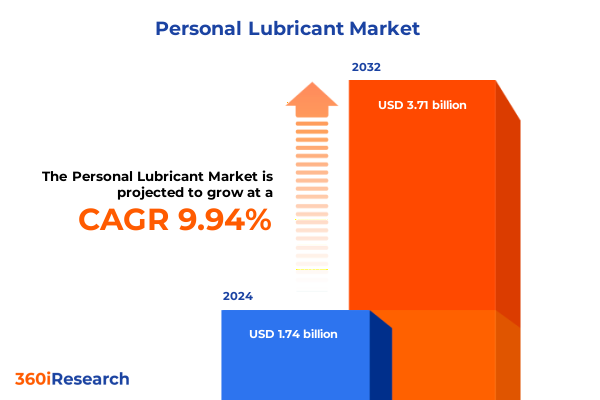

The Personal Lubricant Market size was estimated at USD 1.91 billion in 2025 and expected to reach USD 2.11 billion in 2026, at a CAGR of 9.91% to reach USD 3.71 billion by 2032.

Unveiling the Fundamental Drivers and Market Forces Propelling the Personal Lubricant Industry Toward Enhanced Innovation and Consumer-Centric Growth

The personal lubricant industry has evolved from a niche afterthought to a pivotal segment within the broader sexual wellness market, driven by shifting consumer attitudes and heightened awareness around intimate well-being. As destigmatization continues to reshape cultural conversations, individuals across demographic groups are seeking products that not only enhance comfort and performance but also align with their values related to health, sustainability, and personalization. In this dynamic environment, industry leaders must recognize the dual influence of evolving consumer expectations and technological advancements to maintain relevance and foster innovation.

Moreover, the digital revolution has significantly altered how consumers discover, evaluate, and purchase personal lubricants. Online channels now serve as primary touchpoints for education and exploration, enabling brands to connect directly with end users through targeted content, social media engagement, and e-commerce platforms. This shift underscores the importance of an integrated omnichannel approach that seamlessly bridges digital outreach with in-store experiences. Moving forward, companies that successfully balance product innovation with an agile marketing strategy are poised to lead the market, leveraging insights into consumer behavior and technological integration to deliver unparalleled value.

Examining the Pivotal Changes and Emerging Trends Revolutionizing the Personal Lubricant Landscape Through Consumer Insights and Tech Innovation

Over the past few years, the personal lubricant landscape has undergone transformative shifts characterized by bold product innovations and a growing emphasis on sustainability. Brands are pioneering new formulations that incorporate natural and organic ingredients, responding to consumer demands for transparency and safety. This move toward cleaner label solutions is complemented by an uptick in personalized offerings, where advanced data analytics and consumer feedback loops enable the creation of niche products tailored to specific preferences, such as plant-based silicone blends or water-based formulas with functional additives.

Concurrently, advances in packaging technology and eco-friendly materials have redefined the supply chain, prompting a reevaluation of sourcing strategies and reducing environmental footprints. Innovative delivery systems, including precision applicators and refillable containers, not only enhance user experience but also signal a broader commitment to circular economy principles. These developments, when paired with digital-first marketing campaigns and influencer partnerships, are revolutionizing brand-consumer interactions, driving deeper engagement, and setting new benchmarks for differentiation in a crowded marketplace.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chains Cost Structures and Competitive Positioning within the Personal Lubricant Market

The implementation of United States tariffs in early 2025 has exerted mounting pressure on cost structures across the personal lubricant value chain. Key raw materials, most notably high-purity silicones and specialized polymers, have seen import duties drive manufacturing expenses upward, prompting both domestic and international suppliers to renegotiate contracts and explore alternative sourcing strategies. As a result, many formulators have begun to absorb a portion of these increased costs to maintain competitive pricing, while others have shifted toward locally sourced feedstocks and ingredient composites with lower duty burdens.

In addition to raw material considerations, packaging components such as aluminum tubes and PET bottles have faced elevated tariffs, further straining profit margins. Companies are responding by optimizing packaging weights, deploying modular manufacturing operations closer to end markets, and fostering strategic alliances that consolidate procurement volumes. Taken together, these adaptations reflect an industry-wide recalibration of supply chain resilience, emphasizing agility, regional diversification, and value-engineered design to mitigate the ripple effects of tariff-driven volatility.

Uncovering Critical Segmentation Insights by Product Type Form Distribution Channel End User and Price Range Driving Targeted Growth Strategies

A nuanced understanding of product-type segmentation is critical for companies aiming to capitalize on shifting consumer preferences. Hybrid formulations that blend silicone and water-based ingredients are gaining traction for their balanced performance profile, while oil-based variants maintain a loyal following among users prioritizing long-lasting lubrication. Silicone-based options continue to command premium pricing due to their superior skin feel and moisture retention, though they must navigate regulatory scrutiny related to specialty polymer sourcing. Water-based lubricants dominate retail channels, especially when enhanced with flavors or designed without added fragrances, catering to both sensitivity concerns and experiential novelty.

Form diversity further shapes consumer choice, as creams offer enhanced skin-conditioning properties and gels deliver targeted viscosity benefits. Liquids remain a mainstay for everyday use, whereas sprays are increasingly recognized for their discreet convenience and rapid absorption. Distribution channel segmentation reveals that while brick-and-mortar outlets such as convenience stores, pharmacies, and specialty retailers remain important for impulse purchases, online platforms are the primary growth engine. Within digital channels, direct-to-consumer websites, large marketplaces, and dedicated online pharmacies each play distinct roles in product discovery and repurchase velocity. End-user insights underscore gender-based consumption patterns, with female cohorts aged 18 to 25 exhibiting strong engagement with flavored water-based varieties, and male segments across all age brackets showing steady demand for mid-range gel formats. In the premium tier, organic and all-natural options outpace standard formulations, reflecting a broader willingness to invest in aspirational wellness products and nuanced sensory experiences.

This comprehensive research report categorizes the Personal Lubricant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- End User

- Price Range

Exploring Distinct Regional Dynamics in the Americas Europe Middle East Africa and Asia-Pacific Impacting Consumer Behavior and Market Access

Regional dynamics within the Americas underscore the United States as both the largest and most innovation-driven market, where consumers show a marked preference for water-based lubricants enhanced with natural extracts. Canada and Latin American markets, while smaller in absolute terms, are exhibiting rapid adoption of premium and organic formulations, driven by expanding retail footprints and rising awareness of intimate wellness issues. Across North and South America, regulatory frameworks are converging toward higher safety standards, encouraging transparency in ingredient disclosure and ethical sourcing practices that resonate with socially conscious buyers.

In the Europe, Middle East and Africa region, European markets lead in product sophistication, with stringent cosmetic regulations fostering heightened product safety and sustainability benchmarks. Middle Eastern markets emphasize culturally tailored formulations, highlighting discreet packaging and gender-specific marketing. African markets, though still nascent, are showcasing burgeoning interest in affordable, economy-range lubricants distributed primarily through pharmacy networks. Meanwhile, the Asia-Pacific region is characterized by dynamic growth, propelled by increasing digital penetration and shifting societal attitudes toward sexual health. In key countries such as China, Japan and Australia, robust e-commerce infrastructure and influencer-driven education campaigns are accelerating penetration rates, while emerging markets in Southeast Asia and India present untapped potential for mid-range and economy segment entrants.

This comprehensive research report examines key regions that drive the evolution of the Personal Lubricant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players and Strategic Alliances Shaping Competitive Dynamics and Innovation Trajectories in the Personal Lubricant Sector

Leading companies in the personal lubricant space are continuously redefining competitive boundaries through strategic mergers, acquisitions, and innovation-led partnerships. Major consumer goods corporations leverage extensive distribution networks and marketing prowess to introduce adjacent wellness products, thereby strengthening cross-category synergies. At the same time, specialized players concentrate on niche formulations-such as organic, vegan, or medical-grade lubricants-to establish differentiated brand identities that resonate with targeted consumer segments.

In addition to traditional pharmaceutical and consumer packaged goods firms, a wave of agile start-ups is leveraging direct-to-consumer models and digital community building to capture market share. These disruptors often employ rapid prototyping and lean manufacturing techniques to iterate on new textures, scents, and delivery systems. Collectively, this constellation of companies fosters a landscape where incumbents and challengers alike must remain vigilant, drawing upon real-time consumer feedback, regulatory foresight, and collaborative research initiatives to stay ahead of industry inflection points.

This comprehensive research report delivers an in-depth overview of the principal market players in the Personal Lubricant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aloe Cadabra by Live Well Brands, Inc.

- Ansell Limited

- BioFilm Inc.

- Church & Dwight Co., Inc.

- Cobeco Pharma

- Cupid Limited

- Doc Johnson Enterprises, Inc.

- Edgewell Personal Care Company

- Good Clean Love, Inc.

- Hathor Professional Skincare Ltd.

- Kenvue Inc.

- LifeStyles Healthcare Pte. Ltd.

- Lovehoney Group Limited

- Mankind Pharma Ltd.

- Maude Group, Inc.

- Mayer Laboratories, Inc.

- McKesson Corporation

- Multi-Pack Solutions LLC

- MyMuse India Pvt., Ltd.

- OhnutCo.

- Pjur Group AG

- Reckitt Benckiser Group plc

- Sensuous Beauty, Inc.

- Sliquid LLC

- Trigg Laboratories, Inc.

- Westridge Laboratories, Inc.

- Wicked Sensual Care LLC

Formulating Actionable Recommendations to Capitalize on Market Opportunities Enhance Supply Chain Resilience and Accelerate Product Differentiation Efforts

To capitalize on evolving market opportunities, industry leaders should prioritize investment in hybrid and natural-ingredient formulations that align with rising consumer health consciousness while retaining performance attributes. Simultaneously, enhancing supply chain resilience through localized production and strategic sourcing partnerships will mitigate exposure to import duties and raw material shortages. Extending beyond product development, brands must optimize omnichannel distribution by integrating seamless digital interfaces with experiential retail activations, thereby catering to both convenience-driven and engagement-driven consumer journeys.

Furthermore, companies can accelerate differentiation by adopting modular packaging solutions and refillable systems that appeal to environmentally conscious end users. Tailored marketing strategies should leverage data-driven insights to address specific demographic cohorts-such as flavor-forward youth segments or age-driven sensitivity groups-ensuring communications resonate authentically. Finally, forging alliances with healthcare professionals and wellness influencers can elevate brand credibility and facilitate informed purchasing decisions, reinforcing a holistic approach to market leadership based on innovation, sustainability, and consumer trust.

Outlining Rigorous Research Methodology Integrating Qualitative and Quantitative Techniques to Deliver Robust Insights and Ensure Data Integrity

This research employs a robust, multi-phase methodology combining both qualitative and quantitative techniques to ensure comprehensive and reliable insights. The initial phase involved an extensive review of publicly available information, regulatory filings, patent databases, and corporate disclosures to map the competitive landscape and identify key trends. Primary research was conducted through in-depth interviews with senior executives, formulation scientists, supply chain specialists, and channel partners, providing expert perspectives on strategic priorities and operational challenges.

In parallel, consumer-level data collection utilized online surveys and focus groups segmented by age, gender, and purchasing behavior, yielding granular understanding of preferences and unmet needs. Statistical analysis was applied to validate correlations between demographic attributes and product adoption rates. Finally, a triangulation process reconciled findings from secondary sources, expert interviews, and consumer feedback, followed by rigorous data validation workshops. This layered approach guarantees that the conclusions and recommendations are grounded in both market realities and forward-looking scenarios, delivering a high degree of confidence to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Personal Lubricant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Personal Lubricant Market, by Product Type

- Personal Lubricant Market, by Form

- Personal Lubricant Market, by Distribution Channel

- Personal Lubricant Market, by End User

- Personal Lubricant Market, by Price Range

- Personal Lubricant Market, by Region

- Personal Lubricant Market, by Group

- Personal Lubricant Market, by Country

- United States Personal Lubricant Market

- China Personal Lubricant Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate Future Pathways for Sustainable Growth and Competitive Excellence in the Lubricant Market

This executive summary has distilled the most salient developments in the personal lubricant market, from emerging consumer-driven product innovations to the strategic ramifications of recent tariff changes. Segmentation analysis highlights the pivotal role of hybrid and water-based formulations, diverse delivery forms, and targeted distribution strategies in driving market penetration. Regional insights underscore the heterogeneity of demand across the Americas, EMEA and Asia-Pacific, each presenting unique regulatory and socio-cultural dynamics that require tailored approaches.

Strategic imperatives point to the necessity of agile supply chains, consumer-centric product portfolios, and collaborative partnerships that foster innovation and sustainability. Companies that successfully navigate these imperatives will unlock new growth trajectories and solidify their positions as market leaders. As the sector continues to mature, maintaining a pulse on evolving trends and regulatory shifts will remain critical. In essence, the future of the personal lubricant industry will be defined by those who can integrate data-driven insights with a bold vision for product excellence and responsible business practices.

Engage with Ketan Rohom to Unlock Exclusive Market Insights and Tailored Strategic Solutions Elevating Your Competitive Edge through Research Consultation

Are you ready to transform your strategic approach to the personal lubricant market and stay ahead of ever-shifting consumer demands? Ketan Rohom, Associate Director of Sales & Marketing, invites you to engage directly with him for an exclusive consultation. By partnering with him, you will gain unparalleled access to the latest market insights, tailored strategic solutions, and actionable intelligence designed to elevate your competitive edge. Whether you seek to refine your product portfolio, optimize distribution channels, or navigate complex regulatory landscapes, this one-on-one consultation will empower you to make informed decisions and drive sustainable growth. Don’t miss the chance to leverage expert guidance that can unlock hidden opportunities and accelerate your path to market leadership in the personal lubricant sector. Connect with Ketan today to secure your personalized research pathway and harness the full potential of our comprehensive market analysis.

- How big is the Personal Lubricant Market?

- What is the Personal Lubricant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?