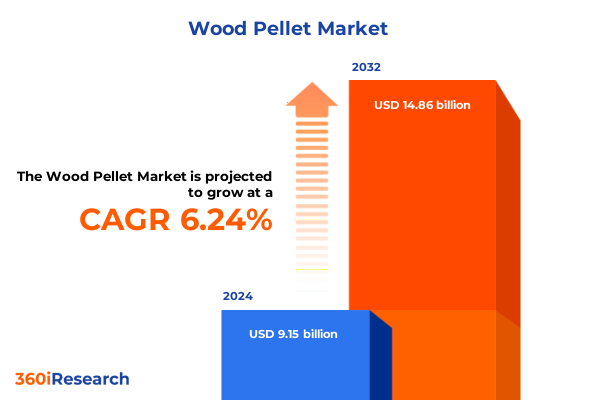

The Wood Pellet Market size was estimated at USD 9.70 billion in 2025 and expected to reach USD 10.28 billion in 2026, at a CAGR of 6.28% to reach USD 14.86 billion by 2032.

Unveiling the Rising Prominence of Wood Pellets as a Sustainable Energy Solution Amidst Global Environmental and Supply Chain Dynamics

The global energy transition is accelerating demand for renewable fuel sources and wood pellets have emerged as a critical component of sustainable biomass energy strategies. As governments and enterprises intensify efforts to reduce carbon footprints and comply with stringent emissions regulations the wood pellet sector is experiencing a profound elevation in strategic importance. Heightened awareness around circular economy principles is propelling the adoption of this low-carbon alternative in both industrial and residential applications. Meanwhile supply chain complexities from raw material sourcing to distribution logistics are reshaping competitive dynamics and driving innovation across the value chain.

This executive summary distills essential findings from a comprehensive study of the wood pellet market, offering decision-makers a clear view of transformative trends regulatory influences and critical success factors. We explore paradigm shifts driven by technological advancements and evolving policy frameworks before unpacking the tangible outcomes of recent tariff measures in the United States. Deep segmentation and regional insights illuminate nuanced demand drivers while profiles of leading market participants reveal strategic positioning and emerging competitive edges. Concluding with actionable recommendations this summary equips stakeholders with the perspectives needed to navigate an increasingly complex and opportunity-rich landscape.

Exploring the Dramatic Evolution of the Wood Pellet Sector Driven by Technological Innovations and Sustainability Imperatives

Over the past decade the wood pellet industry has undergone remarkable metamorphosis spurred by advancements in production technologies and heightened sustainability mandates. Pellet mills leveraging precision moisture control and densification techniques now deliver consistently high calorific value fuels that meet rigorous industrial specifications. Concurrently novel pelletization processes utilize alternative feedstocks such as agricultural residues and waste wood to address raw material constraints and bolster circular economy goals. These innovations have catalyzed a shift from single-purpose heating applications to diversified end uses spanning power generation cement kilns and large-scale commercial heating systems.

In parallel the regulatory landscape has grown increasingly supportive of biomass energy with incentive schemes and renewable portfolio standards driving off-taker commitments. Carbon pricing mechanisms and emissions trading systems have further enhanced the economic viability of wood pellets relative to fossil fuels. As a result, this sector is transitioning into a mature market characterized by integrated supply chains, strategic partnerships and cross-sector collaboration. The net effect is a marketplace where agility and sustainability credentials are becoming core determinants of competitive advantage.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on Wood Pellet Trade Flows and Industry Competitiveness

The 2025 tranche of United States tariffs has imposed a cumulative effect on import dynamics, compelling strategic realignments across the wood pellet value chain. Elevated duties have eroded cost competitiveness for suppliers reliant on transatlantic and transpacific shipments, prompting end-users to diversify sourcing strategies and accelerate vertical integration. Domestic producers have seized the opportunity to expand capacity and optimize planting cycles to capitalize on growing internal demand. Conversely international exporters have pursued tariff mitigation through tariff rate quotas and negotiated supply agreements to preserve market access.

These policy actions have also stimulated closer alignment between producers and off-takers, with offtake agreements incorporating price adjustment clauses to share tariff risk. Meanwhile logistics providers and freight forwarders are recalibrating shipping schedules and modal mixes to offset increased border costs. Ultimately the sustained impact of the 2025 tariff measures is a more resilient and regionally anchored supply network, underpinned by collaborative risk management and agile procurement practices that reduce exposure to external cost shocks.

Revealing In-Depth Segmentation Dynamics Shaping the Wood Pellet Market Across Product Type Raw Material Application and Distribution Channels

Segmentation analysis reveals distinct performance contours across product classifications, raw material sources, application domains and distribution pathways. The delineation among food-grade wood pellets, premium wood pellets and standard wood pellets underscores variances in quality specifications and end-use alignment, with food-grade variants commanding stringent purity and consistency criteria for agricultural markets. From a raw material perspective the distinction between hardwood inputs such as birch maple and oak softwood feedstocks like fir pine and spruce and alternative sources including sawdust and wood chips highlights contrasting supply chains and sustainability credentials.

Looking at applications, the landscape extends beyond absorbents and animal bedding into commercial heating contexts and industrial deployments such as cement kilns and power generation, while residential installation options span fireplaces pellet furnaces and stove systems. The distribution spectrum encompasses both offline retail channels typified by hardware stores and specialty shops and the burgeoning influence of online retail platforms enabling broader market reach. Integration of these segmentation insights illuminates how tailored product portfolios and channel strategies can optimize value capture and deepen market penetration within specific end-use ecosystems.

This comprehensive research report categorizes the Wood Pellet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Raw Material

- Grade

- Application

- Distribution Channel

Illuminating Regional Variations Highlighting the Distinct Wood Pellet Market Dynamics Across the Americas EMEA and Asia Pacific Regions

Regional analysis highlights divergent growth drivers and policy frameworks shaping wood pellet deployment across the Americas Europe Middle East and Africa and Asia Pacific regions. In the Americas climate imperatives and robust renewable energy mandates have sustained strong demand for bioenergy solutions with modernized pellet mills scaling up output to meet both domestic and export commitments. Europe the Middle East and Africa exhibit a patchwork of regulatory incentives from the European Union’s renewable energy directive to national heating subsidies that are facilitating a transition from fossil heating toward biomass alternatives.

Across Asia Pacific burgeoning industrial power requirements and urbanization trends are fueling interest in bio-based heat and power applications, though resource competition and land use considerations underpin calls for sustainability certifications and transparent supply mechanisms. Emerging initiatives in Southeast Asia and Oceania are investing in feedstock cultivation and logistic infrastructure to unlock latent potential while stringent compliance regimes ensure that environmental safeguards keep pace with market expansion. Collectively these regional contours underscore the necessity of tailoring strategic approaches to local policy, resource availability and end-user demand profiles.

This comprehensive research report examines key regions that drive the evolution of the Wood Pellet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Showcasing Strategic Positions and Innovations Driving Growth in the Wood Pellet Sector

Leading participants across the wood pellet landscape are deploying differentiated strategies to consolidate competitive advantage. Integrated forest owners and pellet producers are leveraging control of raw material sources to secure feedstock continuity while enhancing sustainability credentials through third-party certification schemes. Technology-focused firms are investing in advanced densification and torrefaction processes to deliver higher-energy-density products that meet rigorous industrial specifications and reduce transportation costs.

Downstream players are forging strategic alliances with logistics providers to optimize cold-chain distribution and improve supply reliability under fluctuating tariff regimes. Collaborative ventures between energy utilities and pellet suppliers are streamlining procurement through long-term offtake agreements that embed flexibility mechanisms tied to carbon pricing indices. Companies committed to digital transformation are implementing real-time monitoring and quality assurance systems to uphold product consistency and traceability, thereby strengthening trust with both commercial and residential end-users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wood Pellet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A Group Archimbaud's Company

- Ambienta Sgr S.p.A.

- An Viet Phat Energy Co., Ltd.

- AS Graanul Invest

- Ayo Biomass

- Biomass Vietnam JSC (BVN)

- CSE Biomass

- Dongguan FREETO Medical Technology Co., LTD

- Drax Group PLC

- Duraflame Inc.

- Eco Energy One Co., Ltd

- Ecowood Pellets

- Energex Corporation

- Enviva Inc.

- Farm Fuels

- FORESTALIA RENOVABLES SL

- Fram Renewable Fuels LLC

- Furtado Farms Cookwood

- Grilla Grills by American Outdoor Brands, Inc.

- Groupe Savoie Inc.

- Highland Pellets, LLC.

- I.C.S. (Lacroix) Lumber Inc.

- Land Energy Girvan Limited

- Lauzon Hardwood

- Lignetics, Inc.

- Mallard Creek Inc.

- Mann Lake Bee & Ag Supply

- Mayr-Melnhof Holz Holding AG

- Midland Bio Energy Ltd.

- Naparpellet

- Pfeifer Holding GmbH

- PREMIUM PELLETS s.r.o.

- Quality Box (1971) Ltd.

- Schwaiger Holzindustrie GmbH & Co. KG

- Segezha-Group

- Sinclar Group Forest Products

- Stanford Sonoma Corp.

- TANAC

- TotalEnergies SE

- TPN Green Innovation Co., Ltd.

- Traeger, Inc.

- United Group

- Valfei Products Inc.

- Vermont Wood Pellet Company

- Wood & Sons

- Wooder Ukraine LLC

- Woodyfuel Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Evolving Wood Pellet Environment

Industry leaders seeking to fortify market positions should prioritize diversification of feedstock portfolios by integrating waste wood streams and exploring partnerships for agricultural residue utilization. Cultivating resilient supply chains involves establishing regional processing hubs and embedding tariff-pass-through clauses within contractual frameworks to mitigate policy-driven cost volatility. Equally critical is the adoption of energy-efficient pelletization technologies and investment in torrefaction to produce premium high-calorific products that address industrial heating requirements and command differentiated pricing.

Furthermore commercial viability can be enhanced by cultivating integrated service offerings that bundle logistics consulting and after-sales maintenance for pellet stoves and furnaces. Stakeholders should also engage proactively in policy dialogues to shape incentive structures and carbon accounting methodologies that recognize biomass’s decarbonization contributions. Finally advancing digitalization across operations from feedstock procurement to customer relationship management will underpin operational excellence and foster agility in responding to emergent market shifts.

Outlining Rigorous Research Methods Employed to Ensure Data Integrity and Analytical Rigor in the Wood Pellet Market Assessment

This market assessment leverages a mixed-methods research design encompassing primary interviews with industry executives technical experts and regulatory authorities alongside extensive secondary data collection from publicly available policy documents trade statistics and sustainability certification bodies. Geospatial analysis of feedstock distribution patterns was conducted using satellite imagery and supply chain mapping tools to quantify feedstock accessibility and transportation corridors. Product quality parameters were validated through lab testing protocols aligned with international standards to ensure comparability across production geographies.

Quantitative data modeling employed scenario analysis frameworks to explore tariff impact sensitivities and supply-demand realignment under varied policy regimes. Case studies of strategic partnerships illustrate best practices in vertical integration and technology deployment. Quality controls included rigorous peer review of findings by sector specialists and method triangulation to reconcile discrepancies across data sources. Ethical considerations were observed in all primary engagements with confidentiality agreements and data anonymization measures preserving participant privacy and proprietary sensitivities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wood Pellet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wood Pellet Market, by Raw Material

- Wood Pellet Market, by Grade

- Wood Pellet Market, by Application

- Wood Pellet Market, by Distribution Channel

- Wood Pellet Market, by Region

- Wood Pellet Market, by Group

- Wood Pellet Market, by Country

- United States Wood Pellet Market

- China Wood Pellet Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Critical Takeaways Emphasizing Future Directions and the Strategic Importance of Wood Pellets in a Decarbonizing Energy Landscape

Wood pellets are poised to play a central role in global decarbonization initiatives by offering a versatile renewable fuel that bridges industrial heating and power generation gaps. The convergence of advanced production methods stringent sustainability standards and supportive policy frameworks has elevated the sector from niche heating applications to a cornerstone of renewable energy strategies. Regional differentiation underscores the importance of agile business models tailored to local feedstock availability regulatory environments and end-user preferences.

As tariff landscapes evolve and competitive pressures intensify the ability to innovate across feedstock sourcing product quality and distribution channels will separate leaders from followers. Organizations that successfully integrate advanced technologies, digitalization and strategic partnerships will be best positioned to capture the full potential of wood pellets as a low-carbon energy solution. The insights presented here offer a roadmap for stakeholders to navigate complexities and align their efforts with broader climate and energy objectives.

Partner with Ketan Rohom to Secure Your Comprehensive Wood Pellet Market Intelligence Report and Stay Ahead in a Rapidly Transforming Energy Sector

If your organization is ready to leverage unparalleled insights into the dynamic wood pellet marketplace reach out directly to Ketan Rohom Associate Director Sales & Marketing at 360iResearch to secure your copy of the comprehensive market research report Discover how you can transform strategic planning accelerate growth and seize emerging opportunities with the guidance of cutting-edge data and expert analysis

- How big is the Wood Pellet Market?

- What is the Wood Pellet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?