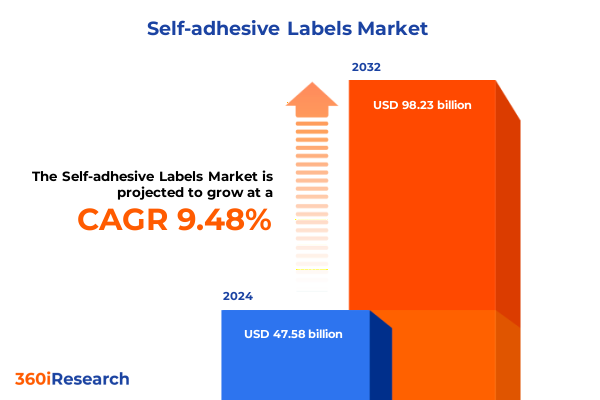

The Self-adhesive Labels Market size was estimated at USD 51.32 billion in 2025 and expected to reach USD 55.36 billion in 2026, at a CAGR of 9.71% to reach USD 98.23 billion by 2032.

Uncovering the Transformative Power and Underscored Importance of Self-Adhesive Labels in Modern Packaging and Brand Engagement Strategies

The self-adhesive label market has evolved from a niche packaging solution into a dynamic pillar of global branding and logistics ecosystems. Fueled by the convergence of high-resolution digital printing and rising consumer demand for personalization, these labels now serve as a canvas for brand storytelling and an enabler of operational efficiency. This executive summary presents a concise overview of the critical forces shaping this market, outlining the interplay of technological, regulatory, and sustainability drivers accelerating change across industries.

Our analysis begins by contextualizing the self-adhesive label within broader packaging and regulatory frameworks, highlighting how modern supply chains and consumer engagement strategies have elevated the role of labels from mere informational tags to interactive components of the customer journey. By examining recent innovations in materials, adhesive chemistry, and digital finishing processes, we set the stage for a deeper exploration of the market’s structural shifts and strategic inflection points.

How Technological Innovations and Sustainability Imperatives Are Redefining the Landscape of Self-Adhesive Labeling Solutions

Over the past decade, the self-adhesive label industry has experienced profound transformation as digital printing technologies displaced analogue methods, enabling unprecedented flexibility in short-run customization and rapid design iterations. This shift has empowered brand managers to launch targeted campaigns with hyper-personalized packaging, driving consumer interaction and loyalty. Concurrently, the circular economy imperative has spurred investment in recyclable and compostable materials, reshaping procurement strategies and supplier partnerships across the value chain.

Beyond material innovations, advancements in smart labeling-integrating NFC chips, QR codes, and sensors-are unlocking new applications in anti-counterfeiting, supply chain traceability, and consumer engagement. These digital enhancements are not only bolstering brand protection but also generating rich data streams that inform real-time decision-making. As a result, label converters and end users are collaboratively redefining the boundaries of packaging intelligence, with sustainability and digital integration emerging as the twin pillars of future growth.

Examining the Ripple Effects of 2025 United States Tariff Adjustments on Cost Structures and Supply Dynamics in the Self-Adhesive Label Market

The imposition of updated United States tariffs in early 2025 has introduced significant cost headwinds for label manufacturers dependent on imported raw materials. By targeting specific categories of films and composite substrates, these trade measures have elevated procurement expenses and prompted reevaluation of supply chain configurations. In response, several converters have shifted sourcing toward domestic suppliers and regional free trade partners to mitigate margin erosion and maintain production continuity.

These tariff-related cost pressures have also accelerated vertical integration strategies, as end users seek to secure reliable access to key substrates and adhesives. Strategic alliances between material producers and label converters are becoming more commonplace, enabling collaborative investments in local manufacturing capacity. While short-term adjustments have imposed operational challenges, the realignment of supply chains could yield a more resilient and geographically diversified industry structure over the long term.

Diving Deep into Multifaceted Segmentation Reveals Nuanced Material, Format, Adhesive, and Application Dynamics Driving Market Diversification

Analyzing segmentation through the lens of material composition reveals a market landscape defined by distinct performance attributes and application niches. Material study encompasses Composite substrates, which include both foil and laminate constructions, Film variants segmented into BOPP, polyester, and vinyl options, and Paper formats divided between coated and uncoated variants. Each category aligns with specific labeling requirements-from high-durability applications necessitating metallic foil to cost-sensitive uses where uncoated paper suffices.

Complementing material segmentation, format innovation has accelerated across roll labels, sheet labels, and tag labels, each catering to unique production workflows and end-user preferences. Adhesive selection further refines product differentiation, with permanent adhesives ensuring lasting bond strength and removable adhesives facilitating peel-and-replace use cases. Application-based segmentation spans Food & Beverage-including bakery, beverage, and dairy & frozen sectors-Healthcare-covering diagnostics, medical devices, and pharmaceuticals-Household Chemicals, Logistics & Transportation-such as parcel labeling and warehouse labeling-and the Personal Care & Cosmetics segment, which demands high-resolution graphics and tactile finishes. This multi-tiered segmentation framework underpins tailored product development and go-to-market strategies, enabling stakeholders to capture value across diverse end-use environments.

This comprehensive research report categorizes the Self-adhesive Labels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Format

- Adhesive Type

- Application

Assessing Regional Nuances Illuminates How Americas, EMEA, and Asia-Pacific Markets Are Shaping Global Self-Adhesive Label Industry Trajectories

Regional dynamics play a pivotal role in shaping global demand and innovation pathways for self-adhesive labels. In the Americas, established infrastructure and mature end-user industries such as consumer packaged goods and healthcare drive steady demand for advanced label solutions. The region’s leadership in digital label printing and focus on sustainability standards have positioned it as a launchpad for cutting-edge materials and interactive labeling concepts.

Europe, the Middle East, and Africa represent a heterogeneous market characterized by stringent regulatory environments and a strong emphasis on environmental compliance. European adoption of extended producer responsibility mandates has propelled growth in recyclable label substrates, while emerging markets in the Middle East and Africa are investing in packaging modernization to support expanding retail and pharmaceutical sectors. In the Asia-Pacific region, explosive growth in e-commerce and food & beverage manufacturing, particularly in China and India, is fueling rapid uptake of high-speed roll-to-roll printing systems and smart label applications. This diversity across the Americas, EMEA, and Asia-Pacific underscores the necessity for regionally-tailored strategies to capitalize on distinct growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Self-adhesive Labels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Their Strategic Initiatives Offers Insights into Competitive Maneuvers and Innovation Drivers in the Self-Adhesive Label Sector

Key industry participants are executing differentiated strategies to secure competitive positioning in an increasingly fragmented market. Leading converters are expanding digital printing capacity to meet demand for short-run customization, while material innovators are pioneering bio-based films and water-based adhesives that address emerging environmental regulations. Partnerships between technology providers and brand owners are enabling pilot deployments of smart labeling platforms, integrating blockchain-enabled supply chain visibility with consumer engagement features.

Simultaneously, several players are consolidating through mergers and acquisitions to bolster geographic footprint and diversify product portfolios. This consolidation trend is fostering the creation of end-to-end labeling ecosystems, where substrate production, adhesive formulation, and printing services are seamlessly integrated. These strategic maneuvers reflect a broader industry shift toward platform-based offerings that bundle hardware, software, and service capabilities under unified value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Self-adhesive Labels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arconvert S.p.A.

- Avery Dennison Corporation

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- Essentra plc

- FLEXcon Company Inc.

- Huhtamäki Oyj

- LINTEC Corporation

- Multi-Color Corporation

- SATO Holdings Corporation

- UPM-Kymmene Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends, Navigate Tariff Challenges, and Cultivate Sustainable Growth in Labeling

Industry leaders should prioritize investment in advanced digital print assets to capture the growing demand for personalized and variable-data labels. By integrating sustainable substrate options-such as recyclable composite films and bio-derived adhesives-companies can address tightening environmental regulations and bolster their green credentials. Concurrently, developing contingency sourcing strategies and fostering partnerships with domestic suppliers will help buffer against tariff volatility and supply chain disruptions.

Moreover, embracing smart labeling applications through collaborations with technology firms can deliver differentiated product offerings and create new revenue streams via data services. Companies are encouraged to adopt agile innovation frameworks that facilitate rapid prototyping and pilot testing of new materials and printing techniques. This approach not only accelerates time-to-market but also enables continuous refinement in response to evolving customer requirements and regulatory landscapes.

Unveiling the Rigorous Research Framework and Analytical Techniques Employed to Deliver Robust Self-Adhesive Label Market Insights

Our research methodology combines primary and secondary data collection to ensure comprehensive market coverage and analytical rigor. Primary insights were garnered through in-depth interviews with industry executives, material producers, label converters, and packaging end users across key regions. These interviews informed qualitative assessments of strategic initiatives, technological adoption rates, and supply chain dynamics.

Secondary research involved the systematic review of industry journals, regulatory filings, trade association reports, and public financial disclosures. Data triangulation techniques were applied to validate findings and reconcile discrepancies across sources. Statistical models were used to analyze adoption trends and segment performance drivers. Finally, our analytical framework underwent a multi-stage validation process, involving peer reviews and expert panel consultations, to guarantee the accuracy and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Self-adhesive Labels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Self-adhesive Labels Market, by Material

- Self-adhesive Labels Market, by Format

- Self-adhesive Labels Market, by Adhesive Type

- Self-adhesive Labels Market, by Application

- Self-adhesive Labels Market, by Region

- Self-adhesive Labels Market, by Group

- Self-adhesive Labels Market, by Country

- United States Self-adhesive Labels Market

- China Self-adhesive Labels Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Critical Trends, Structural Shifts, and Strategic Opportunities Defining the Future of Self-Adhesive Labels

The self-adhesive label market stands at a crossroads where digital transformation, sustainability mandates, and trade dynamics converge to redefine competitive imperatives. Technological innovations in printing and smart labeling are expanding the functional boundaries of labels, while evolving regulations and tariff regimes are reshaping supply chains. Segmentation analysis underscores the critical role of material, format, adhesive, and application diversity in unlocking new growth avenues.

As regional markets exhibit unique demand drivers-from the Americas’ digital-first orientation to EMEA’s regulatory focus and Asia-Pacific’s scale-driven expansion-industry participants must tailor their strategies accordingly. The strategic recommendations outlined herein offer a roadmap for navigating this complex landscape, capitalizing on emerging opportunities, and securing a leadership position in a market poised for continued innovation.

Engage with Our Associate Director to Unlock Comprehensive Market Intelligence and Secure the Definitive Self-Adhesive Label Report Today

If you are ready to gain an unparalleled advantage in the self-adhesive label arena, reach out to Ketan Rohom, our Associate Director of Sales & Marketing, to secure your copy of the full market research report. Through a personalized consultation, you’ll explore detailed insights into emerging trends, cost implications, and strategic opportunities tailored to your organization’s needs. Engage with our expert to discuss bespoke data packages, customization options, and collaborative research pathways designed to drive your business forward. Take the decisive step toward informed decision-making by partnering with Ketan Rohom on refining your competitive strategy and ensuring you lead the market with confidence.

- How big is the Self-adhesive Labels Market?

- What is the Self-adhesive Labels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?