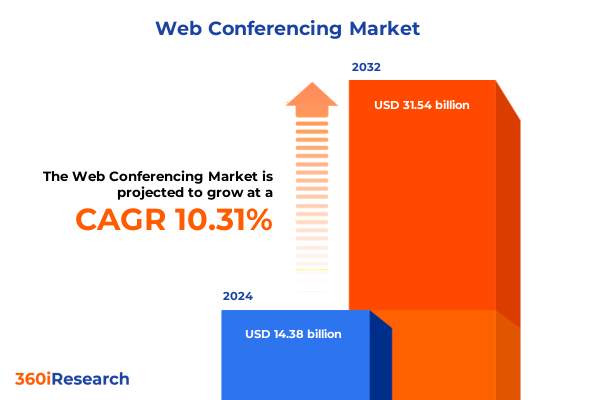

The Web Conferencing Market size was estimated at USD 15.80 billion in 2025 and expected to reach USD 17.37 billion in 2026, at a CAGR of 10.37% to reach USD 31.54 billion by 2032.

Navigating the New Era of Web Conferencing to Drive Seamless Hybrid Collaboration and Digital Transformation Across Industries

Web conferencing has evolved from a simple meeting tool into a critical component of digital business transformation. Organizations across sectors are integrating advanced collaboration platforms to maintain productivity, enhance customer engagement, and streamline internal operations. This phenomenon has accelerated in response to the widespread adoption of hybrid work arrangements, where seamless virtual collaboration is no longer a convenience but a necessity.

As remote and in-office teams converge on unified communication platforms, the emphasis on reliability, security, and user experience has intensified. In parallel, technological advancements such as high-definition video, low-latency audio, and robust encryption standards have elevated user expectations. Furthermore, the integration of collaboration tools with broader enterprise systems-from customer relationship management to learning management systems-has created a complex ecosystem that demands strategic oversight and continuous innovation.

Uncovering How Hybrid Work Models AI Innovations and Security Enhancements Are Redefining Web Conferencing Use and Engagement

The web conferencing landscape is undergoing transformative shifts driven by the convergence of hybrid work models, AI innovations, and heightened security requirements. Hybrid work has emerged as a dominant paradigm, compelling solution providers to optimize platforms for both in-office and remote participants, ensuring equitable audio and video experiences regardless of location. Concurrently, artificial intelligence is being embedded into platforms to automate meeting summaries, provide real-time language translation, and suppress background noise, thereby enhancing meeting efficiency and inclusivity.

In addition, the emphasis on user experience has led vendors to invest in intuitive interfaces, rapid onboarding, and seamless integrations with collaborative tools like virtual whiteboards and project management systems. Security remains paramount as organizations seek to protect sensitive discussions and safeguard data across distributed endpoints. Consequently, advanced encryption protocols and compliance certifications are becoming standard offerings, reinforcing trust in virtual communication environments.

Assessing the Far Reaching Effects of the 2025 United States Trade Tariffs on Web Conferencing Equipment Supply Chains and Costs

New United States trade tariffs effective in 2025 have significantly impacted the cost structure of audio-visual and web conferencing equipment. Industry professionals report immediate price hikes on essential hardware, with select devices facing duties ranging from 10% to 46%, directly affecting budget forecasts and procurement timelines. Integrators and end users have observed that price increases are often passed down the supply chain, squeezing margins or prompting scope adjustments for conference room projects.

These tariff measures have also prompted a strategic reevaluation of global sourcing strategies. Vendors are exploring alternate manufacturing hubs in regions with lower duty exposure, yet transitioning production lines involves logistical challenges and potential delays. As a result, organizations are grappling with extended lead times and uncertain availability of critical conferencing components, driving a renewed focus on inventory planning, demand forecasting, and vendor diversification to mitigate supply chain risks.

Exploring Critical Segmentation Layers to Unveil Component Type Deployment and Industry Vertical Dynamics Shaping Web Conferencing Solutions

A comprehensive understanding of the web conferencing market requires a multi-layer segmentation framework that captures the full spectrum of solutions. By component, offerings fall into software platforms and services, the latter encompassing managed services for system administration and professional services delivering consulting, training, and support expertise. Conferencing types span audio-only calls, screen sharing and remote access tools, immersive video conferencing suites, large-scale webcasting infrastructure, and interactive webinar platforms for high-volume engagement.

Organizational adoption patterns are influenced by enterprise size, with solutions tailored for large global corporations, mid-market enterprises, and small or micro businesses with lean IT resources. The choice of device-ranging from mobile devices and laptops to tablets-impacts user experience and deployment logistics. Deployment models are typically cloud-native for rapid scalability and remote management or on-premises to meet stringent security or regulatory requirements. Application segments reflect diverse use cases, including education and training, enterprise communication, marketing and client engagement, sales and customer service, remote IT support, and telehealth. Finally, industry verticals such as banking, education, energy, government, healthcare, IT, manufacturing, media, and retail exhibit distinct collaboration needs driven by sector-specific workflows and compliance mandates.

This comprehensive research report categorizes the Web Conferencing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Conferencing Type

- Organization Size

- Device Type

- Deployment Type

- Application

- Industry Vertical

Revealing Regional Differences from the Americas to EMEA and Asia Pacific That Are Driving Distinct Web Conferencing Adoption Patterns

Regional dynamics are shaping the adoption and evolution of web conferencing technologies in unique ways. In the Americas, North America leads with a substantial share of global usage, driven by large-scale hybrid work deployments and ongoing investments in cloud collaboration solutions. Despite economic headwinds in certain sectors, organizations continue to prioritize modernizing meeting spaces and integrating AI-powered features into everyday workflows.

In Europe, the Middle East, and Africa, growth is moderated by a mix of regulatory complexities and economic variability. While established markets in Western Europe show steady demand for advanced systems, emerging economies in the Middle East and Africa present greenfield opportunities, particularly as digital infrastructure matures and regional hubs invest in technology-led productivity gains.

Across Asia-Pacific, the emphasis on workspace modernization and AI-driven device enhancements has led to double-digit growth in conferencing hardware adoption. Organizations in this region are embracing immersive meeting solutions and energy-efficient devices, reflecting broader sustainability goals alongside technological innovation.

This comprehensive research report examines key regions that drive the evolution of the Web Conferencing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Moves of Leading Web Conferencing Vendors Zoom Microsoft Teams and Cisco in Their Race to Innovate and Expand

Leading vendors are aggressively innovating to capture market leadership in web conferencing. Zoom continues to expand its product portfolio with AI-powered collaboration tools and has raised its revenue forecast for fiscal 2025, reflecting robust enterprise demand and a strategic share repurchase program. Amazon’s decision to standardize on Zoom for internal meetings underscores the platform’s connectivity strengths and external ecosystem integrations.

Microsoft Teams is enhancing its hardware ecosystem with certified devices such as headsets, cameras, and audio kits optimized for unified communications. Recent releases include dongle-free Bluetooth headsets with hybrid active noise cancellation and AI-driven video bars for small to large meeting rooms. These investments demonstrate Microsoft’s commitment to delivering end-to-end collaboration solutions within its productivity suite.

Cisco Webex is doubling down on AI assistance and immersive experiences, launching intelligent summaries, interactive Vidcast tools for content creation, and spatial meeting capabilities for mixed-reality engagement. Cisco’s AI-powered Customer Experience portfolio and on-premises sovereign controls cater to regulated industries, reinforcing its position in enterprise contact centers and secure collaboration environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Web Conferencing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- AT&T, Inc.

- Avaya LLC

- Bridgit Inc.

- Cafex Communications Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc

- Communiqué Conferencing, Inc.

- Dialpad, Inc.

- Enghouse Systems Limited

- Glance Networks, Inc.

- Google LLC by Alphabet Inc.

- GoTo Technologies Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- QUOBIS NETWORKS, SLU.

- RHUB Communications, Inc.

- RingCentral, Inc.

- Verizon Communications Inc.

- Windstream Communications Inc.

- Zoom Video Communications, Inc

- ZTE Corporation

Delivering Practical Strategies for Industry Leaders to Leverage Technology Trends Optimize Investments and Strengthen Competitive Positioning

To navigate this dynamic environment, industry leaders should prioritize strategic investments in AI and automation technologies that streamline meeting setup, content generation, and post-meeting analytics. By leveraging AI assistants and real-time insights, organizations can minimize administrative overhead and focus on high-value collaboration outcomes.

Supply chain resilience is critical; enterprises must diversify vendor portfolios and establish local or regional sourcing options to mitigate tariff impacts and avoid project delays. Scenario planning for hardware procurement, including buffer inventory strategies and alternate manufacturing partnerships, will reduce exposure to global trade fluctuations.

Moreover, investments in user training and support services will enhance technology adoption rates and maximize return on collaboration tools. By deploying tailored training programs and managed services, organizations can ensure that employees extract full value from advanced conferencing features. Finally, a focus on sustainability through energy-efficient devices and green data-center initiatives will align technological modernization with corporate ESG objectives, strengthening brand reputation and meeting regulatory demands.

Detailing a Transparent and Rigorous Research Approach Combining Primary Interviews Secondary Data and Data Triangulation for Credible Insights

This research integrates a blend of primary and secondary methodologies to deliver comprehensive market insights. Primary research included in-depth interviews with industry stakeholders-ranging from IT directors and procurement managers to technology integrators and end-users-to capture firsthand perspectives on emerging challenges and solution preferences.

Secondary research involved a rigorous review of publicly available information, including press releases, regulatory filings, industry blogs, and reputable news sources. Data triangulation techniques were applied to cross-verify findings, ensuring consistency and validity across multiple information streams.

The segmentation framework was developed through close analysis of component types, conferencing modalities, organization sizes, device form factors, deployment models, applications, and vertical markets. This structured approach enables granular understanding of adoption drivers and investment priorities, while the regional analysis leverages both qualitative and quantitative indicators to map differing market maturities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Web Conferencing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Web Conferencing Market, by Component

- Web Conferencing Market, by Conferencing Type

- Web Conferencing Market, by Organization Size

- Web Conferencing Market, by Device Type

- Web Conferencing Market, by Deployment Type

- Web Conferencing Market, by Application

- Web Conferencing Market, by Industry Vertical

- Web Conferencing Market, by Region

- Web Conferencing Market, by Group

- Web Conferencing Market, by Country

- United States Web Conferencing Market

- China Web Conferencing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing Key Takeaways on Industry Transformations Strategic Imperatives and Market Dynamics Guiding Future Web Conferencing Investments

The web conferencing sector stands at a pivotal juncture, propelled by hybrid work mandates and the infusion of AI-driven capabilities that redefine virtual collaboration experiences. While technological advances unlock new productivity avenues, external factors such as trade tariffs and supply chain vulnerabilities necessitate strategic agility.

Segmentation analysis highlights the necessity for organizations to tailor solution portfolios by component, conferencing type, enterprise size, device preference, deployment model, application use-case, and vertical requirements. Regional insights demonstrate that growth trajectories differ across the Americas, EMEA, and Asia-Pacific, underscoring the value of localized strategies.

Key vendor innovations by Zoom, Microsoft, and Cisco illustrate the competitive imperative to enhance AI functionalities, device ecosystems, and integration capabilities. In response, actionable recommendations call for investment in AI-enabled workflows, supply chain diversification, user enablement, and sustainable practices. Collectively, these strategic imperatives will enable organizations to harness the full potential of web conferencing technologies and sustain a competitive edge in an evolving digital landscape.

Connect with Ketan Rohom to Secure Invaluable Market Intelligence Purchase the Comprehensive Web Conferencing Report and Drive Your Strategic Decisions

For tailored insights and to stay ahead in the dynamic web conferencing landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan is available to discuss how our comprehensive report can address your organization’s specific needs and empower your decision-making with in-depth analysis. Don’t miss the opportunity to leverage our expertly curated data and strategic recommendations to optimize your collaboration investments and drive sustained business growth. Contact Ketan today to secure your copy of the full market research report and unlock actionable intelligence that will shape your future success

- How big is the Web Conferencing Market?

- What is the Web Conferencing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?