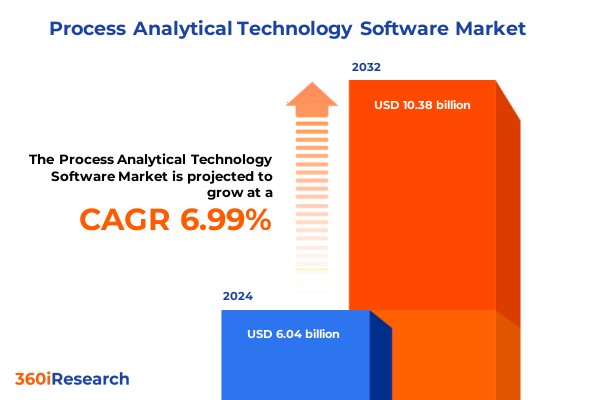

The Process Analytical Technology Software Market size was estimated at USD 6.43 billion in 2025 and expected to reach USD 6.90 billion in 2026, at a CAGR of 7.08% to reach USD 10.38 billion by 2032.

Harnessing Process Analytical Technology Software to Revolutionize Quality Control Efficiency and Regulatory Compliance across Manufacturing and Biotech Industry

In today’s manufacturing and life science sectors, the integration of process analytical technology software has become a cornerstone of digital transformation. Organizations are increasingly seeking real-time insights into critical process parameters to ensure consistent product quality, reduce time to market, and comply with stringent regulatory mandates. As pharmaceutical and biotech companies face escalating pressure from global regulators to implement quality by design frameworks, process analytical technology software offers a robust platform for automating data collection, analytics, and visualization. Through advanced sensor integration and real-time data analytics, stakeholders can move away from offline testing toward continuous monitoring paradigms that enhance predictive capabilities and risk mitigation.

Moreover, the convergence of cloud computing, artificial intelligence, and machine learning is redefining traditional process control strategies. Service providers are deploying modular, scalable software architectures that support everything from analytical test management to execution planning, enabling rapid deployment across multiple facilities. While some organizations continue to rely on on-premise deployments due to data sovereignty concerns, the growing acceptance of cloud-based solutions reflects an industry-wide shift toward decentralized data management. As a result, end users across biotechnology, chemicals, food and beverages, and pharmaceutical sectors are reimagining how digital platforms can streamline workflows, optimize resource allocation, and drive sustainable growth.

Exploring the Pivotal Technological and Regulatory Shifts Driving a Paradigm Change in Process Analytical Technology Software Development and Adoption

The landscape of process analytical technology software is undergoing a profound metamorphosis driven by both technological breakthroughs and evolving regulatory expectations. Artificial intelligence and machine learning algorithms are now embedded into analytics engines, empowering systems to detect anomalies, predict process deviations, and recommend corrective actions in real time. At the same time, the advancement of edge computing architectures allows critical data to be processed locally, reducing latency and preserving bandwidth for core enterprise networks. These innovations are complemented by regulatory bodies endorsing digital batch records and continuous verification approaches that recognize the value of data integrity, traceability, and audit readiness.

In parallel, the industry is witnessing the emergence of unified platforms that facilitate interoperability among instrumentation, enterprise resource planning solutions, and laboratory information management systems. This trend is underpinned by the adoption of open standards, which foster plug-and-play compatibility and simplify validation workflows. Furthermore, cybersecurity concerns have elevated discussions around secure software development lifecycles, encryption protocols, and role-based access controls. Collectively, these shifts underscore a broader paradigm change in how organizations conceptualize process monitoring, from a siloed quality assurance function to an integral element of strategic decision-making and operational excellence.

Assessing the Far-Reaching Effects of 2025 United States Tariff Measures on Process Analytical Technology Software Supply Chains and Operational Economics

The imposition of new United States tariffs on key software components, instrumentation imports, and service contracts in 2025 has introduced a layer of complexity to process analytical technology deployments. Companies that depend on overseas vendors for specialized sensors, analytical modules, or cloud hosting services are experiencing upward pressure on procurement costs, leading many to reevaluate vendor relationships and total cost of ownership. These cost dynamics are particularly acute for small and medium enterprises, which must balance budget constraints with the need to maintain competitive capabilities in real-time release testing and process optimization.

Moreover, the tariff measures have prompted some organizations to explore nearshoring strategies, seeking domestic suppliers for implementation services, support, and training offerings. This pivot has implications for service-level agreements, lead times, and localized expertise, as providers adjust their delivery models to align with emerging trade conditions. While larger corporations may absorb incremental costs through efficiency gains or pass them on to end customers, the cumulative impact of these tariffs underscores the necessity of agile procurement strategies and robust risk management frameworks to mitigate supply chain disruptions and preserve innovation momentum.

Unveiling Comprehensive Insights into End-User Industry Segmentation Offering Deployment Application and Organization Size Trends in PAT Software

An examination of market dynamics according to end-user industry reveals that biotechnology firms continue to prioritize applications in compliance management and risk mitigation, leveraging analytical test management modules to accelerate drug development cycles. Chemical manufacturers, on the other hand, are directing their investments toward real-time release testing capabilities, seeking to optimize production throughput while ensuring consistency with tight reaction parameters. Within the food and beverage segment, companies focus on process optimization and data automation features to improve batch uniformity and reduce waste, whereas pharmaceutical enterprises integrate high-precision PAT execution workflows across large enterprise infrastructures.

When segmenting by offering, it becomes clear that services remain a critical component of adoption strategies. Implementation services are essential for configuring complex analytical platforms, while support services and training services empower staff to extract maximum value from the technology. Simultaneously, software suites that consolidate data automation, analytical test management, and PAT execution are gaining traction as organizations aim to centralize control over quality and compliance documentation. Deployment preferences further differentiate market patterns, with cloud installations appealing to companies seeking rapid scalability and remote accessibility, while on-premise configurations are favored by entities prioritizing data sovereignty and closed-loop validation scenarios.

Applications such as compliance management, process optimization, real-time release testing, and risk management each drive distinct software requirements. Large enterprises typically opt for comprehensive end-to-end platforms that integrate seamlessly with existing enterprise systems, whereas small and medium enterprises often prefer modular solutions that address specific pain points without extensive customization. Across the board, this multifaceted segmentation lens highlights how diverse needs shape vendor roadmaps and influence the evolution of software capabilities.

This comprehensive research report categorizes the Process Analytical Technology Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- End-User Industry

- Application

- Deployment Type

- Organization Size

Illuminating Regional Dynamics Shaping Process Analytical Technology Software Adoption across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, the convergence of favorable regulatory frameworks and a mature digital infrastructure has accelerated the uptake of advanced PAT software. Organizations across North and South America invest in cloud-based platforms to support distributed manufacturing networks and cross-border quality oversight, while emerging markets in Latin America are adopting on-premise installations to align with local data regulations. This regional mix of approaches reflects a strategic balancing of innovation with compliance and resource availability.

Across Europe, the Middle East, and Africa, stringent data privacy standards and harmonized quality directives drive vendors to emphasize secure data architectures and comprehensive audit capabilities. European entities place a premium on interoperability with laboratory information management systems and enterprise resource planning modules, facilitating seamless batch release processes. In the Middle East and Africa, the focus often centers on building foundational digital competencies, which creates opportunities for service providers to deliver end-to-end implementation and training offerings.

Meanwhile, Asia-Pacific markets exhibit a dynamic blend of cloud-first and on-premise deployments, tailored to the needs of both multinational corporations and rapidly growing local enterprises. Regulatory agencies in key markets such as Japan, South Korea, and Australia have begun endorsing digital batch records, spurring demand for real-time release testing functionalities and advanced analytics. Simultaneously, Southeast Asian nations are exploring hybrid deployment paradigms to accommodate varying levels of digital readiness and infrastructure maturity. Collectively, these regional nuances illustrate how localized policies, technological ecosystems, and market maturity influence the trajectory of PAT software adoption.

This comprehensive research report examines key regions that drive the evolution of the Process Analytical Technology Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Movements and Innovations among Leading Process Analytical Technology Software Providers to Stay Competitive in a Rapidly Evolving Market

Leading software providers are differentiating their offerings through strategic partnerships, vertical integration, and continuous innovation streams. Several firms have expanded their portfolios by acquiring specialized analytics startups, thereby embedding next-generation machine learning models directly into their PAT platforms. Others are forging alliances with instrumentation manufacturers to deliver turnkey solutions that span from sensor hardware to cloud-based analytic dashboards, streamlining the validation process for end users.

Competitive positioning is further defined by service excellence: firms that excel in implementation services, support services, and training services report higher customer retention rates and faster time to value. At the same time, those that invest heavily in user experience design and modular software architectures are winning engagements within large enterprise accounts. In parallel, a cohort of emerging vendors is gaining traction by offering niche capabilities-such as advanced risk management modules or specialized real-time release testing workflows-that address unfilled gaps in incumbent product lines. Together, these strategic movements are reshaping the competitive landscape, driving incumbents to elevate their roadmaps and compelling new entrants to fortify their unique value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Process Analytical Technology Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Agilent Technologies, Inc

- Emerson Electric Co.

- Endress+Hauser AG

- Honeywell International Inc.

- Mettler-Toledo International Inc.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens Aktiengesellschaft

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Actionable Guidance for Industry Leaders to Leverage Process Analytical Technology Software Investments for Operational Excellence and Enhanced Compliance

Industry leaders should prioritize the integration of sophisticated analytics engines within existing control frameworks to extract actionable insights in real time. By aligning implementation services with advanced training programs, organizations can ensure that personnel are equipped to interpret complex data outputs and drive continuous improvement initiatives. In addition, adopting hybrid deployment models-where sensitive core processes leverage on-premise systems while non-critical operations utilize cloud resources-can optimize both agility and security.

Furthermore, executives must conduct regular portfolio reviews to identify underutilized modules and reallocate resources toward high-impact applications such as real-time release testing and risk management. Establishing strategic partnerships with specialized software vendors and instrumentation manufacturers can shorten deployment timelines and reduce validation burdens. Finally, embedding compliance management workflows into daily operations through automated audit trails and digital batch records will strengthen regulatory preparedness and minimize manual intervention errors. Collectively, these recommendations offer a roadmap for maximizing return on investment while future-proofing technology ecosystems.

Detailing the Research Framework and Methodological Approaches Employed to Validate Data and Insights in the Process Analytical Technology Software Landscape

This research integrates insights derived from a rigorous blend of primary and secondary methodologies. Primary data collection included in-depth interviews with quality assurance managers, process engineers, and IT architects across multiple industries, ensuring a rich tapestry of perspectives on adoption drivers and implementation challenges. These qualitative interviews were supplemented by structured surveys targeting C-level executives to validate hypothesis trends and prioritize feature preferences across both services and software offerings.

Secondary research efforts encompassed a thorough review of regulatory guidance documents, white papers from leading instrumentation manufacturers, and academic publications detailing advancements in analytical measurement techniques. Market intelligence databases were consulted to map vendor partnerships, acquisition activities, and patent filings, providing a comprehensive view of technology roadmaps. Data validation protocols included cross-referencing interview insights with published case studies and filtering out anecdotal inconsistencies. The outcome is a cohesive framework that balances strategic foresight with on-the-ground realities, ensuring that the narrative accurately captures the evolving dynamics of the process analytical technology software domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Process Analytical Technology Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Process Analytical Technology Software Market, by Offering

- Process Analytical Technology Software Market, by End-User Industry

- Process Analytical Technology Software Market, by Application

- Process Analytical Technology Software Market, by Deployment Type

- Process Analytical Technology Software Market, by Organization Size

- Process Analytical Technology Software Market, by Region

- Process Analytical Technology Software Market, by Group

- Process Analytical Technology Software Market, by Country

- United States Process Analytical Technology Software Market

- China Process Analytical Technology Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Highlight the Strategic Imperative and Future Directions for Process Analytical Technology Software Integration

The synthesis of core findings underscores the strategic imperative of embedding process analytical technology software into end-to-end quality and production workflows. From the biotechnology sector’s emphasis on compliance management to food and beverage companies’ drive for process optimization, tailored software capabilities are pivotal for achieving operational excellence. Additionally, the segmentation analysis highlights how offering models, deployment preferences, and organizational scale shape the adoption curve, revealing nuanced decision levers that vendors and buyers alike must navigate.

Looking ahead, the interplay of regulatory evolution and technological innovation will continue to accelerate. Companies that embrace unified platforms with integrated analytics, robust risk management tools, and flexible deployment options will secure a competitive edge. Those that neglect to invest in comprehensive training, cybersecurity best practices, and agile procurement strategies risk being left behind. Ultimately, the future of manufacturing and life sciences will be defined by organizations that transform data into strategic assets, fostering resilience, compliance, and sustainable growth through the power of process analytical technology software.

Engage Directly with Ketan Rohom to Secure Your Comprehensive Process Analytical Technology Software Market Research Report and Empower Your Strategic Decisions

Unlock direct collaboration and fast-track your organization’s strategic advantage by engaging with Ketan Rohom Associate Director of Sales & Marketing at 360iResearch

Ketan Rohom brings deep expertise in process analytical technology solutions and a proven track record of guiding executives to the insights they need. Reach out today to discuss your unique requirements, tailor a research package that aligns with your objectives, and secure immediate access to the market research report that will empower your decision-making. Whether you’re refining your digital roadmap, evaluating new software platforms, or benchmarking your competencies against industry best practices, Ketan is ready to help you translate data into action and fuel your growth trajectory.

- How big is the Process Analytical Technology Software Market?

- What is the Process Analytical Technology Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?