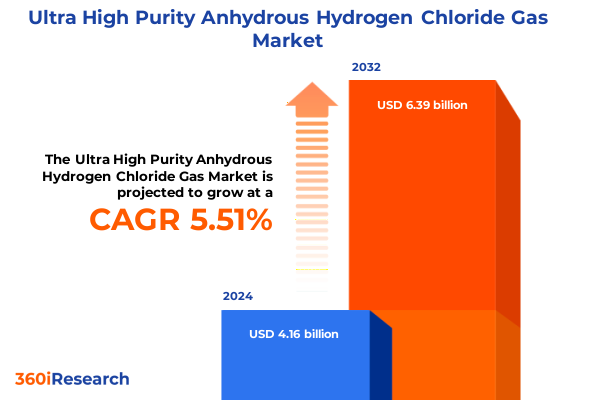

The Ultra High Purity Anhydrous Hydrogen Chloride Gas Market size was estimated at USD 4.37 billion in 2025 and expected to reach USD 4.59 billion in 2026, at a CAGR of 5.57% to reach USD 6.39 billion by 2032.

Unlocking the Critical Role of Ultra High Purity Anhydrous Hydrogen Chloride Gas in Powering Advanced Manufacturing and Emerging Technologies

The Ultra High Purity Anhydrous Hydrogen Chloride Gas stands as an indispensable industrial reagent, characterized by its exceptional purity levels that far exceed conventional specifications. Through advanced dehydration processes and rigorous contaminant removal techniques, this specialty gas attains moisture content measured at single-digit parts per billion. Consequently, it guarantees an uncontaminated environment for processes where even minuscule impurities could compromise product integrity. These exacting quality thresholds make the gas a foundational component across a multitude of high precision applications.

In semiconductor fabrication, the gas facilitates critical etching and surface conditioning operations that underpin the creation of increasingly complex device architectures. Similarly, within pharmaceutical and biotechnology disciplines, its precise acidity control is leveraged during active pharmaceutical ingredient synthesis, allowing for reproducible reaction kinetics and stringent compliance with regulatory safety standards. Beyond chemical reactivity, the handling and storage of ultra high purity anhydrous hydrogen chloride gas necessitate specialized infrastructure, including cryogenic containment and moisture-scrubbed delivery systems, to preserve performance attributes throughout the supply chain. Together, these factors underscore the pivotal role this gas occupies in enabling next-generation manufacturing, driving innovation across leading industrial sectors.

Examining the Paradigm-Shifting Innovations and Dynamic Market Drivers Reshaping the Ultra High Purity Anhydrous Hydrogen Chloride Landscape Worldwide

The landscape for Ultra High Purity Anhydrous Hydrogen Chloride Gas is undergoing a profound evolution, defined by technological breakthroughs and shifting supply paradigms. At the production level, manufacturers are incorporating green chemistry principles to minimize environmental footprints, deploying energy-efficient dehydration units that reuse waste heat streams. Furthermore, digital twins and real-time analytics now guide process optimization, ensuring consistent purity standards while reducing operational variability. As a result, end users benefit from enhanced reliability and traceability, which, in turn, bolsters confidence among stakeholders managing complex value chains.

Meanwhile, on the distribution front, innovative storage solutions have emerged to balance safety and cost efficiency. High performance cryogenic tanks equipped with advanced insulation materials are replacing legacy systems, enabling large-scale customers to maintain uninterrupted supply with reduced boil-off rates. At the same time, smart cylinder platforms outfitted with Internet of Things sensors deliver actionable data on pressure, temperature, and remaining volume, fostering predictive maintenance and just-in-time replenishment strategies. Taken together, these shifts reflect a market that is dynamically responding to heightened purity demands, environmental imperatives, and the imperative for end-to-end digital integration.

Assessing the Far-Reaching Effects of 2025 United States Tariff Measures on Ultra High Purity Anhydrous Hydrogen Chloride Supply Chains and Competitiveness

In 2025, a new wave of US tariff measures targeting specialty chemical imports introduced layerings of duties on ultra high purity specialty gases imported from select economies. These levies, imposed under broader trade action policies, have generated material shifts in procurement strategies as buyers confront higher landed costs and extended lead times. Consequently, many end users have pivoted toward local supply sources, fostering investment in domestic purification capacity and pre-emptive inventory management practices to mitigate potential disruptions and preserve operational continuity.

Moreover, the tariff environment has incentivized strategic collaborations between producers and industrial consumers to co-invest in regional distribution hubs. Such partnerships aim to streamline customs clearance, aggregate volumes for more favorable shipping terms, and jointly finance storage infrastructure that adheres to rigorous purity protection protocols. As a result, supply networks are becoming more resilient and geographically diversified, with an emphasis on nearshoring to reduce exposure to cross-border uncertainties. These adaptations underscore how fiscal policy has transcended mere cost implications to catalyze foundational changes in supply chain architecture and stakeholder engagement models.

Deciphering Critical Insights Across Grading, Supply Form Factors, End-User Verticals, and Distribution Routes in the Market

Insights into market segmentation reveal that product grades dictate application suitability and end-user adoption patterns. Electronic grade gas remains the cornerstone for lithography and etch processes in advanced semiconductor fabs, where tolerance for trace metals is negligible. Pharmaceutical grade variants are engineered to comply with stringent compendial standards and are increasingly utilized in active pharmaceutical ingredient manufacture owing to their acid-catalysis reliability. Reagent grade supplies, while less exacting in impurity thresholds, continue to fulfill foundational laboratory and pilot-scale requirements.

Supply form preferences further differentiate user cohorts, as bulk tank solutions offer economies of scale for major chemical producers and integrated wafer foundries. Cryogenic tanks, in particular, deliver superior temperature control, minimizing volumetric loss during storage. Conversely, standard tanks provide modularity for mid-tier sites. On the cylinder side, high pressure cylinders grant small labs and service providers the flexibility of portable delivery, while low pressure cylinders are favored for operations where incremental dosing precision is paramount.

End-user industry segmentation highlights divergent demand drivers across verticals. Biotechnology firms leverage the gas in bio-process pH adjustments, whereas chemicals and petrochemicals sectors rely on it for chlorination catalysts. Electronics manufacturers dominate volumetric consumption through wafer etch tool usage, while food and beverage operations apply it for acidulation. Pharmaceutical customers demand full compliance traceability, and semiconductor designers continue to push purity requirements as device nodes shrink.

The distribution channel landscape underscores how direct sales and distributor networks serve distinct priorities. Captive direct sales models enable major end users to synchronize procurement planning with plant expansions, while non-captive sales afford agility for opportunistic projects. OEM distributors reinforce application support through equipment integration services, whereas value-added distributors bundle supply with analytics and safety training to enhance customer value.

This comprehensive research report categorizes the Ultra High Purity Anhydrous Hydrogen Chloride Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Supply Form

- End-User Industry

- Distribution Channel

Unveiling Strategic Regional Dynamics and Demand Drivers Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics are shaping market growth trajectories in distinctive ways. Within the Americas, the United States leads the charge through its advanced semiconductor cluster and robust biotechnology research hubs, which demand consistent deliveries and zero-tolerance impurity levels. Canada has emerged as a dependable supply corridor, leveraging its proximity to key end markets and streamlined customs protocols to reduce lead times. Meanwhile, Brazil is fostering capacity expansion projects to serve its burgeoning chemicals industry, supported by governmental incentives for specialty gas infrastructure.

Across Europe, Middle East, and Africa, market activity is concentrated in chemical processing centers of Germany and the Netherlands, where established logistics networks facilitate efficient distribution. Investment in gas storage terminals across the Middle East is creating new export avenues, while North African nations are exploring regional supply partnerships to support local pharmaceutical manufacturing. These collaborative initiatives underscore a regional focus on integrating purity-critical gases into broader petrochemical and life sciences ecosystems.

In the Asia-Pacific realm, China remains the foremost producer, with large-scale purification facilities catering to both domestic consumption and export commitments. South Korea’s advanced wafer fabrication industry is driving incremental enhancements in gas specification, and Japan continues to demand the highest quality standards for its pharmaceutical and electronics segments. India’s market is rapidly evolving, as multinational companies establish on-shore capacity to circumvent logistical bottlenecks and align with national self-reliance objectives.

This comprehensive research report examines key regions that drive the evolution of the Ultra High Purity Anhydrous Hydrogen Chloride Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players’ Strategic Positioning, Innovation Roadmaps, and Collaborative Ventures Driving Market Leadership and Differentiation

Leading suppliers have strategically positioned themselves to capitalize on the increasing demand for ultra high purity specialty gases. Global players are investing in on-site generation units that enable large customers to produce hydrogen chloride on demand, thereby reducing the risk of supply interruptions. Concurrently, these firms are forging alliances with equipment manufacturers to integrate purification modules directly into gas delivery systems, offering turnkey solutions that simplify validation and regulatory compliance for end users.

In addition, several companies are pioneering digital platforms that centralize order management, track real-time inventory levels, and automate replenishment triggers. This confluence of digital innovation and supply chain integration not only enhances operational transparency but also fosters enduring partnerships across the value chain. Such strategic moves underscore a broader industry trend toward embedding advanced service offerings alongside product sales, reinforcing customer loyalty and differentiating corporate brands in a competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ultra High Purity Anhydrous Hydrogen Chloride Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- BASF SE

- Gulf Cryo Holding PJSC

- Inox Air Products Private Limited

- Iwatani Corporation

- Linde plc

- Messer Group GmbH

- Niacet Corporation

- Taiyo Nippon Sanso Corporation

- Wacker Chemie AG

Empowering Industry Stakeholders with Targeted Strategies to Enhance Supply Resilience, Cost Optimization, and Sustainable Growth Trajectories

Industry leaders are advised to adopt a multifaceted approach that balances cost efficiency with supply resilience. Establishing strategic stock buffering at regional hubs can mitigate the impact of unexpected trade disruptions, while collaborative investments in shared storage infrastructure can optimize capital expenditures. Furthermore, integrating digital supply chain tools will enhance visibility across supplier networks, enabling proactive risk management and streamlined logistics coordination.

Sustainability considerations should be embedded within process design and distribution decisions. Transitioning to low-emission purification technologies and exploring circular economy models for byproduct recovery can not only reduce environmental footprints but also create new value streams. By fostering cross-sector partnerships and engaging in targeted R&D initiatives, companies can develop differentiated gas grades and service offerings that align with evolving regulatory mandates and customer expectations.

Detailing Robust Research Frameworks and Mixed-Method Approaches Underpinning the Comprehensive Ultra High Purity Hydrogen Chloride Gas Analysis

The research underpinning this analysis combines primary and secondary methodologies to ensure comprehensive coverage. In-depth interviews with senior executives, process engineers, and procurement specialists provided firsthand insights into operational challenges and strategic priorities. These qualitative findings were triangulated with secondary data sourced from industry publications, trade associations, and regulatory filings to validate emerging trends and supply network configurations.

Quantitative modeling of trade flows and tariff schedules was complemented by supply chain mapping exercises that traced end-to-end delivery pathways. A rigorous segmentation framework was applied to classify products by grade, supply form, end-user industry, and distribution channel. All data were subjected to expert review panels to confirm accuracy and relevance, delivering a research foundation that supports actionable decision-making for stakeholders across the Ultra High Purity Anhydrous Hydrogen Chloride Gas market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ultra High Purity Anhydrous Hydrogen Chloride Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by Grade

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by Supply Form

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by End-User Industry

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by Distribution Channel

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by Region

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by Group

- Ultra High Purity Anhydrous Hydrogen Chloride Gas Market, by Country

- United States Ultra High Purity Anhydrous Hydrogen Chloride Gas Market

- China Ultra High Purity Anhydrous Hydrogen Chloride Gas Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Illuminate Key Takeaways and Strategic Imperatives for Ultra High Purity Hydrogen Chloride Gas Stakeholders

The convergence of advanced purification technologies, evolving regulatory landscapes, and shifting trade policies has created a dynamic environment for ultra high purity anhydrous hydrogen chloride gas stakeholders. Key takeaways emphasize the imperatives of supply chain diversification, digital integration, and collaborative infrastructure investments as essential strategies to navigate rising complexity and cost pressures.

As industries from semiconductors to pharmaceuticals continue to push the boundaries of purity requirements, responsiveness to regional developments and tariff impacts will define competitive advantage. By synthesizing core insights on segmentation, regional dynamics, and leading company strategies, this analysis equips decision-makers with the clarity and foresight needed to capitalize on opportunities and address emerging risks throughout the gas value chain.

Connect with Ketan Rohom to Gain Exclusive Insights and Secure Access to the Definitive Market Research Report on Ultra High Purity Hydrogen Chloride Gas

Unlock unparalleled strategic insights and gain the competitive edge your organization needs by securing the comprehensive Ultra High Purity Anhydrous Hydrogen Chloride Gas Market Research Report. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore the full spectrum of analytical depth and actionable intelligence contained within this definitive study. His expertise and personalized guidance will ensure that you receive targeted recommendations and tailored support to optimize your supply strategy, strengthen stakeholder collaboration, and drive sustainable growth. Connect with Ketan today to transform raw data into strategic advantage and position your enterprise at the forefront of innovation and excellence in this critical specialty gas sector.

- How big is the Ultra High Purity Anhydrous Hydrogen Chloride Gas Market?

- What is the Ultra High Purity Anhydrous Hydrogen Chloride Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?