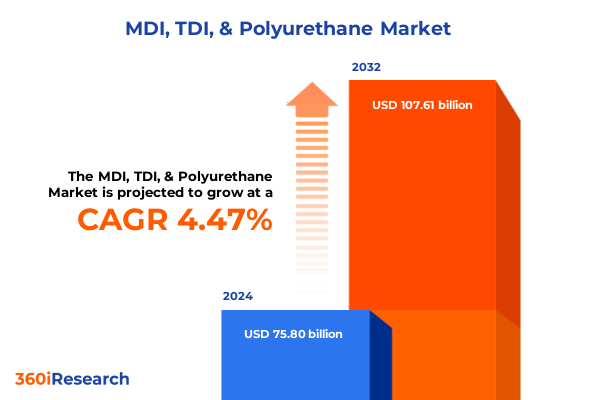

The MDI, TDI, & Polyurethane Market size was estimated at USD 77.99 billion in 2025 and expected to reach USD 81.04 billion in 2026, at a CAGR of 5.34% to reach USD 112.27 billion by 2032.

Unveiling the Foundational Landscape of Methylene Diphenyl Diisocyanate, Toluene Diisocyanate and Polyurethane with Strategic Context

The executive summary opens by establishing the foundational context for understanding the intertwined evolution of Methylene Diphenyl Diisocyanate, Toluene Diisocyanate and their critical downstream polyurethanes. This introduction frames the significance of diisocyanate chemistry as a cornerstone of advanced materials, tracing how improvements in synthesis, additive integration and sustainability considerations have elevated MDI and TDI from commodity feedstocks to strategic enablers of high-value applications. It underscores the imperative for decision makers to grasp both the technical nuances and commercial dynamics driving raw material selection, quality specifications and end use performance.

Moving from heritage to horizon, the narrative situates MDI, TDI and polyurethane within a broader industrial transformation. Emerging regulatory pressures around volatile organic compounds, coupled with end user demand for lightweight, durable and eco-efficient products, have reoriented R&D priorities toward greener isocyanate production and bio-based polyol alternatives. As a result, the industry is adopting continuous process intensification, digitalization of quality control and circular supply chain frameworks in parallel. This introduction thus not only contextualizes current market conditions but also primes the reader for deeper insights on strategic inflection points and competitive imperatives ahead.

Exploring the Transformative Shifts Reshaping MDI, TDI and Polyurethane Synthesis, Market Drivers, Innovation Trajectories and Competitive Dynamics

The MDI, TDI and polyurethane ecosystem is undergoing a period of transformative shifts catalyzed by innovation, sustainability mandates and evolving consumer expectations. Advances in catalyzed synthesis routes have enhanced diisocyanate purity and yield, enabling formulation experts to push the boundaries of mechanical performance and chemical resistance in polyurethane derivatives. At the same time, digital twins and machine learning algorithms are reshaping process optimization, enabling rapid identification of reaction variables that boost throughput while minimizing energy consumption.

Concurrently, industry players are accelerating the development of high-recycled-content polyurethanes to align with circular economy targets. Closed-loop chemical recycling and upcycling initiatives are gathering momentum, forging novel partnerships between petrochemical producers, specialty chemical formulators and end users in automotive, construction and consumer electronics. As a result, competitive dynamics are shifting from purely volume-based strategies toward value differentiation driven by green credentials, lifecycle transparency and rapid customization capabilities.

Together, these shifts are redefining how stakeholders across the value chain-from raw material licensors to contract manufacturers-interact, innovate and compete. The interplay of technological breakthroughs, regulatory expectations and sustainability commitments heralds a new chapter in which agility, collaboration and digital empowerment serve as fundamental drivers of growth.

Assessing the Cumulative Impacts of United States Trade Tariffs in 2025 on MDI, TDI Supply Chains, Pricing Structures and Industry Resilience

In 2025, the imposition of revised United States tariffs on key diisocyanate imports has reverberated throughout the supply chain, prompting both immediate cost adjustments and strategic realignments. Tariff surcharges on Chinese and European sourced MDI and TDI shipments have elevated landed raw material costs for domestic manufacturers. This has in turn pressured formulation margins and encouraged a recalibration of sourcing strategies, including increased local production investments and expanded utilization of tariff-exempt intermediates.

Revealing Key Insights Across Raw Material, Grade, Application and End User Industry Segmentation Driving Strategic Opportunities in MDI, TDI and Polyurethane

A detailed segmentation analysis reveals distinctive patterns across raw material, grade, application and end user dimensions that warrant tailored strategic responses. When examining the market through the lens of raw material, it is clear that Methylene Diphenyl Diisocyanate maintains its stronghold in applications demanding exceptional rigidity and thermal stability, while Toluene Diisocyanate retains relevance in flexible foam systems due to its lower viscosity and reactivity profile. These material characteristics drive formulation choices when formulating adhesives with exacting bond strength or coatings with robust weatherability.

Considering the grade perspective, industrial grade diisocyanates dominate bulk applications where cost efficiency and consistent performance underpin large-scale foam production, whereas technical grade variants support specialty segments by delivering enhanced purity levels critical for high-precision sealants and specialty elastomers. The distinction between these grades influences supply chain resilience, as technical grade isocyanates often command premium manufacturing routes with tighter quality controls.

Within application segmentation, polyurethane adhesives and sealants benefit from the unique crosslinking attributes afforded by precise MDI and TDI ratios. Coatings applications leverage diisocyanate chemistry to impart scratch resistance and UV stability, particularly in automotive and electronic device finishes. Elastomeric components harness the superior tensile strength and elasticity derived from tailor-made isocyanate-polyol interactions. Foam systems, split between flexible and rigid categories, capitalize on MDI’s propensity to yield high compressive strength in rigid insulation boards or TDI’s suitability for crafting soft, resilient cushioning in furniture and automotive seating.

From an end user industry stance, the automotive sector continues to drive demand for lightweight, crash-absorbing foam and high-performance coatings, while the building and construction industry prioritizes thermal insulation and moisture-resistant elastomers for energy-efficient structures. In electrical and electronics, diisocyanate-based potting compounds and encapsulants safeguard components against vibration and humidity. Footwear and apparel segments exploit polyurethane foams and elastomers for ergonomic comfort and design versatility, whereas healthcare applications rely on biocompatible elastomer formulations. Furniture and interior design leverage both flexible and rigid foams for aesthetic and functional elements, and packaging solutions integrate polyurethane adhesives and foams to enhance protection without compromising recyclability.

This comprehensive research report categorizes the MDI, TDI, & Polyurethane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Raw Material

- Grade

- Applications

- End User Industry

Analyzing Regional Dynamics in the Americas, Europe Middle East Africa and Asia Pacific Illuminating Growth Catalysts and Market Maturation Pathways

Regional analysis underscores a mosaic of growth catalysts and emerging priorities across the Americas, Europe Middle East Africa and Asia Pacific. In the Americas, domestic capacities are expanding through strategic capital spending on new diisocyanate units coupled with joint ventures that bolster chemical recycling capabilities. This region also sees accelerated uptake of bio-based polyols, driven by corporate sustainability pledges and regulatory incentives promoting lower carbon footprints.

Europe Middle East Africa continues to prioritize circular economy frameworks, advancing chemical recycling technologies and closed-loop pilot programs that reincorporate polyurethane scrap into new formulations. Stricter eco-labeling requirements have steered formulation innovation toward high-renewable-content polyurethanes with verified lifecycle metrics. Meanwhile, the Middle East leverages its petrochemical infrastructure to increase local MDI and TDI output for regional downstream consumption.

In Asia Pacific, robust demand from construction and consumer electronics fuels sustained foam and coating volumes, while domestic manufacturers intensify research into next-generation isocyanate catalysts to reduce energy intensity. Government initiatives across key markets are offering grants and tax rebates for green chemical manufacturing, further stimulating investments in low-emission production lines. Collectively, these regional dynamics highlight the necessity for global players to adopt nuanced strategies that align production footprints, supply chain configurations and R&D agendas with localized market imperatives.

This comprehensive research report examines key regions that drive the evolution of the MDI, TDI, & Polyurethane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Corporate Strategies, Partnerships, Innovations and Investment Priorities Among Top MDI, TDI and Polyurethane Manufacturing Enterprises

Leading companies in the diisocyanate and polyurethane sphere are adopting multifaceted approaches to secure competitive advantage and foster sustainable growth. Several manufacturers are forging cross-sector alliances to accelerate advanced recycling capabilities, integrating upstream diisocyanate conversion with downstream foam reprocessing. These collaborations aim to shorten development cycles for high-recycled content products that meet rigorous quality and performance benchmarks.

On the innovation front, prominent producers are investing in modular plant designs that enable rapid scale-up of specialized grades, reducing time to market for technical grade diisocyanates used in niche sealants and elastomers. Meanwhile, chemical suppliers are extending their portfolios with precatalyst packages and performance additives that simplify processing and enhance end-product durability, carving out value-added differentiation in a traditionally commoditized landscape.

Strategic acquisitions and licensing agreements further underscore the competitive priority placed on intellectual property. By securing proprietary synthesis technologies and formulation footprints, key players are insulating themselves from margin erosion and reinforcing customer loyalty. At the same time, joint ventures with biopolyol developers position them to capitalize on the transition toward renewable raw materials, establishing first-mover advantages in emerging green segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the MDI, TDI, & Polyurethane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Arkema S.A.

- BASF SE

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Chematur Engineering AB

- Coim Group

- Covestro AG

- DuPont de Nemours, Inc.

- Hangzhou Peijin Chemical Co.,Ltd.

- Huntsman International LLC

- Kuwait Polyurethane Industries W.L.L

- Lanxess AG

- Manali Petrochemicals Limited

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- OCI COMPANY Ltd.

- Recticel NV

- Saudi Basic Industries Corporation

- Shandong INOV Polyurethane Co., Ltd.

- Shandong Longhua New Material Co., Ltd.

- Shell PLC

- Springfeel Polyurethane Foams Private Limited

- The Dow Chemical Company

- The Lubrizol Corporation

- Tosoh Asia Pte. Ltd.

- Trelleborg AB

- Umax Chemicals (shandong) Corporation

- Wanhua Chemical Group Co., Ltd.

- Woodbridge Foam Corporation

- Xuchuan Chemical(Suzhou) Co., Ltd.

- Yantai Juli Fine Chemical Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Innovations, Supply Chain Complexities and Market Volatility

Industry leaders should prioritize a set of actionable strategic imperatives to navigate the evolving MDI, TDI and polyurethane landscape with confidence. First, they must intensify investment in green chemistry platforms that encompass both bio-based feedstock integration and circular recycling methodologies. By doing so, they safeguard supply chain continuity and resonate with end users demanding verifiable sustainability credentials.

Simultaneously, firms ought to enhance digitalization across the value chain, deploying advanced analytics to optimize reaction parameters, predict maintenance needs and accelerate new product development. This approach will sharpen cost efficiencies while bolstering agility in responding to dynamic market requirements.

It is equally critical to cultivate cross-industry partnerships that extend beyond traditional chemical alliances. Collaboration with construction firms, automotive OEMs and electronics manufacturers can yield co-developed formulations that de-risk commercialization and reinforce customer lock-in. Concurrently, establishing open innovation forums with academic institutions and technology startups will accelerate breakthroughs in next-generation diisocyanate catalysts and eco-friendly polyol chemistries.

Finally, maintaining proactive engagement with regulatory bodies and standardization committees ensures alignment with shifting compliance landscapes. Leaders who anticipate regulatory changes and contribute to evolving industry standards will secure early mover advantages by streamlining product approvals and earning stakeholder trust.

Outlining a Robust, Transparent and Comprehensive Research Methodology Emphasizing Data Collection, Analytical Rigor and Validation Protocols

This research employs a meticulous methodology that combines primary and secondary data, ensuring both breadth and depth of insight. Primary research entailed in-depth interviews with key stakeholders, including diisocyanate producers, formulation engineers and regulatory experts, to capture firsthand perspectives on raw material constraints, performance requirements and sustainability aspirations. Quantitative surveys supplemented these dialogues, gauging end user priorities across automotive, construction, healthcare and consumer goods sectors.

Secondary sources comprised peer-reviewed journals, patent databases and reputable industry publications, providing a robust backdrop of historical context and emerging trends. Proprietary process mapping and supply chain modelling techniques were leveraged to identify bottlenecks and forecast capacity expansions without disclosing proprietary estimates. Triangulation of data points through cross validation enhanced reliability and minimized bias.

Analytical rigor was upheld through multi-criteria evaluation frameworks, which assessed technologies on parameters such as energy intensity, lifecycle emissions, cost competitiveness and scalability. Validation protocols included peer reviews by subject matter experts and scenario stress testing to ensure that findings are resilient across varying market conditions. This structured approach underpins the credibility of the report’s insights and equips decision makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our MDI, TDI, & Polyurethane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- MDI, TDI, & Polyurethane Market, by Raw Material

- MDI, TDI, & Polyurethane Market, by Grade

- MDI, TDI, & Polyurethane Market, by Applications

- MDI, TDI, & Polyurethane Market, by End User Industry

- MDI, TDI, & Polyurethane Market, by Region

- MDI, TDI, & Polyurethane Market, by Group

- MDI, TDI, & Polyurethane Market, by Country

- United States MDI, TDI, & Polyurethane Market

- China MDI, TDI, & Polyurethane Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Conclusive Insights and Strategic Observations to Illuminate Future Trajectories and Guide Decision Making in the MDI TDI and Polyurethane Ecosystem

The conclusive insights distilled from this analysis shine a light on the critical junctions that will define future trajectories in MDI, TDI and polyurethane. Technological innovation remains the primary catalyst, with breakthroughs in catalyst design, process intensification and digital integration driving competitive differentiation. Sustainability, while no longer optional, will serve as a gatekeeper for access to strategic accounts and premium markets, demanding that players embed circular economy principles into core business models.

Strategic observations point to the rising importance of flexible manufacturing assets capable of switching between grades and chemistries, enabling rapid responses to shifting end user requirements and regulatory mandates. Equally, companies that cultivate end-to-end transparency-from feedstock sourcing to end-of-life disposition-will earn enduring trust and unlock cost efficiencies through waste reduction and resource recovery.

Ultimately, the ecosystem is converging toward an era characterized by collaborative innovation and aligned incentives that balance performance ambitions with ecological stewardship. Industry participants who align their strategic roadmaps with these imperatives stand to capture disproportionate share of value, forging resilient pathways through evolving challenges and unlocking opportunities at the nexus of technology, sustainability and market demand.

Prompting Immediate Engagement with Associate Director Sales and Marketing to Secure Access to the Comprehensive MDI TDI and Polyurethane Market Research Report

To explore the full depth of the MDI, TDI and polyurethane market, request personalized insights directly from Ketan Rohom, Associate Director of Sales and Marketing. Engaging today ensures you receive tailored guidance on leveraging data-driven strategies across raw material selection, application development and regional expansion priorities. Ketan is prepared to outline how this research can address your specific operational challenges, from optimizing supply chain continuity to identifying high-opportunity innovation pathways in adhesives, coatings, elastomers and foam. Connect with him to secure comprehensive access to the report and uncover the competitive intelligence that will elevate your decision making and strengthen your market positioning.

- How big is the MDI, TDI, & Polyurethane Market?

- What is the MDI, TDI, & Polyurethane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?