which integrate high-resolution slide scanners, sophisticated image management software, and cloud-based collaboration platforms. This transition from brightfield to digital workflows has streamlined remote consultations, academic training, and consensus meetings, enhancing both efficiency and diagnostic accuracy.

Simultaneously, automation has made significant inroads into routine laboratory tasks. Automated slide stainers and tissue processors are now capable of handling higher volumes with consistent quality, thereby freeing skilled personnel for more complex analytical duties. Laboratory robotics and AI-driven image analysis are also gaining traction, offering predictive insights and pattern recognition that support pathologists in identifying subtle morphological changes. Together, these technological milestones are catalyzing a more integrated, data-centric approach to sample management and diagnostic interpretation.

Analyzing the cascading effects of the 2025 U.S. tariff revisions on pathology instrument availability costs and supply chain resilience

In early 2025, the United States implemented a revised tariff framework targeting select medical equipment imports, including components used in high-precision pathology instruments. These measures, intended to bolster domestic manufacturing, have introduced supply chain complexities for laboratories reliant on specialized imaging systems, microtomes, and staining platforms. Consequently, procurement cycles have lengthened as organizations reassess sourcing strategies and navigate increased customs duties.

Despite short-term cost pressures, these tariffs have also spurred investments in local assembly and in-country partnerships. Several vendors have expanded U.S.-based manufacturing footprints and established strategic alliances with domestic distributors to mitigate duty impacts and ensure supply continuity. In parallel, laboratories are exploring alternative suppliers and near-shoring opportunities to balance compliance obligations with operational resilience. As the market adapts, these cumulative tariff effects will influence pricing structures, vendor selection processes, and long-term procurement models.

Revealing market dynamics driven by diverse product types technologies and end user applications shaping strategic segmentation insights

A nuanced view of the pathology instruments market emerges when examining core segmentation dimensions by product type, technology, end user, application, and distribution channel. In terms of product type, digital pathology systems are accelerating growth alongside fluorescence imaging platforms, while cryostat microtomes and immersion tissue processors address niche needs in research and education environments. Automated slide stainers are increasingly preferred in high-volume diagnostic laboratories, contrasting with manual stainers that remain prevalent in smaller facilities.

Assessing technology, automated solutions continue to outpace manual instruments in adoption due to their precision, reproducibility, and integration capabilities. Among end users, diagnostic laboratories drive the highest equipment demand, closely followed by hospitals upgrading lab infrastructure to support point-of-care testing. Pharmaceutical companies and research institutes remain key purchasers of specialized microtomes and fluorescence scanners, reflecting ongoing investment in drug discovery and translational research. Applications in clinical diagnostics dominate, but significant activity in educational settings and veterinary pathology underscores emerging pockets of demand. Finally, direct sales continue to serve large institutional buyers, whereas distributors and online platforms facilitate access for decentralized and smaller purchasers.

This comprehensive research report categorizes the Pathology Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

- Distribution Channel

Examining regional trends and investments informing divergent growth patterns across the Americas EMEA and Asia-Pacific markets

Regional variations in pathology instrument adoption highlight distinct growth trajectories and market drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, demand is anchored by robust healthcare infrastructure, substantial research funding, and a drive toward precision medicine initiatives. This region also leads in digital pathology implementation, with several large networks deploying centralized slide scanning and AI-enabled diagnostics.

Conversely, the Europe, Middle East & Africa region showcases heterogeneous market maturity. Western European nations emphasize regulatory compliance and integration with national health services, while emerging markets in the Middle East and Africa present untapped opportunities driven by expanding laboratory networks and rising healthcare expenditure. Meanwhile, the Asia-Pacific region demonstrates the fastest expansion, propelled by rising incidence of chronic diseases, expansion of private diagnostic laboratory chains, and government-led healthcare modernization programs. Investments in automated tissue processing and fluorescence imaging are particularly notable in large economies like China, India, and Japan.

This comprehensive research report examines key regions that drive the evolution of the Pathology Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how leading manufacturers and collaborators are reshaping competitive dynamics through innovation partnerships and strategic expansions

Leading pathology instrument providers are advancing their positions through targeted innovation, strategic partnerships, and capacity expansions. Manufacturers of digital pathology systems are integrating AI-driven analysis modules to differentiate their offerings, while traditional microscopy vendors are diversifying portfolios by introducing fluorescence capabilities. Collaborations between instrument suppliers and software developers are yielding end-to-end solutions that streamline data management and support cloud-based diagnostics.

In parallel, major players in microtome and tissue processor segments are enhancing automation and user ergonomics to appeal to high-throughput laboratories. Companies are also optimizing their distribution networks, forging alliances with regional distributors to achieve deeper market penetration. Moreover, mergers and acquisitions continue to reshape competitive dynamics, as established firms seek to bolster technological capabilities and geographic reach. These industry movements underscore an ecosystem where continuous innovation and strategic alignment are critical to sustaining leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pathology Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio SB

- Bio-Genex Laboratories

- Bio-Rad Laboratories, Inc.

- BrandTech Scientific, Inc.

- Danaher Corporation

- Diapath S.p.A.

- F. Hoffmann-La Roche AG

- Fujifilm Holdings Corporation

- GPC Medical Ltd.

- Hamamatsu Photonics K.K.

- Hologic, Inc.

- Leica Biosystems Nussloch GmbH

- Liberty Industries, Inc.

- Merck KGaA

- Mikroscan Technologies, Inc.

- PerkinElmer Inc.

- PHC Holdings Corporation

- QIAGEN GmbH

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Driving sustained growth by integrating digital solutions optimizing supply chains and forging strategic alliances to meet evolving laboratory needs

Industry leaders should prioritize a multi-pronged strategy to capitalize on shifting market conditions. First, embracing digital transformation by integrating AI-enabled image analysis with existing hardware will unlock enhanced diagnostic accuracy and workflow efficiency. Concurrently, diversifying the supply chain by developing regional manufacturing partnerships can mitigate the impacts of fluctuating tariffs and trade policies.

Furthermore, aligning product development with end user needs-particularly in diagnostic laboratories and academic research centers-will foster deeper customer engagement. Targeted investments in training and support services can enhance user adoption and satisfaction. Finally, establishing collaborative ecosystems with software vendors, cloud providers, and academic institutions will accelerate innovation cycles and broaden solution capabilities. By combining strategic alliances, technological differentiation, and operational resilience, companies can secure a sustainable competitive advantage.

Outlining the comprehensive primary and secondary research framework applied to ensure accuracy reliability and depth in pathology instrument analysis

This report is underpinned by a rigorous research methodology that synthesizes both primary and secondary data sources. Primary research involved interviews with laboratory directors, procurement managers, pathologists, and R&D leaders across key geographic markets. These insights were complemented by secondary research encompassing peer-reviewed journals, industry white papers, regulatory filings, and company brochures.

Data triangulation was employed to ensure robustness of findings, with cross-verification of market trends, technology adoption rates, and tariff impacts. Secondary data were carefully vetted to exclude outdated or non-representative sources, and primary interviews were conducted using structured questionnaires to maintain consistency. Quality assurance protocols included internal reviews and expert validation to uphold accuracy and reliability. This comprehensive approach enables a credible and actionable understanding of the global pathology instruments landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pathology Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pathology Instruments Market, by Product Type

- Pathology Instruments Market, by Technology

- Pathology Instruments Market, by End User

- Pathology Instruments Market, by Application

- Pathology Instruments Market, by Distribution Channel

- Pathology Instruments Market, by Region

- Pathology Instruments Market, by Group

- Pathology Instruments Market, by Country

- United States Pathology Instruments Market

- China Pathology Instruments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing key trends insights and strategic imperatives that define the evolving competitive landscape in pathology instrumentation

The convergence of digital innovation, evolving trade policies, and diverse end user requirements is redefining the pathology instruments market. As laboratories seek higher throughput, greater precision, and operational resilience, the importance of automated imaging, advanced tissue processing, and integrated software solutions has never been more pronounced. Simultaneously, the 2025 tariff adjustments underscore the need for supply chain agility and strategic partnerships.

Looking ahead, companies that effectively align their product roadmaps with regional market drivers and user-specific demands will emerge as frontrunners. By leveraging advanced analytics, embracing collaborative ecosystems, and maintaining a flexible operational footprint, stakeholders can navigate uncertainties and seize emerging opportunities. In this dynamic environment, actionable insights and data-driven decision-making will be essential to sustaining competitive advantage and driving long-term growth.

Unlock unparalleled market intelligence for pathology instrument advancements by contacting the Associate Director of Sales & Marketing to acquire your comprehensive industry report

Ready to elevate your strategic planning with in-depth market insights tailored to the pathology instruments sector? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive report and gain a competitive edge in applied diagnostic technologies. Our seasoned team has distilled the most critical trends, drivers, and actionable recommendations to empower your organization’s decision-making. Engage now to benefit from exclusive data, expert analysis, and customized support designed to advance your market positioning and growth trajectory.

- How big is the Pathology Instruments Market?

- What is the Pathology Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?