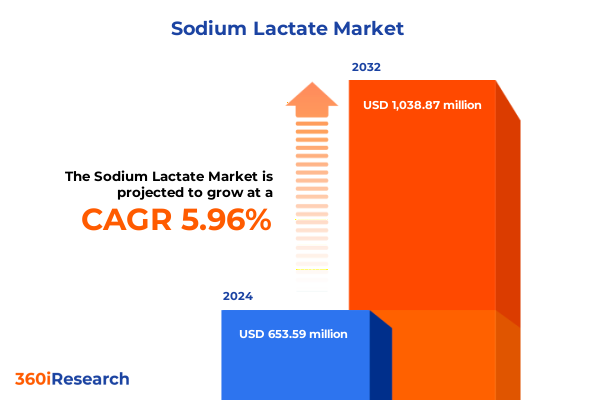

The Sodium Lactate Market size was estimated at USD 690.67 million in 2025 and expected to reach USD 736.16 million in 2026, at a CAGR of 6.00% to reach USD 1,038.87 million by 2032.

Unveiling Sodium Lactate’s Chemical Characteristics and Crucial Role as a Versatile Ingredient in Food Pharma and Personal Care Applications

Sodium lactate, the sodium salt of natural L(+)-lactic acid, is produced through the neutralization of lactic acid derived from fermentation processes. It exists as a colorless to pale yellow liquid or as a white crystalline powder when dehydrated, reflecting its adaptability for diverse handling and storage conditions. Analytical assessments indicate that sodium lactate’s chemical stability and solubility across a broad pH range make it a preferred choice for formulators seeking consistent performance in complex matrices.

The compound’s mild saline taste and nearly odorless profile enable its broad acceptance in applications ranging from pharmaceutical intravenous solutions to bakery and dairy products. Its role as a pH regulator and preservative is underpinned by its buffering capacity and antimicrobial activity, qualities that are validated by both regulatory agencies and end users seeking label-friendly ingredients. Its versatility is further enhanced by its compatibility with natural and synthetic systems, making it a critical building block across sectors.

Recent industry analyses highlight that the mild humectant properties of sodium lactate support moisture retention in personal care preparations, while its chelating action contributes to the stabilization of metal ions in cosmetic and pharmaceutical formulations. As consumer demand intensifies for multifunctional, clean-label ingredients, sodium lactate’s chemical profile positions it at the intersection of performance and regulatory compliance, setting the stage for sustained adoption across food, personal care, and healthcare industries.

Tracing the Key Technological and Regulatory Transformations Shaping Sodium Lactate Production Sustainability and Market Positioning

Sodium lactate production is undergoing a sustainability-driven transformation, driven by advancements in green manufacturing techniques. Manufacturers are increasingly turning to enzymatic conversion and microbial fermentation processes that utilize renewable feedstocks such as sugarcane molasses. These shifts reduce energy consumption and minimize carbon footprint compared to traditional chemical neutralization methods, aligning with corporate environmental objectives and tightening regulatory mandates around sustainable sourcing.

Technological breakthroughs in reactor design and process control have enhanced yield and purity, enabling continuous production systems that lower operational costs and improve supply reliability. In tandem, real-time analytical monitoring allows producers to maintain stringent quality standards, a necessity for pharmaceutical-grade sodium lactate used in intravenous fluids and antigen stabilizers for injectable therapies. Such innovations are redefining cost structures and opening pathways for new market entrants equipped with agile, modular production capabilities.

Moreover, regulatory momentum around food safety and clean-label requirements has increased scrutiny of synthetic preservatives, propelling sodium lactate’s adoption as a naturally derived alternative. Consumer preferences for minimally processed ingredients are fueling demand in meat, poultry, and seafood applications, where sodium lactate extends shelf life and inhibits microbial growth. The alignment of technological, regulatory, and consumer trends underscores a landscape in which continuous innovation in production and application development is paramount for maintaining competitive advantage.

Analyzing How the Latest U.S. Tariff Structures and Trade Policies Impact Sodium Lactate Import Dynamics and Commercial Strategies

Under the Harmonized Tariff Schedule of the United States (HTS 2918.11.51), sodium lactate is classified within ‘‘other’’ lactic acid salts and esters, carrying a general duty rate of 3.4% ad valorem. This base duty applies to imports from all origins and reflects longstanding tariff commitments under World Trade Organization rules, ensuring a level playing field for established global suppliers.

Imports originating from non–free trade agreement partners may incur a special rate of up to 25% when not covered by preferential trade programs. This differential exposes U.S. formulators and distributors to elevated landed costs for sodium lactate sourced from key Asian producers outside FTA frameworks. Consequently, buyers have recalibrated sourcing strategies, prioritizing FTA-compliant suppliers and exploring domestic manufacturing partnerships to mitigate exposure to elevated tariffs.

Despite a comprehensive four-year review of Section 301 measures in 2024, the U.S. Trade Representative maintained existing rates for products from China within its technology transfer and intellectual property actions, focusing tariff increases on semiconductors and related hardware instead. Sodium lactate, not enumerated among the escalated items, continues to face the established duty structure without additional Section 301 surcharges in 2025. This stability in policy affords supply chain planners clarity while underscoring the importance of proactive tariff risk management in procurement practices.

Uncovering Critical Segmentation Breakdowns That Define Sodium Lactate Demand Patterns by Application End Use Type and Physical Form

Insight into sodium lactate’s application segmentation reveals distinct performance demands across industries. In animal feed, formulators leverage its buffering and preservative functionalities in aquafeed, cattle feed, poultry feed, and swine feed to enhance nutrient stability and feed palatability. Chemical processing pathways utilize sodium lactate as a plasticizer precursor and surfactant intermediate, driving its strategic importance in polymer and specialty chemical supply chains. Meanwhile, food and beverage processors in bakery, beverages, confectionery, dairy, and meat and seafood sectors prize its antimicrobial action to prolong shelf life and maintain product freshness. In personal care, hair care, oral care, and skin care products incorporate sodium lactate for its humectant and pH regulating properties. In pharmaceutical applications ranging from antacid formulations to injectable preparations and topical formulations, stringent purity thresholds make sodium lactate indispensable as both an excipient and stabilizer.

From an end-use industry vantage, sodium lactate’s role in animal nutrition underpins performance feed solutions that target growth efficiency and health outcomes. In chemical synthesis, it functions as a key building block for esterification and neutralization reactions. Cosmetic formulators integrate it into moisturizing and antimicrobial systems, while food processing applications exploit its flavor enhancement and preservation capabilities to meet consumer demands for natural ingredients. In pharmaceutical manufacturing, where compliance with pharmacopeial standards is critical, sodium lactate’s reliability in pH control and isotonic formulations drives its continued prominence.

Grade differentiation further defines market behavior, with food-grade sodium lactate adhering to stringent food safety and additive regulations, industrial-grade variants optimized for processing robustness, and pharmaceutical-grade materials conforming to United States Pharmacopeia standards for injection and topical use. The selection of grade influences supply chain complexity and cost considerations, as manufacturers and end users navigate certification requirements and quality control benchmarks to ensure product integrity and regulatory compliance.

Physical form also shapes value propositions: the liquid form, commanding a majority share, offers immediate solubility and ease of handling in high-throughput operations, whereas the powder form provides logistical advantages in storage, transportation, and incorporation into dry blends. This duality enables supply chain optimization by aligning form selection with processing workflows and cost structures.

This comprehensive research report categorizes the Sodium Lactate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End-Use Industry

Examining Regional Nuances That Drive Sodium Lactate Adoption From the Americas Through Europe Middle East Africa to Asia Pacific

In the Americas, the United States serves as a hub for pharmaceutical and personal care applications of sodium lactate, driven by robust healthcare infrastructure, a rigorous regulatory environment under the FDA, and increasing consumer preference for clean-label and multifunctional ingredients. Food processors in North America heavily utilize sodium lactate for its preservative efficacy in meat and dairy categories, with regulatory acceptance by U.S. and Canadian authorities further anchoring its market position. Mexico and Brazil also exhibit growing interest in value-added feed additives and specialty chemical applications, supported by investments in animal nutrition and agro-processing facilities.

Across Europe, the Middle East, and Africa, stringent cosmetic and food safety standards set by the European Food Safety Authority and regional bodies drive adoption in personal care and bakery applications. The European market’s sustainability focus has accelerated demand for bio-based sodium lactate, and regional manufacturers are investing in green production technologies to meet both regulatory obligations and corporate social responsibility targets. Meanwhile, Middle Eastern and African markets are gradually expanding their use in animal feed and food preservation as cold chain improvements reduce spoilage risks and augment the value proposition of shelf-life enhancers.

The Asia-Pacific region is characterized by rapid growth in food and beverage processing, animal nutrition, and pharmaceutical manufacturing. High population density and expanding middle-class demographics in China and India drive increased demand for processed meat, dairy products, and packaged goods, with sodium lactate’s efficacy as a natural preservative and flavor enhancer meeting quality expectations. Japan and South Korea maintain sophisticated pharmaceutical sectors that rely on pharmaceutical-grade sodium lactate for isotonic solutions, while Southeast Asian markets demonstrate burgeoning interest in personal care ingredients, reflecting rising disposable incomes and shifting consumption patterns.

This comprehensive research report examines key regions that drive the evolution of the Sodium Lactate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Manufacturers and Strategic Collaborations Defining Competition and Innovation in the Global Sodium Lactate Industry

The global sodium lactate landscape is shaped by a cadre of leading manufacturers boasting integrated production and distribution networks. Corbion, Jungbunzlauer, Henan Jindan Lactic Acid Technology, and Foodchem International have established capacity expansions in North America, Europe, and Asia, leveraging proprietary fermentation platforms and strategic joint ventures to secure feedstock access and optimize logistics. These companies continuously invest in R&D, focusing on process intensification and downstream application development to maintain technological leadership.

In parallel, strategic collaborations between specialty chemical producers and pharmaceutical ingredient suppliers have emerged to co-develop high-purity grades for injectable and topical formulations. Joint innovation centers facilitate rapid prototyping and scale-up, while acquisition activities underscore the drive toward portfolio diversification. For instance, partnerships between regional biotech firms and multinational chemical groups aim to integrate enzymatic catalysis modules into existing production lines, enhancing yield and reducing waste streams.

Regional players, particularly in China and India, are scaling their operations to capture growing domestic demand and to serve export markets. Companies such as Hefei TNJ Chemical Industry and Jungbunzlauer’s regional subsidiaries tailor product specifications to local regulatory frameworks and consumer preferences, offering localized technical support and streamlined supply agreements. This localization strategy enables agile responses to market shifts and reinforces competitive positioning in high-growth economies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sodium Lactate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- abcr GmbH

- Advance Inorganics

- Archer Daniels Midland Company

- BASF SE

- BBCA Biochemical Co., Ltd.

- Biosynth Carbosynth

- Brenntag AG

- Cargill, Incorporated

- Corbion NV

- Dr. Paul Lohmann GmbH & Co. KGaA

- Finetech Industry Limited

- Finoric LLC

- Fisher Chemical

- Foodchem International Corporation

- Galactic SA

- Glentham Life Sciences Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Henan Jindan Lactic Acid Technology Co., Ltd.

- JIAAN BIOTECH

- Jungbunzlauer AG

- Loba Chemie Pvt. Ltd.

- Luoyang Longmen Pharmaceutical Co., Ltd.

- Merck KGaA

- Prathista Industries Limited

- Qingdao Dawei Biological Engineering Co., Ltd.

- Qingdao Great Biological Engineering Co., Ltd.

- Shandong Jiejing Bioengineering Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

Providing Actionable Strategies for Industry Leaders to Optimize Sodium Lactate Supply Chains and Capitalize on Emerging Market Opportunities

To navigate tariff complexities and supply volatility, industry leaders should diversify sourcing strategies by establishing or expanding facilities in free trade agreement regions. Partnerships with local distributors can mitigate landed cost pressures and ensure priority access to critical feedstocks. Concurrently, adopting dual-sourcing frameworks and inventory hedging mechanisms will insulate operations from discrete tariff shocks and logistical disruptions.

Investment in sustainable production technologies must remain a priority. Companies can achieve both cost efficiencies and environmental objectives by integrating enzymatic conversion processes and adopting renewable raw materials. Pursuing third-party green certifications and publishing environmental impact metrics will strengthen market positioning with sustainability-focused customers and regulators alike.

Prioritizing high-value segments, such as pharmaceutical-grade and specialized personal care formulations, will unlock margin expansion. Tailored R&D initiatives should focus on enhancing product differentiation through impurity profile optimization and functional performance enhancements. Engaging with regulatory agencies early in development cycles will accelerate approval timelines and market entry for novel formulations.

Finally, robust quality management and regulatory compliance frameworks are essential. Harmonizing quality systems across global sites and leveraging digital traceability platforms will streamline audit readiness and bolster customer confidence. Proactive engagement with emerging market regulators, combined with localized technical support, will facilitate market expansion and reinforce leadership positions in dynamic regions.

Detailing a Rigorous Research Framework Combining Primary and Secondary Data to Deliver High Integrity Insights Into Sodium Lactate Markets

This analysis was grounded in an exhaustive review of secondary sources, including global trade databases, regulatory filings, industry association white papers, and peer-reviewed journals. Harmonized Tariff Schedule data was cross-referenced with U.S. International Trade Commission publications to ensure precision in duty rate assessments. Market trends were validated through recent industry reports and technical bulletins.

Primary research comprised in-depth interviews with senior executives at leading sodium lactate producers, formulation scientists at established end-use companies, regulatory affairs specialists, and supply chain managers. These qualitative insights were instrumental in interpreting the strategic implications of emerging production technologies and shifting trade policies.

Data triangulation methods were applied to reconcile quantitative trade flow statistics, capacity utilization figures, and regulator-approved application use cases. A peer review process involving external subject matter experts and internal industry analysts provided further validation, ensuring the robustness and reliability of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sodium Lactate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sodium Lactate Market, by Type

- Sodium Lactate Market, by Form

- Sodium Lactate Market, by Application

- Sodium Lactate Market, by End-Use Industry

- Sodium Lactate Market, by Region

- Sodium Lactate Market, by Group

- Sodium Lactate Market, by Country

- United States Sodium Lactate Market

- China Sodium Lactate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Industry Trends and Strategic Imperatives Into a Cohesive Overview of Sodium Lactate’s Position in Evolving Global Markets

Sodium lactate’s unique blend of chemical stability, functional versatility, and regulatory acceptance cements its status as an essential ingredient across food, pharmaceutical, personal care, and chemical processing sectors. Technological innovations in sustainable production and heightened consumer demand for natural preservatives are redefining cost structures and elevating market opportunities.

Despite established tariff frameworks, strategic sourcing and proactive tariff risk management remain critical for safeguarding cost competitiveness. Segmentation insights underscore differentiated value propositions by application, grade, and form, enabling targeted investment in high-growth niches. Regional dynamics reveal pockets of robust demand and progressive regulatory landscapes, each offering distinct pathways for expansion.

Key players are advancing through capacity expansions, strategic collaborations, and localized offerings, intensifying competition while raising quality and sustainability benchmarks. Industry leaders equipped with agile supply chains, sustainable production capabilities, and robust regulatory compliance frameworks will be best positioned to capitalize on evolving demands.

This executive summary lays the groundwork for informed decision-making, providing a cohesive perspective on the forces shaping sodium lactate markets globally. It serves as a foundational reference for stakeholders intent on driving growth, innovation, and resilience in an increasingly complex and opportunity-rich landscape.

Connect With Associate Director Ketan Rohom to Unlock the Full Sodium Lactate Market Research and Gain a Competitive Edge Today

To explore the full breadth of insights, strategic analyses, and specialized data on sodium lactate markets, connect directly with Associate Director Ketan Rohom. Secure tailored guidance on how these findings translate into actionable strategies for your organization’s growth and resilience. Learn more about report customization options, pricing tiers, and exclusive deliverables designed to empower your decision-making. Engage now to access the comprehensive proprietary research that will equip your team with the competitive intelligence necessary to lead in the evolving sodium lactate landscape.

- How big is the Sodium Lactate Market?

- What is the Sodium Lactate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?