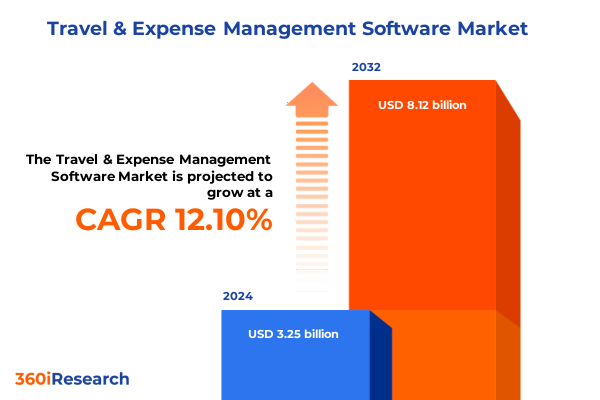

The Travel & Expense Management Software Market size was estimated at USD 3.63 billion in 2025 and expected to reach USD 4.05 billion in 2026, at a CAGR of 12.19% to reach USD 8.12 billion by 2032.

Navigating the Ever-Evolving Terrain of Travel and Expense Management Solutions to Empower Business Efficiency and Cost Control Across Diverse Enterprises Globally

In today’s fast-paced business environment, effectively overseeing travel expenditures and expense reporting has become a critical function for enterprises of all sizes. As organizations strive to balance cost containment with employee satisfaction, they face an expanding array of digital tools and evolving user expectations. This dynamic landscape presents both opportunities and challenges for decision-makers charged with optimizing travel policies and automating reimbursement processes.

Consequently, this executive summary delivers a holistic overview of the travel and expense management software market, spotlighting transformative technologies and emerging strategies. By synthesizing key trends, regulatory impacts, and competitive dynamics, it equips senior leaders and finance professionals with actionable intelligence. More importantly, this document frames how modern solutions are driving efficiency gains and reinforcing corporate governance, setting the stage for deeper analysis in subsequent sections.

Discover How Next-Generation Automation and Integrated Ecosystems Are Redefining Efficiency and User Experience in Travel and Expense Management

Over recent years, the travel and expense management domain has undergone profound shifts driven by technological innovation and changing workforce expectations. Automation through artificial intelligence and machine learning has transcended basic rule-based expense auditing, enabling predictive analytics that forecast spending patterns and identify anomalies in real time. These advances facilitate more proactive compliance monitoring, reducing financial leakage and strengthening internal controls.

Simultaneously, user-centric design philosophies have reshaped corporate platforms to mirror consumer-grade mobile applications. Travelers now expect seamless booking experiences integrated directly into chat interfaces or voice-activated assistants. This era of hyper-connectivity has also extended to policy enforcement, where context-aware systems dynamically adapt approval workflows based on spend categories, corporate hierarchy, and traveler risk profiles. As a result, organizations benefit from enhanced policy adherence without compromising user satisfaction.

Furthermore, the convergence of travel and expense software with broader enterprise ecosystems has accelerated through robust application programming interfaces. End-to-end integration with procurement, enterprise resource planning, and human capital management platforms ensures centralized data repositories and unified reporting capabilities. In effect, these interconnected landscapes enable finance and operations teams to coalesce around shared analytics dashboards, driving collaborative decision-making and continuous improvement.

Examining the Multifaceted Ripple Effects of United States Tariff Adjustments on Travel Costs and Policy Compliance Throughout 2025

The cumulative impact of United States tariffs throughout 2025 has introduced additional complexity to corporate travel and expense portfolios. As import duties on hospitality supplies and ground transportation equipment have incrementally increased, organizations with extensive domestic and international operations have recalibrated budgets to mitigate unanticipated cost escalations. These adjustments have reverberated across vendor negotiations, reimbursement rate tables, and travel policy thresholds.

In response, leading software vendors have embedded advanced currency conversion and tariff-adjustment modules, enabling real-time expense flagging when costs exceed predefined thresholds. This functionality works in tandem with regional compliance engines that account for disparate tax treatments and customs duties imposed on travel services and ancillary goods. Consequently, companies gain granular visibility into the true landed cost of travel, ensuring that finance teams can validate expense claims against both corporate policies and external regulatory variables.

Moreover, proactive scenario modeling tools now simulate the budgetary impact of potential tariff changes, allowing strategic planners to forecast adjustments under varying duty regimes. By leveraging these capabilities, enterprises can adopt agile budget reallocation strategies, negotiate supplier concessions, and maintain traveler satisfaction despite evolving cost structures. Ultimately, tariff-aware platforms reinforce organizations’ resilience against external economic shocks.

Uncovering How Deployment Models End-user Needs Organization Size and Application Profiles Drive Differentiated Adoption Across Platforms

Insight into market segmentation underscores how distinct deployment, user, and functional preferences shape adoption patterns across organizations. Cloud-based solutions, spanning public, private, and hybrid architectures, are increasingly favored for their scalability and rapid innovation cycles, while on-premises offerings continue to serve enterprises with stringent data residency requirements. Corporate entities, characterized by high transaction volumes and decentralized operations, often leverage integrated suites to harmonize travel and expense data, whereas government bodies prioritize audit trails and regulatory compliance in mission-critical environments.

Organizational size further differentiates platform selection and feature prioritization. Large enterprises typically demand comprehensive modules encompassing automated expense reporting, invoice processing and approval, and policy compliance auditing. Conversely, small and medium-sized businesses may focus on core expense reporting and online travel booking capabilities to streamline basic workflows with minimal IT overhead. Within application domains, expense management tools emphasize accuracy and expedited reimbursements, while travel management suites focus on itinerary optimization and self-service booking portals that empower employees.

Component-level analysis reveals specialized preferences for booking and reservation engines, integration-layer middleware, mobile applications, and advanced reporting and analytics dashboards. The depth of integrations and mobile functionality often distinguishes best-in-class solutions, enabling real-time expense capture, location-based policy enforcement, and executive-level spend visualization. Such nuanced segmentation insights highlight the importance of aligning deployment choice, user type, and functional scope with organizational priorities when selecting travel and expense platforms.

This comprehensive research report categorizes the Travel & Expense Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality Type

- Deployment Model

- End User Industry

- Organization Size

Exploring the Diverse Regulatory Data Privacy and Digital Transformation Imperatives Shaping Regional Adoption Across Key Global Markets

Regional dynamics exert a significant influence on how travel and expense management solutions evolve and gain traction. In the Americas, diverse regulatory landscapes in North and South America have accelerated demand for unified compliance modules that encapsulate federal, state, and provincial tax requirements alongside cross-border reporting standards. Meanwhile, Latin American economies are gradually embracing mobile-first expense capture as smartphone penetration increases, offering fertile ground for innovation in receipt scanning and AI-driven categorization.

Across Europe, the Middle East, and Africa, data privacy regulations such as the GDPR and regional VAT directives have prompted solution providers to fortify security architectures and embed localized tax engines. Organizations in EMEA benefit from multi-language interfaces and region-specific policy templates that accommodate complex travel corridors spanning Schengen zones and intra-Gulf Cooperation Council travel. This mosaic of regulations has also spurred partnerships between software vendors and global travel agencies to ensure seamless booking compliance.

In the Asia-Pacific region, rapid digital transformation initiatives in East Asia and the Pacific Islands are extending cloud-native expense platforms into emerging markets. High-growth economies are pioneering the integration of mobile wallets and digital identity frameworks into travel and expense workflows, fostering frictionless authentication and payment reconciliation. Furthermore, multinational corporations in the region demand standardized reporting mechanisms to align with headquarters’ consolidation requirements, driving demand for robust analytics and centralized control towers.

This comprehensive research report examines key regions that drive the evolution of the Travel & Expense Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Strategic Alliances Technology Acquisitions and Niche Innovations Define Leadership and Competitive Differentiation in the Ecosystem

Market leaders in travel and expense management software demonstrate a clear commitment to strategic partnerships, product innovation, and ecosystem integration. Top-tier providers have extended their capabilities beyond core expense reporting to encompass AI-powered risk scoring, dynamic policy enforcement, and embedded payment solutions. These firms differentiate through investments in open APIs that foster ecosystem co-creation and by securing alliances with major travel agencies, fintech startups, and compliance specialists.

Innovative challengers have also captured market attention by focusing on niche requirements, such as tailored workflows for government entities or specialized analytics for high-velocity sales teams. Their agility enables rapid feature rollouts, including next-generation mobile receipt capture, blockchain-enabled audit trails, and pre-trip approval engines that leverage real-time travel hazard data. Such targeted offerings underscore the competitive landscape’s dual emphasis on scale and specialization.

Furthermore, strategic acquisitions have reshaped vendor portfolios, allowing incumbents to integrate best-of-breed technologies and expand geographic reach. As a result, the market now comprises a blend of established enterprises and emerging disruptors, each vying for differentiation through superior user experiences, comprehensive compliance frameworks, and data-driven insights. For organizations evaluating potential partners, the ability to harmonize global requirements with local operational nuances remains the ultimate test of vendor suitability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Travel & Expense Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- "ATPI Group "

- "Circula GmbH "

- "Webexpenses Pty Ltd "

- Amadeus IT Group SA

- American Express Company

- AppZen, Inc.

- Basware Corporation

- Bill.com, LLC

- Booking Holdings Inc.

- Circula GmbH

- Concur Technologies, Inc. by SAP SE

- Coupa Software Inc.

- Ebix, Inc.

- Emburse, Inc. by Certify Inc.

- Expedia Group Inc.

- Expensify, Inc.

- FCM Travel Solutions Pty Limited

- Fyle Technologies Inc. by Sage Group plc

- iTiLiTE Incorporated

- Lanes & Planes GmbH

- MakeMyTrip Limited

- Navan, Inc.

- Oracle Corporation

- Routespring, Inc.

- Sabre Corporation

- Serko Limited

- Spendesk SAS

- TravelBank Holdings Ltd.

- Traveloka Indonesia Pte. Ltd.

- TravelPerk Limited

- Trip.com Group Limited

- VV Finly Technologies Pvt. Ltd.

- Workday, Inc.

- Zoho Corporation Private Limited

Developing a Holistic Roadmap That Aligns Change Management Compliance Automation and Ecosystem Partnerships for Sustainable Success

Industry leaders seeking to excel must adopt a strategic roadmap that aligns technology investments with evolving compliance landscapes and user expectations. Initially, organizations should conduct comprehensive readiness assessments to identify existing system gaps and future-proof requirements, ensuring that procurement plans reflect both current operational realities and aspirational digital objectives. Equally important, finance and travel managers must collaborate to embed policy rules within system configurations, thereby reducing manual interventions and policy exceptions.

In parallel, fostering employee adoption through targeted change management initiatives is essential. By delivering role-based training, leveraging in-application guidance, and incentivizing compliance behaviors, companies can accelerate time-to-value and minimize resistance to new workflows. Additionally, continuous performance monitoring via real-time dashboards and pre-configured KPIs allows stakeholders to track key metrics and refine policies based on empirical evidence.

Finally, building an ecosystem of strategic partners-including travel agencies, fintech platforms, and compliance specialists-enhances platform versatility and mitigates risks associated with regulatory shifts. Regularly reviewing roadmap deliverables and engaging in vendor advisory councils will ensure that organizations remain at the forefront of innovation. Ultimately, this proactive posture will drive sustained value realization and cement a competitive advantage in the dynamic arena of travel and expense management.

Employing a Robust Hybrid Research Framework That Blends Primary Interviews Secondary Analysis and Triangulated Data for Unbiased Findings

This research integrates rigorous qualitative and quantitative methodologies to ensure comprehensive coverage and analytical accuracy. Primary insights were gathered through structured interviews with finance executives, travel managers, and solution architects across diverse industries and organization sizes. These discussions illuminated real-world challenges, user satisfaction drivers, and unmet needs within existing platforms.

Complementing primary data, secondary sources such as regulatory frameworks, vendor product releases, and technology white papers were meticulously reviewed. This enabled cross-validation of feature capabilities, compliance requirements, and innovation trajectories. Data triangulation techniques were applied to reconcile insights from primary interviews with secondary benchmarks, thereby enhancing result reliability.

In addition, a robust vendor profiling exercise was conducted, examining strategic partnerships, acquisition activity, product roadmaps, and customer feedback. Regional analysis leveraged external databases and proprietary tax and tariff schedules to reflect localized compliance landscapes. Together, these methodologies ensure that the findings within this executive summary are grounded in empirical evidence and aligned with the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Travel & Expense Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Travel & Expense Management Software Market, by Functionality Type

- Travel & Expense Management Software Market, by Deployment Model

- Travel & Expense Management Software Market, by End User Industry

- Travel & Expense Management Software Market, by Organization Size

- Travel & Expense Management Software Market, by Region

- Travel & Expense Management Software Market, by Group

- Travel & Expense Management Software Market, by Country

- United States Travel & Expense Management Software Market

- China Travel & Expense Management Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Illuminate Strategic Imperatives and Competitive Pathways in the Dynamic Travel and Expense Management Landscape

In conclusion, the travel and expense management software market stands at an inflection point, where technological disruption, regulatory complexity, and user expectations converge. Organizations that embrace next-generation automation, seamless integrations, and data-driven compliance strategies will be best positioned to control costs, enhance governance, and elevate traveler satisfaction.

By understanding how deployment models, customer profiles, and component preferences influence adoption patterns, decision-makers can tailor platform evaluations to organizational needs. Moreover, the regional insights presented herein highlight the importance of adapting to diverse regulatory regimes and digital maturity levels across the Americas, EMEA, and Asia-Pacific.

As industry leaders chart their strategic paths, this executive summary serves as both a diagnostic tool and a roadmap for sustained innovation. Ultimately, the ability to anticipate tariff fluctuations, leverage segmentation intelligence, and harness emerging technologies will differentiate market leaders from laggards in the years ahead.

Unlock Exclusive Travel and Expense Management Software Insights by Engaging with Ketan Rohom for Your Custom Research Report

To explore in depth the strategic insights and data-driven analysis contained in this report, connect with Ketan Rohom, who leads sales and marketing initiatives. His expertise will guide you through the findings and ensure that your organization harnesses the full potential of the research. Reach out today to secure a copy of the comprehensive executive summary and gain the competitive edge required to navigate the complex travel and expense management software arena.

- How big is the Travel & Expense Management Software Market?

- What is the Travel & Expense Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?