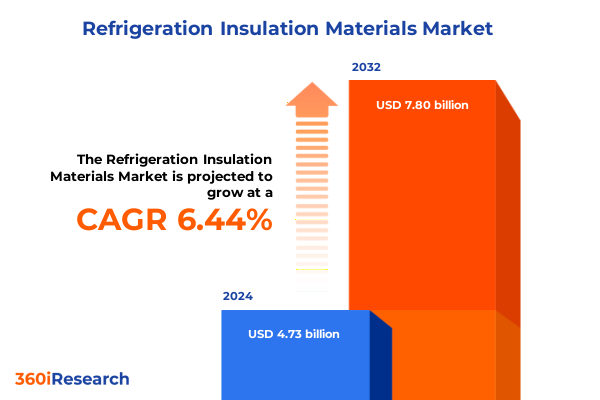

The Refrigeration Insulation Materials Market size was estimated at USD 5.04 billion in 2025 and expected to reach USD 5.36 billion in 2026, at a CAGR of 6.45% to reach USD 7.80 billion by 2032.

Unveiling the Critical Role of Advanced Thermal Insulation in Elevating Energy Efficiency and Sustainability Across Refrigeration Systems

In an era defined by stringent energy regulations and an ever-growing demand for sustainable cooling technologies, advanced thermal insulation materials have emerged as a pivotal component for enhancing refrigeration system performance. As refrigeration networks span from residential freezers to large-scale cold storage facilities, the ability to minimize thermal losses directly impacts operational costs, carbon footprints, and compliance with evolving environmental standards. The rising emphasis on renewable energy integration, coupled with global commitments to reduce greenhouse gas emissions, has propelled thermal insulation from a secondary consideration to a foundational element in refrigeration equipment design and infrastructure planning.

Moreover, innovations in polymer chemistry, manufacturing processes, and material science have unlocked new possibilities in insulation performance. Cutting-edge formulations now deliver ultra-low thermal conductivity while balancing fire safety, moisture resistance, and mechanical strength. Consequently, facility operators and equipment manufacturers are recalibrating procurement strategies, prioritizing materials that not only lower life-cycle energy consumption but also align with circular economy principles. As a result, stakeholders across the supply chain-from raw material producers to end-users-must navigate a complex landscape of technological breakthroughs, regulatory mandates, and shifting market expectations that collectively define the future of refrigeration insulation.

Exploring Key Technological Breakthroughs and Regulatory Forces Redefining Material Innovation and Supply Dynamics in Refrigeration Insulation

Recent years have witnessed a convergence of regulatory pressures and technological advancements that have radically altered the refrigeration insulation landscape. Stricter energy performance standards in multiple jurisdictions have mandated lower overall system heat transfer coefficients, prompting manufacturers to explore high-performance polymeric foams, hybrid composite assemblies, and vacuum insulation panels. Concurrently, financial incentives and carbon credit mechanisms have incentivized early adopters to integrate next-generation materials that deliver superior thermal resistance per unit thickness, thereby enabling more compact equipment footprints and facilitating retrofits in constrained spaces.

Technological developments in digital twin modeling and advanced computational fluid dynamics have further accelerated innovation cycles. By simulating thermal behavior under real-world load profiles, R&D teams can now optimize cellular structure, additive dispersions, and blowing agent chemistry before committing to large-scale production. Similarly, the proliferation of Industry 4.0–driven manufacturing platforms has driven down per-unit costs, making premium insulation solutions more accessible to mid-tier appliance makers and logistics operators. At the same time, heightened awareness of environmental sustainability has catalyzed research into bio-based and recycled feedstocks, underscoring a transformative shift towards circular supply chains. This paradigm change is reshaping competitive dynamics and opening new pathways for material differentiation and strategic partnerships.

Analyzing How New United States Tariff Policies Enacted in 2025 Are Reshaping Cost Structures and Sourcing Strategies in Insulation Markets

The United States government’s implementation of revised tariff schedules in early 2025 introduced significant import duties on a broad array of polymeric foams and specialty insulation panels. These changes were designed to protect domestic manufacturers yet have triggered ripple effects across procurement strategies and cost structures within the refrigeration sector. As offshore suppliers face higher duties, importers have reevaluated sourcing arrangements, often turning to regional producers to mitigate incremental landed costs and potential supply chain disruptions associated with customs inspections and compliance complexities.

In response, several global insulation producers have announced strategic investments in U.S. production facilities to bypass tariff barriers and maintain competitive pricing. While this localization trend reduces exposure to duty fluctuations, it necessitates substantial capital outlays and extended lead times for manufacturing ramp-up. Meanwhile, equipment original equipment manufacturers (OEMs) and cold chain operators are absorbing portions of the tariff-induced cost increases or negotiating long-term supply agreements with built-in price stability clauses. Ultimately, the 2025 tariff regime has underscored the importance of diversified sourcing, vertical integration, and proactive supply-chain intelligence as essential strategies for maintaining resilience in the face of trade policy volatility.

Decoding Material, Application, End Use, Form, and Distribution Segments to Reveal Emerging Opportunities and Strategic Priorities in Refrigeration Insulation

When segmenting the market by material type, Expanded Polystyrene continues to serve as the cost-effective choice for low-to-medium performance requirements, yet Extruded Polystyrene is gaining prominence in applications demanding higher moisture resistance and compressive strength. Glass Wool finds its niche where acoustic dampening couples with thermal insulation needs, whereas Phenolic Foam stands out for its fire-retardant properties and extremely low thermal conductivity. Polyurethane Foam retains market leadership in high-performance environments such as pharmaceutical cold storage, and Rock Wool appeals to industrial and commercial clients prioritizing non-combustibility and mechanical robustness.

From an application standpoint, demand in Cold Storage-encompassing both modular cold rooms and large walk-in freezers-drives considerable uptake of panelized insulation due to its ease of assembly and tight thermal continuity. Commercial refrigeration units rely heavily on spray foam to achieve seamless void filling, while refrigerated transport segments like container refrigeration, rail, and truck applications demand lightweight, high-insulation solutions with rapid on-site application. Residential refrigeration continues to adopt board and panel formats designed for automated assembly lines, aligning with appliance manufacturers’ need for high reproducibility and consistent thermal performance.

Looking at end-use industries, the Food & Beverage sector remains the largest consumer, fueled by burgeoning e-commerce sales and expanding cold chain networks. The HVAC industry leverages insulation materials for temperature control in building integrated systems, and the Chemical sector’s specialized processing facilities necessitate precise thermal management protocols. Pharmaceutical applications, driven by stringent temperature-sensitive storage requirements, have become a key growth driver for ultra-high-efficiency insulation panels.

When examining insulation form, board products maintain share in applications where installation speed and modularity are paramount. Loose fill solutions are favored for retrofits and irregular cavities, whereas specialized panels-such as PIR panels and sandwich panels-dominate high-end cold storage. Spray foam’s closed-cell variants deliver superior water ingress protection in refrigerated transport, while open-cell chemistries find use where permeability and acoustic performance are valued. Finally, distribution channels reflect a hybrid mix of direct sales for large industrial projects, distributors for mid-market engagements, and retail outlets servicing aftermarket and residential customers.

This comprehensive research report categorizes the Refrigeration Insulation Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Insulation Form

- Application

- End Use Industry

- Distribution Channel

Illuminating Regional Drivers and Challenges Shaping the Refrigeration Insulation Market Across Americas, Europe Middle East Africa, and Asia Pacific

Across the Americas, robust growth in e-commerce and pharmaceutical cold chain networks has propelled the adoption of advanced insulation solutions. In North America, regulatory frameworks such as the AIM Act have accelerated the phase-down of high-global-warming-potential blowing agents, prompting material suppliers to innovate low-GWP alternatives compatible with existing manufacturing infrastructure. Latin American markets are characterized by cost-sensitivity, yet major cold storage investments in agribusiness exports are driving demand for modular panel systems that ensure both speed of deployment and long-term thermal stability.

Turning to Europe, the Middle East, and Africa, stringent building insulation regulations in the European Union have set a high bar for energy efficiency, thereby creating a fertile environment for premium high-performance foams and vacuum insulated panels. Meanwhile, the Middle East’s extreme ambient conditions have sparked growth in insulated transport containers and infrastructure protective claddings. African markets remain emergent, with demand largely centered on smaller-scale cold storage solutions for agricultural value chains and vaccine logistics, often supplied through public-private partnerships aimed at reducing post-harvest losses.

In the Asia-Pacific region, accelerating industrialization and urbanization have created parallel surges in cold chain development and residential refrigeration adoption. China’s “dual carbon” targets are driving local producers to embrace bio-based insulation formulations, whereas Southeast Asian economies are prioritizing rapid installation and retrofit solutions to support hotel, retail, and food service expansion. Australia and New Zealand, with stringent fire safety standards and a mature logistics infrastructure, are increasingly leaning on advanced composite panels and spray foam variants optimized for coastal and corrosive environments.

This comprehensive research report examines key regions that drive the evolution of the Refrigeration Insulation Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unraveling Competitive Strategies and Portfolio Diversifications Steering Market Leadership Among Leading Refrigeration Insulation Manufacturers

Leading manufacturers have adopted differentiated strategies to capture value across the refrigeration insulation chain. Several global polymer producers are forging joint ventures with appliance OEMs to co-develop proprietary foam chemistries that optimize thermal performance while ensuring regulatory compliance. At the same time, specialty material companies have pursued bolt-on acquisitions of regional insulation converters to broaden their geographic footprints and gain access to established distribution networks.

Innovation ecosystems have also taken shape, with selected players investing in dedicated research centers focused on next-generation, bio-based blowing agents and recycled feedstocks. Partnerships with academic institutions and consortia have accelerated time-to-market for novel formulations, particularly those targeting ultra-low thermal conductivity benchmarks. Additionally, digital transformation initiatives-ranging from automated mixing and dispensing systems to real-time thermal performance monitoring-are enabling manufacturers to offer value-added services such as predictive maintenance analytics and energy-savings guarantee programs.

Moreover, a tier of emerging disruptors is challenging incumbents by offering modular, plug-and-play insulation systems that simplify installation and replacement. These nimble entrants often leverage additive manufacturing and digital supply-chain platforms to deliver just-in-time production, minimizing inventory burdens for cold storage operators. Collectively, these competitive dynamics underscore a market in flux, where scale advantages, technological leadership, and service integration are critical for sustaining growth and profitability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Refrigeration Insulation Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- Johns Manville Corporation

- Kingspan Group plc

- Knauf Insulation

- L'Isolante K-Flex S.p.A.

- Lydall, Inc.

- Morgan Advanced Materials plc

- NMC SA

- Owens Corning

- Rockwool International A/S

- Saint-Gobain S.A.

- Zotefoams plc

Delivering Strategic Recommendations to Guide Executives in Navigating Supply Chain Disruptions and Accelerating Innovation Within Insulation Solutions

Industry leaders should prioritize the diversification of raw material sources to mitigate exposure to trade policy volatility and supply-chain bottlenecks. Establishing strategic alliances with regional producers and exploring backward integration can ensure continuity of supply and greater control over quality specifications. Simultaneously, investment in advanced simulation tools for thermal and mechanical performance modeling will reduce development cycles, enabling faster commercialization of high-value insulation solutions.

It is equally imperative to accelerate R&D efforts in bio-derived and recycled feedstocks to align with tightening environmental regulations and corporate sustainability targets. Organizations can benefit from launching pilot programs that validate circular-economy concepts, such as foam reclamation and reuse in panel manufacturing. Furthermore, integrating digital tracking and performance monitoring systems within insulation products will empower end-users with real-time energy-use insights, differentiating offerings through service-based revenue models.

Lastly, executives should cultivate collaborative forums with regulatory bodies to anticipate future policy shifts on blowing agents, fire safety, and carbon emissions. By participating in standards development and industry consortia, companies can influence the regulatory agenda while ensuring early access to compliance guidelines. Such proactive engagement will not only safeguard market access but also position firms as trusted partners in driving the next wave of refrigeration efficiency.

Detailing the Rigorous Multimethod Research Approach Underpinning Insights and Validating Data Integrity for the Refrigeration Insulation Analysis

This analysis is built upon a hybrid research framework that combines primary interviews with key industry stakeholders and extensive secondary data gathering from credible trade publications, government policy documents, and academic research. Primary discussions included conversations with procurement managers at major cold storage operators, R&D directors at insulation material producers, and regulatory affairs experts. These engagements provided firsthand perspectives on emerging technology adoption, tariff impacts, and regional market priorities.

Secondary research incorporated a thorough review of regulatory filings, patent databases, technical journals, and sustainability reports to validate technological trends and environmental compliance trajectories. Data triangulation methods were employed to cross-verify cost impacts, material performance benchmarks, and installation practices across multiple sources. Quantitative analyses leveraged proprietary databases to track shipment volumes, while qualitative assessments explored strategic initiatives and competitive maneuvers.

Rigorous data integrity protocols were maintained throughout the research process, including quality checks on interview transcripts, cross-referencing of tariff schedules, and peer reviews of analytical models. This multi-method approach ensures that insights are both robust and actionable, offering decision-makers a reliable foundation for strategic planning in the dynamic refrigeration insulation arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Refrigeration Insulation Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Refrigeration Insulation Materials Market, by Material Type

- Refrigeration Insulation Materials Market, by Insulation Form

- Refrigeration Insulation Materials Market, by Application

- Refrigeration Insulation Materials Market, by End Use Industry

- Refrigeration Insulation Materials Market, by Distribution Channel

- Refrigeration Insulation Materials Market, by Region

- Refrigeration Insulation Materials Market, by Group

- Refrigeration Insulation Materials Market, by Country

- United States Refrigeration Insulation Materials Market

- China Refrigeration Insulation Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Core Findings and Strategic Imperatives That Will Drive Innovation, Resilience, and Sustainable Growth in Refrigeration Insulation Industry

The refrigeration insulation sector is poised at a critical juncture where technological innovation, regulatory evolution, and shifting supply-chain dynamics converge to redefine performance benchmarks. Advanced foam chemistries and composite panel assemblies are unlocking new levels of thermal efficiency, while digital manufacturing and real-time monitoring are creating value beyond mere material properties. At the same time, the recalibration of trade policies, particularly the 2025 U.S. tariff adjustments, underscores the imperative of diversified sourcing and strategic localization.

Looking ahead, sustainable materials and circular economy principles will drive competitive differentiation, as stakeholders across the value chain seek to reconcile performance demands with environmental mandates. Companies that excel will be those capable of integrating next-generation insulation solutions with digital service offerings, all while maintaining agility in the face of geopolitical and economic uncertainties. Ultimately, the industry’s trajectory will hinge on collaborative innovation, regulatory foresight, and operational resilience, enabling refrigeration ecosystems to meet rising cooling demands with minimal environmental impact.

Connect with Ketan Rohom to Access Comprehensive Refrigeration Insulation Market Intelligence and Empower Your Strategic Decision Making Today

To secure access to the full market research report and gain customized insights tailored to your organization’s needs, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise and consultative approach will ensure you receive the in-depth analysis required to inform critical decisions and drive strategic initiatives in the refrigeration insulation sector.

- How big is the Refrigeration Insulation Materials Market?

- What is the Refrigeration Insulation Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?