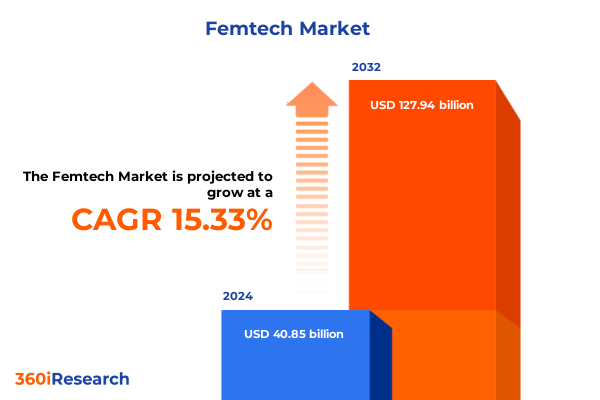

The Femtech Market size was estimated at USD 47.01 billion in 2025 and expected to reach USD 54.11 billion in 2026, at a CAGR of 15.37% to reach USD 127.94 billion by 2032.

Driving Innovation Beyond Boundaries to Illuminate the Diverse and Rapidly Evolving Landscape of Femtech in Today's Healthcare Ecosystem

Over the past decade, femtech has transitioned from a niche concept to a central pillar of modern healthcare innovation. Driven by the convergence of digital health technologies, increased consumer awareness, and a heightened focus on personalized care, this landscape is rapidly expanding to address the unique health needs of women at every life stage. Emerging diagnostic and monitoring devices that leverage real-time biosensing capabilities are being complemented by telehealth services and mobile applications, democratizing access to reproductive health support and chronic condition management. Concurrently, software platforms are integrating advanced analytics and machine learning to deliver tailored insights, enabling more proactive and preventive care approaches.

This expansion has been underpinned by shifting regulatory frameworks that increasingly recognize the importance of women’s health outcomes. Approval pathways are streamlining to accelerate time-to-market for innovative solutions, while reimbursement policies are evolving to accommodate digital therapeutics and remote consult services. As public and private funding landscapes embrace femtech venture capital investments and strategic partnerships, stakeholders are collaborating to overcome longstanding barriers in clinical research and care delivery.

Looking forward, the sector’s trajectory is defined by its ability to harness interoperable technologies, foster patient-centric design, and integrate multidisciplinary expertise. Companies that can strategically balance medical rigor with user-friendly experiences are poised to lead this transformation, setting new benchmarks for efficacy, engagement, and equity in women’s health.

Identifying the Transformative Forces That Are Redefining Femtech Through Technological, Regulatory, and Consumer-Driven Paradigm Shifts

The femtech ecosystem is experiencing paradigm shifts across technological, regulatory, and consumer domains that are reshaping how women’s health solutions are conceived, developed, and delivered. Technologically, artificial intelligence–powered diagnostic algorithms and predictive analytics are moving from proof-of-concept stages into mainstream clinical and at-home use, enabling early detection of conditions such as endometriosis and polycystic ovary syndrome. Coupled with cloud-based solutions that facilitate seamless data exchange between patients and providers, these innovations are breaking down historical silos in health data and fostering integrated care pathways.

Regulatory evolution is equally transformative. Health authorities in the United States and beyond have introduced specialized guidelines for digital therapeutics and mobile medical applications, reducing approval timelines while maintaining safety and performance standards. This regulatory clarity is enabling faster adoption by healthcare systems and payers, who are increasingly recognizing the value of remote consults and subscription-based service models for fertility and menopause management.

On the consumer side, heightened health literacy and empowered patient communities are driving demand for personalized, convenient, and accessible care options. Women today expect mobile applications to guide them through fertility tracking, lifestyle adjustments during menopause, pelvic floor rehabilitation, and nursing assistance. Wearable sensors and networked monitors are meeting this demand by offering continuous, unobtrusive monitoring that integrates smoothly into daily life.

Together, these forces are converging to redefine the workflow of clinicians, the design of health programs, and the experience of end users. Success in this dynamic environment will depend on the ability of femtech leaders to anticipate regulatory changes, harness emerging technologies, and place user experience at the forefront of solution development.

Examining the Multifaceted Effects of 2025 Tariff Adjustments on Femtech Supply Chains, Pricing Dynamics, and Market Accessibility in the United States

In 2025, adjustments to United States tariff policies have introduced a wave of complexities for the femtech supply chain, affecting both cost structures and market accessibility. Tariffs on imported diagnostic and therapeutic devices have increased the landed cost of key hardware components, prompting device manufacturers to evaluate localized production strategies and alternative sourcing partnerships. As a result, some industry players have accelerated investments in domestic assembly lines and contract manufacturing, while others are renegotiating supplier agreements to mitigate the impact of higher duties.

Service offerings have also felt the indirect effects of tariff changes. Laboratory services relying on imported reagents and test kits have encountered elevated input costs, leading to marginal price adjustments that ripple through telehealth and in-clinic consult fees. Meanwhile, software developers leveraging IoT-enabled devices and smart sensors are facing higher integration expenses, as device manufacturers pass on increased tariffs downstream. These dynamics have reinforced the imperative for cross-functional teams to collaborate on cost containment strategies, including vendor diversification, volume discounts, and supply-chain visibility tools.

Despite these challenges, the industry has demonstrated resilience through innovation and strategic adaptation. Companies with cloud-based solutions and digital platforms have been able to absorb some tariff-related cost pressures by scaling subscription revenues and optimizing service delivery remotely. Moreover, advanced analytics have become instrumental in forecasting inventory needs and aligning procurement with demand patterns, reducing both overstock risks and exposure to tariff fluctuations.

Consequently, the 2025 tariff adjustments have catalyzed a shift from purely cost-driven decision-making to a more holistic approach that balances operational efficiency, supply-chain robustness, and customer value delivery. Moving forward, stakeholders will need to continue refining their sourcing models and leveraging digital tools to maintain competitive pricing without compromising quality or innovation.

Deep-Dive into Femtech Segmentation Dynamics Through the Lens of Products, Applications, End Users, Channels, and Advanced Technologies Driving Differentiation

The femtech market can be understood through interlinked segmentation dimensions that collectively illustrate the breadth of solutions and end-user engagement models. When dissected by product type, it spans tangible device categories-ranging from diagnostic devices that detect hormonal imbalances to therapeutic devices designed for targeted pelvic floor therapy-alongside monitoring devices that capture longitudinal health data, in addition to telehealth and lab services as well as software delivered via mobile applications and comprehensive platform solutions. Shifting focus to application, the landscape broadens further to encompass the entire continuum of women’s health, from fertility services like IVF support and ovulation tracking to menopause programs centered on hormone therapy and lifestyle adjustments, all the way through uterine disorder management, nursing assistance, and sexual health education.

End users navigate this environment based on their care context, whether providers in hospitals and clinics-both private and public-or diagnostic laboratories managing in-house and outsourced testing, or home care settings where remote patient monitoring and self-assisted care empower individuals outside clinical facilities. Distribution channels further shape market interactions, from field and tele sales driving direct engagements to pharmacies-both inpatient and outpatient-while online sales through company websites and e-commerce platforms broaden reach alongside retail pharmacy outlets.

Finally, technology underpins each of these segments with AI-powered software that refines clinical decision-making, cloud-based solutions that ensure secure data storage and telehealth connectivity, IoT-enabled devices that feed real-time health metrics into analytic engines, and wearable sensors such as smart garments and patches that offer continuous, noninvasive monitoring. By analyzing how these dimensions interact, stakeholders can pinpoint growth opportunities, optimize go-to-market strategies, and tailor value propositions to specific user needs and operational realities.

This comprehensive research report categorizes the Femtech market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Revealing How Regional Trends in the Americas, EMEA, and Asia-Pacific Shape Femtech Adoption, Investment Patterns, and Innovation Pathways Across Geographies

Regionally, the femtech landscape reflects diverse adoption curves and innovation drivers across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, robust venture capital ecosystems and progressive reimbursement pathways have propelled telehealth and mobile application uptake, particularly in fertility tracking and chronic condition management. Leading healthcare systems are piloting integrated platform solutions that connect patients with specialists across geographies, establishing best practices that shape regulatory harmonization efforts.

In Europe, the Middle East and Africa, the market narrative is marked by a duality of mature markets prioritizing advanced therapeutic devices and emerging economies seeking scalable, low-cost telehealth models. Public health initiatives in several European countries are integrating pelvic floor therapy and menopause management programs into national health systems, while Middle Eastern hubs invest heavily in digital health infrastructure. In Sub-Saharan Africa, mobile health applications addressing sexual wellness and general health monitoring are rising in prominence as smartphone penetration accelerates.

Across the Asia-Pacific region, the diversity of healthcare infrastructures yields varied growth trajectories. Developed markets like Japan and Australia are leading in the adoption of AI-driven diagnostic devices and predictive analytics platforms, whereas Southeast Asian countries are prioritizing wearable sensors and IoT-enabled devices to support remote care in geographically dispersed communities. Government stimulus measures aimed at boosting domestic manufacturing capabilities are further influencing the deployment of cloud-based telehealth solutions, with collaboration between public and private stakeholders forming a cornerstone of regional expansion strategies.

By comparing these regional ecosystems, industry leaders can identify cross-regional partnerships, benchmark regulatory models, and adapt product portfolios to align with local reimbursement structures and consumer behavior patterns, ultimately maximizing global market engagement.

This comprehensive research report examines key regions that drive the evolution of the Femtech market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Femtech Innovators to Uncover Competitive Strategies, Partnerships, and Value Propositions Driving Market Leadership and Growth

Market leadership in femtech is increasingly defined by a combination of technological innovation, strategic partnerships, and user-centric design philosophies. Companies pioneering AI-powered diagnostic algorithms are collaborating with academic research centers to refine predictive accuracy for conditions such as polycystic ovary syndrome and endometriosis, thereby strengthening clinical credibility and payer adoption. Meanwhile, device manufacturers specializing in smart sensors and networked monitors are forming alliances with cloud platform developers to offer integrated solutions that streamline patient monitoring and data analytics.

Service providers, ranging from telehealth consult networks to in-clinic fertility treatment centers, are differentiating their offerings through subscription-based models and value-added digital services, leveraging software platforms that enable seamless scheduling, remote tracking, and concierge support. In parallel, mobile application developers focusing on sexual wellness and general health management are investing in content partnerships and community-driven features to deepen user engagement and foster brand loyalty.

Distribution strategies are also evolving. Companies with direct sales forces are supplementing field activities with tele-sales teams to increase outreach in underserved regions, while those leveraging online channels are optimizing e-commerce experiences and digital marketing to capture consumer interest. Retail pharmacy collaborations and hospital pharmacy integrations further extend market reach, providing additional touchpoints for device and consumable distribution.

Ultimately, the most successful players are those that blend cross-functional expertise, deploying advanced technologies alongside patient support services, forging alliance networks that extend clinical capabilities, and maintaining agile go-to-market models that can adapt to shifting regulatory and consumer landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Femtech market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allara Health

- Apple Inc.

- Athena Feminine Technologies, Inc.

- AVA Sciences-FMTC LLC

- Bloomlife

- Canopie Inc.

- Carrot Fertility, Inc.

- Chiaro Technology Limited

- Chorus Health Inc.

- Cleo Labs, Inc.

- Clue by Biowink GmbH

- Elektra Health

- Everlywell, Inc.

- Fitbit LLC by Google, Inc.

- Flo Health UK Limited

- FOLX Health, Inc.

- Future Family, Inc.

- Garmin Ltd.

- Glow Inc.

- INTIMINA

- Kindbody

- Koninklijke Philips N.V.

- Maven Clinic Co.

- NextGen Jane

- Nuvo Group Ltd.

- Organon & Co.

- Renovia Inc.

- Rosy Wellness, Inc.

- Rume Medical Group, Inc.

- Samsung Electronics Co., Ltd.

- Thirty Madison company

- Tia, Inc.

- Unified Women’s Healthcare

- Univfy Inc.

- Willow Innovations, Inc.

- Wolomi

Delivering Actionable Strategies for Industry Leaders to Navigate Regulatory Complexities, Accelerate Digital Integration, and Maximize Stakeholder Impact in Femtech

Industry leaders seeking to advance their position in femtech must pursue a multifaceted strategy that balances innovation with operational resilience and stakeholder collaboration. Initially, organizations should prioritize the integration of AI-driven analytics into their product roadmaps, ensuring that data-derived insights inform both clinical efficacy and user experience enhancements. Simultaneously, establishing localized manufacturing or assembly partnerships will mitigate tariff-related cost pressures and bolster supply-chain continuity.

Engaging with payers and regulatory bodies early in product development can streamline reimbursement approvals and regulatory clearances for digital therapeutics, particularly those targeting menopause management and fertility support. Structured pilot programs that demonstrate real-world outcomes will build stakeholder confidence and pave the way for broader market adoption. Complementing these efforts, strategic alliances with healthcare providers and academic institutions can validate new device and software offerings, creating robust evidence bases that support pricing negotiations.

From a go-to-market perspective, leveraging omnichannel distribution models will maximize reach across direct sales, hospital and retail pharmacy outlets, and digital platforms. Tailored marketing campaigns that underscore the clinical benefits and user experience differentiators of femtech solutions will resonate with both professional decision-makers and end consumers. Additionally, investing in user education-through in-app guidance, telehealth coaching, and community engagement-will drive adoption and long-term retention.

By executing these recommendations, industry leaders can not only navigate current market complexities but also position themselves to capitalize on emerging opportunities, driving sustained growth and meaningful impact in women’s health.

Detailing the Robust Research Framework Employing Qualitative and Quantitative Methods to Ensure Comprehensive and Unbiased Femtech Market Insights

This research draws upon a rigorous framework combining both qualitative and quantitative methodologies to ensure comprehensive and unbiased insights. Initial secondary research encompassed peer-reviewed journals, government regulatory documents, white papers, and healthcare databases to map current trends in diagnostic devices, software platforms, and service delivery models. To validate these findings, expert interviews were conducted with key opinion leaders, including clinicians specializing in reproductive health, regulatory advisors, supply-chain executives, and femtech entrepreneurs.

Primary data collection involved targeted surveys and in-depth interviews with end users across diagnostic laboratories, home care patients, and hospital administrators, capturing user preferences, adoption barriers, and perceived value drivers. Additionally, the study employed advanced analytics techniques to synthesize large datasets from IoT-enabled device logs, telehealth utilization records, and software engagement metrics, enabling the identification of usage patterns and unmet clinical needs.

To ensure data integrity, multiple triangulation points were applied, cross-referencing primary inputs against secondary sources and statistical benchmarks. The segmentation framework was designed iteratively, with each dimension-product type, application, end user, distribution channel, and technology-refined through expert workshops. Regional analyses incorporated country-level regulatory and reimbursement landscape reviews, while company profiling leveraged publicly available financial reports, press releases, and partnership announcements.

Taken together, this methodology provides a robust foundation for the conclusions and recommendations presented, ensuring that strategic guidance is grounded in verifiable data and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Femtech market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Femtech Market, by Product Type

- Femtech Market, by Technology

- Femtech Market, by Application

- Femtech Market, by End User

- Femtech Market, by Distribution Channel

- Femtech Market, by Region

- Femtech Market, by Group

- Femtech Market, by Country

- United States Femtech Market

- China Femtech Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Synthesizing Key Insights to Highlight the Strategic Importance of Femtech Innovation While Foreseeing Future Directions and Industry Opportunities

This executive summary has illustrated the dynamic interplay of innovation, regulation, and consumer empowerment that defines today’s femtech landscape. From advanced diagnostic and therapeutic devices to immersive software platforms and telehealth services, the sector is poised for continued growth as women’s health takes center stage in global healthcare agendas. The tariff changes of 2025 serve as both a challenge and a catalyst, underscoring the need for resilient supply-chain models and agile go-to-market approaches.

Segmentation insights have revealed the complex tapestry of product types, applications, end-user contexts, distribution channels, and enabling technologies that market participants must navigate. Regional analyses highlight the divergent growth pathways across the Americas, EMEA, and Asia-Pacific, while company profiles showcase the strategic alliances and innovation paradigms driving leadership.

Looking ahead, the most successful organizations will be those that orchestrate cross-disciplinary collaboration, harness data-driven decision-making, and maintain a relentless focus on user experience. The femtech sector’s future will be shaped by its ability to integrate medical rigor with digital excellence, forge partnerships across the healthcare ecosystem, and deliver personalized care that addresses the full spectrum of women’s health needs.

By synthesizing these insights, this report lays the groundwork for informed strategic planning, investment prioritization, and operational optimization in a space that promises profound societal and commercial impact.

Connect with Ketan Rohom to Unlock Comprehensive Femtech Market Intelligence and Propel Your Strategic Decision-Making to the Next Level

To secure the comprehensive market research report that will equip you with the strategic insights needed to lead in the evolving femtech sector, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating complex data into actionable strategies will ensure you have the authoritative intelligence required to guide investment decisions, operational priorities, and partnership initiatives. Don’t miss the opportunity to deepen your understanding of the femtech landscape and drive competitive advantage-connect with Ketan today to discuss how this report can be tailored to meet your specific objectives.

- How big is the Femtech Market?

- What is the Femtech Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?