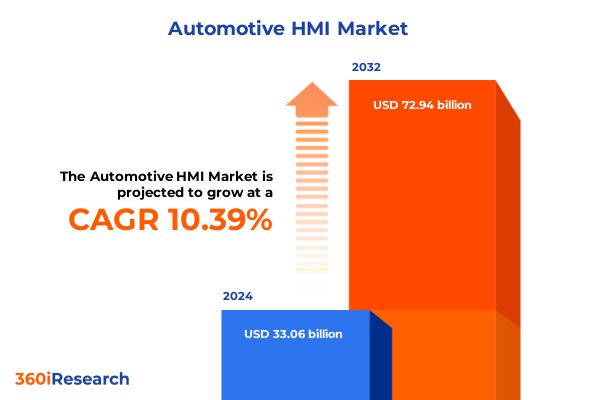

The Automotive HMI Market size was estimated at USD 36.24 billion in 2025 and expected to reach USD 39.73 billion in 2026, at a CAGR of 10.50% to reach USD 72.94 billion by 2032.

Unveiling the Dawn of Intelligent Vehicle Interfaces That Redefine the Driver Experience and Safety

The automotive landscape is undergoing a paradigm shift where vehicles are no longer simple machines but become intelligent partners in the driving journey. At the heart of this evolution lies the human machine interface which serves as the critical bridge between driver intent and vehicular response. Far beyond the days of basic dials and switches, modern HMIs integrate advanced display technologies, intuitive voice and gesture controls, and artificial intelligence that anticipates user needs.

This report delves into how human machine interfaces are redefining the in–car experience by enhancing safety, personalization, and connectivity. It outlines the drivers behind this transformation including regulatory mandates for advanced driver assistance systems, consumer demand for seamless digital ecosystems, and the burgeoning shift toward electrified mobility. By examining the interplay of hardware innovations and software intelligence, we establish a foundation for understanding where the market stands and where it is headed.

Mapping the Convergence of Electrified Mobility Connectivity and AI That’s Revolutionizing Cockpit Interactions

The past few years have witnessed an explosive acceleration in user–centric automotive technologies as consumer expectations converge with digital lifestyles. Vehicle cockpits are morphing into immersive environments where head–up displays overlay critical information directly in the driver’s line of sight, while advanced gesture recognition and haptic feedback replace traditional button presses. Simultaneously, AI–driven voice assistants have evolved to understand natural language nuances, enabling hands–free control of climate, navigation, and media systems.

In parallel, the surge in electric vehicle adoption and software–defined vehicle architectures has elevated the role of over–the–air updates and centralized computing, allowing continuous feature enhancements post–purchase. These transformative shifts demand that OEMs and Tier–1 suppliers rethink development cycles, prioritizing modular, scalable platforms over bespoke, hardware–locked designs. As a result, the HMI ecosystem is moving toward standardized software stacks and flexible hardware interfaces that can keep pace with rapid innovation.

Evaluating the Ripple Effects of Recent U S Trade Measures on Automotive Electronics Sourcing and Development

The enactment of elevated import duties in 2025 has reverberated throughout the automotive electronics supply chain as cost pressures cascaded across semiconductors, display modules, and sensor packages. The 25 percent levy on imported chips and display assemblies imposed material cost increases that in some cases approached half of prior sourcing budgets. These heightened expenses challenged suppliers of capacitive touchscreens and guided acoustic wave sensors to recalibrate pricing and production locators, while prompting several leading automakers to reassess program timelines.

Faced with margin erosion, original equipment manufacturers shifted capital away from noncritical R&D initiatives to absorb and mitigate tariffdriven headwinds. Production delays were reported as dualsourcing efforts and regionalization strategies came online to reduce vulnerability to crossborder tariffs. Although some cost increases were passed through to end consumers, the broader impact manifested in compressed margins and postponed feature rollouts, compelling stakeholders to forge closer collaborative ties to navigate the evolving trade environment.

Deconstructing the Multidimensional Segments That Define the Evolution of In Car Human Machine Interfaces

When examining the market through the lens of interface types it becomes clear that each modality serves distinct user needs and carries unique deployment considerations. Gesture recognition technologies are evolving from twodimensional sensor patterns toward threedimensional motion tracking to support more intuitive user commands, while headup displays now integrate combiner and windshieldbased solutions to balance cost against visual fidelity. Touchscreen modules span from resistive layers suited for heavy-duty commercial use to highresolution capacitive surfaces that prioritize responsiveness, and voice control interfaces bridge basic command sets and fullfledged AI assistants to accommodate varied consumer preferences.

Likewise the application domain underscores how climate control panels are transitioning from manual dials to fully automatic systems governed by predictive algorithms, and infotainment suites now fuse audio, video, and connectivity in unified platforms that rival home media centers. Navigation tools have branched out from static map data to dynamic real-time traffic overlays, and vehicle control functions such as brake modulation and seat adjustment are now accessible through enriched touchscreen and voice modalities. This multiplicity of segments highlights the need for adaptable HMI architectures that can support modular upgrades and cross-functional convergence.

This comprehensive research report categorizes the Automotive HMI market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Interface Type

- Technology

- Vehicle Type

- Application

- Distribution Channel

Illuminating How Global Market Forces and Local Regulations Shape Distinct HMI Adoption Patterns Across Regions

Regional dynamics are reshaping how suppliers and automakers tailor their HMI strategies to align with local consumer demands and regulatory frameworks. In the Americas, a strong emphasis on advanced driver assistance and intuitive voice command stems from safety mandates and widespread smartphone integration. The Europe Middle East and Africa region is driving rapid adoption of augmented head-up displays and multi-ring gesture detection to meet stringent emission and collision standards while enhancing luxury segment differentiation. Across Asia Pacific, the proliferation of electric vehicle platforms has accelerated investment in high-definition touchscreens and AI-based assistants to cater to tech-savvy buyers and emerging mobility services.

These regional nuances not only influence feature prioritization but also affect supply chain architectures and aftermarket support models. Vendors are increasingly establishing localized manufacturing footprints for critical components such as surface acoustic wave sensors and projective capacitive panels to overcome tariff constraints and meet just-in-time delivery requirements. Concurrently, software localization teams work closely with OEM partners to ensure voice assistants and interface layouts resonate with language complexities and cultural preferences, cementing the role of regional insights in steering global HMI product roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Automotive HMI market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Ecosystem Where Electronics Titans and Innovative Startups Shape the Future of Vehicle Cockpits

The competitive landscape for automotive HMI is characterized by a mix of established electronics giants and nimble specialized innovators. Industry leaders are investing heavily in cohesive ecosystems that span hardware and software to deliver end-to-end solutions. Some large players are capitalizing on scale to drive down the cost of capacitive displays and ASIC-based gesture engines, while platform-agnostic providers are carving out niches by offering modular head-up display kits that integrate seamlessly into legacy dashboards.

Meanwhile, a cadre of agile startups is challenging incumbents by pioneering novel interaction models such as proximity sensing, augmented reality overlays, and neurofeedback loops. Collaboration between Tier-1 system integrators and semiconductor foundries is becoming increasingly strategic as companies seek to co-develop next-generation chips optimized for automotive-grade performance. Partnerships between UX design consultancies and OEM digital teams are also on the rise, reflecting the critical importance of human factors and seamless user journeys in differentiating HMI offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive HMI market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alpine Electronics Inc.

- Altia Inc.

- Capgemini SE

- Clarion Co., Ltd.

- Continental AG

- Continental AG

- Delphi Technologies by BorgWarner Inc.

- DENSO Corporation

- HARMAN International by Samsung Electronics Co., Ltd.

- In2tec Ltd.

- Intellias

- Luxoft Holding, Inc.

- Magneti Marelli S.p.A.

- Nippon Seiki Co., Ltd.

- Nuance Communications, Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Synaptics Incorporated

- Valeo S.A.

- Visteon Corporation

- Yazaki Corporation

Harnessing Open Architectures and Strategic Partnerships to Accelerate Scalable and Cost Effective HMI Innovations

Industry leaders should prioritize the development of flexible software frameworks that can accommodate evolving interface modalities without extensive hardware redesigns. By championing open standards and APIs, companies can foster broader interoperability among gesture sensors, head-up displays, and voice assistants, reducing integration complexity and accelerating time to market. Investing in robust localization capabilities for software and voice recognition will ensure that global deployments resonate with diverse consumer expectations while adhering to regional compliance mandates.

Additionally, organizations should explore strategic joint ventures with semiconductor foundries to secure prioritized access to automotive-qualified chiplets, mitigating exposure to tariff-induced cost volatility. A refocused roadmap that emphasizes modular hardware architectures and cloud-driven feature updates can enable OEMs and suppliers to shift capital from full platform overhauls toward incremental enhancements, preserving margin integrity and sustaining competitive agility in a rapidly shifting landscape.

Combining Executive Interviews Patent Analysis and Supply Chain Modeling to Uncover Robust Human Machine Interface Insights

This analysis draws upon a multi-tiered research approach combining primary interviews with senior executives at OEMs, Tier-1 suppliers, and specialized component manufacturers with secondary research sourced from industry publications regulatory filings and trade association reports. Proprietary databases tracking interface technology patent filings and global vehicle specs were leveraged to validate emerging trends in gesture recognition head-up displays and voice control modules.

Quantitative insights were enriched by supply chain impact assessments that modeled tariff scenarios and regional production footprints, while qualitative perspectives emerged from focus groups comprising fleet operators and early adopter consumers. All findings were cross-referenced against public company disclosures for consistency, and triangulated through expert workshops to ensure robustness of directional insights. The final synthesis presents a holistic view of automotive HMI dynamics grounded in both empirical data and forward-looking stakeholder sentiment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive HMI market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive HMI Market, by Interface Type

- Automotive HMI Market, by Technology

- Automotive HMI Market, by Vehicle Type

- Automotive HMI Market, by Application

- Automotive HMI Market, by Distribution Channel

- Automotive HMI Market, by Region

- Automotive HMI Market, by Group

- Automotive HMI Market, by Country

- United States Automotive HMI Market

- China Automotive HMI Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Embracing Agile Interface Strategies and Collaborative Ecosystems to Define Tomorrow’s Connected Mobility Experiences

As vehicles continue to transition from mechanical conveyances to intelligent platforms, human machine interfaces will emerge as critical differentiators in safety, user satisfaction, and brand loyalty. The convergence of advanced gesture controls head-up displays and AI-powered voice assistants is unlocking new dimensions of driver engagement while accommodating the complex demands of electrification and autonomous support systems.

By embracing flexible architectures open standards and strategic supply chain partnerships, industry participants can navigate regulatory headwinds and market volatility. Ultimately, those who invest in seamless, intuitive, and locally relevant HMI experiences will redefine the future of mobility and secure a competitive edge in an increasingly digital automotive ecosystem.

Connect with Ketan Rohom to Unlock Exclusive Deep Dive Insights and Propel Your Automotive HMI Strategy

To explore the comprehensive findings or to discuss how these insights can drive your strategic roadmap, reach out to Ketan Rohom Associate Director Sales & Marketing to secure your full market research report. His expertise can guide you through tailored data access options and collaborative sessions that align with your enterprise objectives. Take the next step in unlocking actionable intelligence and competitive advantages by contacting Ketan Rohom today

- How big is the Automotive HMI Market?

- What is the Automotive HMI Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?