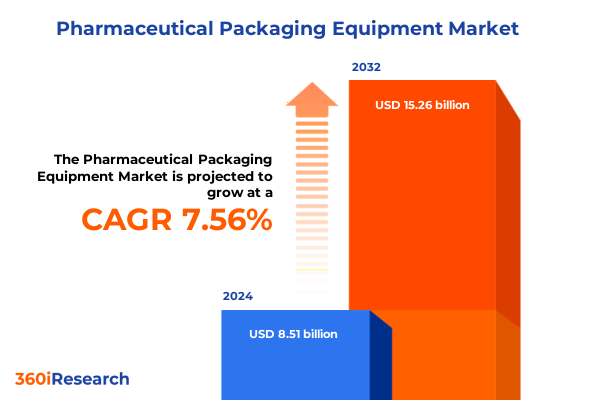

The Pharmaceutical Packaging Equipment Market size was estimated at USD 9.13 billion in 2025 and expected to reach USD 9.80 billion in 2026, at a CAGR of 7.60% to reach USD 15.26 billion by 2032.

Insightful Exploration of Key Drivers and Emerging Opportunities Shaping the Future of Pharmaceutical Packaging Equipment Industry

The pharmaceutical packaging equipment industry stands at the nexus of rising patient expectations, stringent regulatory mandates, and rapid technological breakthroughs. In recent years, supply chain disruptions and shifting global trade policies have underscored the critical importance of resilient and flexible packaging lines. Meanwhile, emerging therapies such as cell and gene treatments demand bespoke primary and secondary packaging solutions capable of maintaining sterility, traceability, and compatibility with advanced delivery systems.

Decision-makers must navigate a market where digital transformation initiatives-from robotics to artificial intelligence-are no longer optional but central to maintaining productivity and compliance. At the same time, sustainability imperatives are pressuring manufacturers to adopt mono-materials, recyclable films, and energy-efficient processes without compromising performance. Against this backdrop, companies are compelled to reevaluate sourcing strategies, diversify supplier bases, and invest strategically in automation to achieve both operational agility and cost resilience.

This executive summary distills the most critical market shifts, tariff impacts, segmentation nuances, regional distinctions, and competitive dynamics that define the pharmaceutical packaging equipment landscape today. By examining these factors in depth, industry leaders, technology providers, and investors can align their strategies to foster innovation while mitigating the risks posed by geopolitical tensions and evolving customer demands.

Critical Technological Breakthroughs and Sustainability Imperatives Redefining Pharmaceutical Packaging Processes and Operational Efficiency

The wave of digital transformation washing over pharmaceutical packaging is characterized by the integration of artificial intelligence, advanced data analytics, and predictive maintenance capabilities. Companies like IMA have formalized AI strategies through the creation of dedicated competence centers-IMA AI LAB and Embedded Data Machines-to deploy algorithms that anticipate equipment anomalies, optimize machine efficiency, and deliver real-time insights on production performance. These developments not only bolster overall equipment effectiveness but also strengthen compliance by reducing unplanned downtime in aseptic environments.

Parallel to AI adoption, robotics and Industry 4.0 architectures are redefining line layout and throughput. Syntegon’s demonstration of robotic Settle Plate Changer units for viable monitoring and AI-guided MLD Advanced platforms for syringe processing underscores a trend toward end-to-end automation, where minimal human intervention enhances both speed and sterility controls. This shift addresses labor shortages while enabling flexible production of parenteral formats at high yields.

Sustainability is emerging as another transformative force. Partnerships among Uhlmann, Faller Packaging, Perlen Packaging, and Etimex are pioneering polypropylene blister innovations as a recyclable alternative to PVC-aluminum composites, signaling a broader industry commitment to eco-friendly materials. Concurrently, Romaco’s implementation of heat pumps in fluid bed processes demonstrates how energy-recovery technologies can reduce carbon footprints across formulation and packaging operations.

Regulatory frameworks continue to drive innovation in serialization and track-and-trace capabilities. The EU’s Falsified Medicines Directive mandates unique identifiers and tamper-evident seals on most human prescription medicines, reinforcing supply chain security and patient safety across member states. Italy’s Medicines Agency has recognized industry challenges by extending compliance deadlines to February 2027, reflecting both the complexity of GS1 aggregation standards and the strategic importance of seamless data capture on secondary and tertiary packaging.

Assessing the Multifaceted Consequences of United States 2025 Tariffs on Pharmaceutical Packaging Machinery Supply Chains and Costs

In 2025, U.S. trade policy has introduced significant headwinds for pharmaceutical packaging equipment manufacturers and end-users alike. The United States Trade Representative’s imposition of a 15 percent tariff on medical packaging and lab equipment has triggered cost increases across glass vial filling lines, sterile packaging modules, and advanced inspection technologies sourced from Germany, Japan, and China. Concurrently, a 25 percent duty on large-scale pharmaceutical machinery-including tablet compression systems, fluid bed dryers, and lyophilization units-has elevated capital expenditure requirements for major format changes and line expansions.

While certain machinery categories enjoy temporary exclusions, such as pre-ordered ship-to-shore gantry cranes, the broader Section 301 tariff schedule is poised to reshape supplier selection and lead times. Companies are reevaluating their global sourcing strategies, considering near-shoring options in North America, and accelerating investments in domestic manufacturing capacity to mitigate exposure to ongoing tariff volatility.

The cumulative impact of these measures extends beyond direct equipment costs. Increased duties have prompted elongations in procurement cycles, as organizations navigate complex classification and exclusion request processes. Project budgets are under pressure, and some firms are exploring multi-vendor integration models to distribute risk. In parallel, equipment suppliers are offering hybrid financing solutions and digital commissioning services to offset higher landed costs and expedite line readiness.

Amid this landscape, strategic partnerships between U.S. contract packagers and equipment OEMs have gained traction, combining local assembly with advanced technology deployments. As the tariff environment continues to evolve, industry stakeholders must prioritize supply chain resilience, dynamic cost modeling, and robust trade compliance frameworks to sustain growth and innovation.

In-Depth Examination of Equipment Types, Product Formulations, Materials, Technologies, and End Users to Illuminate Market Segmentation Trends

Delving into equipment-type segmentation reveals a nuanced market where blister packing machines, propelled by the need for unit dose accuracy and patient safety, are increasingly paired with continuous motion cartoners to maximize throughput. Within cartoning, the emergence of alternating top-load and side-load architectures allows processors to handle a broad array of carton sizes and leaflet configurations without extensive format changeovers. Filling machines have undergone a parallel evolution: peristaltic systems offer gentle handling for biological formulations while vacuum filling platforms deliver precision for small-volume, high-value injectable therapies. Labeling solutions are similarly bifurcated, with pressure-sensitive modules enabling rapid format shifts and wrap-around designs achieving seamless adhesion even on complex container geometries. Sealing technologies range from robust heat-sealing tunnels to induction sealing heads optimized for moisture-sensitive liquids, and wrapping equipment encompasses bundlers for multipacks as well as flow-wrap machines for patient convenience packs.

The product-type segmentation further underscores divergent equipment needs. Aerosol formats demand specialized crimping and valve insertion units with integrated leak detection, while liquids require sterile-grade filling lines equipped with nested syringe or vial handling. Semi-solid creams and gels utilize vacuum emulsification and precision piston filling to maintain homogeneity, and solid dosage forms-capsules, granules, powders, and tablets-invoke high-speed capsule fillers, adjacent dry powder inhaler (DPI) micro-dosing modules, and multi-layer tablet presses. A dedicated focus on small-batch, high-potency handling within R&D pilot labs is evident in the launch of machines capable of filling sub-milligram powders and implementing robust containment measures for potent compounds.

Material-based segmentation illustrates a delicate balance between barrier performance and environmental considerations. Glass vials remain the gold standard for parenteral drugs, with borosilicate offering superior chemical resistance and soda lime serving cost-sensitive applications. Plastic substrates-polyethylene, polypropylene, and polyvinylchloride-are evolving to meet recyclability targets, with mono-poly solutions and multi-layer films that integrate barrier coatings without compromising downstream processing. Composite lidding foils and paper-based cartons further complement these primary materials in secondary and tertiary packaging applications.

Technology orientation spans automatic, semi-automatic, and manual systems. Fully automated, continuous motion lines are the workhorses of large-scale producers, delivering high uptime and minimal human intervention. Semi-automatic solutions cater to mid-tier volumes, where modularity and format flexibility are paramount. Manual or bench-top stations remain essential for clinical trial packaging, early-stage formulation, and specialized contract packagers focused on high-mix, low-volume projects.

End-user segmentation reflects diverse adoption patterns. Biotechnology companies favor agile, small-batch platforms that support rapid clinical cycles and aseptic containment. Contract packaging organizations leverage turnkey, modular lines to service multiple clients with varying formats. Meanwhile, global pharmaceutical manufacturers invest in large integrated lines, digital twins, and predictive maintenance tools to sustain high output levels, regulatory compliance, and overall equipment effectiveness.

This comprehensive research report categorizes the Pharmaceutical Packaging Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Product Type

- Packaging Material

- Technology

- End User

Comprehensive Regional Analysis Highlighting Differentiated Growth Trajectories and Regulatory Impacts Across Americas, EMEA, and Asia-Pacific Markets

The Americas market is distinguished by its emphasis on advanced automation, stringent FDA regulations, and a resurgent onshore manufacturing trend. Accelerated by tariff pressures and supply chain risk management, U.S. companies are investing heavily in domestic equipment acquisitions and retrofit programs. These initiatives are supported by incentive programs that encourage reshoring of critical drug manufacturing infrastructure. Cost-sharing agreements between equipment suppliers and end users, as well as collaborations with local engineering partners, have become widespread to accelerate commissioning and validation processes.

In Europe, Middle East, and Africa, regulatory harmonization under the EU Falsified Medicines Directive drives widespread adoption of serialization and anti-tampering solutions. Western European producers often lead in eco-design and energy-efficiency projects, leveraging Sustainability By Design frameworks to reduce lifecycle environmental impacts. Meanwhile, rising pharmaceutical sectors in the Middle East and Africa are characterized by greenfield facilities that adopt turnkey lines, digital quality management systems, and rapid build-out strategies, although capital constraints and regulatory maturity levels vary significantly across the region.

Asia-Pacific represents the most dynamic growth frontier, fueled by China’s expanding API and generic drug exports, India’s contract manufacturing expansions, and the rise of regional biotechnology hubs in South Korea and Singapore. The Asia-Pacific market is witnessing a surge in domestic equipment manufacturing capabilities, with OEMs in China and India enhancing their technology portfolios to compete on innovation, speed, and pricing. Cross-border equipment joint ventures and technology transfer partnerships are commonplace, as international suppliers seek to establish service networks and localize production to meet cost-sensitive demand.

Collectively, these regional dynamics underscore the importance of tailoring equipment strategies to local regulatory landscapes, capital availability, and manufacturing philosophies. Programmatic investments in global spare-parts networks, remote diagnostics, and multilingual training services are essential to sustaining long-term operational reliability across continents.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Packaging Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Review of Leading Industry Players’ Innovations, Collaborations, and Technology Advances Shaping the Pharmaceutical Packaging Equipment Ecosystem

Syntegon has emerged as a pioneer in integrating digital services with advanced machinery. At Interphex 2025, their robotic Settle Plate Changer and MLD Advanced syringe platforms exemplified their commitment to seamless, sustainable solutions that enhance productivity and compliance. The acquisition of Telstar bolstered their vial filling and lyophilization portfolio, creating a one-stop provider for aseptic and nested syringe systems. Syntegon’s approach to retrofit digital modules for existing lines further underscores their strategy of maximizing customer ROI through incremental innovation.

Marchesini Group continues to expand its footprint through strategic M&A and digital service offerings. The company’s showcase at Pharmintech in Milan highlighted integrated powder filling monoblocks with vacuum-pressure disk technology and digital AI-enabled monitoring services. CEO Valerio Soli has articulated a vision of achieving a billion Euros in revenue by extending into new geographic markets and enhancing machine integration with AI-driven performance analytics.

IMA Group has institutionalized artificial intelligence within its R&D through the formation of specialized competence centers-IMA AI LAB and Embedded Data Machines-and launched solutions such as IMA Sentinel for predictive analytics on fill-finish lines. Their roll-out of IMA Sandbox and AlgoMarket platforms reflects a dual emphasis on collaborative algorithm development and turnkey digital applications that drive machine optimization, troubleshooting, and predictive maintenance.

Romaco has demonstrated leadership in sustainable processing and packaging solutions, earning Gold Level recognition from EcoVadis and showcasing energy-recovering heat pumps within fluid bed dryers. Their Romaco Noack Unity 600 blister line integrates Venturi-based vacuum systems to reduce energy consumption, while Romaco Kilian’s containment tablet presses deliver high outputs with stringent operator safety and hygiene standards.

Uhlmann Pac-Systeme’s innovation culture has been recognized with the TOP 100 Award, illustrating the effectiveness of their transparent ticket system in driving continuous improvement. Their PTC 200 and BEC 400 blister lines process recyclable monomaterials, aligning with EU regulations on renewable packaging. Uhlmann’s end-to-end competence center offers customers modular cartoning, blistering, and track-and-trace integration under one roof, supporting rapid format changes and compliance in regulated parenteral packaging.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Packaging Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACG Worldwide Pvt. Ltd.

- ACIC Pharmaceuticals Inc.

- ALPLA Werke Alwin Lehner GmbH & Co. KG

- AptarGroup, Inc.

- Bausch+Ströbel SE + Co. KG

- Coesia S.p.A.

- DS Smith plc

- GEA Group Aktiengesellschaft

- IMA S.p.A.

- Körber AG

- Marchesini Group S.p.A.

- MG2 S.p.A.

- Middleby Corporation

- OPTIMA packaging group GmbH

- Plastipak Packaging, Inc.

- Romaco GmbH

- Syntegon Technology GmbH

- Tofflon Science and Technology Group Co., Ltd.

- Truking Technology Limited

- Uhlmann Pac-Systeme GmbH & Co. KG

- Vanguard Pharmaceutical Machinery, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Digitalization, Supply Chain Resilience, and Sustainable Packaging Practices for Competitive Advantage

To navigate the current landscape, industry leaders should prioritize the digitalization of legacy lines, leveraging AI-driven predictive maintenance tools to enhance uptime and quality metrics. Establishing formal machine-data management platforms helps consolidate performance insights and accelerates root-cause analyses. Partnering with technology providers on proof-of-concept pilots before full-scale deployment can de-risk infrastructure investments and drive incremental value realization.

Supply chain resilience must be addressed through strategic diversification and near-shoring initiatives. Create dual-sourcing agreements for critical components and engage in early classification reviews to identify potential tariff exposures. Exploring government incentive programs and state-level grants can offset the costs of domestic equipment installations, while contract packaging collaborations can alleviate capital pressures during high-growth phases.

Sustainability requirements demand the adoption of recyclable mono-materials, energy-efficient process engineering, and closed-loop water management systems. Invest in eco-design methodologies that embed lifecycle assessments into new line specifications, and pursue recognized sustainability certifications to validate environmental claims.

Regulatory compliance in serialization and track-and-trace calls for early alignment with global GS1 standards and engagement with regulatory bodies on delegated provisions. Practical steps include upgrading labeling lines with high-resolution inkjet or brite-code marking systems and integrating software platforms that manage parent-child aggregation data seamlessly across packaging tiers.

Finally, building strong cross-functional teams that blend engineering, quality assurance, and supply chain expertise will be essential for orchestrating complex line integrations. Cultivate continuous training programs focused on digital competencies, regulatory updates, and process optimization to ensure organizations remain agile and forward-looking.

Robust Research Methodology Detailing Integrated Secondary Research, Expert Consultations, and Data Validation Techniques Underpinning Market Insights

This analysis synthesizes insights from a multi-tiered research framework combining primary and secondary methodologies. Secondary research encompassed peer-reviewed journals, industry publications, regulatory filings, and OEM press releases to map technology trends, tariff developments, and competitive dynamics. Primary research included in-depth interviews with chief engineers, production managers, and procurement leaders across biotechnology, contract manufacturing, and pharmaceutical manufacturing segments to validate market drivers and investment priorities.

Trade show observations from Pharmintech, Interphex, CIPM Spring, and ACHEMA provided direct exposure to emerging innovations in filling, labeling, blistering, and cartoning equipment. Equipment performance and sustainability claims were cross-verified through site visits at representative pilot plants and reference installations. Data triangulation was achieved by correlating OEM disclosures, end-user feedback, and regulatory updates from USTR and EMA databases.

Quantitative analyses focused on equipment order pipelines and trade data to understand the impact of tariffs, while qualitative assessments evaluated strategic positioning, R&D initiatives, and digital service models. All findings were reviewed by an expert advisory panel comprising packaging engineers, regulatory specialists, and supply chain consultants to ensure accuracy, relevance, and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Packaging Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Packaging Equipment Market, by Equipment Type

- Pharmaceutical Packaging Equipment Market, by Product Type

- Pharmaceutical Packaging Equipment Market, by Packaging Material

- Pharmaceutical Packaging Equipment Market, by Technology

- Pharmaceutical Packaging Equipment Market, by End User

- Pharmaceutical Packaging Equipment Market, by Region

- Pharmaceutical Packaging Equipment Market, by Group

- Pharmaceutical Packaging Equipment Market, by Country

- United States Pharmaceutical Packaging Equipment Market

- China Pharmaceutical Packaging Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Conclusive Synthesis of Key Findings Emphasizing Strategic Imperatives and Emerging Trends in Pharmaceutical Packaging Equipment Solutions

The pharmaceutical packaging equipment landscape is undergoing a profound transformation driven by digitalization, regulatory imperatives, and evolving patient-centric demands. Automated, AI-enabled lines are redefining efficiency and compliance, while sustainability mandates are reshaping material choices and energy utilization across the packaging value chain. Tariff changes in the United States have heightened the imperative for supply chain agility, prompting near-shoring initiatives and strategic vendor collaborations.

Segmentation analyses reveal that blistering, cartoning, filling, labeling, sealing, and wrapping equipment each face unique innovation vectors tailored to product formats and end-user profiles. Regional insights underscore the diverse investment patterns across Americas, EMEA, and Asia-Pacific markets, reflecting distinct regulatory frameworks and capital constraints.

Leading OEMs-including Syntegon, Marchesini, IMA, Romaco, and Uhlmann-are competing through advanced automation, sustainable technologies, and digital service offerings to capture growth opportunities and alleviate market challenges. Their strategies illustrate a clear trend toward turnkey solutions, AI-based performance platforms, and modular line architectures.

Moving forward, stakeholders who align technology roadmaps with emerging regulatory requirements, invest strategically in digital ecosystems, and pursue collaborative partnerships will be best positioned to navigate market uncertainties. By staying ahead of material innovations, tariff developments, and clinical packaging demands, organizations can secure competitive advantages and support the reliable supply of critical therapies worldwide.

Exclusive Opportunity to Collaborate with Our Associate Director of Sales & Marketing for Tailored Pharmaceutical Packaging Equipment Market Analysis

For a deeper understanding of the dynamics shaping the pharmaceutical packaging equipment market and to secure your competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s comprehensive insights, help you tailor findings to your strategic priorities, and arrange access to the full suite of data and analyses. Engage directly with an expert who can translate complex market intelligence into actionable plans for your organization’s growth and innovation journey.

- How big is the Pharmaceutical Packaging Equipment Market?

- What is the Pharmaceutical Packaging Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?