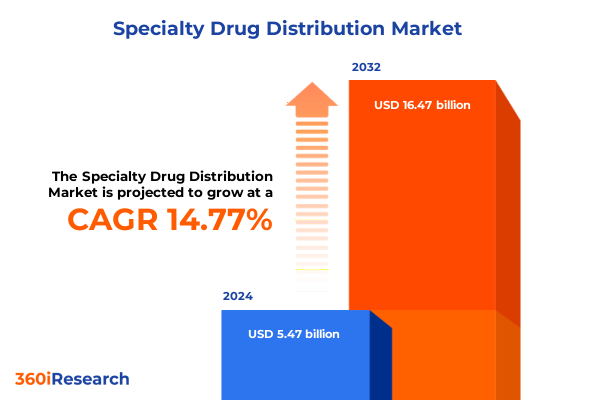

The Specialty Drug Distribution Market size was estimated at USD 6.29 billion in 2025 and expected to reach USD 7.16 billion in 2026, at a CAGR of 14.72% to reach USD 16.47 billion by 2032.

Recognizing the Rising Significance of Specialty Drug Distribution Amid an Evolving Healthcare Ecosystem Driven by Innovation and Patient Expectations

Specialty drug distribution has emerged as a pivotal component of modern healthcare delivery systems, reflecting the industry’s shift toward increasingly complex therapies and personalized medicine. In recent years, breakthrough biologics and advanced gene therapies have redefined treatment paradigms, promising greater efficacy for previously intractable conditions. As a result, the infrastructure and operational models supporting the movement of these therapies from manufacturers to patients have had to evolve rapidly to ensure safety, compliance, and continuity of care.

Against this backdrop, stakeholders across the pharmaceutical value chain-including manufacturers, distributors, payers, and provider networks-are grappling with multifaceted challenges. Cold chain logistics, strict regulatory requirements, patient support services, and evolving reimbursement frameworks have converged to create a distribution environment that demands heightened collaboration and technological innovation. Moreover, end-to-end visibility and data integration have become critical enablers for optimizing supply chain resilience and mitigating risks associated with high-value, temperature-sensitive products.

In response, the market has witnessed an expansion of specialty distribution hubs, enhanced hub-and-spoke models, and the integration of digital platforms offering real-time tracking and patient engagement tools. By understanding the catalysts driving this transformation-ranging from clinical breakthroughs to shifting payer policies-industry decision-makers can better position themselves to navigate complexities and capitalize on emerging opportunities within the specialty drug distribution landscape.

Uncovering the Transformative Forces Redefining Specialty Drug Distribution Through Technology, Policy Shifts, and Patient Centricity Across the Value Chain

The specialty drug distribution landscape is being reshaped by a convergence of technological advancements, regulatory developments, and shifting patient expectations. Digital health platforms now facilitate seamless communication among manufacturers, distributors, and patients, enabling real-time monitoring of therapy adherence and adverse event reporting. Concurrently, regulatory bodies are implementing risk-based frameworks that demand more stringent documentation and serialization practices, compelling distribution partners to invest in advanced track-and-trace systems.

As therapies grow increasingly personalized, with cell and gene treatments tailored to individual patient profiles, distribution networks must adapt to accommodate small batch sizes and complex handling requirements. In parallel, a surge in value-based contracting has incentivized supply chain stakeholders to adopt outcome-oriented metrics, driving the integration of analytics and predictive modeling to forecast demand and reduce waste. These developments also underscore the importance of patient support services, including nurse call centers, financial assistance coordination, and educational programs that must be seamlessly woven into the distribution process.

Moreover, consolidation among distributors and the rise of strategic partnerships with third-party logistics providers are streamlining operations, yielding economies of scale and enhanced capabilities in cold chain management. As a result, companies that proactively embrace digital transformation, foster cross-functional collaboration, and refine their distribution footprints stand to gain a sustainable competitive advantage in a market defined by rapid innovation and exacting quality standards.

Evaluating the Complex Effects of 2025 United States Tariff Measures on Specialty Drug Supply Chains, Cost Structures, and Global Sourcing Strategies

The imposition of new United States tariffs in 2025 has introduced additional complexity into the specialty drug distribution ecosystem, influencing cost structures, sourcing decisions, and supply chain resilience. As tariffs affect critical inputs-ranging from raw materials used in biologics manufacturing to specialized packaging components-distribution partners have been compelled to reevaluate supplier relationships and negotiate revised terms to mitigate margin erosion.

Given the globalized nature of pharmaceutical production, manufacturers sourcing active pharmaceutical ingredients from overseas facilities have confronted heightened import costs, which in turn propagate through distribution agreements. To preserve competitiveness, stakeholders are exploring diversified sourcing strategies, including nearshoring and developing secondary supplier networks. At the same time, tariffs have accelerated investments in domestic manufacturing capacity, with some players electing to repatriate production lines to stabilize supply and reduce exposure to trade policy volatility.

In addition, distribution providers are reassessing freight forwarding and logistics partnerships to optimize the landed cost of specialty therapies. Cold chain routes are being recalibrated to balance tariff implications against transit time, ensuring product integrity while containing expenses. Although the full financial impact continues to unfold, the cumulative effect of these tariffs has underscored the critical importance of agile supply chain design and proactive trade compliance frameworks.

Deriving Actionable Intelligence from Therapeutic, Product, Dosage, and Channel Segmentation to Navigate Nuances in Specialty Drug Distribution Dynamics

A nuanced understanding of market segmentation is essential for navigating the intricate landscape of specialty drug distribution. Within the therapeutic area segment, autoimmune and inflammatory disease treatments benefit from well-established infusion center networks, whereas emerging oncology therapies demand ultra-cold storage capabilities and specialized packaging. Rare disease drugs, particularly orphan and ultra-orphan categories, present unique challenges due to their ultra-small patient populations and bespoke dosing regimens, necessitating highly individualized distribution pathways.

Turning to product type segmentation, biologics and cell and gene therapies require rigorous cold chain management; cell therapies, in particular, often involve cryopreserved shipments tracked through end-to-end digital platforms. Small molecule drugs and specialty generics, while less temperature-sensitive, still demand precision in lot control and serialization to comply with anti-counterfeiting regulations. These distinctions drive investment priorities and service offerings among distribution partners aiming to cater to each product category’s specific requirements.

Dosage form segmentation further influences logistical considerations: injectable therapies frequently rely on pre-filled syringes and vials, which impose strict handling and storage parameters, while oral solids and topicals follow more conventional distribution channels. The injectables segment, given its higher value density and sensitivity, often commands dedicated temperature-monitored freight and specialized courier services. Collectively, these dosage form characteristics shape operational protocols and service level agreements.

Lastly, the distribution channel segment encompasses a spectrum of end-user touchpoints. Alternative channels such as mail order pharmacies and specialty distributors leverage centralized fulfillment centers and digital interfaces to streamline patient deliveries. Hospital pharmacies, including both direct ship and wholesaler distribution models, integrate closely with provider systems to support in-patient and outpatient settings. Online pharmacies, whether manufacturer direct or utilizing third-party platforms, emphasize portal usability and compliance with digital dispensing regulations. Retail pharmacy, spanning chain and independent pharmacies, remains a critical access point, demanding coordination to manage inventory visibility and reimbursement processes. By weaving these four segmentation lenses together, industry leaders can craft distribution strategies that resonate with each stakeholder’s unique operational imperatives.

This comprehensive research report categorizes the Specialty Drug Distribution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Dosage Form

- Distribution Channel

- Therapeutic Area

Illuminating Regional Differences in Specialty Drug Access, Distribution Infrastructure, and Regulatory Landscapes Across the Americas, EMEA, and Asia Pacific

Regional dynamics exert a profound influence on specialty drug distribution strategies and patient access. In the Americas, advanced reimbursement frameworks and mature specialty pharmacy networks drive high patient enrollment in support programs, yet geographical disparities in access persist between urban centers and rural areas. Distribution providers in this region are prioritizing investments in last-mile delivery solutions, including cold chain lockers and mobile temperature-controlled vehicles, to bridge these gaps and enhance patient adherence.

Across Europe, the Middle East, and Africa (EMEA), a diverse regulatory environment spans price controls in Western Europe to growing private market demand in the Middle East. While centralized procurement tends to favor cost containment, the rise of value-based payment pilots in select EU markets is fostering closer collaboration between payers and distributors. Simultaneously, emerging markets within EMEA are witnessing the expansion of regional distribution hubs to streamline customs clearance and improve cold chain reliability, supporting a growing portfolio of high-value biologics.

The Asia Pacific region is characterized by its spectrum of healthcare maturity, from established markets in Japan and Australia to rapidly developing markets in Southeast Asia and India. Here, the dual challenge of regulatory harmonization and infrastructure development is spurring strategic alliances between global distributors and local service providers. Investments in digital track-and-trace systems are accelerating, driven by both regulatory mandates and the need to ensure provenance in long-haul shipments. As regional players expand manufacturing footprints, proximity manufacturing is emerging as a means to reduce lead times and tariff exposure, reinforcing the importance of agile distribution networks.

Collectively, these regional insights highlight the importance of a tailored approach that aligns distribution models with local regulatory frameworks, patient behaviors, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Specialty Drug Distribution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Drivers Among Leading Players Shaping the Future of Specialty Drug Distribution Networks and Partnerships

Leading distributors and logistics providers are executing strategic initiatives to capture growth in the specialty segment. Major players are forging alliances with technology firms to integrate IoT-enabled sensors and blockchain solutions for enhanced cold chain monitoring and tamper-evident traceability. By contrast, specialized third-party logistics providers are differentiating themselves through niche service offerings, such as personalized patient home delivery programs and white-glove handling for ultra-cold shipments.

Simultaneously, traditional pharmaceutical wholesalers are expanding their service portfolios by acquiring or partnering with specialty pharmacies and hub service companies, aiming to deliver end-to-end solutions that encompass benefit verification, copay assistance coordination, and patient education. These vertical integration moves are designed to deepen engagement across the patient journey and create stickiness within payer networks. Furthermore, collaborations between distributors and healthcare providers are yielding embedded logistics operations in outpatient infusion centers, optimizing inventory management and reducing time to therapy initiation.

Meanwhile, emerging digital disruptors are leveraging cloud-based platforms to offer real-time inventory visibility and predictive demand forecasting, compelling established players to accelerate their own digital roadmaps. As the competitive landscape intensifies, companies that seamlessly blend operational excellence with patient-centric services will command premium positioning in the specialty drug distribution ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Drug Distribution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alfresa Holdings Corporation

- Amgen Inc.

- Anda, Inc.

- Avella Specialty Pharmacy, Inc.

- BioCareSD, LLC

- Cardinal Health, Inc.

- Cencora, Inc.

- CuraScript Specialty Distribution, Inc.

- F. Hoffmann-La Roche Ltd.

- FFF Enterprises, Inc.

- Gilead Sciences, Inc.

- McKesson Corporation

- MEDIPAL HOLDINGS CORPORATION

- PHOENIX Pharma SE

- Prodigy Health, Inc.

- Sinopharm Group Co., Ltd.

- Smith Drug Company, Division of J M Smith Corporation

- Teva Pharmaceutical Industries Ltd.

- Walgreens Boots Alliance, Inc.

Transforming Specialty Drug Distribution Strategies with Actionable Recommendations to Enhance Resilience, Efficiency, and Patient Centricity in an Uncertain Market

Industry leaders must proactively invest in integrated digital platforms that unify supply chain visibility, patient support, and regulatory compliance. By harnessing predictive analytics, organizations can anticipate demand fluctuations, optimize inventory positioning, and reduce wastage of high-value therapies. At the same time, forging strategic alliances with specialized cold chain logistics experts will ensure robust handling protocols for temperature-sensitive products, safeguarding product integrity from manufacturing to the patient’s door.

Moreover, executives should prioritize the development of flexible trade compliance frameworks capable of adapting to evolving tariff regimes and cross-border regulations. This entails cultivating diversified supplier networks, exploring near-shoring opportunities, and maintaining rigorous customs documentation processes. In parallel, cultivating strong partnerships with payers and provider networks around value-based contracting and patient outcomes data will differentiate distribution offerings and align incentives across stakeholders. Ultimately, embedding patient support services-such as financial counseling and adherence monitoring-directly within distribution workflows will strengthen patient engagement and elevate treatment success rates.

By executing these recommendations, companies can build resilient, patient-focused distribution models that deliver operational efficiency while capturing growth opportunities in an increasingly complex specialty drug environment.

Outlining Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Validation to Ensure Comprehensive Specialty Drug Distribution Insights

This analysis integrates a multi-method research approach to ensure a comprehensive understanding of the specialty drug distribution landscape. Primary research included in-depth interviews with senior executives from leading distribution companies, specialty pharmacies, and cold chain logistics providers. These conversations provided qualitative insights into strategic priorities, operational challenges, and emerging service models.

Complementing these interviews, secondary research involved a systematic review of industry publications, regulatory filings, and operational benchmarks to contextualize market dynamics and validate findings. Data points were cross-referenced with trade association reports and recognized compliance standards to ensure accuracy, particularly regarding cold chain protocols and serialization requirements. The research team employed triangulation techniques, comparing information across multiple sources to mitigate bias and reinforce the robustness of insights.

Finally, the analysis underwent methodological validation through peer review sessions with subject matter experts in pharmaceutical supply chain management and health economics. This iterative process ensured that the final deliverable presents balanced, actionable intelligence that aligns with current industry practices and anticipated market evolutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Drug Distribution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Drug Distribution Market, by Product Type

- Specialty Drug Distribution Market, by Dosage Form

- Specialty Drug Distribution Market, by Distribution Channel

- Specialty Drug Distribution Market, by Therapeutic Area

- Specialty Drug Distribution Market, by Region

- Specialty Drug Distribution Market, by Group

- Specialty Drug Distribution Market, by Country

- United States Specialty Drug Distribution Market

- China Specialty Drug Distribution Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Provide a Coherent Overview of Specialty Drug Distribution Trends, Challenges, and Opportunities for Strategic Decision Making

This executive summary has delineated the critical forces shaping specialty drug distribution, from transformative technological advancements to the implications of new tariff policies and complex segmentation dynamics. The convergence of personalized therapies and stringent regulatory standards is driving innovation across cold chain logistics, patient support services, and digital integration, compelling stakeholders to rethink traditional distribution models.

Regional variations underscore the need for market-specific strategies, whether optimizing last-mile delivery in the Americas, navigating diverse reimbursement frameworks in EMEA, or building agile infrastructure in Asia Pacific. Additionally, major distributors and innovative third-party providers are carving out competitive advantages through strategic partnerships, vertical integration, and digital service offerings that respond to the unique needs of biologics, cell therapies, and rare disease drugs.

Looking ahead, companies that embed resilience into their supply chains, embrace data-driven decision-making, and align distribution models with evolving stakeholder expectations will be best positioned to capture growth opportunities. By synthesizing these insights, executives can chart a course that balances operational efficiency with patient-centric excellence, ultimately delivering on the promise of specialty therapies in a rapidly changing healthcare environment.

Empowering Stakeholders with Direct Access to Tailored Specialty Drug Distribution Intelligence Through a Conversation with Associate Director of Sales and Marketing

To acquire the full specialty drug distribution market research report and gain unparalleled insights tailored to your strategic objectives, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Engaging in a conversation with him will ensure you receive bespoke guidance on how these insights align with your specific organizational goals and operational challenges. Seize the opportunity to leverage comprehensive analysis, expert recommendations, and forward-looking intelligence that can accelerate decision-making and drive sustainable growth.

Contacting Ketan will provide you with a clear roadmap for accessing the data, understanding the report’s scope, and identifying the optimal licensing options for your enterprise. His deep familiarity with the research methodology and market dynamics guarantees a smooth transaction process and personalized support throughout your evaluation journey. Don’t miss out on equipping your leadership team with the strategic intelligence necessary to outperform competitors and navigate the evolving specialty drug distribution landscape.

Act now to secure your organization’s competitive advantage. Schedule a discussion today and take the definitive step toward informed, proactive planning grounded in rigorous analysis and industry expertise. Your next strategic milestone is just a conversation away.

- How big is the Specialty Drug Distribution Market?

- What is the Specialty Drug Distribution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?