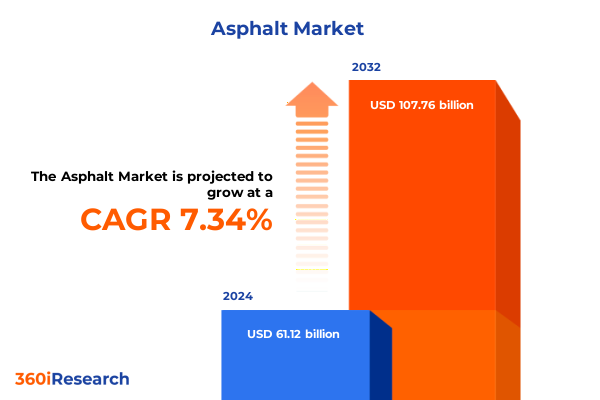

The Asphalt Market size was estimated at USD 65.38 billion in 2025 and expected to reach USD 69.94 billion in 2026, at a CAGR of 7.40% to reach USD 107.76 billion by 2032.

Paving the Path Forward: How Asphalt’s Evolution is Shaping Infrastructure Development with Sustainable and Technological Innovations

Asphalt remains the backbone of modern infrastructure, providing durable surfaces for roadways, parking lots, and airport runways while supporting billions of vehicle miles traveled annually. The industry’s evolution has been propelled by a convergence of legislative frameworks, technological breakthroughs, and sustainability imperatives, all converging to redefine how asphalt is produced, delivered, and applied. In recent years, the Infrastructure Investment and Jobs Act has allocated significant federal funding for highways and bridges, stimulating demand for high-performance materials and prompting contractors to explore advanced binders and additives to enhance longevity and reduce maintenance cycles.

Simultaneously, environmental regulations introduced by the U.S. Environmental Protection Agency and state-level programs such as California’s Low Carbon Fuel Standard are incentivizing lower greenhouse gas emissions from asphalt production, leading to broader adoption of warm mix asphalt technologies that cut CO₂ and particulate emissions by up to 30 percent. With reclaimed asphalt pavement usage reaching historic highs, the sector is embracing circular economy principles by recycling old pavement, conserving aggregates, and preserving bitumen resources. Moving forward, industry stakeholders must balance performance requirements with green credentials and cost pressures, setting the stage for transformative advancements in asphalt solutions.

Exploring the Major Technological Shifts and Policy Drivers Revolutionizing Asphalt Production and Deployment Across Global Infrastructure Projects

The asphalt landscape is undergoing a profound transformation as technological innovation and policy directives reshape production and application practices. Warm mix asphalt has emerged as a cornerstone for sustainable paving, reducing production temperatures by 20 to 35 percent and slashing energy consumption and emissions without compromising pavement performance. At the same time, polymer modification is advancing rapidly, with new elastomeric and plastomeric blends enhancing elasticity, rut resistance, and temperature susceptibility, and nanomodified emulsions promising up to 50 percent longer service life under freeze–thaw conditions.

Beyond material innovations, digitalization is revolutionizing project delivery through AI-driven predictive modeling and digital twin simulations that optimize binder formulations, forecast pavement wear, and ensure quality control in real time. Infrastructure agencies in Europe are integrating stringent environmental targets from the Renewable Energy Directive to prioritize low-carbon asphalt variants, while innovative public–private partnerships are funding pilot programs that validate bio-based additives and waste-derived modifiers under field conditions. These convergent dynamics underscore a shift toward performance-driven, eco-centric paving solutions, with each breakthrough reinforcing the imperative for industry leaders to stay ahead of emerging regulations and adopt agile R&D strategies.

Unpacking the Comprehensive Effects of Escalating United States Tariffs on Steel Aluminum and Polymer Inputs in Asphalt Supply Chains

Recent adjustments to U.S. Section 232 tariffs on steel and aluminum have significantly impacted asphalt supply chains, driving up costs for essential raw materials and derivative products. Effective March 12, 2025, the United States eliminated all country exemptions and imposed a uniform 25 percent tariff on steel and aluminum imports, including derivative articles, in an effort to protect domestic producers. Cost increases were soon felt across the construction sector as contractors faced higher prices for steel-reinforced asphalt equipment and aluminum-based additives.

In subsequent action, tariffs on imported steel and aluminum were further raised from 25 to 50 percent effective June 4, 2025, amplifying supply chain pressures and prompting many firms to seek alternative suppliers or stockpile materials in advance. Experts caution that these escalated duties threaten to slow capital-intensive paving projects and exacerbate budget overruns, potentially delaying maintenance programs and new construction initiatives. As a result, asphalt producers and contractors are reevaluating procurement strategies, diversifying material sources, and engaging in forward-buying agreements to mitigate tariff-driven volatility. This shifting trade environment underscores the critical need for agile supply chain management and proactive policy monitoring.

Revealing Critical Insights from Diverse Asphalt Market Segmentation Spanning Product Types Technologies Applications End Users and Distribution Channels

Analyzing the asphalt market through multiple lenses reveals nuanced performance and growth narratives across segments defined by product, technology, application, end user, and distribution. Examining product types illustrates Cold Mix Asphalt’s flexibility for low-volume pavements, Hot Mix Asphalt’s dominance in heavy-traffic applications-where dense graded, porous, and stone mastic formulations address distinct drainage and durability requirements-and Warm Mix Asphalt’s rising popularity powered by additives, including foam-based agents, chemical modifiers, and organic solutions. From a technology standpoint, traditional bitumen blends remain foundational even as polymer modified systems-leveraging crumb rubber, ethylene vinyl acetate, and styrene-butadiene-styrene-unlock enhanced performance under temperature extremes.

Application-wise, airport runways demand high-strength mixes with superior fatigue resistance, while the maintenance and repair sector relies on specialized overlay and pothole repair materials to extend asset life. Road construction bifurcates into new construction and rehabilitation activities, each requiring tailored mix designs. Government agencies drive baseline infrastructure projects, whereas private contractors pursue specialized and commercial paving work, favoring direct procurement relationships or channel partners depending on project scale. Distribution channels further vary between direct sales engagements-where integrated solutions and technical support are critical-and distributor networks that offer localized inventory, logistics efficiency, and rapid deployment capabilities. This holistic segmentation framework underpins strategic investment and R&D prioritization across the asphalt value chain.

This comprehensive research report categorizes the Asphalt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Examining Regional Dynamics and Growth Drivers Influencing Asphalt Demand Across the Americas Europe Middle East Africa and Asia-Pacific Regions

Regional dynamics play an outsized role in asphalt demand patterns, informed by infrastructure policies, economic growth, and environmental imperatives. In the Americas, robust federal and state investment programs are underpinning extensive highway and urban paving initiatives, with stringent EPA standards and buy-American provisions shaping material sourcing and mix specifications. Meanwhile, Europe, the Middle East, and Africa are experiencing divergent trends: in Europe, the European Green Deal and national decarbonization mandates are steering contractors toward warm mix solutions and high recycled content, whereas Middle Eastern Gulf states are investing heavily in new road networks to support urban expansion and logistics corridors. African markets, though nascent, are pursuing public–private partnerships to upgrade primary and secondary road infrastructure, often prioritizing cost-efficient cold mix options for remote regions.

Asia-Pacific exhibits accelerated urbanization and industrialization that fuel demand for high-performance asphalt. Emerging economies are deploying public infrastructure funds to expand expressways and smart city road grids, while countries in Southeast Asia are embracing environmental regulations that incentivize recycled asphalt pavement and low-temperature mix technologies. Across all regions, local specifications, climatic conditions, and regulatory frameworks drive bespoke asphalt formulations, reinforcing the importance of regional market intelligence when tailoring product portfolios and operational strategies.

This comprehensive research report examines key regions that drive the evolution of the Asphalt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Asphalt Industry Players and Their Strategic Innovations Impacting Market Competitiveness and Sustainability Practices Today

Leading asphalt producers and material innovators are actively reshaping the competitive landscape through targeted investments, partnerships, and technological leadership. International cement and aggregate giants have expanded upstream into specialized binder production, collaborating with chemical manufacturers to co-develop next-generation polymer modifiers that enhance pavement resilience. Independent additives suppliers are forming strategic alliances with equipment OEMs to integrate dosing systems, ensuring precise field blending and quality assurance. Concurrently, mid-tier contractors are differentiating through regional service excellence, deploying mobile mixing units equipped with WMA capabilities to meet remote and time-sensitive project requirements. Across the sector, sustainability commitments-such as net-zero road initiatives and circular supply chain targets-are central to corporate strategies, driving continuous improvements in recycled content, carbon intensity, and lifecycle performance metrics. This mosaic of corporate activity underscores the imperative for ongoing competitive intelligence and collaboration to capture value in an evolving asphalt ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Asphalt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Callanan Industries, Inc.

- China Petroleum & Chemical Corporation

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Nynas AB

- PetroChina Company Limited

- Petroliam Nasional Berhad

- Repsol, S.A.

- Royal Dutch Shell plc

- SK Innovation Co., Ltd.

- The Shelly Company

- TotalEnergies SE

Strategic Actionable Recommendations for Asphalt Sector Leaders to Navigate Supply Chain Disruptions and Accelerate Sustainable Infrastructure Projects

As the asphalt industry confronts supply chain disruptions, regulatory shifts, and sustainability imperatives, leadership teams must embrace proactive measures to maintain resilience and competitive advantage. Prioritizing warm mix asphalt adoption can reduce energy costs, lower emissions, and align with tightening environmental regulations while extending plant throughput under variable weather conditions. Concurrently, diversifying raw material suppliers-particularly for polymer modifiers and steel reinforcements subject to tariff fluctuations-will mitigate procurement risk; establishing strategic inventory buffers and long-term off-take agreements can shield project schedules from sudden cost spikes. Investing in digital quality control tools, including AI-enabled mix design platforms and real-time performance monitoring, will enhance operational efficiency and ensure compliance with performance standards. Finally, engaging with policy makers and industry consortia to shape pragmatic regulatory frameworks around recycled content and binder specifications will support sustainable growth while safeguarding project economics. By aligning innovation agendas with evolving market demands, industry leaders can navigate complexity and deliver higher-value pavement solutions.

Elucidating Rigorous Research Methodology Employed to Ensure Robust Data Integrity Market Intelligence and Comprehensive Asphalt Industry Analysis

This research leverages a multi-method approach to ensure comprehensive market coverage and data integrity. Primary research comprises in-depth interviews with asphalt producers, contractors, additive innovators, and regulatory bodies, providing firsthand insights into material specifications, procurement practices, and emerging challenges. Secondary research integrates patent filings, technical white papers, government publications, and environmental regulations to validate technology trends and policy impacts. Data triangulation techniques reconcile quantitative production and import statistics with qualitative expert opinions, enhancing the reliability of conclusions. A dedicated validation phase involved workshops with industry stakeholders to corroborate findings and refine scenario analyses under varying regulatory and tariff environments. Throughout, rigorous quality control protocols governed data collection, coding, and synthesis, ensuring transparency and repeatability in the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Asphalt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Asphalt Market, by Product Type

- Asphalt Market, by Technology

- Asphalt Market, by Application

- Asphalt Market, by End User

- Asphalt Market, by Distribution Channel

- Asphalt Market, by Region

- Asphalt Market, by Group

- Asphalt Market, by Country

- United States Asphalt Market

- China Asphalt Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways on Asphalt Industry Trends Challenges and Opportunities Shaping Future Infrastructure Development Strategies

The asphalt industry stands at a crossroads defined by converging pressures and opportunities: elevated raw material costs driven by trade policy shifts, heightened environmental mandates that reward low-emission and high-recycled content solutions, and a wave of technological advances in material formulation and digital process management. Across global markets, stakeholders are recalibrating strategies to harness warm mix and polymer modified systems, optimize maintenance cycles, and deploy data-driven project controls. Regional variances-from North American infrastructure lift programs to Europe’s decarbonization targets and Asia-Pacific’s urban network expansion-underscore the need for tailored approaches and localized innovation. By integrating strategic procurement, R&D collaboration, and policy engagement, industry participants can solidify their competitive positions and deliver asphalt infrastructures that meet tomorrow’s performance, sustainability, and cost objectives.

Drive Decisions with Expert Asphalt Market Intelligence Connect with Ketan Rohom to Secure Your Comprehensive Research Report Today

To gain an in-depth view of emerging asphalt trends, regulatory impacts, and competitive landscapes, secure the comprehensive market research report tailored to your strategic needs by contacting Ketan Rohom (Associate Director, Sales & Marketing). He can guide you through customized data packages, exclusive insights, and actionable intelligence designed to inform procurement strategies and investment decisions. Elevate your organization’s resilience in an evolving asphalt market by reaching out to Ketan Rohom today and unlocking unparalleled expertise.

- How big is the Asphalt Market?

- What is the Asphalt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?