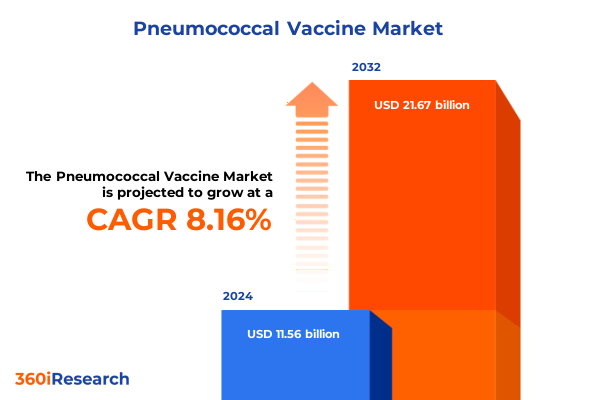

The Pneumococcal Vaccine Market size was estimated at USD 12.49 billion in 2025 and expected to reach USD 13.45 billion in 2026, at a CAGR of 8.18% to reach USD 21.67 billion by 2032.

Setting the Stage for an Evolving Pneumococcal Vaccine Landscape Shaped by Global Public Health Imperatives and Cutting-Edge Scientific Breakthroughs

An intricate interplay of epidemiological shifts, public health policies, and scientific breakthroughs is reshaping the global pneumococcal vaccine domain. Rising awareness of disease burden and expanding immunization guidelines have heightened demand for both next-generation conjugate formulations and long-standing polysaccharide options. In parallel, the maturation of vaccine technology-driven by novel adjuvant systems and enhanced serotype coverage-has accelerated the timeline from research to market authorization, creating a rich landscape of innovation.

Against this backdrop, industry stakeholders are contending with evolving regulatory frameworks, increasing pressure to demonstrate cost-effectiveness, and the imperative to address vaccine equity across diverse populations. Simultaneously, public and private sector collaborations are redefining commercialization pathways, while digital health platforms are introducing new mechanisms for patient education and adherence tracking. As a result, decision-makers must navigate a complex ecosystem where strategic investments in supply chain resilience, stakeholder engagement, and differentiated value propositions are critical to success.

This executive summary provides a succinct yet comprehensive overview of current market dynamics, outlines transformative trends shaping the future of pneumococcal vaccination, and offers a roadmap for leveraging these insights to inform strategic planning and investment decisions.

Uncovering the Transformative Technological and Policy Shifts Reshaping the Pneumococcal Vaccine Ecosystem in the Context of 2025 Dynamics

The past several years have witnessed transformative shifts that are redefining the pneumococcal vaccine landscape on multiple fronts. Technological innovation has led to expanded serotype coverage in conjugate formulations, enabling broader protection against emerging strains. At the same time, advances in manufacturing platforms have substantially reduced production timelines, fostering more agile responses to changing epidemiological profiles.

Policy developments have been equally impactful. Progressive inclusion of pneumococcal immunization in national infant and adult vaccination schedules, supported by updated World Health Organization recommendations, has driven uptake in both developed and emerging markets. Furthermore, the introduction of innovative financing models-such as tiered pricing agreements and public-private funding partnerships-has improved access in price-sensitive regions.

Market consolidation through strategic collaborations, licensing agreements, and targeted acquisitions is also reshaping competitive dynamics. Leading vaccine developers are forging alliances with research institutions and contract manufacturing organizations, enabling them to scale capacity while mitigating risk. Collectively, these shifts are galvanizing a more dynamic and resilient marketplace that is better equipped to address global health challenges.

Analyzing the Comprehensive Ripple Effects of United States Tariff Changes on Pneumococcal Vaccine Supply Chains and Market Access in 2025

Against a backdrop of evolving trade policy, 2025 has brought a series of tariff adjustments in the United States that are exerting a cumulative impact on the pneumococcal vaccine supply chain. Increased duties on certain biopharmaceutical imports have prompted manufacturers to reassess their global sourcing strategies and, in some cases, relocate key components of the production process closer to end markets to mitigate cost pressures.

These tariff changes have also stimulated negotiations for enhanced bilateral trade agreements with vaccine-producing partner countries. As a result, stakeholders are exploring flexible contract structures that allow for tariff-sharing mechanisms, safeguarding margins while ensuring steady supply. At the same time, importers have enhanced inventory planning and diversified supplier portfolios to build resilience against policy uncertainty.

Ultimately, while the short-term effects have included modest increases in landed costs, industry participants are leveraging strategic operational adjustments and collaborative frameworks to ensure uninterrupted availability of high-quality vaccines. These measures are vital to sustaining immunization programs and upholding public health objectives despite shifting trade landscapes.

Revealing Critical Segmentation Insights That Illuminate Diverse Market Dynamics Across Vaccine Types, Age Cohorts, Distribution Channels, and End Users

Inspection of the market through the lens of vaccine type reveals a critical distinction between conjugate and polysaccharide formulations. While conjugate vaccines such as Pcv13, Pcv15, and Pcv20 dominate the immunization landscape due to their robust immunogenicity and ability to elicit long-term immune memory, the established polysaccharide option remains relevant for adult and geriatric populations where broader serotype coverage is prioritized and cost considerations are paramount.

When evaluating the market across age group, children remain a focal segment driving initial uptake and public health impact in immunization schedules, whereas adult vaccination programs are gaining traction as awareness of invasive pneumococcal disease risks escalates among working-age cohorts. Simultaneously, geriatric vaccination efforts are expanding, driven by rising life expectancy and targeted recommendations from professional health associations that underscore the heightened vulnerability of seniors.

A closer look at distribution channel dynamics demonstrates that offline channels, including hospital pharmacies and immunization clinics, continue to serve as primary delivery points for routine vaccinations. Nonetheless, online platforms are emerging as complementary routes, particularly for adult and geriatric populations seeking convenient scheduling and home-delivery options. Parallel to these trends, the end-user segmentation highlights a diversified utilization of ambulatory care centers for rapid dose administration, clinics for targeted outreach programs, hospitals for high-risk patient groups, and specialized immunization centers orchestrating mass vaccination drives.

Through this multifaceted segmentation lens, stakeholders can align product development, marketing, and outreach strategies to the specific requirements of each demographic and channel, driving patient engagement and program efficiency.

This comprehensive research report categorizes the Pneumococcal Vaccine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Age Group

- Distribution Channel

- End User

Exploring Regional Variations and Strategic Opportunities in the Pneumococcal Vaccine Market Across Americas, Europe Middle East Africa, and Asia-Pacific

Geographic considerations are paramount in understanding pneumococcal vaccine uptake, as regional healthcare infrastructures, reimbursement frameworks, and disease epidemiology diverge significantly. In the Americas, robust public immunization programs and well-established private healthcare networks have facilitated strong baseline coverage, though emerging concerns around adult booster compliance are prompting targeted awareness campaigns in both North and South America.

In Europe, the Middle East, and Africa, heterogeneous healthcare delivery models and variable financing mechanisms shape market penetration. Western European nations with centralized procurement systems exhibit high uptake of advanced conjugate formulations, while Middle Eastern and African countries are increasingly leveraging innovative funding partnerships to broaden access and manage supply constraints. Cross-regional collaborations, such as pooled procurement initiatives, are gaining traction to achieve cost efficiencies and regulatory harmonization.

Across Asia-Pacific, rapid urbanization and strengthening national immunization schedules are driving expansion of pediatric vaccination programs. Simultaneously, governments are prioritizing adult and geriatric coverage through policy updates and subsidy schemes, reflecting heightened awareness of pneumococcal disease burden among vulnerable age groups. This region’s dynamic growth underscores the importance of adaptive market access strategies that account for diverse regulatory landscapes and evolving healthcare priorities.

This comprehensive research report examines key regions that drive the evolution of the Pneumococcal Vaccine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Driving Advancements and Competitive Strategies in the Global Pneumococcal Vaccine Sector Through 2025

The competitive landscape is characterized by a mix of established pharmaceutical giants and innovative biotechnology specialists, each deploying distinct strategies to strengthen their market positions. Leading global vaccine developers are leveraging their extensive serotype portfolios and manufacturing scale to negotiate favorable supply agreements with national immunization programs, while also investing in novel adjuvant and delivery technologies to differentiate next-generation offerings.

At the same time, emerging biotech players are forging strategic collaborations and licensing deals to access advanced conjugate platforms and expand geographic reach. These partnerships often include technology transfer arrangements that bolster local production capabilities in key markets, enhancing affordability and supply security. Furthermore, contract manufacturing organizations are playing an increasingly pivotal role, offering flexible capacity and specialized expertise to accelerate product commercialization timelines.

Innovative entrants focused on niche segments-such as high-valency conjugates or thermostable formulations-are attracting substantial interest from public health agencies seeking to optimize immunization strategies in resource-constrained environments. Collectively, these developments underscore a competitive ecosystem where strategic alliances, technological differentiation, and supply chain agility define leadership in the pneumococcal vaccine domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pneumococcal Vaccine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott

- Astellas Pharma Inc.

- Beijing Minhai Biotechnology Co., Ltd.

- Bharat Biotech International Ltd.

- Biological E. Limited

- BioNTech SE

- GSK plc

- Inventprise LLC

- KM Biologics Co., Ltd.

- LG Chem Ltd.

- Merck & Co., Inc.

- Novartis AG

- Panacea Biotec Ltd.

- Pfizer Inc.

- Pnuvax Incorporated

- Sanofi S.A.

- Serum Institute of India Pvt. Ltd.

- Shenzhen Kangtai Biological Products Co., Ltd.

- SK Bioscience Co., Ltd.

- Vaxcyte Inc.

- Walvax Biotechnology Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Challenges in Pneumococcal Vaccine Development

To navigate the shifting dynamics of the pneumococcal vaccine market, industry leaders should prioritize accelerated development of high-valency conjugate candidates that address emergent serotypes while demonstrating robust safety and immunogenicity profiles. Concurrently, investing in manufacturing flexibility through modular facilities or multi-product platforms can mitigate supply chain disruptions and enable faster scaling in response to outbreak scenarios.

Strategic engagement with policymakers and payers is essential to secure inclusion in national immunization programs and reimbursement schemes. By articulating clear value propositions-grounded in real-world evidence and health economic models-manufacturers can strengthen their positioning and facilitate policy adoption, particularly for adult and geriatric vaccination initiatives. Moreover, fostering partnerships with digital health providers offers a pathway to enhance patient adherence and streamline vaccination workflows through integrated tracking and reminder systems.

Finally, expanding regional footprint via targeted licensing and technology transfer agreements can unlock new growth opportunities. Collaborations with local manufacturers and contract service providers not only reduce trade-related risk but also resonate with stakeholders focused on bolstering domestic vaccine production. Collectively, these recommendations offer a roadmap for stakeholders to capitalize on emerging trends and secure sustainable competitive advantage.

Outlining a Rigorous Multi-Stage Research Methodology Combining Comprehensive Secondary Analysis and Expert Validation for Pneumococcal Vaccine Insights

This research initiative commenced with an exhaustive secondary review of peer-reviewed journals, regulatory filings, global health organization reports, and patent databases to establish a robust data foundation. Key epidemiological and clinical data were synthesized to map disease incidence patterns and assess serotype prevalence trends across diverse geographic contexts.

Subsequently, primary qualitative interviews were conducted with immunization program directors, healthcare payers, vaccine procurement experts, and manufacturing executives to validate secondary findings and uncover real-world operational insights. These discussions provided nuanced perspectives on policy drivers, commercialization challenges, and end-user priorities, enriching the analytical framework.

Quantitative triangulation methods were then employed to reconcile disparate data sources, ensuring consistency across clinical trial outcomes, supply chain metrics, and utilization rates. Finally, a panel of external subject-matter experts reviewed preliminary conclusions and recommendations, offering critical feedback on strategic relevance and feasibility. This multi-stage methodology ensures that the insights presented are both comprehensive and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pneumococcal Vaccine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pneumococcal Vaccine Market, by Vaccine Type

- Pneumococcal Vaccine Market, by Age Group

- Pneumococcal Vaccine Market, by Distribution Channel

- Pneumococcal Vaccine Market, by End User

- Pneumococcal Vaccine Market, by Region

- Pneumococcal Vaccine Market, by Group

- Pneumococcal Vaccine Market, by Country

- United States Pneumococcal Vaccine Market

- China Pneumococcal Vaccine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Distilling Key Takeaways and Overarching Conclusions to Guide Stakeholders in Navigating the Next Era of Pneumococcal Vaccine Innovation and Adoption

The synthesis of emerging trends, tariff impacts, segmentation nuances, regional dynamics, and competitive strategies provides a comprehensive vantage point for stakeholders engaged in the pneumococcal vaccine arena. As conjugate and polysaccharide formulations continue to evolve, it is evident that differentiated product profiles aligned with specific demographic and geographic needs will underpin future success.

Furthermore, trade policy shifts underscore the importance of supply chain resilience and strategic sourcing arrangements, while regional variations highlight the need for adaptable market access approaches that account for diverse regulatory and funding environments. Competitive trajectories reveal that strategic partnerships and technological innovation remain critical levers for differentiation and sustainable growth.

In conclusion, the interplay of scientific advances, policy evolution, and market forces is forging a dynamic and complex landscape. Stakeholders equipped with deep segmentation insights, robust regional strategies, and actionable recommendations will be best positioned to drive public health outcomes and deliver value in the next era of pneumococcal vaccine development.

Immediate Next Steps and Customized Engagement Opportunities with Ketan Rohom at 360iResearch to Acquire In-Depth Pneumococcal Vaccine Market Intelligence

I encourage you to take the next step toward strengthening your pneumococcal vaccine strategy by connecting directly with Ketan Rohom (Associate Director, Sales & Marketing). Ketan brings deep expertise in translating comprehensive market intelligence into actionable plans for pharmaceutical and biotechnology organizations. By reaching out, you will gain personalized guidance on how to leverage the full breadth of insights contained in this in-depth report to inform your product positioning, competitive analysis, and stakeholder engagement efforts.

Engaging with Ketan ensures you receive a tailored overview of the report’s most critical findings, including custom data breakdowns aligned to your specific interests and operational needs. Ketan can also organize a detailed briefing session or executive summary presentation for your leadership team, setting the stage for rapid implementation of the strategies highlighted in this research. To secure your copy of the full market research report and unlock the competitive advantages it offers, please contact Ketan promptly to arrange your personalized consultation and purchase options.

- How big is the Pneumococcal Vaccine Market?

- What is the Pneumococcal Vaccine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?