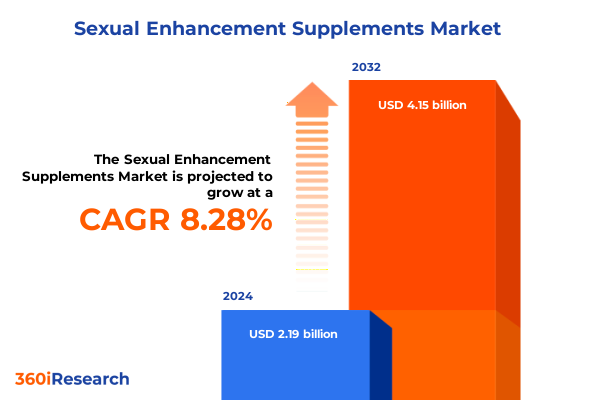

The Sexual Enhancement Supplements Market size was estimated at USD 2.37 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 8.29% to reach USD 4.15 billion by 2032.

How consumer expectations, regulatory vigilance, and channel innovation are reshaping product credibility and competitive advantage in sexual enhancement supplements

The sexual enhancement supplement category is being reshaped by a convergence of elevated consumer expectations, intensifying regulatory scrutiny, and accelerating channel innovation. Consumers increasingly expect formulations that deliver measurable outcomes while providing transparent sourcing and clinical rationale. At the same time, regulators and public health authorities are scrutinizing the category’s historical risk points, notably the appearance of undeclared pharmaceutical actives and inconsistent quality controls. This combination is evolving the category from one driven primarily by marketing claims to one where safety verification, ingredient provenance, and documented efficacy form the baseline for brand credibility. Consequently, leaders are finding that product stewardship and trust-building are as important as conventional brand positioning.

These dynamics are unfolding alongside rapid changes in how people discover and purchase wellness products. Digital-first routes to market are compressing product adoption cycles, enabling smaller brands to achieve national reach quickly and forcing legacy players to invest in direct consumer relationships and data-driven personalization. Meanwhile, supply-chain complexity - from ingredient sourcing to manufacturing and cross-border logistics - has increased the operational premium on traceability and contingency planning. Taken together, these forces are creating a market environment where agility, validated safety, and clear differentiation determine which products gain and retain consumer trust.

Rapid evolution in product verification, delivery innovation, and omnichannel economics is redefining how brands win consumer trust and commercial scale

The landscape of sexual enhancement supplements is undergoing transformative shifts that extend beyond product formulation to include science communication, retail economics, and supply-chain governance. First, ingredient transparency and independent testing are transitioning from optional marketing claims to table-stakes requirements; consumers and retailers demand certificates of analysis and third-party verification as evidence of safety and label accuracy. In response, manufacturers are investing in laboratory partnerships and upstream supplier audits to document botanical identity, amino acid specifications, and micronutrient purity, while also tightening lot-level traceability.

Second, formulation strategies are diversifying to suit differentiated consumer needs and usage occasions. Delivery formats that prioritize convenience and sensory experience are gaining traction, prompting innovation across gummy textures, liquid absorbability, powder mixes for ritualized consumption, and capsule technologies that support quick-release or sustained-release profiles. This product-level variety is paralleled by targeted ingredient strategies spanning herbal extracts, amino acids, synthetic actives, and vitamin-mineral complements that are combined to address specific objectives such as energy, hormonal balance, libido enhancement, and mitigation of erectile dysfunction symptoms. Brands that articulate clear mechanisms of action and use clinically meaningful proxies in messaging are finding higher engagement and retailer acceptance.

Third, channel economics are shifting the balance of power. Online direct-to-consumer platforms and large e-commerce marketplaces enable rapid discovery and subscription models, but they also increase exposure to reviews, regulatory complaints, and reputation risk. Brick-and-mortar pharmacies and specialty stores continue to provide point-of-care trust and counseling benefits that are especially valuable for formulations marketed to older age cohorts or to consumers managing comorbidities. The interplay of these channels is changing promotional tactics: digital-first rollouts are increasingly paired with targeted retail assortments and clinician outreach to build credibility and broaden reach.

Finally, public policy and trade policy noise have introduced new uncertainty into ingredient sourcing and cost assumptions, motivating firms to develop multi-source procurement strategies and to evaluate Nearshore or domestic manufacturing options. As businesses adapt to these shifts, the winners will be those that integrate rigorous safety systems, clear science communication, and resilient commercial models that bridge digital velocity with clinical-grade assurances.

How evolving national security reviews, tariff policy, and low-value parcel rule changes are forcing supply-chain reconfiguration and sourcing diversification across supplement supply chains

Recent U.S. trade and tariff developments have introduced material friction for ingredients and finished goods that cross borders, which in turn affects strategic sourcing, inventory planning, and cost management for supplement manufacturers and distributors. Policymakers have signaled a willingness to subject pharmaceutical and related chemical imports to focused national-security reviews and tariff measures, prompting industry stakeholders to seek clear carve-outs and expedited guidance for nutrients and botanical inputs. The formal public docket and agency review processes have given trade representatives, industry associations, and suppliers a platform to describe how supply chains for vitamins, amino acids, and botanical extracts differ from finished pharmaceuticals, and to request treatment that minimizes disruption to consumer access and domestic manufacturing economics. These interactions are shaping the short-term policy environment and informing contingency planning among ingredient purchasers and formulators.

Concurrently, industry groups and trade associations have been actively lobbying to preserve tariff exemptions for dietary ingredients, arguing that sweeping tariff application could increase the likelihood of supply dislocations and create incentives for cost-driven shortcuts in sourcing and quality controls. The concern is that tariffs calibrated for pharmaceuticals could unintentionally sweep in key supplement inputs, syndicating higher input costs and longer lead times which may squeeze smaller brands and import-reliant formulators. This policy flux has prompted many firms to re-evaluate their supplier footprints, accelerate qualification of alternative ingredient sources, and in some cases explore increased domestic contract manufacturing capacity to reduce exposure.

Additional policy changes affecting low-value cross-border parcels have also increased the administrative burden on importers of small retail shipments and subscription boxes. The removal or tightening of low-value import exemptions for small packages and the introduction of new customs validation steps have the potential to increase landed cost and slow fulfillment times for direct-to-consumer channels that rely on low-cost cross-border sourcing. As a result, brands that once relied on low-cost overseas warehousing and small-parcel fulfillment are reassessing pricing models, inventory positioning, and customer service strategies to offset potential delays and duty assessments. These combined trade-policy shifts are forcing industry actors to adopt more robust scenario planning, to commit to safety-first sourcing, and to prioritize supply-chain investments that preserve on-shelf continuity and compliance.

Actionable segmentation intelligence that links delivery format, ingredient strategy, demographic needs, therapeutic application, and channel fit for precise go-to-market alignment

Segmentation within the sexual enhancement supplement space reveals differentiated paths to growth and risk mitigation when product design, ingredient strategy, consumer cohort, gender-specific messaging, intended application, and distribution choices are considered in concert. Product form options range across capsule formats where manufacturers can choose quick-release or sustained-release technologies to control onset and duration profiles, gummy and chewable formats that emphasize taste and daily ritual appeal, liquid formats optimized for perceived bioavailability and rapid absorption, powders that allow dose flexibility and lifestyle integration, and traditional tablets that can also be engineered for immediate or extended release. Ingredient strategies span amino acids that target vascular and neurotransmitter pathways, herbal extracts that draw on traditional use and ethnobotanical narratives, synthetic compounds that offer targeted pharmacologic actions, and vitamin-mineral combinations that address micronutrient support and general wellness.

Demographic segmentation further informs formulation and marketing decisions. Younger adult cohorts often prioritize convenience, flavour and lifestyle congruence and respond to social proof and creator-led sampling; midlife adults balance efficacy claims against safety signals and often seek products that integrate with broader hormonal or metabolic health goals; older adults focus on clinical language, interactions with prescription regimens, and pharmacist or clinician endorsement. Gender distinctions matter: male-targeted formulations frequently emphasize performance metrics and vascular support, whereas female-targeted innovations often couple libido enhancement with hormonal balance and energy narratives. Application-driven positioning creates product differentiation: some offerings are clearly framed as energy-supporting and vitality-enhancing adjuncts for daily use, others are positioned to address erectile dysfunction support with vascular and neurological mechanisms, and still others emphasize hormonal balance and libido enhancement as part of holistic well-being.

Distribution channel segmentation creates further nuance. Brands that prioritize online retail - including dedicated brand websites and broader e-commerce platforms - must invest in digital conversion, review management, and subscription retention mechanics to scale profitably. Pharmacy and specialty store placements deliver credibility and professional touchpoints, making them advantageous for formulations that warrant counseling or have complex label claims. Supermarket and hypermarket placements provide mass reach but often favor price-competitive SKUs and simplified positioning. Successful companies design product portfolios that map form, ingredient, age, gender, and application attributes to channel strengths, enabling targeted launches and a clearer path to retailer listing acceptance.

This comprehensive research report categorizes the Sexual Enhancement Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Ingredient Type

- Age Group

- Gender

- Application

- Distribution Channel

Regional differentiation in regulation, retail structure, and ingredient sourcing that demands tailored market entry, compliance, and distribution strategies

Geographic differences influence ingredient sourcing, regulatory interpretation, consumer attitudes, and retail ecosystems, creating region-specific strategies for brand expansion and supply-chain engineering. In the Americas, regulatory vigilance and strong consumer awareness of product safety have elevated the importance of third-party testing and transparent labeling, while distribution is characterized by a mix of national pharmacy chains, specialty retailers, and high-volume e-commerce platforms that enable national rollouts. Brands entering this market must reconcile rigorous safety expectations with a multi-channel strategy that leverages pharmacist trust and digital subscription economics.

In Europe, Middle East & Africa, regulatory frameworks and market access pathways vary significantly by country and subregion. In many European markets, harmonized standards and established nutraceutical regulation foster higher expectations for clinical substantiation and quality systems, while markets in the Middle East and Africa may place more emphasis on cultural formulations and trusted retail partners. Currency and logistics variability across the region require flexible route-to-market strategies and localized labeling and claims compliance planning.

Asia-Pacific presents a complex mixture of mature markets with sophisticated retail infrastructures and high consumer receptivity to novel delivery formats, alongside emerging markets where price sensitivity and traditional botanical narratives remain influential. The region is also a major global source of botanical raw materials and specialty ingredients, so strategies that prioritize supplier partnerships, quality audits, and ethical sourcing can both unlock cost advantages and mitigate reputational risk. Across all regions, companies that tailor product mix, clinical storytelling, and channel partnerships to local regulatory and cultural contexts will achieve more efficient market entry and sustained consumer trust.

This comprehensive research report examines key regions that drive the evolution of the Sexual Enhancement Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape overview showing how ingredient suppliers, contract manufacturers, digital challengers, and legacy consumer health firms are differentiating through compliance, speed, and credibility

Competitive dynamics in the category are shaped by a spectrum of players, from ingredient suppliers and contract manufacturers to digitally native challenger brands and established consumer health companies that leverage broad retail penetration. Ingredient suppliers that demonstrate consistent quality, supply reliability, and transparency of origin have become strategic partners for brands that need to differentiate through validated inputs and traceability. Contract manufacturers offering small-batch capabilities and quality management systems are enabling faster product iteration and compliance with lot-level testing requirements, which benefits agile brands seeking rapid iteration.

Digital-first brands that couple evidence-backed formulation with polished storytelling and experiential packaging have proven effective at capturing trial among younger cohorts, especially when paired with subscription models and influencer-led education. Established consumer health companies continue to leverage deep retailer relationships and scale manufacturing, but they must adapt to digital-native expectations for personalization and sensory-driven formats. Specialist players focusing on clinically oriented formulations and pharmacy distribution prioritize safety, pharmacist education, and clinician outreach to access older and medically complex cohorts. Across these company types, collaboration between regulatory affairs, product development, and commercial teams is emerging as a decisive capability: firms that operationalize compliance as a commercial asset - integrating lab data, label accuracy, and clinician-friendly evidence packs into retailer and prescriber conversations - secure more durable placements and higher consumer trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sexual Enhancement Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adaptive Health, LLC

- Amway Corp.

- Biotab Nutraceuticals, Inc.

- Blackmores Limited

- Church & Dwight Co., Inc.

- Force Factor, LLC

- GNC Holdings, LLC

- Herbalife Nutrition Ltd.

- Himalaya Global Holdings Ltd.

- Hims & Hers Health, Inc.

- Incredible Health Decisions, LLC

- Irwin Naturals, Inc.

- Leading Edge Health, LLC

- M.D. Science Lab, LLC

- Metagenics, LLC

- Nature’s Way Products, LLC

- NOW Health Group, Inc.

- Nutraceutical Corporation

- Reckitt Benckiser Group plc

- Roman Health Ventures Inc.

- SuHK Trading Ltd

- Swanson Health Products, Inc.

- TEK Naturals LLC

- The Bountiful Co. LLC

- Vianda, LLC

Practical, compliance-first actions companies should take now to protect margins, build credibility, and accelerate omnichannel growth in a volatile policy and retail landscape

Industry leaders should prioritize a set of coordinated actions that reduce regulatory risk, enhance product credibility, and protect commercial margins. Start by establishing rigorous upstream supplier verification and routine third-party laboratory testing as standardized operational protocols; these investments reduce the likelihood of adulteration incidents and strengthen retailer and healthcare partner relationships. Complement supply-chain controls with clear science communication: publish concise mechanism-of-action summaries and accessible testing documentation so consumers and pharmacy staff can quickly understand product intent and safety.

Operationally, diversify ingredient sourcing footprints and accelerate qualification of alternative suppliers to reduce single-source exposure. Where feasible, develop nearshoring or domestic manufacturing options for critical inputs to insulate the business from tariff volatility and logistic chokepoints. In parallel, align product portfolios to channel strengths by designing formulations and packaging that match pharmacy counseling needs, specialty-store experiential expectations, and e-commerce discovery patterns, thereby optimizing conversion across touchpoints.

From a commercial standpoint, tailor marketing and product positioning by age cohort and gender-specific needs while avoiding overpromising language that may trigger regulatory attention. Invest in clinician and pharmacist education programs to build trusted pathways for consumers who require professional guidance. Finally, incorporate scenario-based trade-policy planning into financial and inventory models so the business can flex with tariff changes, parcel rule adjustments, and shifting customs requirements, thereby preserving continuity of supply and consumer access.

A layered research design combining regulatory surveillance, supplier and retailer interviews, product audits, and channel mystery-shopping to triangulate risk and opportunity

The research approach employed a layered methodology that synthesized regulatory monitoring, primary stakeholder engagement, product and supply-chain audits, and channel analysis to produce a holistic view of the category. Regulatory monitoring included systematic review of public enforcement notices, recall databases, and agency guidance to identify risk hotspots and enforcement trends. Primary stakeholder engagement comprised structured interviews with supply-chain managers, contract manufacturers, ingredient suppliers, trade association representatives, and pharmacy procurement specialists to capture operational constraints, sourcing logic, and channel requirements. Product and supply-chain audits used anonymized specimen testing data and supplier documentation reviews to evaluate label accuracy, lot-level traceability, and certificate-of-analysis practices.

Channel analysis combined qualitative retailer interviews with mystery-shopping exercises across e-commerce platforms, brand websites, pharmacies, and specialty retailers to understand purchase drivers and post-purchase experiences. Secondary research integrated trade-policy documents, customs notices, and industry submissions to public dockets to map the evolving tariff and regulation environment and to identify pathways by which policy decisions could materially affect ingredient access and landed cost. Findings were triangulated through cross-validation between primary data points and authoritative public records to ensure reliability and to surface where further diligence or testing would be most impactful.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sexual Enhancement Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sexual Enhancement Supplements Market, by Product Form

- Sexual Enhancement Supplements Market, by Ingredient Type

- Sexual Enhancement Supplements Market, by Age Group

- Sexual Enhancement Supplements Market, by Gender

- Sexual Enhancement Supplements Market, by Application

- Sexual Enhancement Supplements Market, by Distribution Channel

- Sexual Enhancement Supplements Market, by Region

- Sexual Enhancement Supplements Market, by Group

- Sexual Enhancement Supplements Market, by Country

- United States Sexual Enhancement Supplements Market

- China Sexual Enhancement Supplements Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of findings showing that quality-first product design, resilient sourcing, and credible evidence are core determinants of long-term success and trust in the category

The cumulative evidence indicates that the sexual enhancement supplement category is maturing: safety assurance, supply-chain resilience, and credible science are now integral to commercial success. Brands and suppliers that treat compliance and testing as competitive advantages will have privileged access to pharmacy listings, clinician endorsements, and long-term consumer trust. Conversely, those that rely solely on marketing narratives without demonstrable quality controls face elevated enforcement risk and reputational exposure. Trade-policy uncertainty and adjustments to small-parcel import rules have created an operational imperative to diversify sourcing and to integrate tariff scenario planning into procurement decisions.

Looking ahead, companies that invest in validated ingredient sources, transparent testing, and channel-specific product design will be best positioned to adapt as regulatory scrutiny and trade policies continue to evolve. Integrating these capabilities with targeted consumer messaging and clinical-grade evidence will create defensible differentiation and reduce the probability of adverse regulatory outcomes, enabling sustainable growth anchored in trust and demonstrated product integrity.

Secure a tailored briefing with an Associate Director of Sales and Marketing to convert evidence-based research into commercial advantage and rapid go-to-market actions

To access the full market research report and receive a tailored briefing, contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan can coordinate a demonstration that highlights how the report’s regulatory scans, ingredient-level diligence, and channel-specific intelligence will reduce commercial risk and accelerate go-to-market timelines. Engage him to arrange a short executive briefing that aligns the report’s findings with your strategic priorities and to learn about license options, custom add-ons, and enterprise distribution rights. Acting now will ensure timely access to the evidence-based insights and implementation tools that support compliance, product differentiation, and resilient sourcing strategies in an environment of shifting trade policy and heightened regulatory scrutiny.

- How big is the Sexual Enhancement Supplements Market?

- What is the Sexual Enhancement Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?