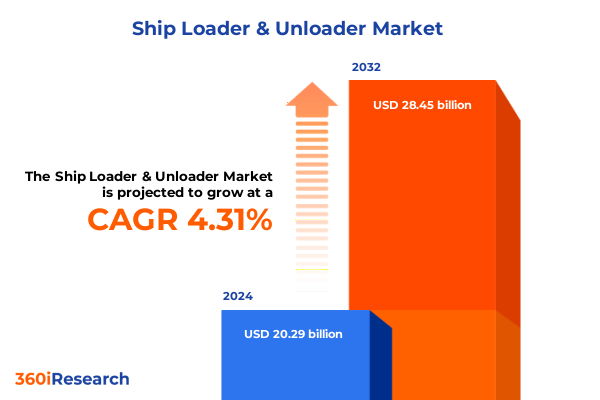

The Ship Loader & Unloader Market size was estimated at USD 26.29 billion in 2024 and expected to reach USD 27.62 billion in 2025, at a CAGR of 5.36% to reach USD 39.94 billion by 2032.

Exploring the dynamic ship loader and unloader market with an in-depth overview of competitive environments, technological drivers, and growth outlook

The global market for ship loaders and unloaders has entered a pivotal era defined by escalating trade volumes, heightened automation demands, and intricate logistical challenges. Modern maritime infrastructure, striving to accommodate ever-larger vessels, faces growing pressure to streamline material handling processes. In response, original equipment manufacturers and port authorities alike are intensifying their focus on advanced loading and unloading solutions that mitigate downtime, boost throughput, and minimize environmental footprints. As global supply chains become more interconnected, the efficiency of bulk handling equipment plays a critical role in sustaining port competitiveness and operational resilience.

Furthermore, the competitive environment in this sector is shaped by a diverse set of technological drivers. Continuous and telescopic ship loaders now integrate smart sensors and predictive analytics to optimize performance, while pneumatic and screw-type unloaders leverage energy-efficient designs to reduce maintenance cycles and comply with stricter emissions regulations. Amid these shifts, key stakeholders are reevaluating their strategic priorities, seeking partnerships that deliver not only robust machinery but also digital services such as remote monitoring, condition-based maintenance, and real-time performance benchmarking. Against this backdrop, this report provides an in-depth exploration of market dynamics, dissecting competitive landscapes, assessing technology adoption trends, and illuminating emerging growth vectors.

Uncovering the transformative technological advancements, operational optimizations, and regulatory shifts reshaping the ship loading and unloading industry

Over recent years, the ship loader and unloader industry has undergone transformative shifts driven by a convergence of technological innovation and evolving regulatory frameworks. Industry 4.0 paradigms have introduced digital twins, IoT connectivity, and AI-enabled control systems, enabling port operators to achieve unprecedented levels of process visibility and automation. Modern continuous ship loaders now leverage machine-learning algorithms to predict wear on critical components, while telescopic variants incorporate modular designs to adapt swiftly to varying vessel specifications. In tandem, pneumatic unloaders have benefited from advancements in compressed-air management, delivering faster material transfer rates with reduced energy consumption, and screw-type unloaders have seen improvements in seal integrity and corrosion resistance suited for harsh marine environments.

In addition to technology breakthroughs, the regulatory landscape has shifted substantially. Heightened environmental mandates are steering investments toward low-emission equipment and sustainable practices such as dust suppression and noise abatement. Ports worldwide are implementing stricter safety standards that require advanced remote-operation capabilities and fail-safe mechanisms. As a result, equipment manufacturers are forging strategic alliances with technology providers to embed compliance features directly into machine architectures. Looking ahead, the interplay between digitalization, decarbonization, and regulatory compliance will continue to reshape procurement strategies and operational priorities, positioning the industry for a more resilient and responsive future.

Assessing the effects of United States tariffs implemented in 2025 on cost structures, sourcing strategies, and operational realignments in ship loading

In 2025, a new tranche of United States tariffs has exerted tangible pressure on the ship loader and unloader sector’s cost structures and strategic planning. Tariffs targeting steel, aluminum, and select components have elevated raw material expenses, compelling equipment manufacturers to reassess sourcing strategies and explore alternative supply networks. Higher steel levies have particularly impacted the production of grab ship loaders and structural elements of telescopic arms, driving up fabrication costs by an average of 10 to 15 percent. Consequently, some original equipment manufacturers have relocated portions of their fabrication lines to tariff-exempt regions or leveraged free-trade agreements to mitigate financial burdens.

Moreover, the ripple effects of these tariffs extend beyond direct input costs. Port operators facing elevated equipment acquisition expenses are now reevaluating fleet modernization schedules and exploring rental or leasing arrangements to preserve capital flexibility. Supply chain realignments have also accelerated, as end users diversify supplier portfolios and increase inventory buffers to guard against future tariff spikes. In parallel, procurement teams are negotiating longer-term contracts with fixed-price clauses to stabilize capital expenditure forecasts. These adaptations underscore the necessity for stakeholders to monitor policy developments closely and incorporate tariff scenarios into their financial models, ensuring that operational resilience and competitive positioning remain intact in a shifting trade policy environment.

Highlighting detailed market segmentation by product type, position, technology, load capacity, application, and end-use industry for comprehensive insights

A nuanced understanding of market segmentation is crucial for stakeholders seeking to tailor product portfolios and service offerings effectively. When examining equipment by product type, continuous ship loaders, grab ship loaders, and telescopic ship loaders each present distinct value propositions based on throughput requirements and vessel compatibility, even as pneumatic ship unloaders and screw-type unloaders offer complementary solutions for discharging operations. Considering position, mobile units address the need for operational flexibility and rapid redeployment across multi-terminal ports, whereas stationary installations deliver higher stability and load capacities for dedicated berths. In terms of technology orientation, mechanical systems emphasize robust, low-maintenance architectures, while pneumatic counterparts integrate precision flow control and dust-free transfer protocols to meet environmental standards.

Shifting focus to load capacity, high-capacity ship loaders are engineered for intensive continuous operations on Panamax and larger vessels; medium-capacity equipment strikes a balance between agility and throughput for feeder ships; and low-capacity loaders enable satellite port terminals to service smaller bulk carriers economically. From an application standpoint, dry bulk handling solutions are optimized for commodities such as coal, grain, and ores, whereas liquid bulk configurations are designed for the safe transfer of chemicals, petroleum products, and edible oils. Finally, end-use industries span agriculture, construction, manufacturing, mining, oil and gas, and ports and harbors, each driving distinct demand patterns and service requirements. By mapping these segmentation dimensions in concert, industry participants can pinpoint high-value market niches and formulate differentiated value propositions that resonate with targeted customer cohorts.

This comprehensive research report categorizes the Ship Loader & Unloader market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Position

- Technology

- Material Handling Capacity

- Power Source

- Automation Level

- Application

- End-Use Industry

Dissecting regional dynamics across the Americas, EMEA, and Asia-Pacific to reveal competitive advantages, demand drivers, and investment priorities

Regional dynamics exert a profound influence on equipment demand, investment priorities, and competitive landscapes within the ship loader and unloader market. In the Americas, advanced port infrastructure, well-established bulk commodity corridors, and a strong emphasis on retrofitting legacy stock with digital monitoring systems are driving steady procurement of both stationary and mobile units. Furthermore, environmental regulations in North America have accelerated the adoption of pneumatic unloading solutions equipped with integrated dust control, aligning with broader sustainability targets. Conversely, Latin American players are prioritizing cost-effective maintenance partnerships and modular upgrade kits to extend asset lifecycles amid budget constraints.

In EMEA, regulatory harmonization across the European Union and heightened focus on decarbonization are shaping procurement strategies. Market actors here are investing in high-capacity continuous loaders with energy-recovery systems and remote operation features to comply with stringent emissions and safety directives. Meanwhile, Middle Eastern ports leverage government-backed infrastructure initiatives to integrate next-generation equipment capable of handling multipurpose terminals, and African operators are gradually expanding port capacities through collaborations with global OEMs that offer financing packages and knowledge transfer.

The Asia-Pacific region presents a dual landscape of mature markets and rapid expansion zones. Established East Asian ports emphasize automation upgrades and smart berth management, while Southeast Asian and South Asian terminals are ramping up capital expenditures to accommodate growing trade volumes. Heavy investments in new port developments across India and Indonesia are creating greenfield opportunities for OEMs to deploy both mechanical and pneumatic loaders tailored to regional commodity profiles. Across all regions, localized service networks and digital support platforms are emerging as critical differentiators for equipment suppliers seeking to win long-term contracts.

This comprehensive research report examines key regions that drive the evolution of the Ship Loader & Unloader market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing leading global ship loader and unloader companies, showcasing their technological innovations, strategic collaborations, and market positioning

The competitive landscape in the ship loader and unloader domain features a blend of established industrial conglomerates and agile specialized manufacturers. Leading players have differentiated through a combination of proprietary technology, integrated service portfolios, and strategic collaborations with port authorities and logistics providers. Several global OEMs have elevated their market positions by embedding condition-based monitoring systems and 24/7 remote support offerings directly into their machinery, reducing unplanned downtime and enhancing total cost of ownership. In contrast, niche manufacturers have carved out defensible positions within specific load capacity brackets or commodity segments, capitalizing on lean engineering and modular design principles.

In addition, strategic alliances have become a pervasive trend, with technology firms partnering with equipment suppliers to co-develop digital platforms for performance benchmarking and lifecycle management. Many key companies have also pursued aftermarket expansion, offering turnkey maintenance contracts, spare-parts stocking solutions, and operator training programs to reinforce recurring revenue streams. While some market leaders focus on broadening their footprint in emerging Asia-Pacific and Middle Eastern terminals, others concentrate on European and North American retrofitting projects, where upgrading existing fleets presents lower barriers to entry and quicker returns. This blend of global expansion, product innovation, and service differentiation underscores the multifaceted strategies companies employ to maintain competitive positioning in a landscape defined by technical complexity and evolving customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ship Loader & Unloader market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMECO Group

- Astec Bulk Handling Solutions

- AUMUND Fördertechnik GmbH

- Bedeschi SpA

- BEUMER Group GmbH & Co. KG

- Bruks Siwertell Group

- BVS Bülbüloğlu Vinç San. Tic. A.Ş.

- Bühler AG

- Dalian Huarui Heavy Industry Group Co., Ltd.

- Dana Incorporated

- FM Bulk Handling A/S

- Fuller Technologies

- IBAU HAMBURG Ingenieurgesellschaft Industriebau mbH

- Jiangsu Tonghui Lifting Equipment Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Konecranes PLC

- Liebherr-International Deutschland GmbH

- Loibl Förderanlagen GmbH

- MITSUI MIIKE MACHINERY CO., LTD.

- NEUERO Industrietechnik für Förderanlagen GmbH

- REEL international SAS

- Sandvik AB

- Shanghai Zhenhua Heavy Industries Co., Ltd.

- SKE Industries

- SMB International GmbH

- Superior Industries, Inc.

- Tadano Ltd.

- Taiyuan Heavy Industry Co., Ltd.

- TAKRAF GmbH

- Telestack Limited

- Tenova S.p.A.

- thyssenkrupp AG

- TSK ELECTRÓNICA Y ELECTRICIDAD, S.A.

- Vigan Engineering SA

- Weihua Group

Delivering actionable recommendations to optimize operational efficiency, drive innovation, and leverage emerging trends in ship loading operations

Industry leaders must adopt a multifaceted approach to capitalize on evolving market conditions and sustain competitiveness. To begin with, prioritizing digital transformation initiatives-such as embedding IoT sensors, leveraging predictive analytics, and integrating remote monitoring dashboards-can significantly reduce maintenance costs and optimize asset utilization. In parallel, forging partnerships with technology providers enables the rapid co-development of tailored automation solutions, accelerating the deployment of smart ship loading and unloading systems that adapt to diverse vessel specifications.

Moreover, diversifying component sourcing and negotiating long-term supplier agreements with built-in tariff-mitigation clauses will help insulate cost structures from geopolitical fluctuations. In addition, equipment manufacturers should expand their aftermarket service portfolios to include performance-based contracts, operator training modules, and flexible rental programs, thereby creating new revenue streams and strengthening customer loyalty. For port operators, adopting a modular procurement strategy-where standardized equipment platforms can be incrementally upgraded-will enhance CapEx efficiency and reduce operational risks. Collectively, these recommendations position stakeholders to seize emerging growth vectors while maintaining agility in the face of regulatory, technological, and trade policy shifts.

Detailing the rigorous research methodology blending primary interviews, secondary data validation to ensure reliability and validity

This report’s findings rest upon a rigorous, multi-stage research framework designed to ensure comprehensive coverage and analytical rigor. Primary research comprised in-depth interviews with port authority officials, logistical service providers, equipment OEM executives, and industry consultants, gathering firsthand insights into procurement criteria, technological adoption timelines, and operational pain points. These qualitative inputs were complemented by secondary research, which integrated corporate filings, trade publications, regulatory documents, and patent databases to validate market trends and company positioning.

To bolster the accuracy of these insights, data triangulation methods were applied, reconciling quantitative shipment records with end-user surveys and expert forecasts. Furthermore, analytical frameworks-including Porter’s Five Forces and SWOT assessments-were leveraged to dissect competitive pressures and strategic opportunities. Finally, the entire dataset underwent a multi-layered validation process, ensuring that both emerging and established market dynamics are robustly represented. This structured methodology underpins the strategic relevance and credibility of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ship Loader & Unloader market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ship Loader & Unloader Market, by Product Type

- Ship Loader & Unloader Market, by Position

- Ship Loader & Unloader Market, by Technology

- Ship Loader & Unloader Market, by Material Handling Capacity

- Ship Loader & Unloader Market, by Power Source

- Ship Loader & Unloader Market, by Automation Level

- Ship Loader & Unloader Market, by Application

- Ship Loader & Unloader Market, by End-Use Industry

- Ship Loader & Unloader Market, by Region

- Ship Loader & Unloader Market, by Group

- Ship Loader & Unloader Market, by Country

- United States Ship Loader & Unloader Market

- China Ship Loader & Unloader Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Concluding insights highlight market maturity, innovation directions, strategic imperatives for stakeholders in the evolving ship loading and unloading sector

The collective analysis underscores a market moving toward heightened automation, sustainable operations, and strategic diversification. As continuous, grab, and telescopic loaders integrate advanced digital capabilities, and pneumatic and screw-type unloaders prioritize energy efficiency, stakeholders are navigating a complex interplay of regulatory mandates, tariff uncertainties, and evolving trade flows. In this context, segmentation insights reveal distinct customer needs across product, positional, and application dimensions, while regional analyses highlight diverse investment drivers from the Americas to Asia-Pacific.

Ultimately, the industry’s trajectory will be defined by the ability of equipment suppliers and port operators to forge collaborative ecosystems, harness emerging technologies, and adapt to policy disruptions. Those who successfully align innovation with operational resilience are poised to capture disproportionate value in the dynamic ship loader and unloader sector.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the definitive ship loader and unloader market research report today

To secure access to this definitive ship loader and unloader market research report, please connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the detailed insights, competitive analyses, and strategic recommendations tailored to your organization’s objectives. Reach out now to discuss customized licensing options, enterprise packages, or bespoke consulting engagements. Engage this opportunity today to equip your team with the authoritative intelligence needed to outpace rivals and capture emerging market opportunities.

- How big is the Ship Loader & Unloader Market?

- What is the Ship Loader & Unloader Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?