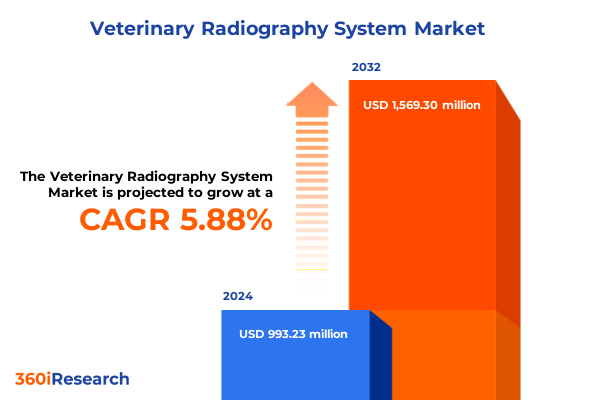

The Veterinary Radiography System Market size was estimated at USD 1.04 billion in 2025 and expected to reach USD 1.11 billion in 2026, at a CAGR of 5.92% to reach USD 1.56 billion by 2032.

Unveiling the Transformative Power of Next-Generation Veterinary Radiography Systems to Enhance Diagnostic Precision and Clinical Workflows

Veterinary radiography systems have emerged as indispensable diagnostic tools that bridge the gap between clinical intuition and objective image-based insights. At the heart of these systems lie two core technologies: computed radiography, which leverages phosphor imaging plates to capture detailed X-ray exposures, and digital radiography, which harnesses advanced detector arrays for real-time image acquisition. Computed radiography continues to offer a cost-effective, high-resolution alternative for practices upgrading from analog workflows, while digital radiography systems-deploying charge coupled device, complementary metal oxide semiconductor, and flat panel detectors-deliver instantaneous image display, streamlined workflows, and enhanced diagnostic clarity. Through seamless integration with digital archiving platforms and image management software, veterinary practices can now optimize case throughput, facilitate multidisciplinary reviews, and ensure consistent record keeping.

How Digital Innovation, Artificial Intelligence, and Portable Hardware Are Redefining the Veterinary Radiography Landscape for Unprecedented Care Delivery

In recent years, the veterinary radiography landscape has undergone a profound metamorphosis driven by digital innovation, artificial intelligence, and hardware miniaturization. The advent of AI-enabled image analysis modules now empowers clinicians to detect subtle pathologies, quantify radiographic markers, and prioritize cases requiring immediate intervention, effectively reducing diagnostic turnaround times and mitigating the risk of oversight. These intelligent systems operate in tandem with picture archiving and communication frameworks, ensuring that every pixel of data contributes to a data-driven approach to animal health management.

Examining the Chain Reaction of United States Tariff Adjustments in 2025 on Veterinary Radiography Supply Chains and Equipment Accessibility

In 2025, a recalibration of United States tariff schedules targeted medical imaging components, imposing higher duties on imported detector elements, power supplies, and precision manufacturing materials integral to veterinary radiography systems. This policy adjustment has amplified production expenses for original equipment manufacturers and introduced new pricing pressures across the value chain. As vendors recalibrate price lists to accommodate elevated input costs, end users must weigh the imperative for advanced imaging capabilities against evolving budgetary constraints.

Delineating Crucial Segmentation Patterns That Illuminate Usage Behaviors and Purchase Drivers Across Veterinary Radiography Market Segments

A nuanced understanding of market segmentation reveals how diverse system configurations, portability options, animal categories, end-user environments, and distribution pathways shape purchasing behavior and technology adoption. Systems differentiated by core process-computed radiography versus digital radiography-cater to distinct practice profiles, with digital radiography further diversified by sensor technology spanning charge coupled devices, complementary metal oxide semiconductors, and flat panel detectors. Portability emerges as a critical determinant, as fixed installations in hospital settings contrast with handheld and trolley-mounted portable units tailored for field operations and ambulatory care. Distinctions between large and small animal facilities elucidate variations in equipment footfall, with specialized configurations for bovine and equine diagnostics complementing those optimized for canine and feline patients. End-user channels, from dedicated diagnostic centers and mobile service units to veterinary clinics and hospitals, inform service models, with equine mobile and small animal mobile units extending diagnostic reach. Finally, direct sales relationships and distributor partnerships influence procurement timelines, service agreements, and lifecycle support models.

This comprehensive research report categorizes the Veterinary Radiography System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Portability

- Animal Type

- End User

- Distribution Channel

Unearthing Regional Dynamics Shaping Veterinary Radiography Adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in dictating veterinary radiography adoption patterns and clinical workflows. In the Americas, robust veterinary infrastructure, high pet ownership rates, and established reimbursement frameworks underpin a resilient market environment, with North America leading in the deployment of advanced digital and AI-enhanced imaging solutions. In Europe, Middle East & Africa, regulatory harmonization and cross-border telemedicine initiatives foster collaborative diagnostic networks, while rising demand for portable and point-of-care systems addresses the needs of pastoral and remote herds. The Asia-Pacific region is characterized by accelerating investment in veterinary training, rapid expansion of diagnostic center networks, and growing interest in affordable digital radiography offerings-factors that collectively drive the uptake of both fixed and mobile imaging modalities across emerging and mature markets alike.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Radiography System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Veterinary Radiography Innovators and Their Strategic Initiatives That Are Shaping Competitive Dynamics Globally

The competitive terrain of veterinary radiography systems is defined by a diverse array of manufacturers prioritizing technological leadership, service excellence, and strategic partnerships. Market stalwarts such as Canon U.S.A., Carestream Health, and Fujifilm Holdings America have solidified their positions through continuous innovation in detector design, dose reduction technologies, and integrated software suites. GE Healthcare and Excelsior Union Limited bring extensive imaging portfolios and global support networks, while specialized providers like Sound, a VCA Company, and United Radiology Systems focus exclusively on veterinary workflows, tailoring system ergonomics and veterinary-specific protocols. Emerging competitors-including OzarkImaging, Triangle X-Ray Company, and Merry X-Ray-leverage agile development cycles and targeted customer engagement to carve niche positions. Together, these organizations shape an ecosystem of collaborative development, competitive differentiation, and relentless pursuit of imaging excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Radiography System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Canon Inc.

- Carestream Health

- E.I. Medical Imaging

- Esaote S.p.A.

- Fujifilm Holdings Corporation

- GE Healthcare

- Heska Corporation

- IDEXX Laboratories, Inc.

- IMV imaging

- Konica Minolta, Inc.

- Mindray Medical International Limited

- Sedecal

- Shimadzu Corporation

- Siemens Healthineers

Strategic Imperatives for Veterinary Imaging Leaders to Navigate Market Disruptions, Technology Adoption, and Supply Chain Resilience

To thrive amidst shifting trade policies, accelerating technology cycles, and evolving clinical demands, industry leaders should prioritize strategic imperatives that reinforce operational resilience. First, cultivating end-to-end supply chain flexibility-through the qualification of domestic component suppliers and adaptive inventory management-will mitigate tariff-induced cost volatility. Simultaneously, accelerating digital transformation initiatives by upgrading legacy computed radiography installations to next-generation digital radiography platforms can unlock workflow efficiencies and improve diagnostic throughput. Investing in targeted training programs for veterinary radiologists and radiographers will bridge the skills gap and maximize the value of AI-augmented imaging tools. Furthermore, forging alliances with telemedicine and cloud service providers can expand service footprints, enabling remote consultation, image sharing, and collaborative case reviews across geographically dispersed networks. Finally, developing modular service offerings that bundle hardware, software, and support under unified subscription models will enhance revenue predictability and lower entry barriers for smaller practices.

Adopting a Rigorous Research Framework Integrating Primary Insights and Secondary Data to Ensure Robust Veterinary Market Intelligence

This research leverages a blended methodology that integrates quantitative data gathering with qualitative expert insights to deliver a comprehensive and balanced perspective. Secondary research encompasses a systematic review of industry publications, regulatory filings, and patent databases to map technological advancements and competitive moves. Primary research includes structured interviews with senior executives, veterinary radiologists, and procurement specialists to validate assumptions, capture emerging needs, and gauge adoption barriers. Data triangulation ensures cross-validation across multiple sources, while scenario analysis assesses the potential impact of regulatory changes and tariff adjustments. Finally, an iterative feedback protocol with industry stakeholders refines the analysis, ensures actionable relevance, and underpins the report’s methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Radiography System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Radiography System Market, by System Type

- Veterinary Radiography System Market, by Portability

- Veterinary Radiography System Market, by Animal Type

- Veterinary Radiography System Market, by End User

- Veterinary Radiography System Market, by Distribution Channel

- Veterinary Radiography System Market, by Region

- Veterinary Radiography System Market, by Group

- Veterinary Radiography System Market, by Country

- United States Veterinary Radiography System Market

- China Veterinary Radiography System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways to Chart the Future of Veterinary Radiography Systems Amidst Emerging Technologies and Market Shifts

The veterinary radiography systems market stands at a pivotal juncture, shaped by the dual engines of technological innovation and dynamic policy landscapes. Digital radiography’s ascendancy-fortified by AI-driven image analysis-heralds a new era of diagnostic precision, while mobile and telemedicine-enabled modalities extend the reach of high-quality imaging services. Tariff adjustments in 2025 underscore the importance of supply chain agility and strategic sourcing to sustain cost-effective equipment deployment. As practices navigate segmentation complexities and regional heterogeneity, alignment on platform interoperability, workforce development, and value-based service models will prove critical. By assimilating these insights into strategic planning, stakeholders can not only address current operational challenges but also anticipate future shifts in veterinary care delivery.

Seize Exclusive Insights and Drive Informed Decisions—Engage with Ketan Rohom to Acquire the Comprehensive Veterinary Radiography System Market Study

To harness the full potential of this comprehensive veterinary radiography systems analysis, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored research packages and licensing arrangements. Engage in a direct conversation with Ketan to clarify specific market applications, discuss bespoke data delivery options, or schedule an in-depth briefing that aligns with your organization’s strategic goals. By partnering with Ketan, you gain privileged access to actionable insights, expert interpretations, and ongoing support, ensuring you are equipped to make informed capital allocation decisions and technology investments. Connect with Ketan today to secure your copy of the report and propel your veterinary imaging initiatives with the definitive market intelligence resource.

- How big is the Veterinary Radiography System Market?

- What is the Veterinary Radiography System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?